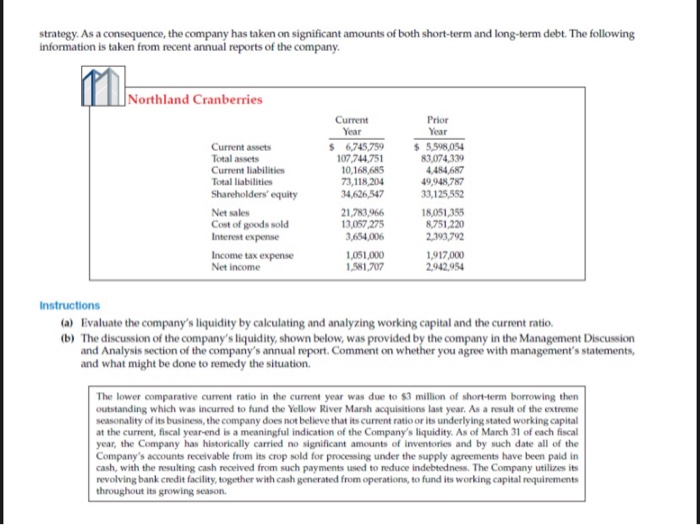

Financial Statement Analysis Cases Case: Northland Cranberries Despite being a publicly traded company only . Nothand world's largest aby w During hapub d o W a p Wi t h wth o h e show mandlengd e. The following strategy. As a con ce, the company has taken t information is taken from recent annual reports of the company Northland Cranberries SO Cura 10 Code 11 1 SU n d the Instructions Evalue the company's by ca The discuss the y ' d and Analytonohan's how port C was onw the Man th i strategy. As a consequence, the company has taken on significant amounts of both short-term and long-term debt. The following information is taken from recent annual reports of the company. Northland Cranberries Current assets Total assets Current liabilities Total liabilities Shareholders' equity Net sales Cost of goods sold Interest expense Income tax expense Net income Current Year $ 6,745,759 107,744.751 10,168,685 73,118,204 34.626,547 21,783,966 13,057 275 3,654,006 1,051,000 1.581.707 Prior Year $ 5,598,054 83,074,339 4.484.687 49,948,787 33,125,552 18,051,355 8.751.220 2.193.792 1,917 000 2,942,954 Instructions (a) Evaluate the company's liquidity by calculating and analyzing working capital and the current ratio, (b) The discussion of the company's liquidity, shown below, was provided by the company in the Management Discussion and Analysis section of the company's annual report. Comment on whether you agree with management's statements, and what might be done to remedy the situation. The lower comparative current ratio in the current year was due to $3 million of short-term borrowing then outstanding which was incurred to fund the Yellow River Marsh acquisitions last year. As a result of the extreme seasonality of its business, the company does not believe that its current ratio or its underlying stated working capital at the current, fiscal year end is a meaningful indication of the Company's liquidity. As of March 31 of each fiscal year, the Company has historically carried no significant amounts of inventories and by such date all of the Company's accounts receivable from its crop sold for processing under the supply agreements have been paid in cash, with the resulting cash received from such payments used to reduce indebtedness. The Company utilizes its revolving bank credit facility, together with cash generated from operations, to fund its working capital requirements throughout its growing season