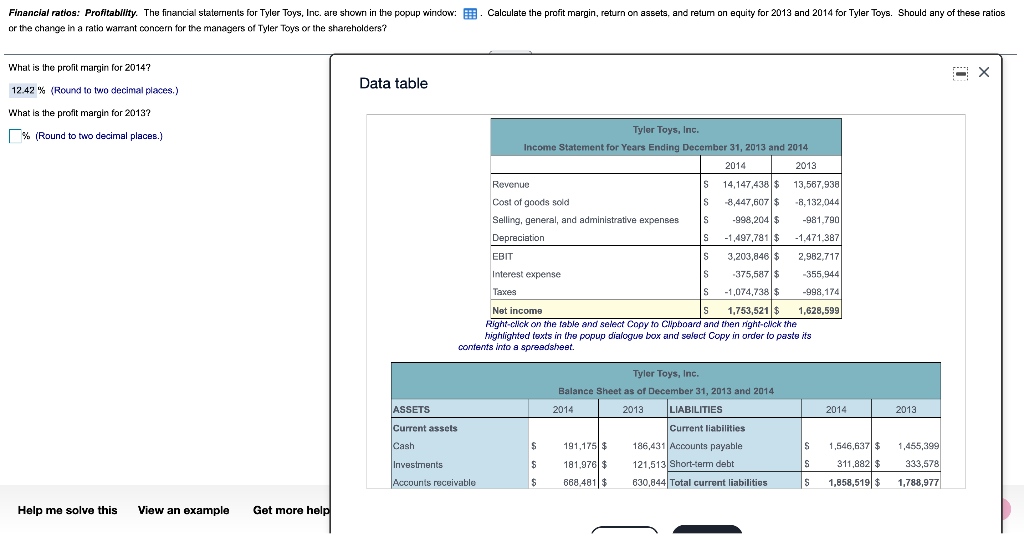

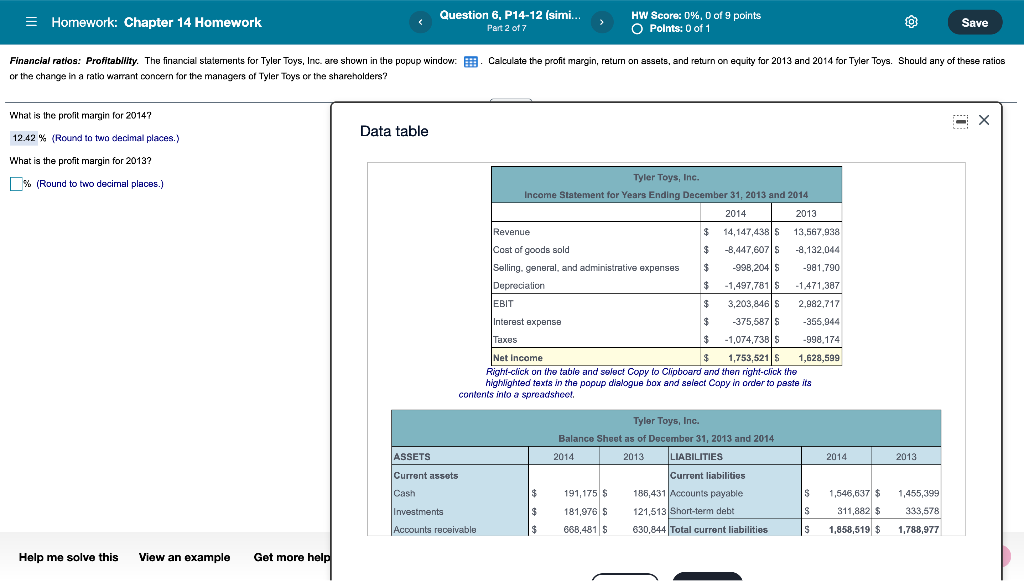

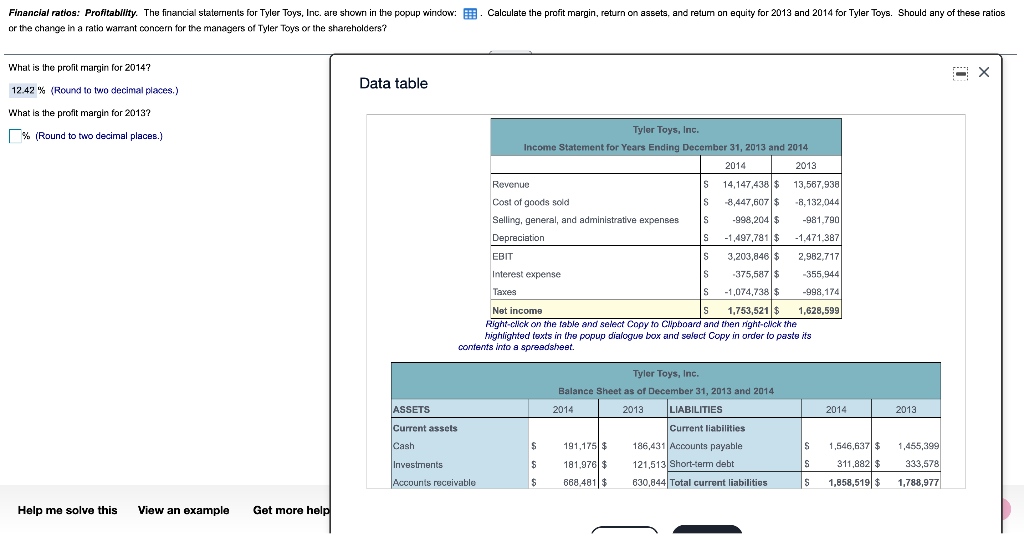

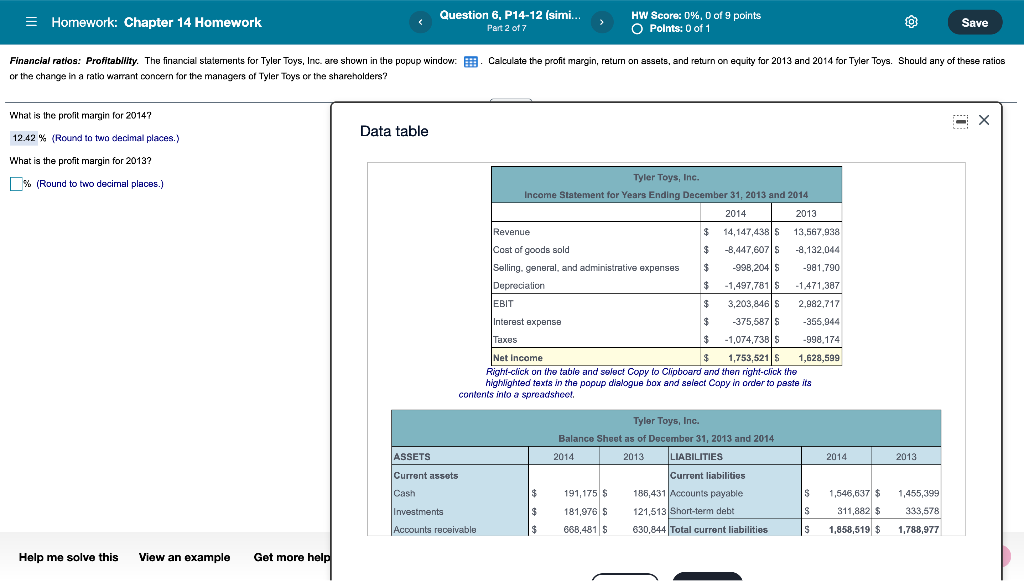

Financial ratios: Profitability. The financial staterrients for Tyler Toys, Inc. are shown in the popup window: B. Calculate the profit margin, return on assets, and retum on equity for 2013 and 2014 for Tyler Toys. Should any of these ratios . . or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? What is the profit margin for 20147 X 12.42 % (Round to two decimal places.) Data table What is the profit margin for 2013? % (Round to two decimal places.) Tyler Toys, Inc. Income Statement for Years Ending December 31, 2013 and 2014 2014 2013 Revenue S 14,147,438 $ 13,567,938 Cost of goods sold S 8,447,607 $ -8, 132,044 Selling, general, and administrative expenses S -998,204 $ -981.790 Depreciation S -1,497,781 $ -1.471.387 EBIT S 3,203,846 $ 2,982,717 Interest expense S -375,587 $ -355,944 Taxes S -1,074,738 $ -998,174 Net income S 1,753,521 $ 1,628,599 Right click on the table and select Copy to clipboard and then night click the highlighted texts in the popup dialogue box and select Copy in order to paste its contents into a spreadsheet. ASSETS 2014 2013 Current assets Tyler Toys, Inc. Balance Sheet as of December 31, 2013 and 2014 2014 2013 LIABILITIES Current liabilities 191,175 $ 186,431 Accounts payable 181,976 $ 121,513 Short-term debt 868,481 $ 630,844 Total current liabilities Cash S S 1,455,399 333,578 Investments 1,546,637 $ 311,882 $ 1,858,519 $ S Accounts receivable $ S 1,788,977 Help me solve this View an example Get more help = Homework: Chapter 14 Homework Question 6, P14-12 (simi... Part 2 of 7 HW Score: 0%, 0 of 9 points O 0 1 Points: 0 of 1 0 Save Financial ratios: Profitability. The financial staternents for Tyler Toys, Inc. are shown in the popup window. B. Calculate the profit margin, return on assets, and return on equity for 2013 and 2014 for Tyler Toys. Should any of these ratios , : , , . or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? What is the profit margin for 20147 - 12.42 % (Round to two decimal places.) Data table What is the profit margin for 2013? % (Round to two decimal places.) Tyler Toys, Inc. Income Statement for Years Ending December 31, 2013 and 2014 2014 2013 Revenue $ 14,147,438 $ 13,567,938 S Cost of goods sold $ -8,447,607 S -8.132,044 Selling general, and administrative expenses $ -998,204 S -981.790 Depreciation $ -1,497,781 S -1.471,387 EBIT $ 3,203,846 S 2,982,717 Interest expense $ 375,587 S -355,944 Taxes $ - 1,074,738 S -998,174 Net Income $ 1,753,52118 1,628,599 Right click on the table and select Copy to clipboard and then right-click the highlighted texts in the popup dialogue box and select Copy in order to peste its contents into a spreadshool ASSETS 2014 2013 Tyler Toys, Inc. Balance Sheet as of December 31, 2013 and 2014 2014 2013 LIABILITIES Current liabilities 191,175 S 186,431 Accounts payable 181,976 S 121,513 Short-term debt 668,481 S 630,844 Total current liabilities $ $ Current assets Cash Investments Accounts receivable $ S 1,455,399 333,578 $ 1,546,637 $ $ 311,882 $ 1,858,519 $ S $ S 1.788,977 Help me solve this View an example Get more help