Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 Given below are the expected cash flow of a project Year 0 1 2 3 4 Cash flow (200,000) 100,000 60,000 36,000 12,960a. Find

1 Given below are the expected cash flow of a project

Year 0 1 2 3 4

Cash flow (200,000) 100,000 60,000 36,000 12,960a.

Find the NPV of the project if the discount rate is:

i. 10%

ii. 5%

Find the IRR of the project.

Find the payback period

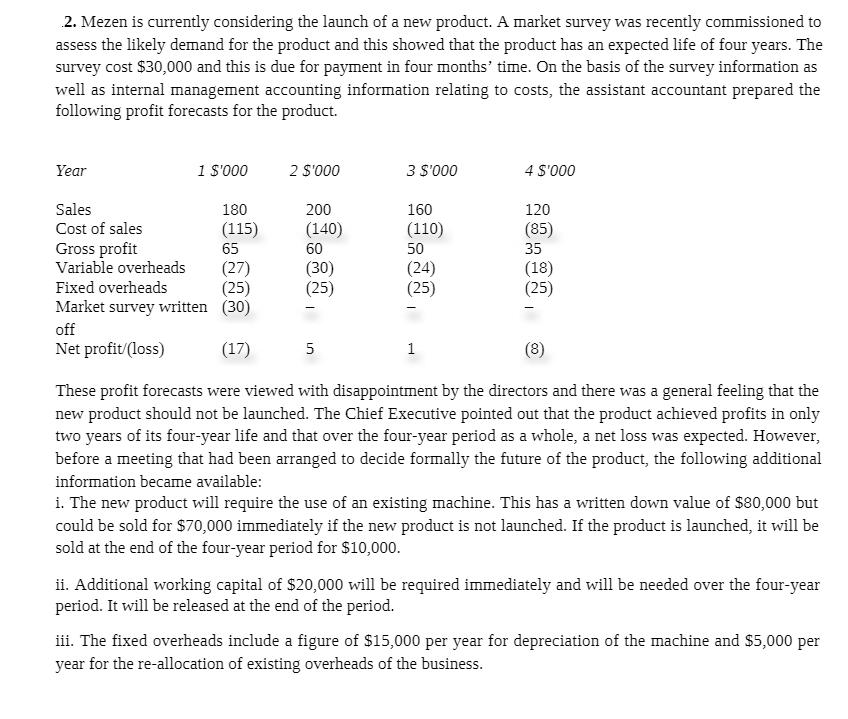

2. Mezen is currently considering the launch of a new product. A market survey was recently commissioned to assess the likely demand for the product and this showed that the product has an expected life of four years. The survey cost $30,000 and this is due for payment in four months' time. On the basis of the survey information as well as internal management accounting information relating to costs, the assistant accountant prepared the following profit forecasts for the product. Year Sales Cost of sales Gross profit Variable overheads 1 $'000 off Net profit/(loss) 180 (115) 65 2 $'000 200 (140) 60 (30) (25) 3 $'000 5 160 (110) 50 (24) (25) (27) Fixed overheads (25) Market survey written (30) (17) (8) These profit forecasts were viewed with disappointment by the directors and there was a general feeling that the new product should not be launched. The Chief Executive pointed out that the product achieved profits in only two years of its four-year life and that over the four-year period as a whole, a net loss was expected. However, before a meeting that had been arranged to decide formally the future of the product, the following additional information became available: I 4 $'000 1 120 (85) 35 (18) (25) i. The new product will require the use of an existing machine. This has a written down value of $80,000 but could be sold for $70,000 immediately if the new product is not launched. If the product is launched, it will be sold at the end of the four-year period for $10,000. ii. Additional working capital of $20,000 will be required immediately and will be needed over the four-year period. It will be released at the end of the period. iii. The fixed overheads include a figure of $15,000 per year for depreciation of the machine and $5,000 per year for the re-allocation of existing overheads of the business.

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 i NP V of the project 200 000 100 000 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started