- Financial of status quo: Cost of good sold? Variable cost? Contribution per unit? 5% increase of price will increase contribution by how much?

- Contribution change and cannibalization assessment of line extension.

- Break-even Analysis with line extension. The new products price can be found by averaging the current price of Plax and the current price of Scope

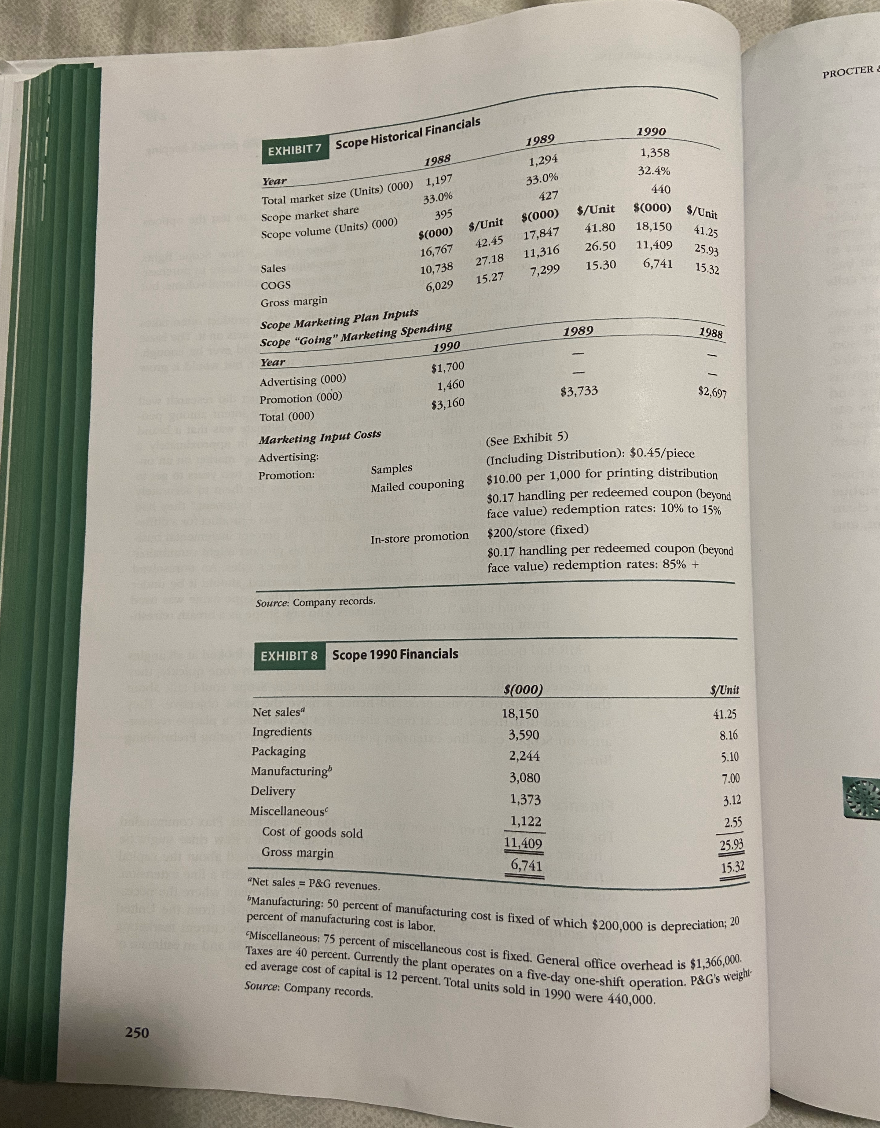

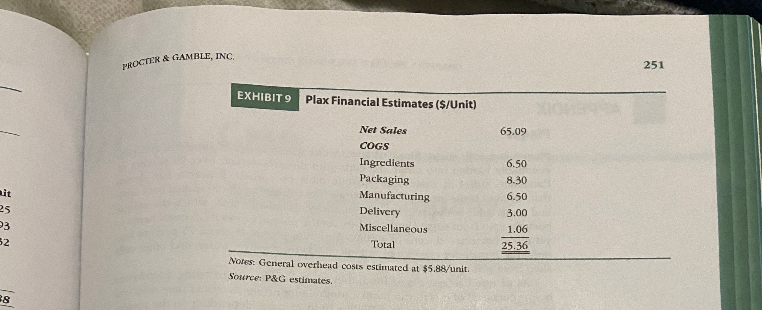

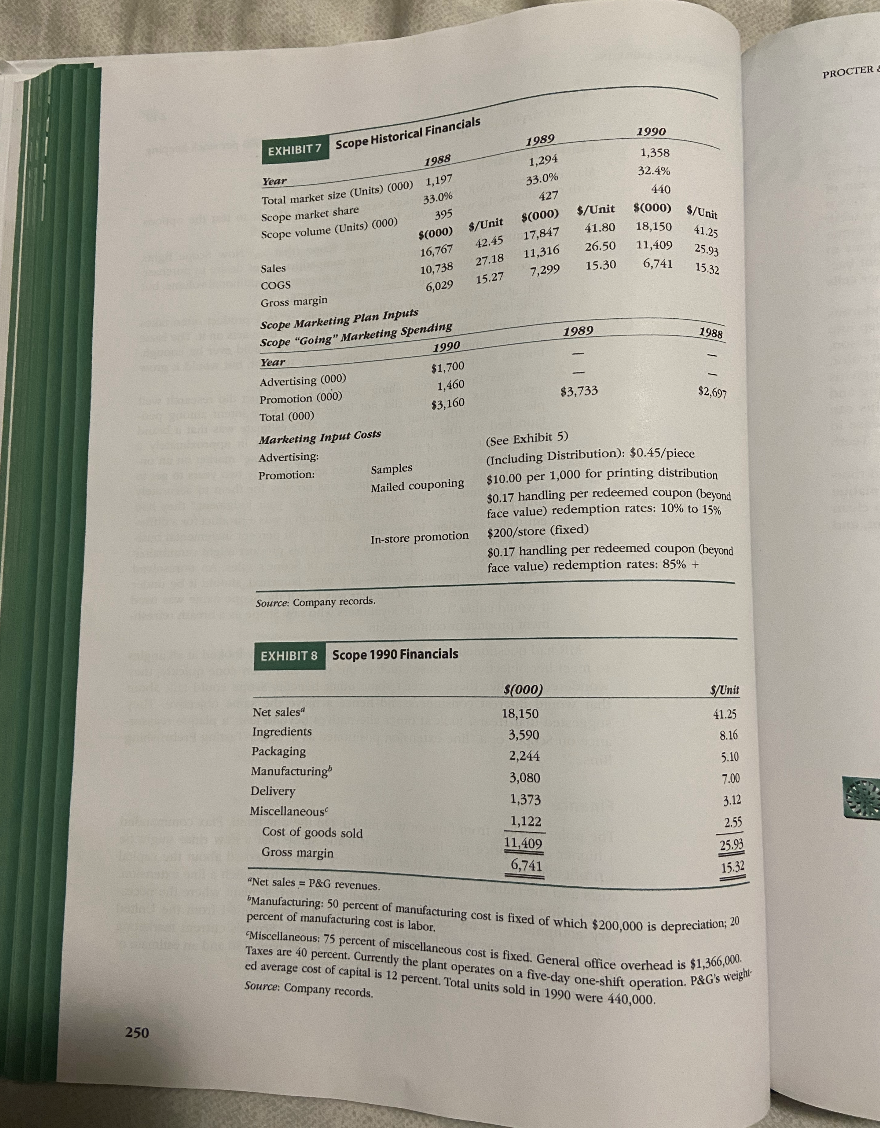

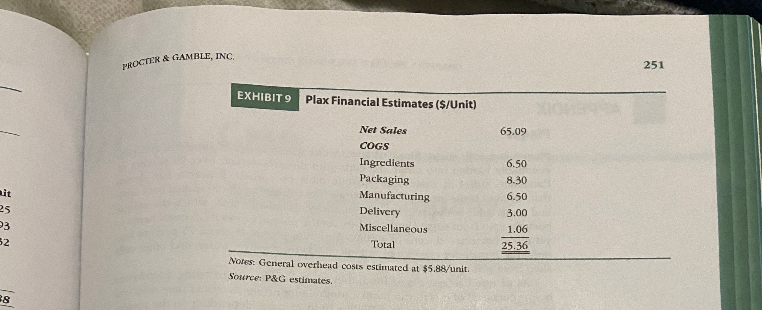

PROCTER 1989 EXHIBIT 7 Scope Historical Financials 1988 Year Total market size (Units) (000) 1,197 Scope market share 33.0% Scope volume (Units) (000) 395 $(000) 16,767 10,738 6,029 1,294 33.0% 427 $(000) 17,847 11,316 7,299 1990 1,358 32.4% 440 $(000) 18,150 11,409 6,741 $/Unit 42.45 27.18 15.27 $/Unit 41.80 26.50 15.30 $/Unit 41.25 25.93 15.32 1989 1988 Sales COGS Gross margin Scope Marketing Plan Inputs Scope "Going" Marketing Spending Year Advertising (000) Promotion (000) $3,160 Marketing Input Costs Advertising Promotion: Samples Mailed couponing 1990 $1,700 1,460 $3,733 $2,697 Total (000) (See Exhibit 5) (Including Distribution): $0.45/piece $10.00 per 1,000 for printing distribution $0.17 handling per redeemed coupon (beyond face value) redemption rates: 10% to 15% $200/store (fixed) $0.17 handling per redeemed coupon (beyond face value) redemption rates: 85% + In-store promotion Source: Company records. EXHIBIT 8 Scope 1990 Financials $/Unit 41.25 8.16 Net sales" Ingredients Packaging Manufacturing Delivery Miscellaneous Cost of goods sold Gross margin S(000) 18,150 3,590 2,244 3,080 1,373 1,122 11,409 6,741 5.10 7.00 3.12 2.55 25.93 15.32 "Net sales = P&G revenues. Manufacturing: 50 percent of manufacturing cost is fixed of which $200,000 is depreciation; 20 percent of manufacturing cost is labor. Miscellaneous: 75 percent of miscellaneous cost is fixed. General office overhead is $1,366,000 ed average cost of capital is 12 percent. Total units sold in 1990 were 440,000 Taxes are 40 percent. Currently the plant operates on a five-day one-shift operation. P&G's weight Source: Company records. 250 PROCTER & GAMBLE, INC. 251 EXHIBIT 9 Plax Financial Estimates ($/Unit) 65.09 Net Sales COGS Ingredients Packaging Manufacturing Delivery Miscellaneous Total it 25 3 52 6.50 8.30 6.50 3.00 1.06 25.36 Notes: General overhead costs estimated at $5.88/unit. Source: P&G estimates 38 PROCTER 1989 EXHIBIT 7 Scope Historical Financials 1988 Year Total market size (Units) (000) 1,197 Scope market share 33.0% Scope volume (Units) (000) 395 $(000) 16,767 10,738 6,029 1,294 33.0% 427 $(000) 17,847 11,316 7,299 1990 1,358 32.4% 440 $(000) 18,150 11,409 6,741 $/Unit 42.45 27.18 15.27 $/Unit 41.80 26.50 15.30 $/Unit 41.25 25.93 15.32 1989 1988 Sales COGS Gross margin Scope Marketing Plan Inputs Scope "Going" Marketing Spending Year Advertising (000) Promotion (000) $3,160 Marketing Input Costs Advertising Promotion: Samples Mailed couponing 1990 $1,700 1,460 $3,733 $2,697 Total (000) (See Exhibit 5) (Including Distribution): $0.45/piece $10.00 per 1,000 for printing distribution $0.17 handling per redeemed coupon (beyond face value) redemption rates: 10% to 15% $200/store (fixed) $0.17 handling per redeemed coupon (beyond face value) redemption rates: 85% + In-store promotion Source: Company records. EXHIBIT 8 Scope 1990 Financials $/Unit 41.25 8.16 Net sales" Ingredients Packaging Manufacturing Delivery Miscellaneous Cost of goods sold Gross margin S(000) 18,150 3,590 2,244 3,080 1,373 1,122 11,409 6,741 5.10 7.00 3.12 2.55 25.93 15.32 "Net sales = P&G revenues. Manufacturing: 50 percent of manufacturing cost is fixed of which $200,000 is depreciation; 20 percent of manufacturing cost is labor. Miscellaneous: 75 percent of miscellaneous cost is fixed. General office overhead is $1,366,000 ed average cost of capital is 12 percent. Total units sold in 1990 were 440,000 Taxes are 40 percent. Currently the plant operates on a five-day one-shift operation. P&G's weight Source: Company records. 250 PROCTER & GAMBLE, INC. 251 EXHIBIT 9 Plax Financial Estimates ($/Unit) 65.09 Net Sales COGS Ingredients Packaging Manufacturing Delivery Miscellaneous Total it 25 3 52 6.50 8.30 6.50 3.00 1.06 25.36 Notes: General overhead costs estimated at $5.88/unit. Source: P&G estimates 38