Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial ratio analysis is one of the best techniques for identifying and evaluating internal strengths and weaknesses. Potential investors and current shareholders look closely at

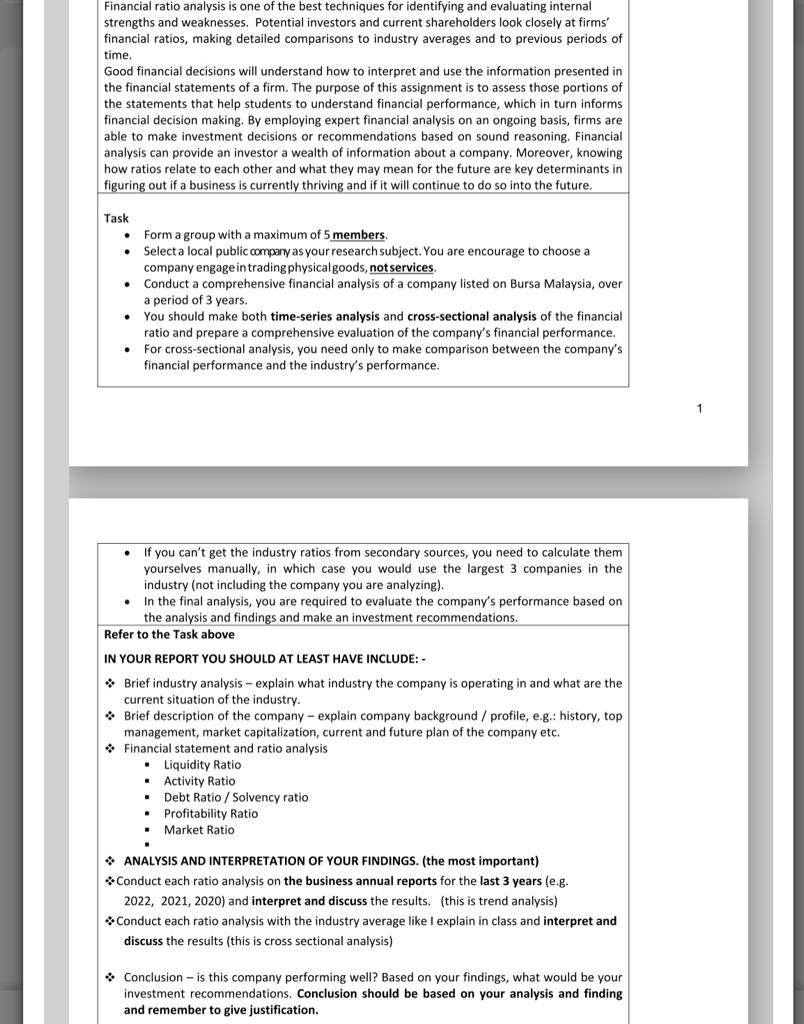

Financial ratio analysis is one of the best techniques for identifying and evaluating internal strengths and weaknesses. Potential investors and current shareholders look closely at firms' financial ratios, making detailed comparisons to industry averages and to previous periods of time. Good financial decisions will understand how to interpret and use the information presented in the financial statements of a firm. The purpose of this assignment is to assess those portions of the statements that help students to understand financial performance, which in turn informs financial decision making. By employing expert financial analysis on an ongoing basis, firms are able to make investment decisions or recommendations based on sound reasoning. Financial analysis can provide an investor a wealth of information about a company. Moreover, knowing how ratios relate to each other and what they may mean for the future are key determinants in figuring out if a business is currently thriving and if it will continue to do so into the future. Task - Form a group with a maximum of 5 members. - Select a local public compary as your research subject. You are encourage to choose a company engage in trading physicalgoods, not services. - Conduct a comprehensive financial analysis of a company listed on Bursa Malaysia, over a period of 3 years. - You should make both time-series analysis and cross-sectional analysis of the financial ratio and prepare a comprehensive evaluation of the company's financial performance. - For cross-sectional analysis, you need only to make comparison between the company's financial performance and the industry's performance. - If you can't get the industry ratios from secondary sources, you need to calculate them yourselves manually, in which case you would use the largest 3 companies in the industry (not including the company you are analyzing). - In the final analysis, you are required to evaluate the company's performance based on the analysis and findings and make an investment recommendations. Refer to the Task above IN YOUR REPORT YOU SHOULD AT LEAST HAVE INCLUDE: - Brief industry analysis - explain what industry the company is operating in and what are the current situation of the industry. $ Brief description of the company - explain company background / profile, e.g.: history, top management, market capitalization, current and future plan of the company etc. Financial statement and ratio analysis - Liquidity Ratio - Activity Ratio - Debt Ratio / Solvency ratio - Profitability Ratio - Market Ratio * ANALYSIS AND INTERPRETATION OF YOUR FINDINGS. (the most important) Conduct each ratio analysis on the business annual reports for the last 3 years (e.g. 2022, 2021, 2020) and interpret and discuss the results. (this is trend analysis) Conduct each ratio analysis with the industry average like I explain in class and interpret and discuss the results (this is cross sectional analysis) *Conclusion - is this company performing well? Based on your findings, what would be your investment recommendations. Conclusion should be based on your analysis and finding and remember to give justification

Financial ratio analysis is one of the best techniques for identifying and evaluating internal strengths and weaknesses. Potential investors and current shareholders look closely at firms' financial ratios, making detailed comparisons to industry averages and to previous periods of time. Good financial decisions will understand how to interpret and use the information presented in the financial statements of a firm. The purpose of this assignment is to assess those portions of the statements that help students to understand financial performance, which in turn informs financial decision making. By employing expert financial analysis on an ongoing basis, firms are able to make investment decisions or recommendations based on sound reasoning. Financial analysis can provide an investor a wealth of information about a company. Moreover, knowing how ratios relate to each other and what they may mean for the future are key determinants in figuring out if a business is currently thriving and if it will continue to do so into the future. Task - Form a group with a maximum of 5 members. - Select a local public compary as your research subject. You are encourage to choose a company engage in trading physicalgoods, not services. - Conduct a comprehensive financial analysis of a company listed on Bursa Malaysia, over a period of 3 years. - You should make both time-series analysis and cross-sectional analysis of the financial ratio and prepare a comprehensive evaluation of the company's financial performance. - For cross-sectional analysis, you need only to make comparison between the company's financial performance and the industry's performance. - If you can't get the industry ratios from secondary sources, you need to calculate them yourselves manually, in which case you would use the largest 3 companies in the industry (not including the company you are analyzing). - In the final analysis, you are required to evaluate the company's performance based on the analysis and findings and make an investment recommendations. Refer to the Task above IN YOUR REPORT YOU SHOULD AT LEAST HAVE INCLUDE: - Brief industry analysis - explain what industry the company is operating in and what are the current situation of the industry. $ Brief description of the company - explain company background / profile, e.g.: history, top management, market capitalization, current and future plan of the company etc. Financial statement and ratio analysis - Liquidity Ratio - Activity Ratio - Debt Ratio / Solvency ratio - Profitability Ratio - Market Ratio * ANALYSIS AND INTERPRETATION OF YOUR FINDINGS. (the most important) Conduct each ratio analysis on the business annual reports for the last 3 years (e.g. 2022, 2021, 2020) and interpret and discuss the results. (this is trend analysis) Conduct each ratio analysis with the industry average like I explain in class and interpret and discuss the results (this is cross sectional analysis) *Conclusion - is this company performing well? Based on your findings, what would be your investment recommendations. Conclusion should be based on your analysis and finding and remember to give justification Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started