Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial Statement Analysis (Bankruptcy Prediction): LO (#2, 3, 4, 5, 6) Dear all students of Intermediate Accounting (I) Select an Industrial firm of listed firms

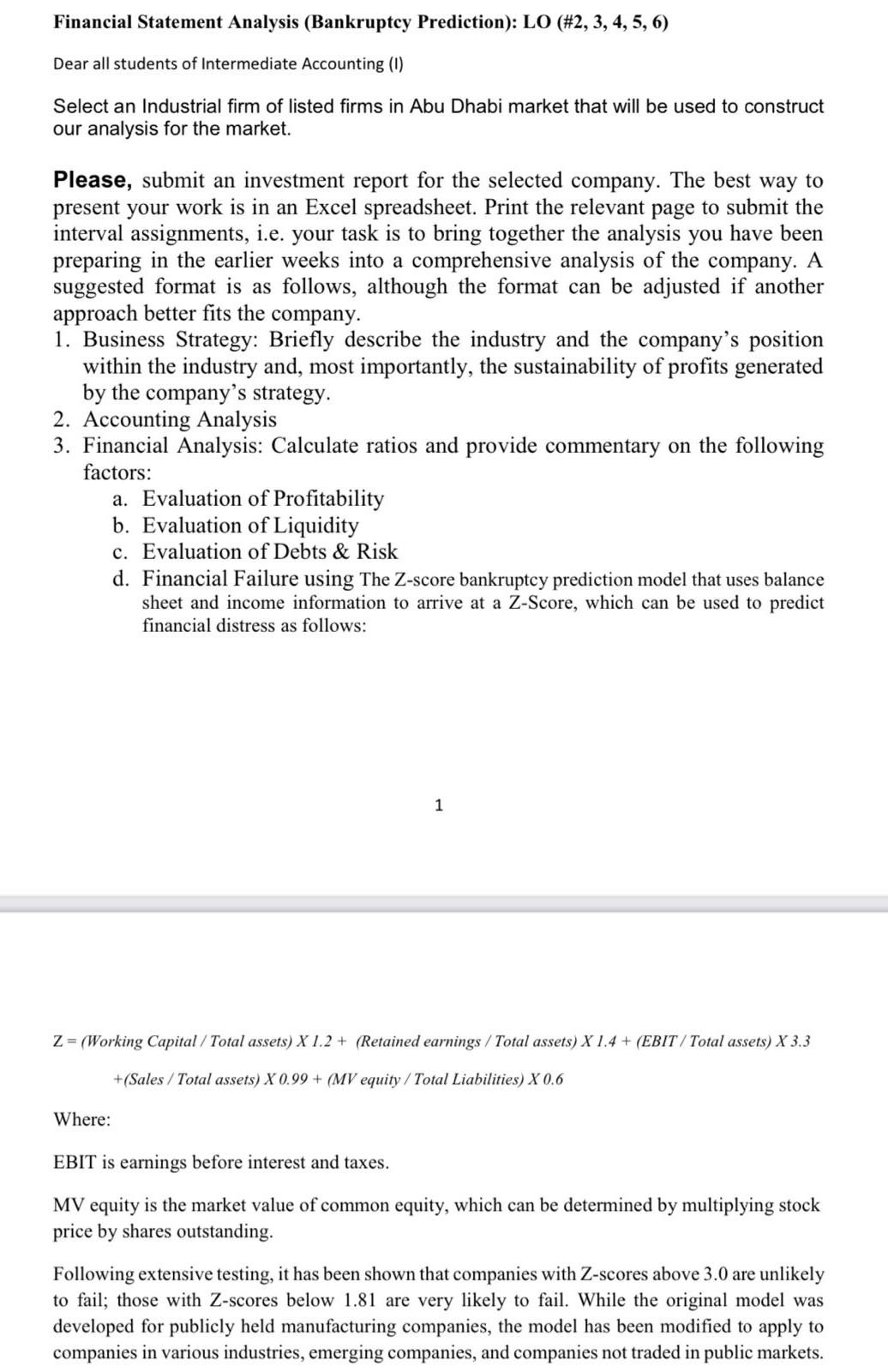

Financial Statement Analysis (Bankruptcy Prediction): LO (\#2, 3, 4, 5, 6) Dear all students of Intermediate Accounting (I) Select an Industrial firm of listed firms in Abu Dhabi market that will be used to construct our analysis for the market. Please, submit an investment report for the selected company. The best way to present your work is in an Excel spreadsheet. Print the relevant page to submit the interval assignments, i.e. your task is to bring together the analysis you have been preparing in the earlier weeks into a comprehensive analysis of the company. A suggested format is as follows, although the format can be adjusted if another approach better fits the company. 1. Business Strategy: Briefly describe the industry and the company's position within the industry and, most importantly, the sustainability of profits generated by the company's strategy. 2. Accounting Analysis 3. Financial Analysis: Calculate ratios and provide commentary on the following factors: a. Evaluation of Profitability b. Evaluation of Liquidity c. Evaluation of Debts \& Risk d. Financial Failure using The Z-score bankruptcy prediction model that uses balance sheet and income information to arrive at a Z-Score, which can be used to predict financial distress as follows: 1 Z= (Working Capital / Total assets) X1.2 + (Retained earnings / Total assets) X 1.4 + (EBIT / Total assets) X3.3 +( Sales / Total assets) X 0.99+( MV equity / Total Liabilities) X0.6 Where: EBIT is earnings before interest and taxes. MV equity is the market value of common equity, which can be determined by multiplying stock price by shares outstanding. Following extensive testing, it has been shown that companies with Z-scores above 3.0 are unlikely to fail; those with Z-scores below 1.81 are very likely to fail. While the original model was developed for publicly held manufacturing companies, the model has been modified to apply to companies in various industries, emerging companies, and companies not traded in public markets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started