Answered step by step

Verified Expert Solution

Question

1 Approved Answer

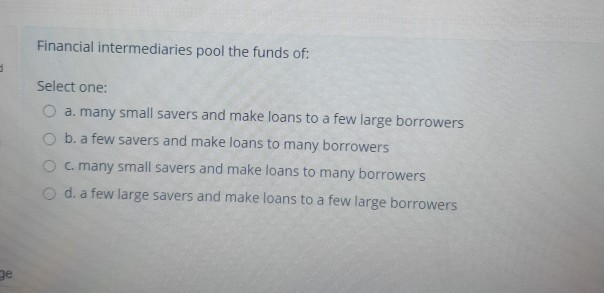

Financial intermediaries pool the funds of: Select one: a. many small savers and make loans to a few large borrowers b. a few savers and

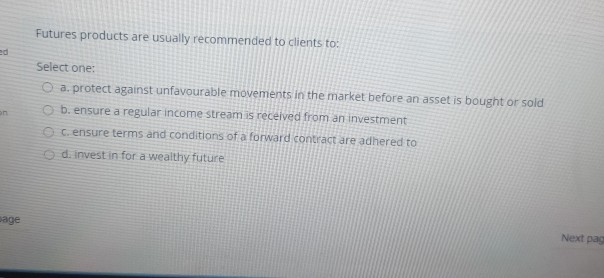

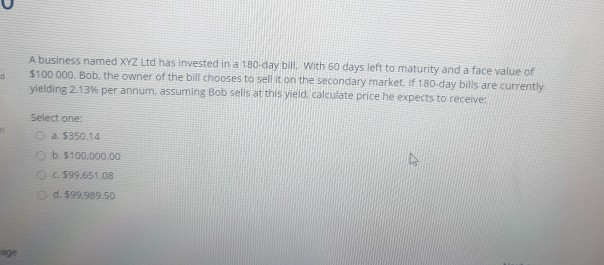

Financial intermediaries pool the funds of: Select one: a. many small savers and make loans to a few large borrowers b. a few savers and make loans to many borrowers c. many small savers and make loans to many borrowers d. a few large savers and make loans to a few large borrowers ge Futures products are usually recommended to clients to: ed Select one: a. protect against unfavourable movements in the market before an asset is bought or sold b. ensure a regular income stream is received from an investment censure terms and conditions of a forward contract are adhered to d. invest in for a wealthy future age Next pag A business named XYZ Ltd has invested in a 180 day bill. With 60 days left to maturity and a face value of $100 000. Bob, the owner of the bill chooses to sell it on the secondary market. If 180 day bills are currently yielding 2.13% per annum, assuming Bob sells at this yield, calculate price he expects to receive Select one a. $350.14 b. $100.000.00 C $99.651.08 d. $99.989.50 age

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started