Answered step by step

Verified Expert Solution

Question

1 Approved Answer

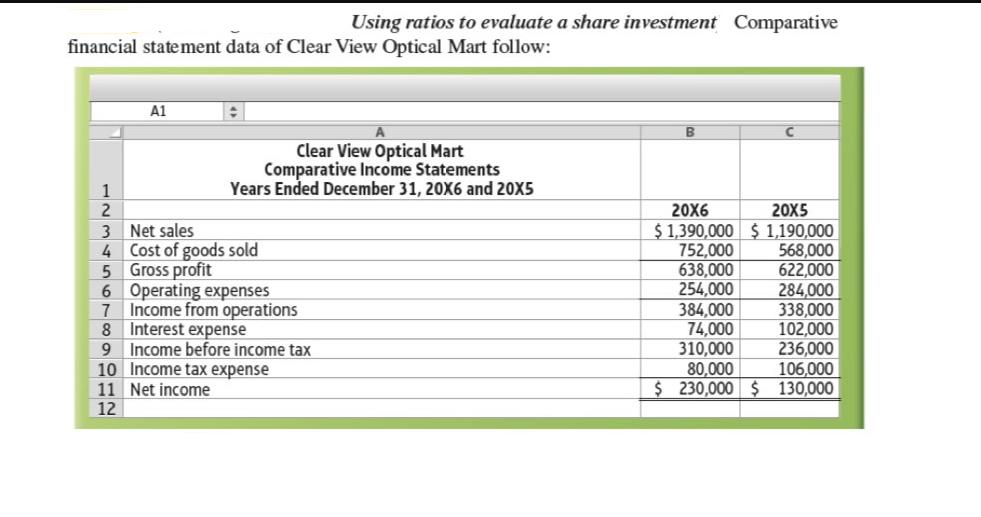

financial statement data of Clear View Optical Mart follow: 790631OSAWNE 2 A1 Using ratios to evaluate a share investment Comparative Clear View Optical Mart

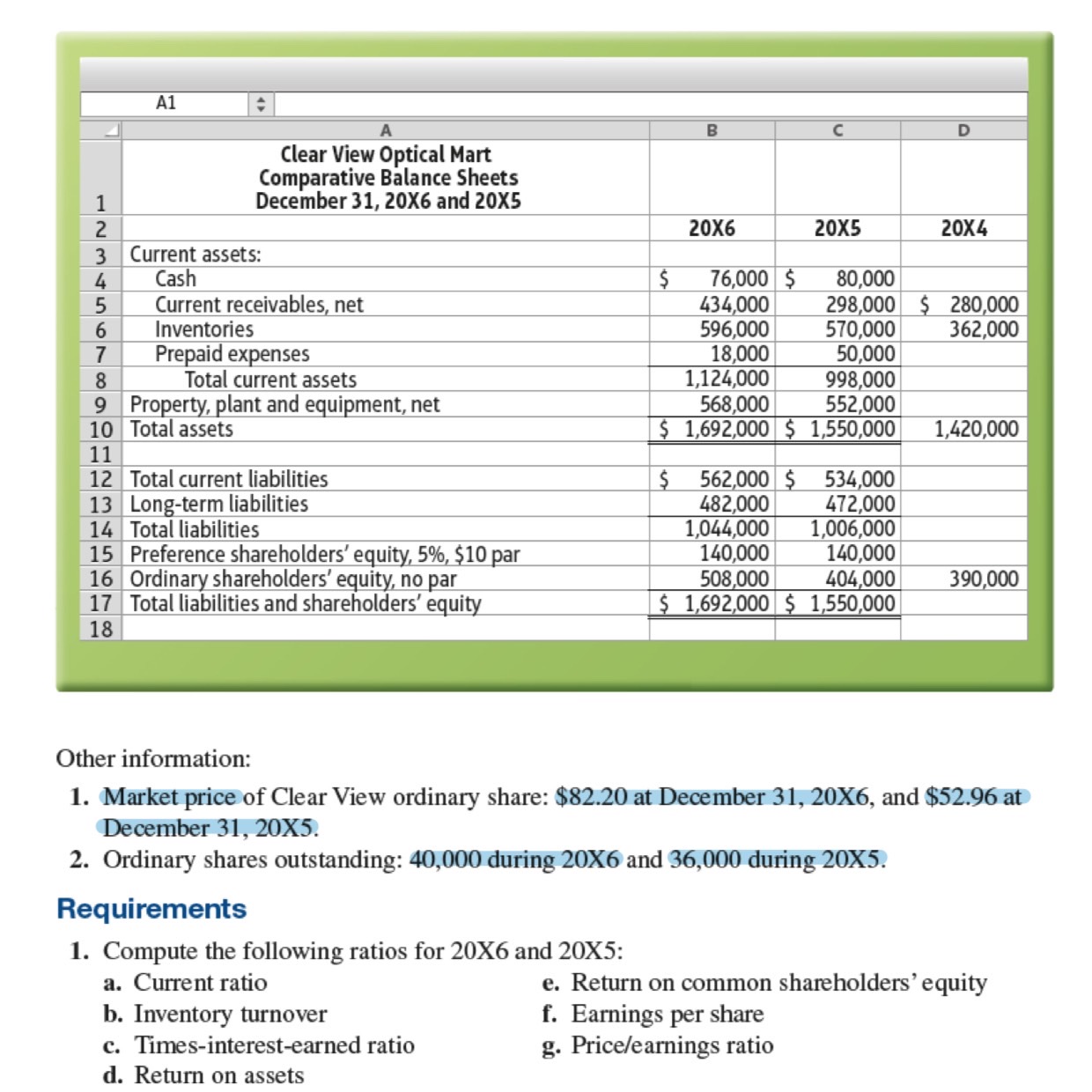

financial statement data of Clear View Optical Mart follow: 790631OSAWNE 2 A1 Using ratios to evaluate a share investment Comparative Clear View Optical Mart Comparative Income Statements Years Ended December 31, 20X6 and 20X5 3 Net sales 4 Cost of goods sold 5 Gross profit 6 Operating expenses Income from operations 8 Interest expense Income before income tax 10 Income tax expense 11 Net income 12 B 20X6 20X5 $1,390,000 $1,190,000 752,000 638,000 254,000 568,000 622,000 284,000 338,000 102,000 310,000 236,000 80,000 106,000 $ 230,000 $ 130,000 384,000 74,000 1 2 3 4 5 6 7 8 9 10 A1 Clear View Optical Mart Comparative Balance Sheets December 31, 20X6 and 20X5 Current assets: Cash Current receivables, net Inventories Prepaid expenses Total current assets Property, plant and equipment, net Total assets 11 12 Total current liabilities 13 Long-term liabilities 14 Total liabilities 15 Preference shareholders' equity, 5%, $10 par 16 Ordinary shareholders' equity, no par 17 Total liabilities and shareholders' equity 18 Requirements 1. Compute the following ratios for 20X6 and 20X5: $ a. Current ratio b. Inventory turnover c. Times-interest-earned ratio d. Return on assets B 20X6 76,000 $ 20X5 80,000 434,000 298,000 596,000 570,000 18,000 50,000 1,124,000 998,000 568,000 552,000 $ 1,692,000 $ 1,550,000 $ 562,000 $ 534,000 482,000 472,000 1,044,000 1,006,000 140,000 508,000 $ 1,692,000 $1,550,000 140,000 404,000 D 20X4 $280,000 362,000 1,420,000 Other information: 1. Market price of Clear View ordinary share: $82.20 at December 31, 20X6, and $52.96 at December 31, 20X5. 2. Ordinary shares outstanding: 40,000 during 20X6 and 36,000 during 20X5. 390,000 e. Return on common shareholders' e quity f. Earnings per share g. Price/earnings ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To evaluate a share investment using ratios you can calculate various financial ratios based on the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started