Answered step by step

Verified Expert Solution

Question

1 Approved Answer

financial markets ...please attempt number b thank you this question has no more data on it please a. Royal Bank of Scotland (RBS) was bailed

financial markets ...please attempt number "b" thank you

this question has no more data on it please

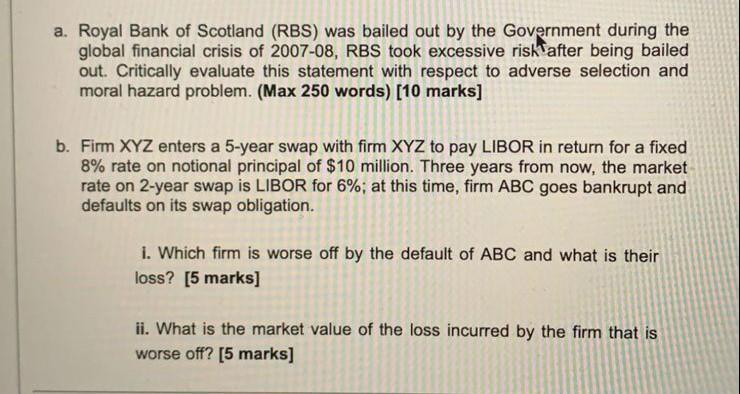

a. Royal Bank of Scotland (RBS) was bailed out by the Government during the global financial crisis of 2007-08, RBS took excessive risk after being bailed out. Critically evaluate this statement with respect to adverse selection and moral hazard problem. (Max 250 words) [10 marks] b. Firm XYZ enters a 5-year swap with firm XYZ to pay LIBOR in return for a fixed 8% rate on notional principal of $10 million. Three years from now, the market rate on 2-year swap is LIBOR for 6%; at this time, firm ABC goes bankrupt and defaults on its swap obligation. 1. Which firm is worse off by the default of ABC and what is their loss? [5 marks] ii. What is the market value of the loss incurred by the firm that is worse off? [5 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started