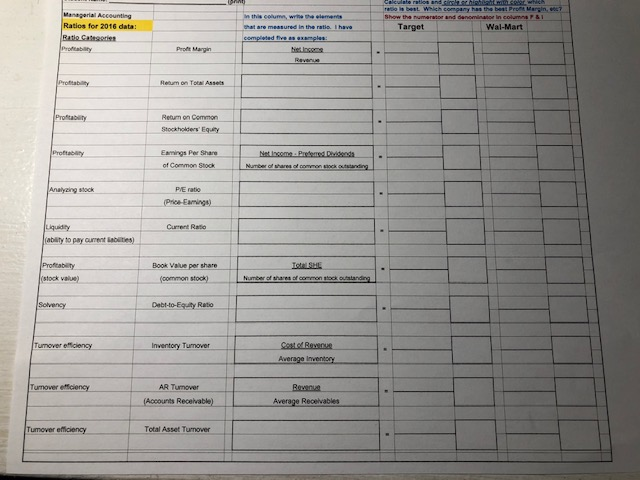

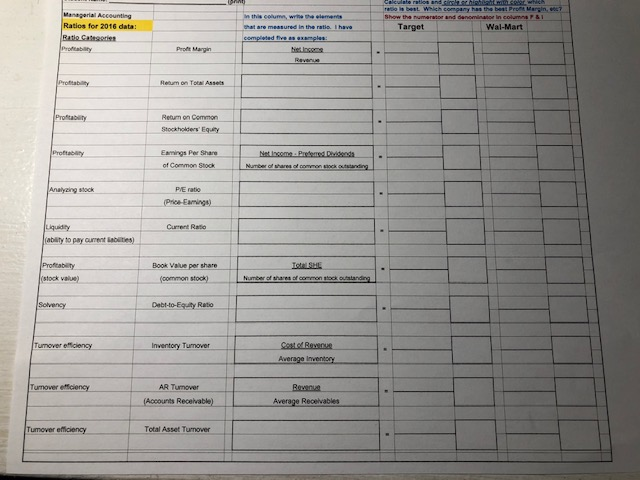

Financial Statement Analysis Project, Chapter 13

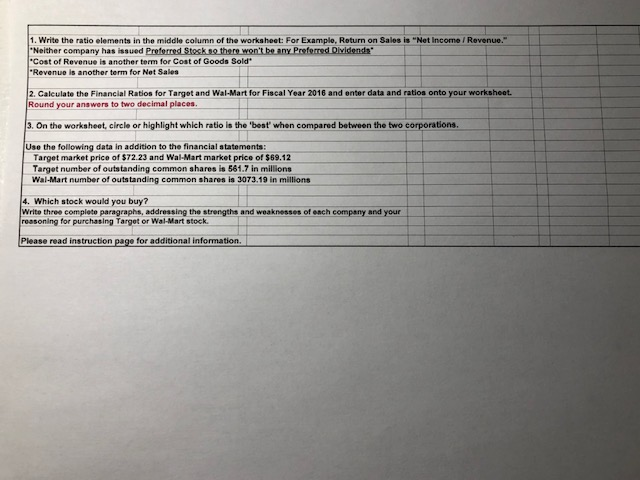

Project Instructions

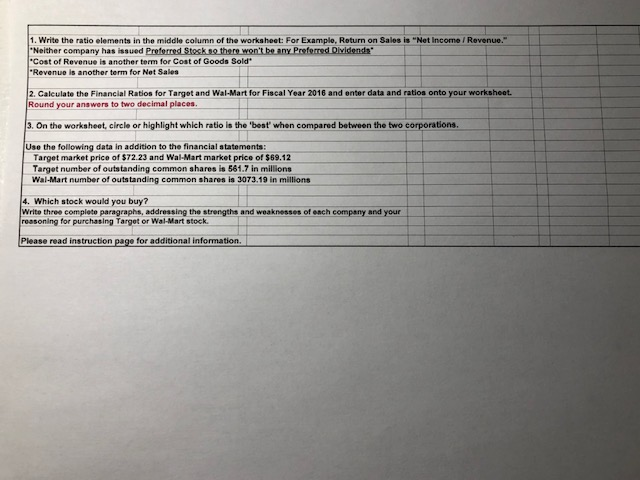

Use the following data in addition to the financial statements provided:

* Target market price per share of $72.23 and Wal-Mart market price per share of $69.12

* Target number of outstanding common shares is 561.7 in millions. (use the number given)

* Wal-Mart number of outstanding common shares is 3073.19 in millions. (use the number given)

After your financial analysis is complete, please answer:

Which stock would you buy and why?

Write three detailed paragraphs addressing the strengths and weaknesses of each company, as well as your reasons for purchasing Target or Wal-Mart stock.

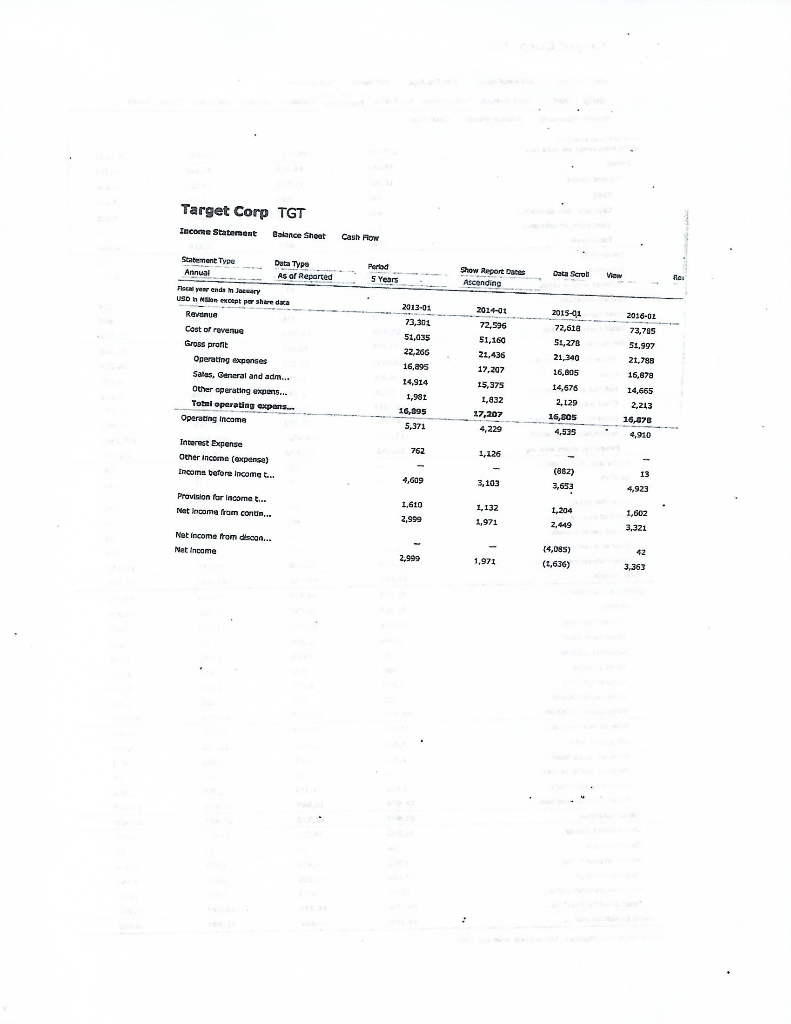

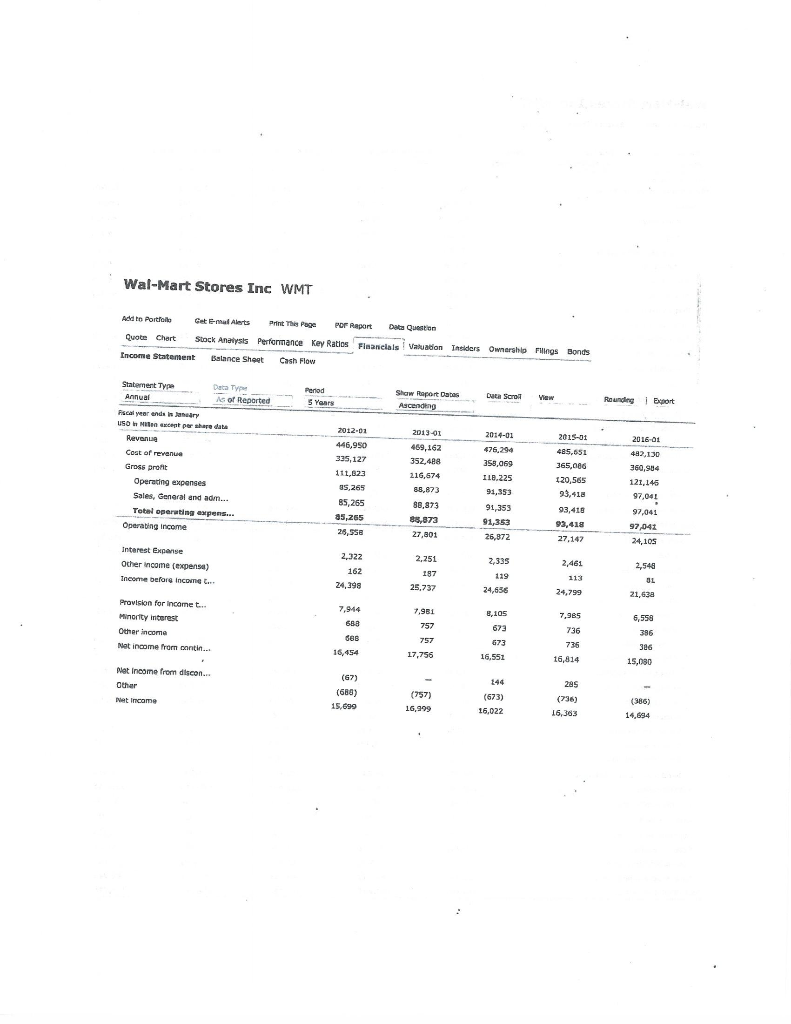

Important: The financial calculations should be completed for 2016 only. Annual reports provide several prior years information so investors and creditors can spot trends from year to year. You will not use 2012, 2013, or 2014 information for any of your calculations. You need 2015 for all ratios that require an average. For example:

(end of year 2015 + end of year 2016) / 2 = average

All ratios should include the numerators and denominators in columns F and I, and answers in columns G and J. Do NOT add zeros. Use the numbers provided. Show your work!

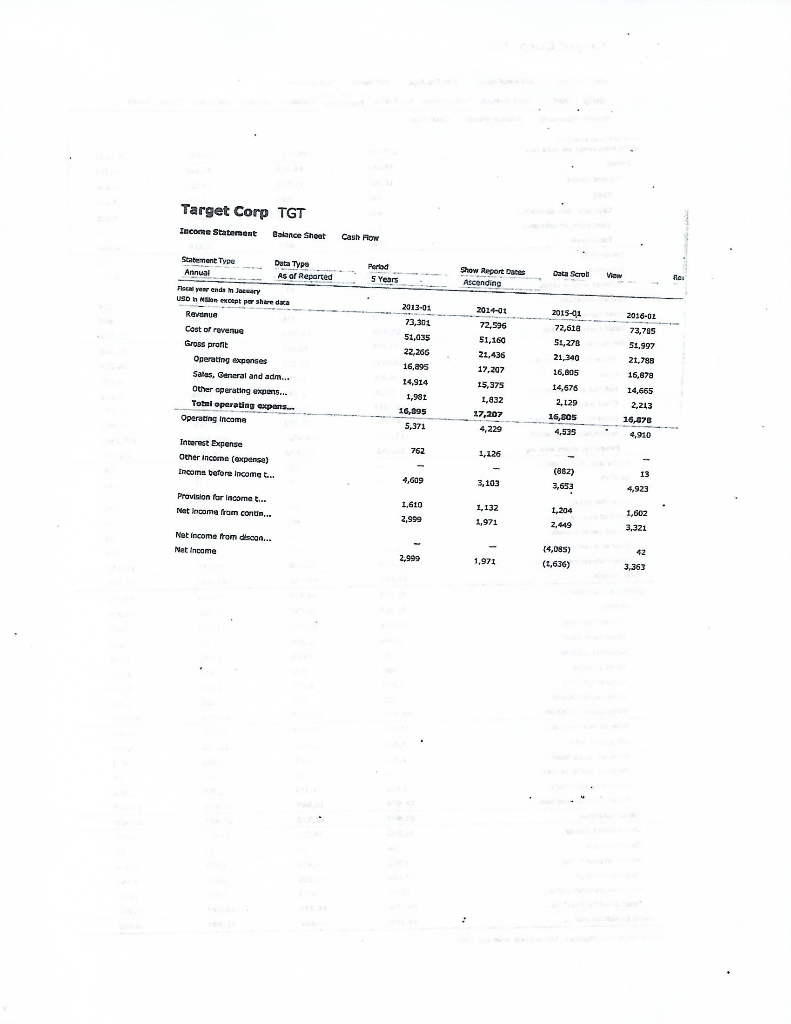

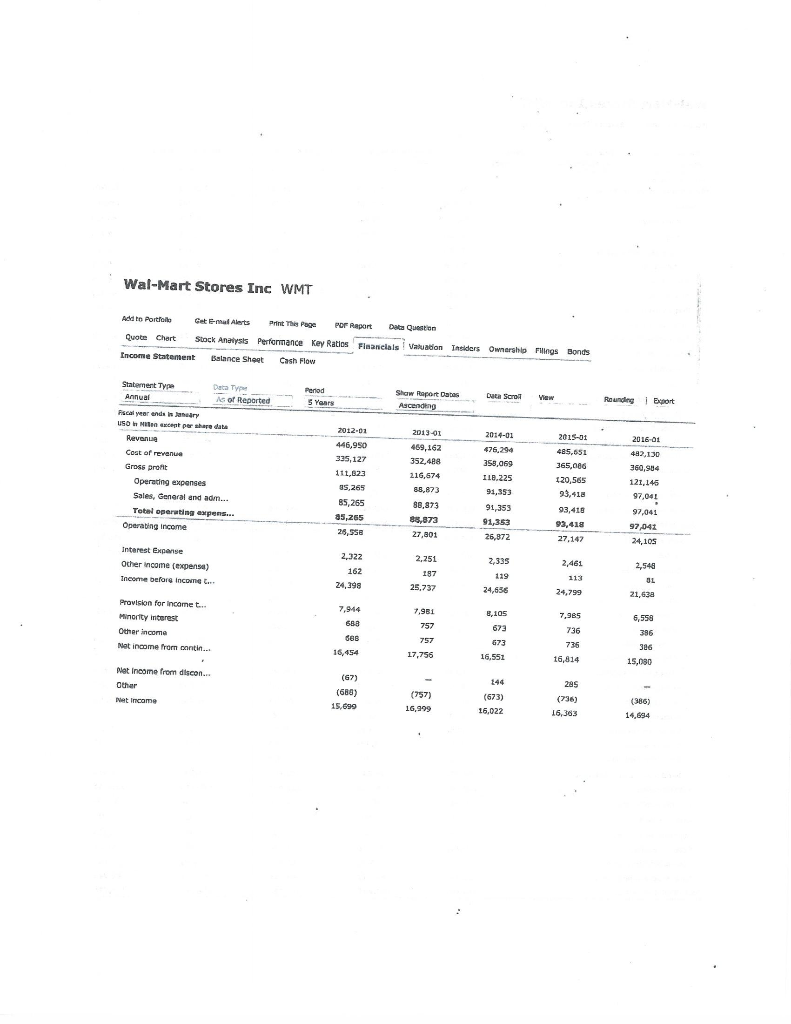

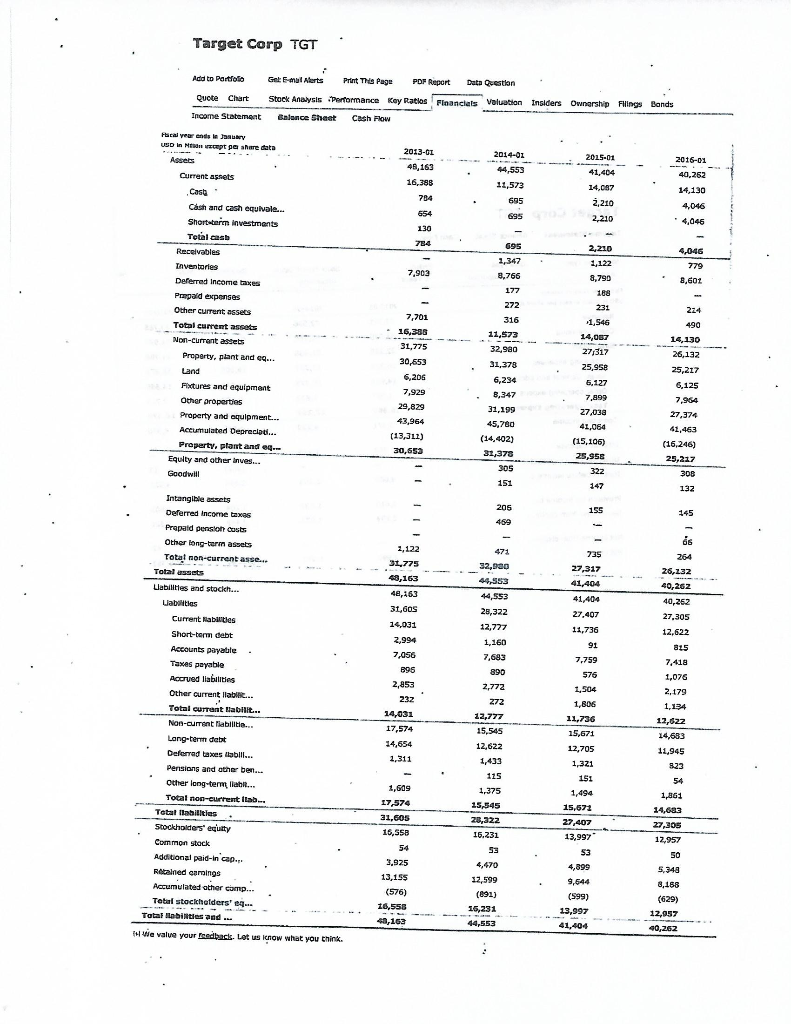

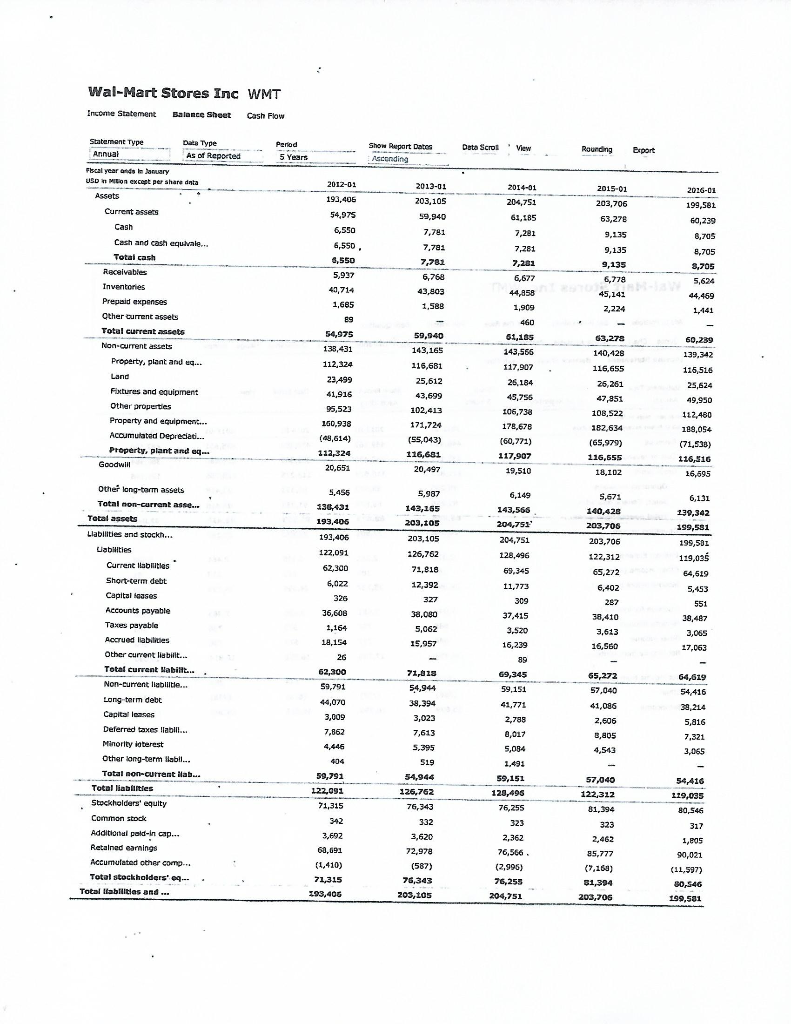

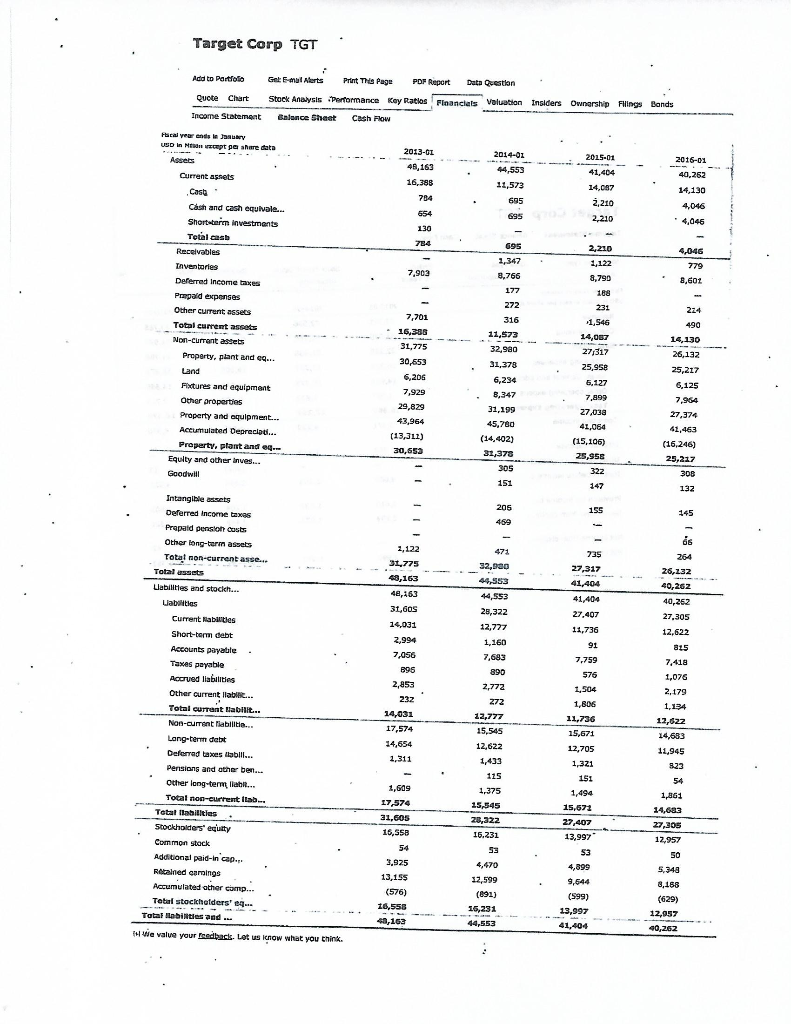

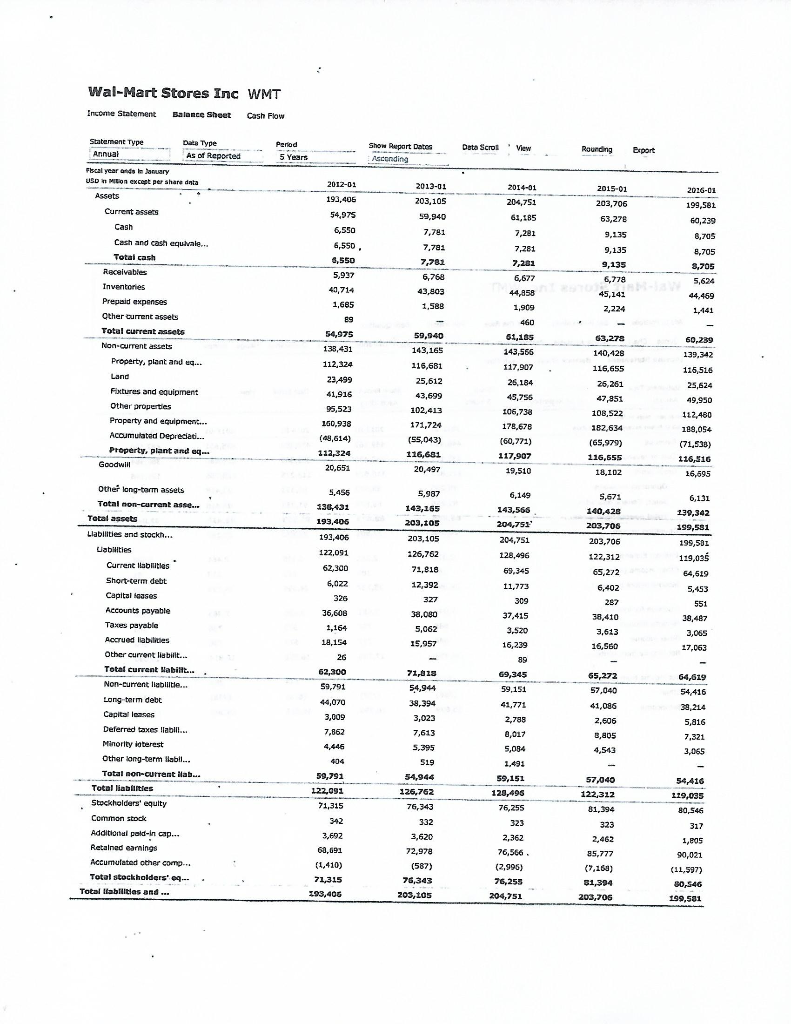

Target Corp TGT Income Statement Balance Sheet Cash Flow Period 5 Years Show Report Date Ascending Data Scroll Hea 2014-01 2015-01 2016-02 Statement Type Data Type Annual As of Reported Fiscal year enda in Jor USD In Non except per share daca Revenue Cast of revenue Gross pranit Operating expenses Sales, General and adm... Other operating expens... Total operating expans. Operating income 2013-01 73,303 51,035 22,266 16,895 14,914 1,981 16,895 5,371 72,61a 51,278 21,340 16.805 73,705 51.997 21,798 72.596 51,160 21.436 17,207 15,375 1,832 17,207 4,229 16,878 14,665 14,676 2,129 16.005 2,213 16,076 4,910 4,535 762 Interest Expense Other Income (expense) Income before Income t.. 1,126 4,609 3,103 (862) 3,653 13 4,923 Provision for Income t... Nat Income from condim... 1,610 2,999 1,132 1,971 1,204 2,449 1,602 3,321 Not Income from disega... Net Income 42 2,999 (4,095) (4,636) 1,971 3,363 Wal-Mart Stores Inc WMT Add to Portfolio Getal Alerts Print This Page Por Raport Data Question Quote Chart Stock Analysis Performance Key Ratios Financials Valuation Treiders Ownership Filings Bonds Encome Statement Balance Sheet Cash Flow Period 5 Years Show Report Dabas Ascending Data Sera Muw Rounding i Export Statement Type Data Type Annual As of Reported Fiscal year ends in any USO Mecept per share date Revenue 2016-01 Cost of revenue 2012-01 446,950 335,127 111,823 95.265 482,130 360,904 Gross pront Operating expenses Sales, General and adin... Total operating apens... Operating Income 2013-02 489,162 352,488 216,674 88,873 88,873 88,873 2014-01 476.294 358,059 I 18.225 91,353 91,353 91,353 2015-01 485,651 365,000 120,565 93,418 93,418 93,418 121,146 97,041 97,041 85,265 85,265 26,35e 97,042 27,801 26,872 27,147 24,105 Interest Experise Other income (expense) Income before income ... 2,322 162 24,398 2.251 197 2,335 119 2,461 113 24,799 2,548 OL 25.737 24,656 21,63a 7.981 8,105 6,558 Provision for income t... Minority interest Other income Nat income from contin 757 7,944 618 GBB 16,454 386 757 7,965 736 736 16,814 17,756 673 16.551 386 15,090 Net Income from discon... Other Net Income (67) (688) 15.699 (757) 16,999 (673) 16.022 295 (736) 16,363 14.694 Target Corp TGT Aspets Cash 2013-01 Add to Partfolo Gal: E-mail Alerts Print The Page POP Report Data Question Quote Chart Stock Analysis Performance Key Ratios Financials Valuation Insiders Ownership Filings Bands Income Statement Balance Sheet Cash Flow Prayer and Jalary USD In de vecept pa share data 2014-01 2015-01 2016-01 48,163 44,553 41,404 40,262 Current assets 16,386 11,573 14,087 14,130 784 695 2.210 4,046 Cash and cash equivale... 654 2.210 Short-term investments 4,046 130 Total cast 784 695 2,210 Receivables 4,046 1,347 2,122 Inventories 779 7.903 8.766 8,790 Deferred Income taxes 8,601 177 184 Pompald expenses 272 231 Other current assets 224 7,701 316 -1,546 490 Total current assets 16,388 11.573 14,067 14,130 Non-current assets 31,775 32,90 27/317 26,132 Property, plant and eq... 30,653 31,378 25,958 25,217 Land 6,206 6,234 6,127 Fixtures and equipment 6,125 7,929 8,347 7,899 Other aroperties 7,964 29,829 31,199 27,038 Property and equipment... 27,374 43,964 45,780 41,064 Accumulated Depreciaul... 41,463 (13,312) (14,402) (15,106) Property, plant and eq.- (16,246) 30,652 31,378 25,95 Equity and other inves... 25,217 305 322 Goodwill 308 151 147 132 205 155 145 469 735 27,317 41,404 2,122 31.775 48,163 40,163 31,60S 14,031 2,994 7,056 471 32,9ao 44,953 44,553 28,322 12,777 1,160 7,683 890 6 264 26,132 40,262 40,262 27.305 12,622 41,404 27,407 11,736 91 7,759 815 7,418 1,076 2,179 576 1.504 Intangible assets Deferred Income taxes Prepaid pension costs Other long-term asants Total non-current asse... Total assets Liabilities and stocich... Uabilities Current Habitles Short-term debt Accounts payable Taxes payable Accrved liabilities Other current abiec... Total current Iabilit... Non-current liabilitie... Long-term dett Deferred taxes llabill... Pensions and other ben.. Other long-term liabil... Total non-current tab. Tetal abilities Stockholders' equity Common stock Additional paid-in cap... Retained carings Accumulated ather comp... Totul stockholders' ... ... Tata Itabilities and We value your feedbacks. Let us know what you think 896 2,853 232 14,031 17,574 1,134 2,772 272 22,777 15,545 12,622 1,433 12,022 14,683 14,654 2.311 1,806 11,736 15,671 12,705 1,321 151 11,945 115 54 1,490 2,609 17,574 31.605 16,558 1,861 14,683 15,674 1,375 15,545 28,azz 16.231 53 27,407 13,997 27,305 12,957 54 S3 3.925 13,15$ (576) 16,556 40,163 4,670 37,599 (691) 16,231 4,899 9,544 (599) 13,997 41,404 50 5.348 8,168 (629) 12,957 40,262 44,553 Wal-Mart Stores Inc WMT Income Statement Balance Sheet Cash Flow Period Data Scrol View Show Report Dates Ascending Rounding Deport 5 Years Statement Type Data Type Annual As of Reported Fiscal year and teamuary USD Milion except per share data Assets Current assets 2012-01 2014-01 193,406 2011-01 203,105 59,940 2015-01 203,706 63,278 2016-01 199,581 69,239 Cash 9,135 6.793 54,975 6,550 6,550 6,550 5,937 40,714 1,665 7,781 7,781 7,782 6,768 43,803 1,588 204,751 63,185 7,281 7,281 7,281 6,677 9,135 9,135 6,778 45,142 8,705 8,705 5,624 44,469 1,141 44,958 1,909 2,224 E9 460 54,975 138,431 60,239 Cash and cash equivale... Total cash Receivables Inventories Prepaid expenses Other current assets Total current assets Non-current assets Property, plant and ug... Land Fixtures and equipment Other properties Property and equipment... Accumulated Depreciati... Property, plant and eq.. Goodwill 139,342 61,185 143,566 117.907 26.184 112,324 23,499 41,916 59,940 143,165 116,681 25,612 43,699 102,413 171,724 (55,043) 116,681 20,497 116,510 25,624 49,950 112,480 189,054 95,523 63,278 140,128 116,655 25,261 47,851 108,522 182,634 (65,979) 116,555 18,102 45,755 106,738 178,678 (60,771) 117,907 19,510 160,938 (49,614) 112,324 20,651 (71.538) 116,516 16,595 Other long-term assets Total non-currant asse... Total assets Llabilities and stockh... 5,456 130,431 193,406 5,987 143,165 203,105 6,149 143,566 204,753 204,751 128,496 69,345 6,131 239,342 199,581 199,581 203, 105 193,406 122,091 62,300 6,022 Liabilities 5,671 140,428 203,706 203,706 122,312 65,272 6,402 126,762 71,818 119,035 Current Ilabilities 12,392 327 54,519 5,453 11,773 309 257 551 326 36,606 1,164 18,194 26 62,300 59,791 38,080 5,062 15,957 38,410 3,613 16,560 38,487 3,065 17.063 37,415 3.520 16,239 89 69,345 59,151 44,070 3,009 65,272 57,040 41,096 2.606 Short-term debt Capital cases Accounts payable Taxes payable Accrued liabilides Other current liabilit... Total current Mabillt... Non-current liabilitie... Long term debt Capital cases Deferred taxes llabill.. Minority laterest Other long-term labil... Total non-current lab.. Total liabilities Stockholders' equity Common stock Additional pold-in cap... Retained earnings Accumulated other comp... Total stockholders' eq... Total abilities and... 41,771 2,788 2,017 7,862 71,013 54,944 39,394 3,023 7,613 5,395 519 54,944 126,762 76,343 64,629 54,416 39,214 5,816 7,321 3,065 4,446 5,034 B,805 4,543 54,416 57,040 122,312 81,394 119,035 80 546 323 317 59,791 1.22,091 71,315 342 3,692 60,091 (1.410) 71,315 293,406 332 3,620 72,978 1.491 59,151 120,496 76,255 323 2,362 76,566 (2,995) 76,255 204,751 (587) 76,343 203, tos 2.462 85,777 (9,169) 31,394 203,706 1,005 90,021 (11,597) 80,546 199,581 Managerial Accounting Ration for 2016 data: Ratio Categories Calculatoration and its redo is best which company has the best Pro Margin, Show the numerator and denominate in columna & Target Wal-Mart in this column, wie elements that are measured in the ratio. I have completed five as example: Seces Prodet Margin Helum on To Ass Profitability Resum on Common Stockholders' Equity Proty Notice Preda Earnings Per Share of Common Stock Analyzing Mock PE ratio Current Ratio (abity to pay current acties) Profitability (stock) Book Value per share (common stock) TIME Number of shares of common rock and Solvency Debt-to-Equity Ratio Turnover efficiency Inventory Turnover Cost Revenue Average Inventory Tumover efficiency AR Tumover (Accounts Receivable) Revenue Average Receivables Tumover efficiency Total Asset Turnover 1. Write the ratio elements in the middle column of the worksheet: For example, Return on Sales is "Net Income / Revenue." "Neither company has issued Proferred Stock 10 there won't be any Preferred Dividends "Cost of Revenue is another term for Coat of Goods Sold "Revenue is another term for Net Sales 2. Calculate the Financial Ratios for Target and Wal-Mart for Fiscal Year 2016 and enter data and ratioa onto your worksheet. Round your answers to two decimal places. 3. On the worksheet, circle or highlight which ratio is the best when compared between the two corporations. Use the following data in addition to the financial statements: Target market price of $72.23 and Wal-Mart market price of $69.12 Target number of outstanding common shares is 561.7 in millions Wal-Mart number of outstanding common shares is 3073.19 in millions 4. Which stock would you buy? Writo three completo paragraphs, addressing the strengths and weaknesses of each company and your reasoning for purchasing Target or Wal-Mart stock. Please read instruction page for additional information