Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial management sales 70 milion 3. Harrison Electronics, Inc, operates a chain of electrical lighting and fixture distribution centers throughout northern Arizona, The firm is

Financial management

sales 70 milion

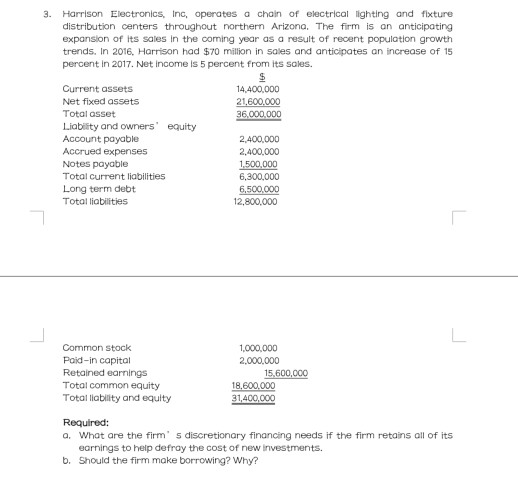

3. Harrison Electronics, Inc, operates a chain of electrical lighting and fixture distribution centers throughout northern Arizona, The firm is an anticipating expansion of its sales in the coming year as a result of recent population growth trends. In 2016, Harrison had $70 million in sales and anticipates an increase of 15 percent in 2017. Net income is 5 percent from its sales. Current assets 14.400.000 Net fixed assets 21,600,000 Total asset Liabiity and owners Account payable Accrued expenses Notes payable 36,000,000 equity 2,400,000 2,400,000 1,500,000 Total current liabilities 6,300,000 Long term debt Total liabilities 6,500,000 12,800,000 Common stock 1,000,000 Paid-in capital Retained earnings Total common equity Total liability and equity 2,000,000 15,600,000 18,600,000 31,400,000 Required: a. What are the firm s discretionary financing needs if the firm retains all of its earnings to help defray the cost of new investments. b. Should the firm make borrowing? Why? 3. Harrison Electronics, Inc, operates a chain of electrical lighting and fixture distribution centers throughout northern Arizona, The firm is an anticipating expansion of its sales in the coming year as a result of recent population growth trends. In 2016, Harrison had $70 million in sales and anticipates an increase of 15 percent in 2017. Net income is 5 percent from its sales. Current assets 14.400.000 Net fixed assets 21,600,000 Total asset Liabiity and owners Account payable Accrued expenses Notes payable 36,000,000 equity 2,400,000 2,400,000 1,500,000 Total current liabilities 6,300,000 Long term debt Total liabilities 6,500,000 12,800,000 Common stock 1,000,000 Paid-in capital Retained earnings Total common equity Total liability and equity 2,000,000 15,600,000 18,600,000 31,400,000 Required: a. What are the firm s discretionary financing needs if the firm retains all of its earnings to help defray the cost of new investments. b. Should the firm make borrowing? WhyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started