Answered step by step

Verified Expert Solution

Question

1 Approved Answer

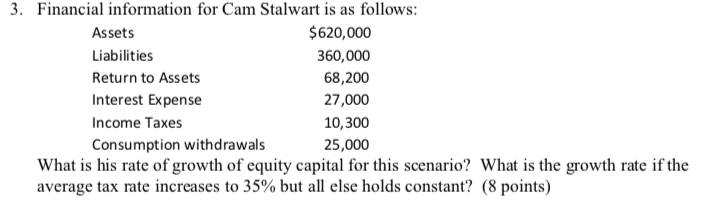

Financial information for Cam Stalwart is as follows: Assets Liabilities Return to Assets Interest Expense Income Taxes Consumption withdrawals $620,000 360,000 68,200 27,000 10,300 25,000

Financial information for Cam Stalwart is as follows:

Assets Liabilities Return to Assets Interest Expense Income Taxes Consumption withdrawals

$620,000 360,000 68,200 27,000 10,300 25,000

What is his rate of growth of equity capital for this scenario? What is the growth rate if the average tax rate increases to 35% but all else holds constant? (8 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started