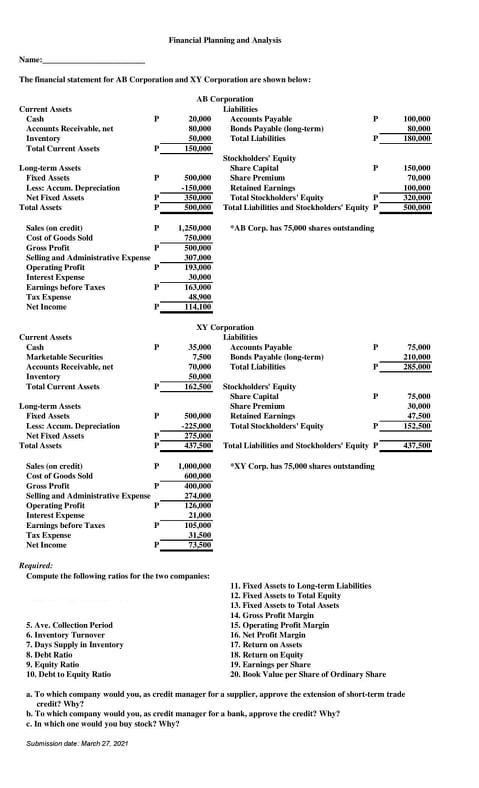

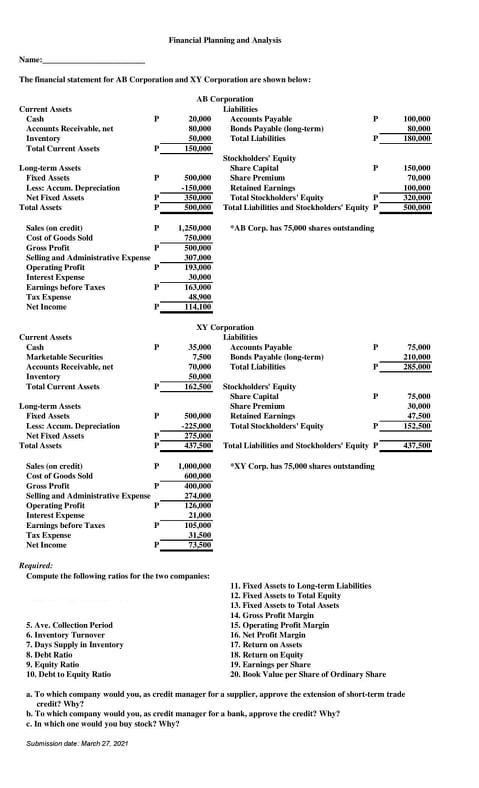

Financial Planning and Analysis 100,000 80.000 180.000 The financial statement for AB Corporation and XY Corporation are shown below: AB Corporation Current Assets Liabilities Cash P 20,000 Accounts Payabile P Accounts Receivable.net 80.1300 Bonds Payable (long-term Inventory 50100 Total Liabilities P Total Current Assets 1.500,00 Stockholders' Equity Long-term Assets Share Capital Fixed Assets 500,00 Share Premium Les Accum. Depreciation - 150.000 Retained Earnings Net Fine Arts 350JDO Total Stockholders' Equity Total Assets 500.000 Total Liabilities and Stockholders' Equity P Sales (on credit) P 1.250,00 AB Corp. has 75,000 shares outstanding Cost of Goods Sold 750,000 Gross Prolit 5000 Selling and Administrative Expense 307.000 Operating Profit 193.000 Interest Expense JOJO Earnings before Taxes 16000 Tax Expense 48.900 Net Income 150,000 70,000 100,000 320,000 SOLO P 75.000 210.000 2.000 Current Assets Cash Marketable Securities Accounts Receivable.net Inventory Total Current Assets Long-term Assets Firud Assets Lee Accum. Depreciation Net Fixed Assets Total Assets P 75,000 30,000 47.500 152.500 P XY Corporation Liabilities 35.100 Accounts Payable P 7.500 Boods Payabile long term 70.000 Total Liabilities 5000 162.500 Stockholders' Fquity Share Capital P Share Premium 50000 Retained Earning -225.000 Total Stockholders' Equity 275000 437.500 Total Liabilities and Stockholders' Equity P 1,000,000 *XY Corp. hues 75,000 shares outstanding 600,000 400,000 274.000 12600 21.000 105.000 J1.500 407.500 Sales con credit) P Cost of Goods Sold Gross Prulit Selling and Administrative Experise Operating Profit Interest Expense Earnings before Taxes Tas Expense Net Income 2.500 Required: Compute the following rates for the two companies: 11. Fixed Assets to Long-term Liabilities 12. Fred Assets to Yotal Equity 13. Fixed Assets to Total Assets 14. Gross Prolit Margin 5. Ave. Collection Period 15. Operating Profit Margin 6. Inventory Turnover 16. Net Profit Margin 7. Days Supply in Inventory 17. Return on Assets 8. Dext Ratio IN. Return on Equity 9. Equity Ratio 19. Earnings per Share 10, Deht to Equity Ratio 20. look Value per Share of Ordinary Share a. To which company would you, as credit manager for a supplier, approve the extension of short-term trade credit? Why? 1. To which company would you, as credit manager for a bank approve the credit? Why? c. In which one would you bey stock? Why? Submission date. March 27, 2021 Financial Planning and Analysis 100,000 80.000 180.000 The financial statement for AB Corporation and XY Corporation are shown below: AB Corporation Current Assets Liabilities Cash P 20,000 Accounts Payabile P Accounts Receivable.net 80.1300 Bonds Payable (long-term Inventory 50100 Total Liabilities P Total Current Assets 1.500,00 Stockholders' Equity Long-term Assets Share Capital Fixed Assets 500,00 Share Premium Les Accum. Depreciation - 150.000 Retained Earnings Net Fine Arts 350JDO Total Stockholders' Equity Total Assets 500.000 Total Liabilities and Stockholders' Equity P Sales (on credit) P 1.250,00 AB Corp. has 75,000 shares outstanding Cost of Goods Sold 750,000 Gross Prolit 5000 Selling and Administrative Expense 307.000 Operating Profit 193.000 Interest Expense JOJO Earnings before Taxes 16000 Tax Expense 48.900 Net Income 150,000 70,000 100,000 320,000 SOLO P 75.000 210.000 2.000 Current Assets Cash Marketable Securities Accounts Receivable.net Inventory Total Current Assets Long-term Assets Firud Assets Lee Accum. Depreciation Net Fixed Assets Total Assets P 75,000 30,000 47.500 152.500 P XY Corporation Liabilities 35.100 Accounts Payable P 7.500 Boods Payabile long term 70.000 Total Liabilities 5000 162.500 Stockholders' Fquity Share Capital P Share Premium 50000 Retained Earning -225.000 Total Stockholders' Equity 275000 437.500 Total Liabilities and Stockholders' Equity P 1,000,000 *XY Corp. hues 75,000 shares outstanding 600,000 400,000 274.000 12600 21.000 105.000 J1.500 407.500 Sales con credit) P Cost of Goods Sold Gross Prulit Selling and Administrative Experise Operating Profit Interest Expense Earnings before Taxes Tas Expense Net Income 2.500 Required: Compute the following rates for the two companies: 11. Fixed Assets to Long-term Liabilities 12. Fred Assets to Yotal Equity 13. Fixed Assets to Total Assets 14. Gross Prolit Margin 5. Ave. Collection Period 15. Operating Profit Margin 6. Inventory Turnover 16. Net Profit Margin 7. Days Supply in Inventory 17. Return on Assets 8. Dext Ratio IN. Return on Equity 9. Equity Ratio 19. Earnings per Share 10, Deht to Equity Ratio 20. look Value per Share of Ordinary Share a. To which company would you, as credit manager for a supplier, approve the extension of short-term trade credit? Why? 1. To which company would you, as credit manager for a bank approve the credit? Why? c. In which one would you bey stock? Why? Submission date. March 27, 2021