Question

Your write-up needs to address each of the following areas. Plainly label each section. Support your observations with numbers from your ratios or directional (horizontal

Your write-up needs to address each of the following areas. Plainly label each section. Support your observations with numbers from your ratios or directional (horizontal & vertical) financial statements. For example, if long-term debt increased, what caused it? Do you see an increase in property & equipment? Has the interest expense increased? Has depreciation jumped significantly?

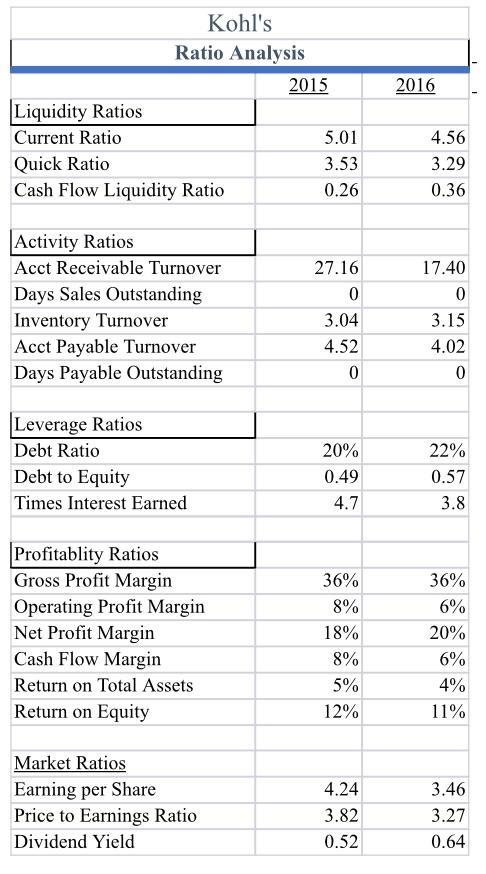

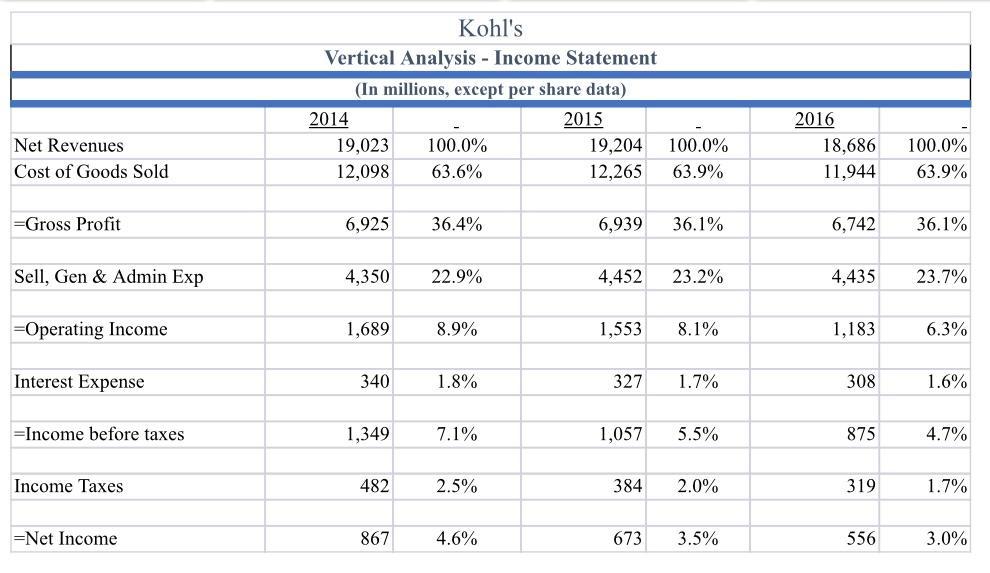

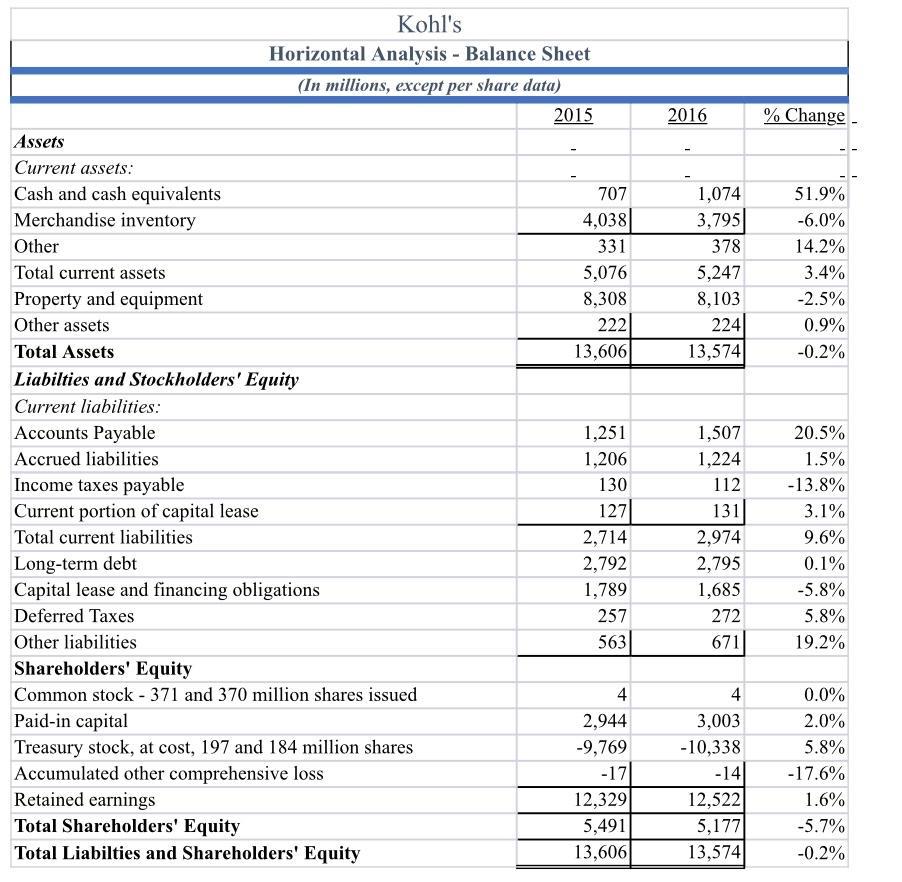

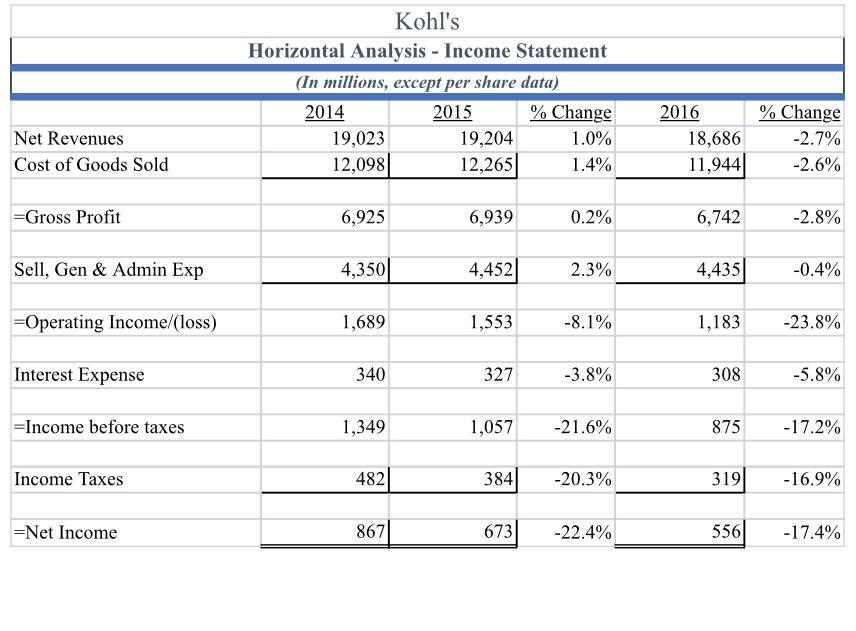

Sales Growth – Are Net Sales Growing? Are there any divisions or product lines growing? Does the annual report indicate the reason(s) for this? Does your directional analysis (horizontal or vertical) bear this out? Can we see the sales increase in the inventory turnover ratio?

Cost Control – are expenses in line with the change in net sales? Look at the costs, including the cost of goods sold, marketing expenses, and administrative expenses. Look at the COGS% change and the SGA% (selling, general & administrative expenses) changes. Again, support your observation with your directional analysis and/or ratios, Profitability – Look at the three levels of profits: gross margin, operating profit, and net income. How are they changing from year to year as a percentage of sales (vertical analysis)?

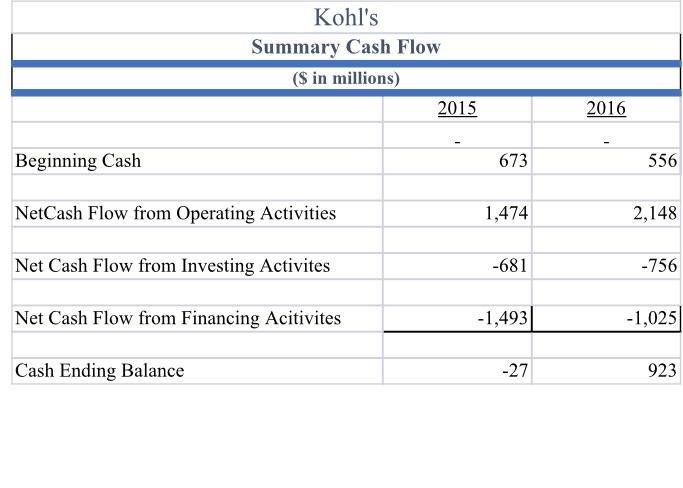

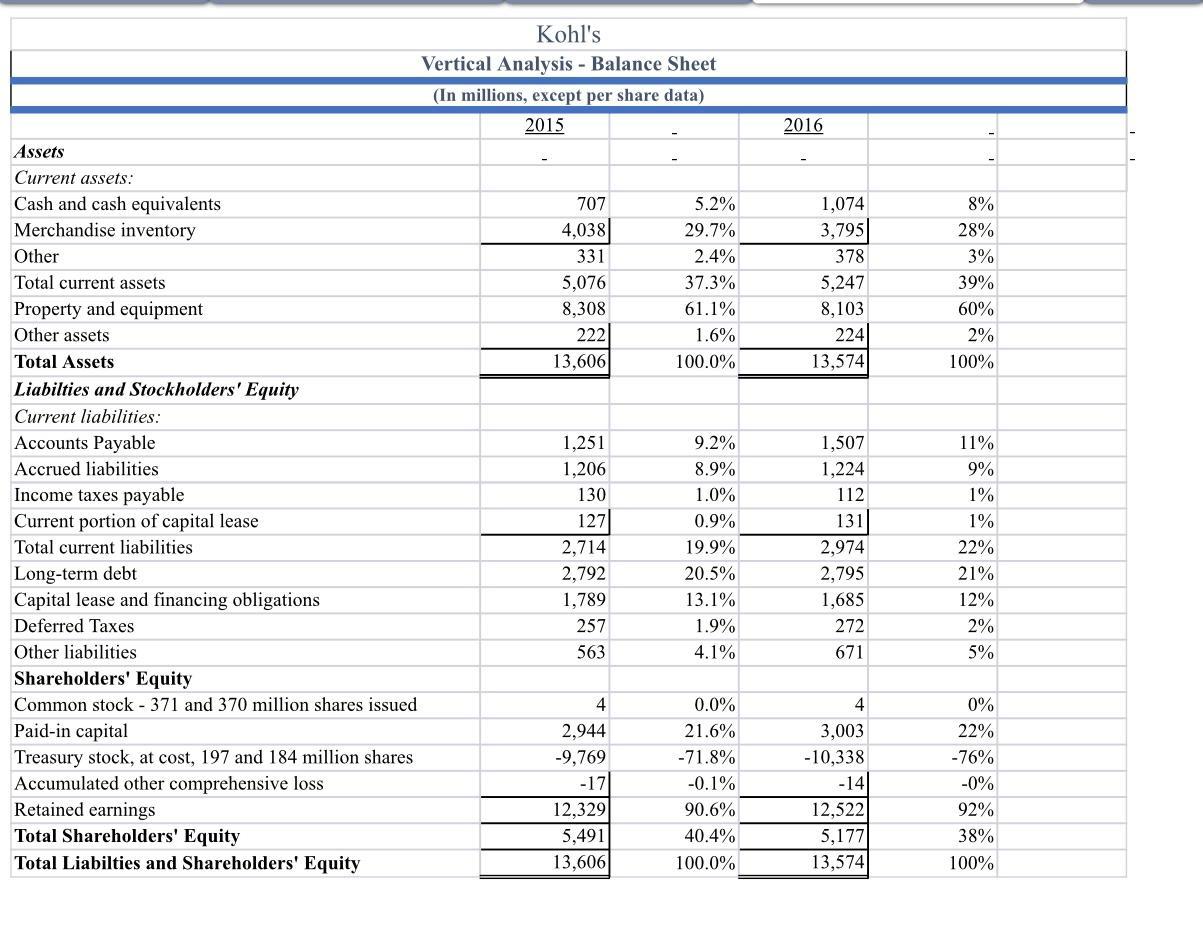

Cash Flow and Liquidity - Is cash increasing or decreasing. Does that make sense in light of the profits? What about the liquidity ratios? Did you find a change in the current or the quick ratio? Look at the cash flow statements. Are operations generating or consuming cash? Is the growth of inventory reasonable as compared to the growing cost of goods sold? Look at the accounts payable turnover ratio. And don’t forget about accounts receivable and their change. Are you concerned with changes in the accounts receivable turnover ratio?

Debt Levels – Is debt increasing or decreasing? Looks at the change in current and long-term liabilities in your directional analyses. What are the reasons for this change? Look at your debt ratios. Is there anything in the annual reports or outside articles to explain a significant change in debt, if you find one?

Equity and Stock Market Factors – Has common stock plus the paid-in capital on common stock increased? Has it decreased from a buyback of common stock (treasury stock)? What about the price of the stock, has it changed significantly over the years of your analysis. Look at the price to earnings ratio and the dividend yield ratio.

Please follow the format above regarding the information below.

Kohl's Summary Cash Flow ($ in millions) Beginning Cash NetCash Flow from Operating Activities Net Cash Flow from Investing Activites Net Cash Flow from Financing Acitivites Cash Ending Balance 2015 673 1,474 -681 -1,493 -27 2016 556 2,148 -756 -1,025 923

Step by Step Solution

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started