Answered step by step

Verified Expert Solution

Question

1 Approved Answer

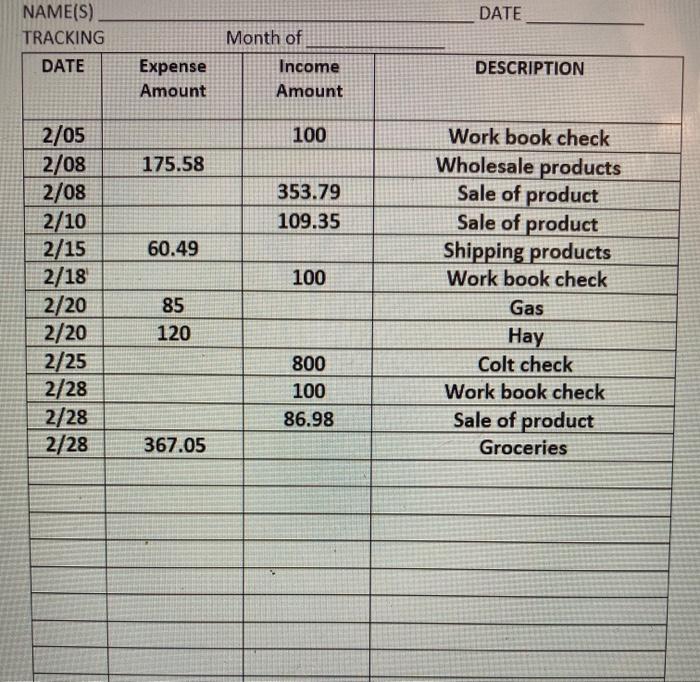

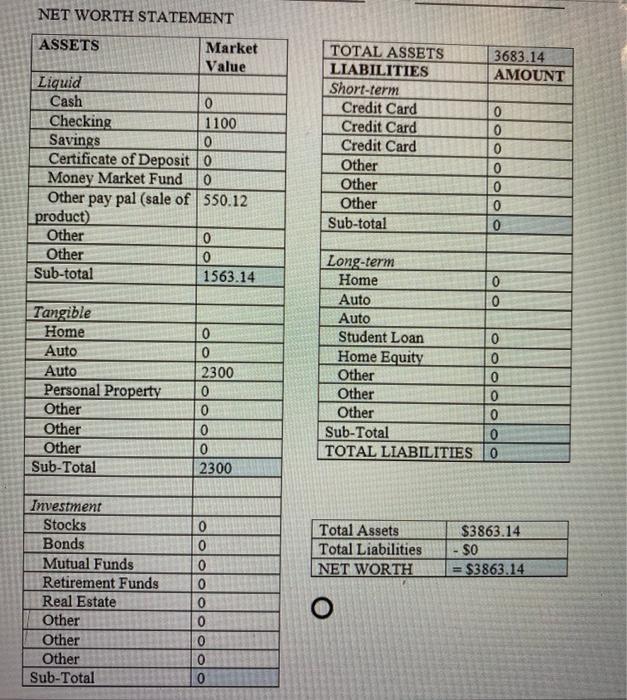

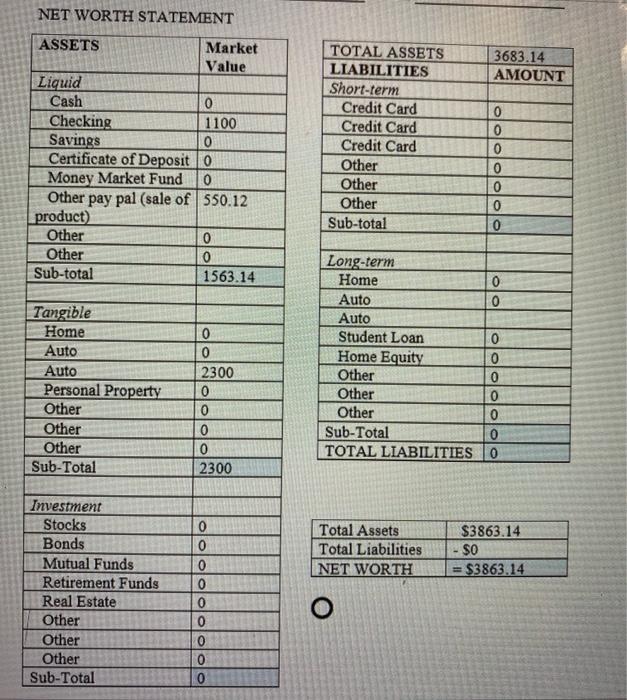

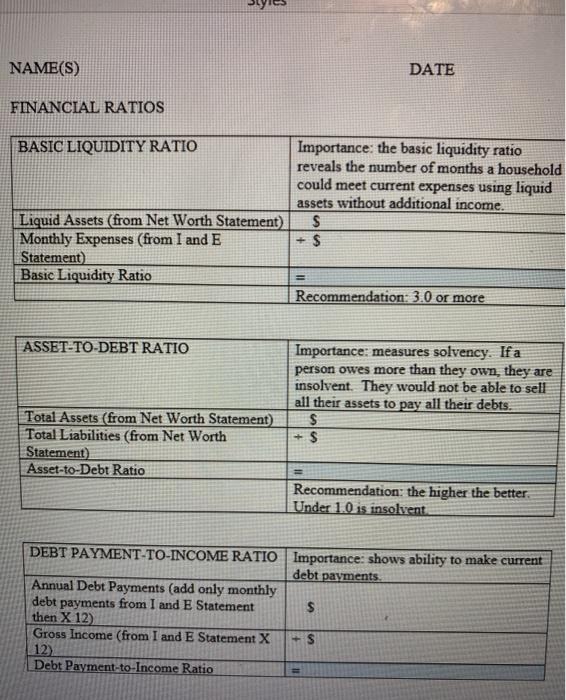

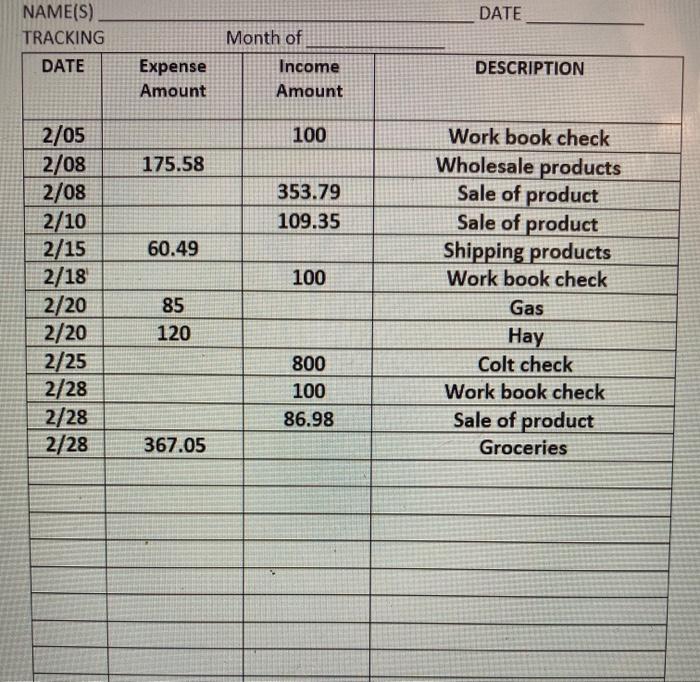

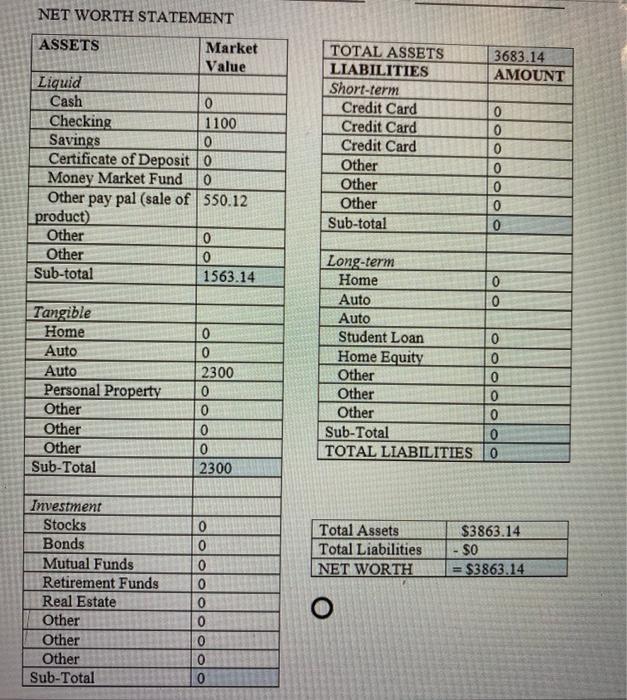

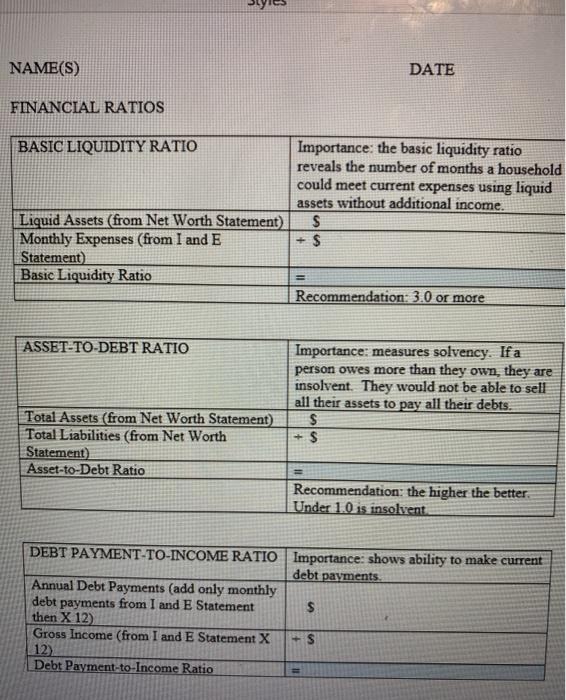

financial ratios help this is what i got so far to help. its the last one. DATE NAME(S) TRACKING DATE Expense Amount Month of Income

financial ratios help this is what i got so far to help. its the last one.

DATE NAME(S) TRACKING DATE Expense Amount Month of Income Amount DESCRIPTION 100 175.58 353.79 109.35 60.49 100 2/05 2/08 2/08 2/10 2/15 2/18 2/20 2/20 2/25 2/28 2/28 2/28 Work book check Wholesale products Sale of product Sale of product Shipping products Work book check Gas Hay Colt check Work book check Sale of product Groceries 85 120 800 100 86.98 367.05 NET WORTH STATEMENT 3683.14 AMOUNT ASSETS Market Value Liquid Cash 0 Checking 1100 Savings 0 Certificate of Deposit Money Market Fund 0 Other pay pal (sale of 550.12 product) Other 0 Other 0 Sub-total 1563.14 TOTAL ASSETS LIABILITIES Short-term Credit Card Credit Card Credit Card Other Other Other Sub-total 0 0 0 0 0 0 0 Olo Tangible Home Auto Auto Personal Property Other Other Other Sub-Total 0 0 2300 0 o 0 0 2300 Long-term Home Auto Auto Student Loan 0 Home Equity 0 Other 0 Other 0 Other 0 Sub-Total 0 TOTAL LIABILITIES O Total Assets Total Liabilities NET WORTH $3863.14 $0 = $3863.14 Investment Stocks Bonds Mutual Funds Retirement Funds Real Estate Other Other Other Sub-Total 0 0 0 0 0 0 0 0 0 NET WORTH STATEMENT 3683.14 AMOUNT ASSETS Market Value Liquid Cash 0 Checking 1100 Savings 0 Certificate of Deposito Money Market Fund 0 Other pay pal (sale of 550.12 product) Other 0 Other 0 Sub-total 1563.14 TOTAL ASSETS LIABILITIES Short-term Credit Card Credit Card Credit Card Other Other Other Sub-total 0 0 0 0 0 0 0 Olo Tangible Home Auto Auto Personal Property Other Other Other Sub-Total 0 0 2300 0 0 0 0 2300 Long-term Home Auto Auto Student Loan 0 Home Equity 0 Other 0 Other 0 Other 0 Sub-Total 0 TOTAL LIABILITIES O Total Assets Total Liabilities NET WORTH $3863.14 $0 = $3863.14 Investment Stocks Bonds Mutual Funds Retirement Funds Real Estate Other Other Other Sub-Total 0 0 0 0 0 0 0 0 0 NAME(S) DATE FINANCIAL RATIOS BASIC LIQUIDITY RATIO Importance: the basic liquidity ratio reveals the number of months a household could meet current expenses using liquid assets without additional income. $ + $ Liquid Assets (from Net Worth Statement) Monthly Expenses (from I and E Statement) Basic Liquidity Ratio Recommendation: 3.0 or more ASSET-TO-DEBT RATIO Importance: measures solvency. If a person owes more than they own, they are insolvent. They would not be able to sell all their assets to pay all their debts. $ + $ Total Assets (from Net Worth Statement) Total Liabilities (from Net Worth Statement) Asset-to-Debt Ratio Recommendation: the higher the better. Under 1.0 is insolvent DEBT PAYMENT-TO-INCOME RATIO Importance: shows ability to make current debt payments Annual Debt Payments (add only monthly debt payments from I and E Statement $ then X 12) Gross Income (from I and E Statement X + S Debt Payment-to-Income Ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started