Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial Statements Analysis of A COMPANY The purpose of most financial statement analyses is to reduce uncertainty in business decisions through a rigorous and

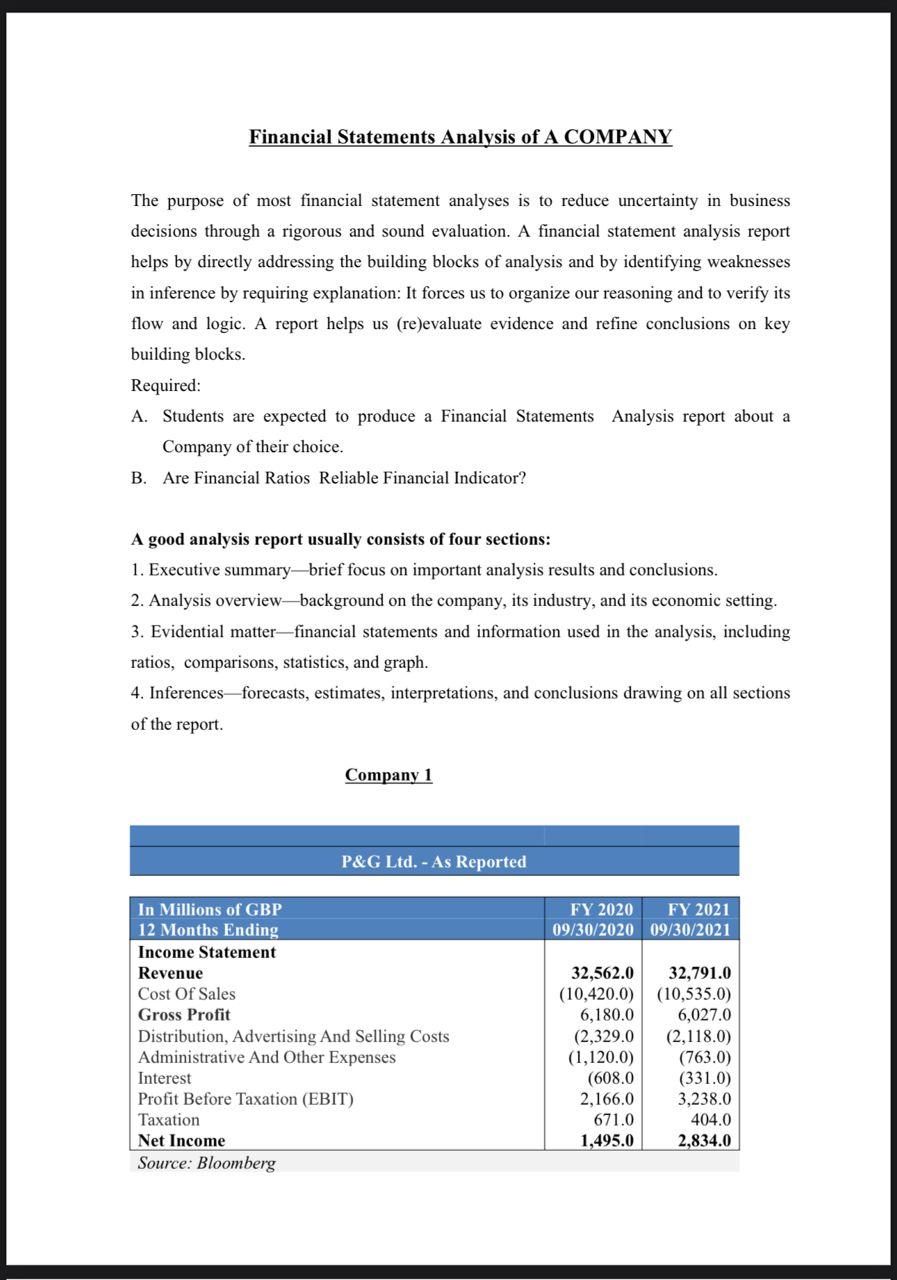

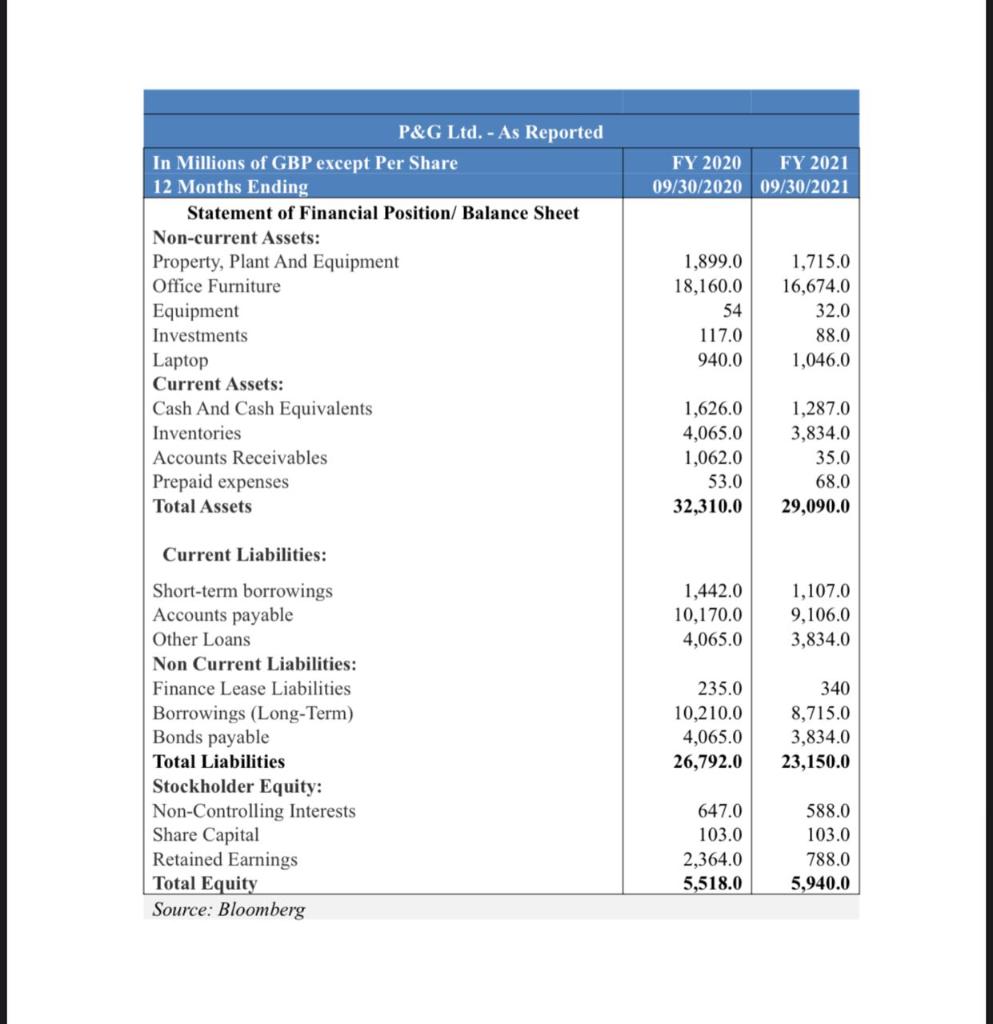

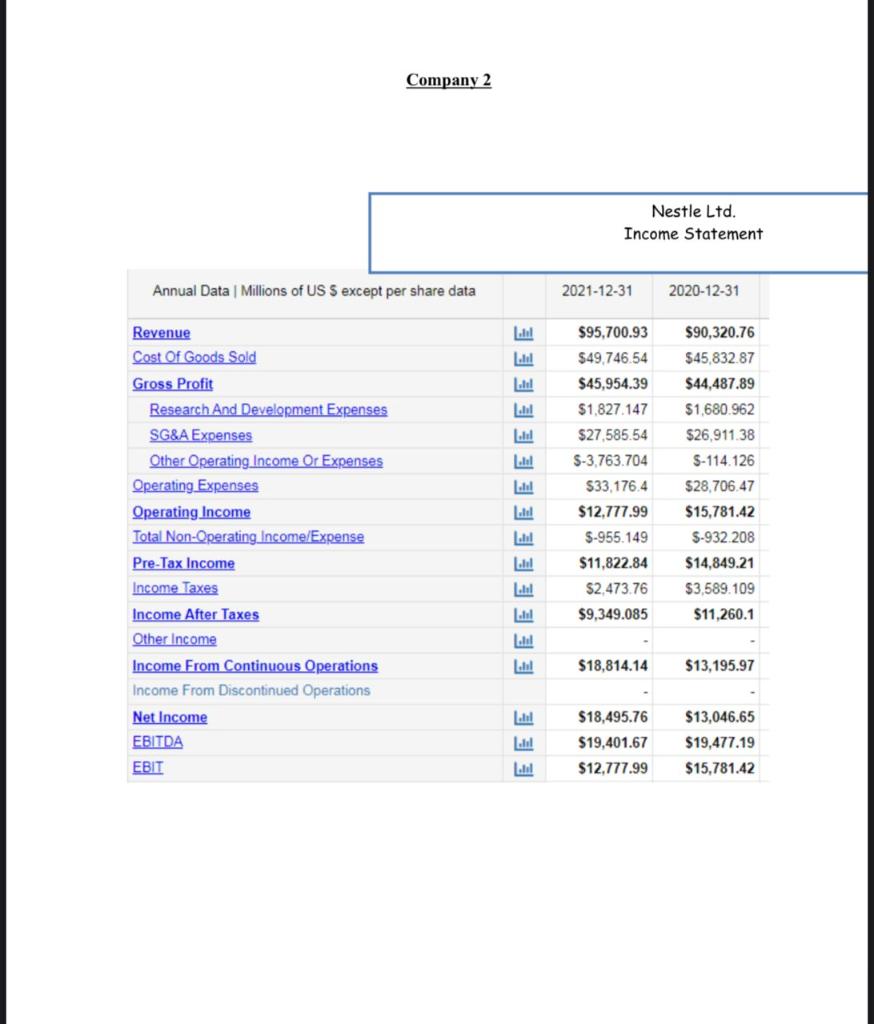

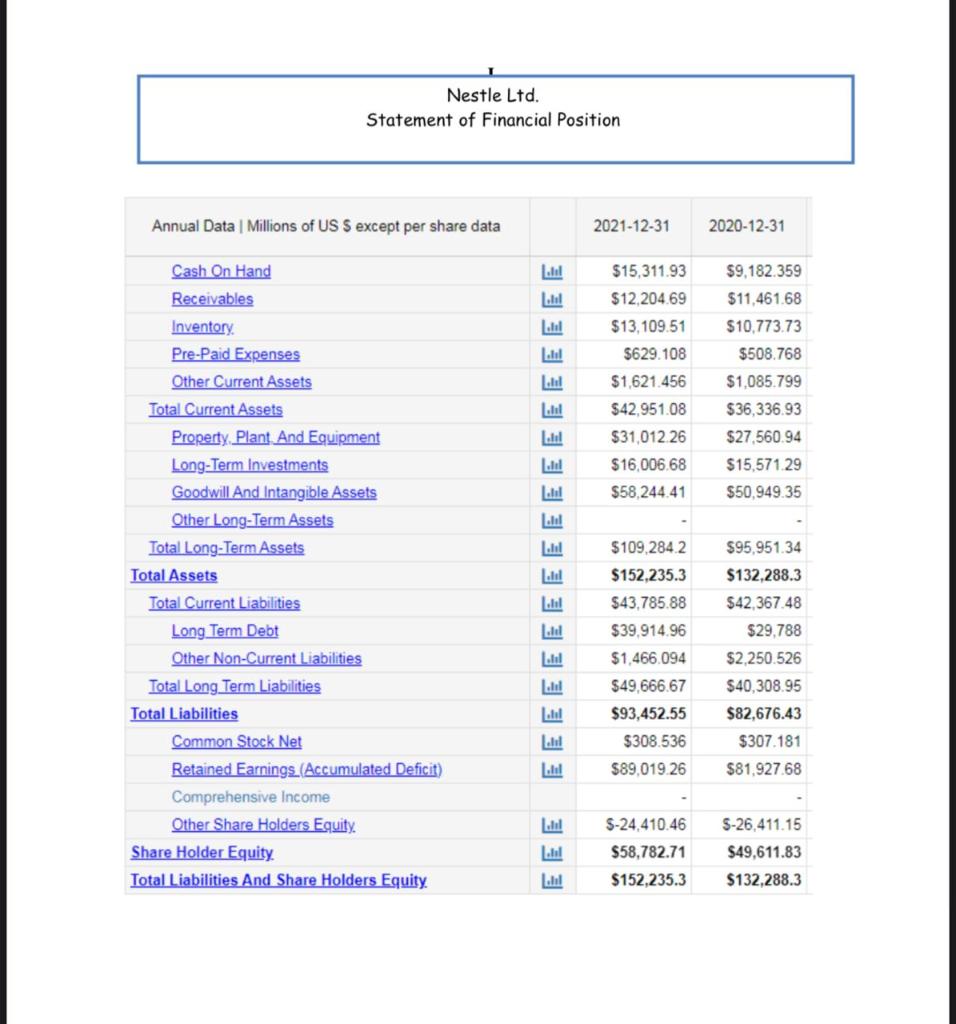

Financial Statements Analysis of A COMPANY The purpose of most financial statement analyses is to reduce uncertainty in business decisions through a rigorous and sound evaluation. A financial statement analysis report helps by directly addressing the building blocks of analysis and by identifying weaknesses in inference by requiring explanation: It forces us to organize our reasoning and to verify its flow and logic. A report helps us (re)evaluate evidence and refine conclusions on key building blocks. Required: A. Students are expected to produce a Financial Statements Analysis report about a Company of their choice. B. Are Financial Ratios Reliable Financial Indicator? A good analysis report usually consists of four sections: 1. Executive summary brief focus on important analysis results and conclusions. 2. Analysis overview background on the company, its industry, and its economic setting. 3. Evidential matter financial statements and information used in the analysis, including ratios, comparisons, statistics, and graph. 4. Inferences forecasts, estimates, interpretations, and conclusions drawing on all sections of the report. In Millions of GBP 12 Months Ending Income Statement Revenue Cost Of Sales Gross Profit Company 1 P&G Ltd. - As Reported Distribution, Advertising And Selling Costs Administrative And Other Expenses Net Income Source: Bloomberg Interest Profit Before Taxation (EBIT) Taxation FY 2020 09/30/2020 FY 2021 09/30/2021 32,562.0 32,791.0 (10,420.0) (10,535.0) 6,180.0 6,027.0 (2,329.0 (2,118.0) (1,120.0) (608.0 2,166.0 671.0 1,495.0 (763.0) (331.0) 3,238.0 404.0 2,834.0 In Millions of GBP except Per Share 12 Months Ending Statement of Financial Position/ Balance Sheet Non-current Assets: Property, Plant And Equipment Office Furniture Equipment Investments Laptop Current Assets: Cash And Cash Equivalents Inventories Accounts Receivables Prepaid expenses Total Assets Current Liabilities: Short-term borrowings Accounts payable Other Loans Non Current Liabilities: Finance Lease Liabilities Borrowings (Long-Term) Bonds payable Total Liabilities P&G Ltd. - As Reported Stockholder Equity: Non-Controlling Interests Share Capital Retained Earnings Total Equity Source: Bloomberg FY 2020 09/30/2020 1,899.0 18,160.0 54 117.0 940.0 1,626.0 4,065.0 1,062.0 53.0 32,310.0 1,442.0 10,170.0 4,065.0 647.0 103.0 FY 2021 09/30/2021 2,364.0 5,518.0 1,715.0 16,674.0 32.0 88.0 1,046.0 1,287.0 3,834.0 35.0 68.0 29,090.0 235.0 340 10,210.0 8,715.0 4,065.0 3,834.0 26,792.0 23,150.0 1,107.0 9,106.0 3,834.0 588.0 103.0 788.0 5,940.0 Annual Data | Millions of US $ except per share data Revenue Cost Of Goods Sold Gross Profit Research And Development Expenses SG&A Expenses Other Operating Income Or Expenses Operating Expenses Operating Income Total Non-Operating Income/Expense Pre-Tax Income Income Taxes Income After Taxes Other Income Company 2 Income From Continuous Operations Income From Discontinued Operations Net Income EBITDA EBIT Labl Ll Labd Label Labd Lad Label Labl Labl EE EEE Nestle Ltd. Income Statement 2021-12-31 $95,700.93 $49,746.54 $45,954.39 $1,827.147 $27,585.54 $-3,763.704 $33,176.4 $12,777.99 $-955.149 $11,822.84 $2,473.76 $9,349.085 $18,814.14 $18,495.76 $19,401.67 $12.777.99 2020-12-31 $90,320.76 $45,832.87 $44,487.89 $1,680.962 $26,911.38 S-114.126 $28,706.47 $15,781.42 $-932.208 $14,849.21 $3,589.109 $11,260.1 $13,195.97 $13,046.65 $19,477.19 $15,781.42 Annual Data | Millions of US S except per share data Cash On Hand Receivables Inventory. Pre-Paid Expenses Other Current Assets Total Current Assets Property Plant And Equipment Long-Term Investments Goodwill And Intangible Assets Other Long-Term Assets Total Long-Term Assets Total Assets Total Current Liabilities Long Term Debt Other Non-Current Liabilities Total Long Term Liabilities Nestle Ltd. Statement of Financial Position Total Liabilities Common Stock Net Retained Earnings (Accumulated Deficit) Comprehensive Income Other Share Holders Equity Share Holder Equity. Total Liabilities And Share Holders Equity d chl Lahd Labd L.bl bl Ladd Labl chl bl Lbl EEE 2021-12-31 $15,311.93 $12,204.69 $13,109.51 $629.108 $1,621.456 $42,951.08 $31,012.26 $16,006.68 $58,244.41 $109,284.2 $152,235.3 $43,785.88 $39,914.96 $1,466.094 $49,666.67 $93,452.55 $308.536 $89,019.26 $-24,410.46 $58,782.71 $152,235.3 2020-12-31 $9,182.359 $11,461.68 $10,773.73 $508.768 $1,085.799 $36,336.93 $27,560.94 $15,571.29 $50,949.35 $95,951.34 $132,288.3 $42,367.48 $29,788 $2,250.526 $40,308.95 $82,676.43 $307.181 $81,927.68 $-26,411.15 $49,611.83 $132,288.3 Guide lines: Financial Statements Analysis must be carried out for the most required two financial year ends. Financial Statements Analysis report must satisfy a minimum of 1500- word count and presented in a word document file. Look up the company you are trying to analysis on any finance data base so you can get a detailed description and industry classification of the business. Financial Statements Analysis of A COMPANY The purpose of most financial statement analyses is to reduce uncertainty in business decisions through a rigorous and sound evaluation. A financial statement analysis report helps by directly addressing the building blocks of analysis and by identifying weaknesses in inference by requiring explanation: It forces us to organize our reasoning and to verify its flow and logic. A report helps us (re)evaluate evidence and refine conclusions on key building blocks. Required: A. Students are expected to produce a Financial Statements Analysis report about a Company of their choice. B. Are Financial Ratios Reliable Financial Indicator? A good analysis report usually consists of four sections: 1. Executive summary brief focus on important analysis results and conclusions. 2. Analysis overview background on the company, its industry, and its economic setting. 3. Evidential matter-financial statements and information used in the analysis, including ratios, comparisons, statistics, and graph. 4. Inferences forecasts, estimates, interpretations, and conclusions drawing on all sections of the report. In Millions of GBP 12 Months Ending Income Statement Revenue Cost Of Sales Gross Profit Company 1 P&G Ltd. - As Reported Distribution, Advertising And Selling Costs Administrative And Other Expenses Net Income Source: Bloomberg Interest Profit Before Taxation (EBIT) Taxation FY 2020 09/30/2020 FY 2021 09/30/2021 32,562.0 32,791.0 (10,420.0) (10,535.0) 6,180.0 6,027.0 (2,329.0 (2,118.0) (1,120.0) (608.0 2,166.0 671.0 1,495.0 (763.0) (331.0) 3,238.0 404.0 2,834.0 In Millions of GBP except Per Share 12 Months Ending Statement of Financial Position/ Balance Sheet Non-current Assets: Property, Plant And Equipment Office Furniture Equipment Investments Laptop Current Assets: Cash And Cash Equivalents Inventories Accounts Receivables Prepaid expenses Total Assets Current Liabilities: Short-term borrowings Accounts payable Other Loans Non Current Liabilities: Finance Lease Liabilities Borrowings (Long-Term) Bonds payable Total Liabilities P&G Ltd. - As Reported Stockholder Equity: Non-Controlling Interests Share Capital Retained Earnings Total Equity Source: Bloomberg FY 2020 09/30/2020 1,899.0 18,160.0 54 117.0 940.0 1,626.0 4,065.0 1,062.0 53.0 32,310.0 1,442.0 10,170.0 4,065.0 647.0 103.0 FY 2021 09/30/2021 2,364.0 5,518.0 1,715.0 16,674.0 32.0 88.0 1,046.0 1,287.0 3,834.0 35.0 68.0 29,090.0 235.0 340 10,210.0 8,715.0 4,065.0 3,834.0 26,792.0 23,150.0 1,107.0 9,106.0 3,834.0 588.0 103.0 788.0 5,940.0 Annual Data | Millions of US $ except per share data Revenue Cost Of Goods Sold Gross Profit Research And Development Expenses SG&A Expenses Other Operating Income Or Expenses Operating Expenses Operating Income Total Non-Operating Income/Expense Pre-Tax Income Income Taxes Income After Taxes Other Income Company 2 Income From Continuous Operations Income From Discontinued Operations Net Income EBITDA EBIT Labl Ll Labd Label Labd Lad Label Labl Labl EE EEE Nestle Ltd. Income Statement 2021-12-31 $95,700.93 $49,746.54 $45,954.39 $1,827.147 $27,585.54 $-3,763.704 $33,176.4 $12,777.99 $-955.149 $11,822.84 $2,473.76 $9,349.085 $18,814.14 $18,495.76 $19,401.67 $12.777.99 2020-12-31 $90,320.76 $45,832.87 $44,487.89 $1,680.962 $26,911.38 S-114.126 $28,706.47 $15,781.42 $-932.208 $14,849.21 $3,589.109 $11,260.1 $13,195.97 $13,046.65 $19,477.19 $15,781.42 Annual Data | Millions of US S except per share data Cash On Hand Receivables Inventory. Pre-Paid Expenses Other Current Assets Total Current Assets Property Plant And Equipment Long-Term Investments Goodwill And Intangible Assets Other Long-Term Assets Total Long-Term Assets Total Assets Total Current Liabilities Long Term Debt Other Non-Current Liabilities Total Long Term Liabilities Nestle Ltd. Statement of Financial Position Total Liabilities Common Stock Net Retained Earnings (Accumulated Deficit) Comprehensive Income Other Share Holders Equity Share Holder Equity. Total Liabilities And Share Holders Equity d chl Lahd Labd L.bl bl Ladd Labl chl bl Lbl EEE 2021-12-31 $15,311.93 $12,204.69 $13,109.51 $629.108 $1,621.456 $42,951.08 $31,012.26 $16,006.68 $58,244.41 $109,284.2 $152,235.3 $43,785.88 $39,914.96 $1,466.094 $49,666.67 $93,452.55 $308.536 $89,019.26 $-24,410.46 $58,782.71 $152,235.3 2020-12-31 $9,182.359 $11,461.68 $10,773.73 $508.768 $1,085.799 $36,336.93 $27,560.94 $15,571.29 $50,949.35 $95,951.34 $132,288.3 $42,367.48 $29,788 $2,250.526 $40,308.95 $82,676.43 $307.181 $81,927.68 $-26,411.15 $49,611.83 $132,288.3 Guide lines: Financial Statements Analysis must be carried out for the most required two financial year ends. Financial Statements Analysis report must satisfy a minimum of 1500- word count and presented in a word document file. Look up the company you are trying to analysis on any finance data base so you can get a detailed description and industry classification of the business. Financial Statements Analysis of A COMPANY The purpose of most financial statement analyses is to reduce uncertainty in business decisions through a rigorous and sound evaluation. A financial statement analysis report helps by directly addressing the building blocks of analysis and by identifying weaknesses in inference by requiring explanation: It forces us to organize our reasoning and to verify its flow and logic. A report helps us (re)evaluate evidence and refine conclusions on key building blocks. Required: A. Students are expected to produce a Financial Statements Analysis report about a Company of their choice. B. Are Financial Ratios Reliable Financial Indicator? A good analysis report usually consists of four sections: 1. Executive summary brief focus on important analysis results and conclusions. 2. Analysis overview background on the company, its industry, and its economic setting. 3. Evidential matter-financial statements and information used in the analysis, including ratios, comparisons, statistics, and graph. 4. Inferences forecasts, estimates, interpretations, and conclusions drawing on all sections of the report. In Millions of GBP 12 Months Ending Income Statement Revenue Cost Of Sales Gross Profit Company 1 P&G Ltd. - As Reported Distribution, Advertising And Selling Costs Administrative And Other Expenses Net Income Source: Bloomberg Interest Profit Before Taxation (EBIT) Taxation FY 2020 09/30/2020 FY 2021 09/30/2021 32,562.0 32,791.0 (10,420.0) (10,535.0) 6,180.0 6,027.0 (2,329.0 (2,118.0) (1,120.0) (608.0 2,166.0 671.0 1,495.0 (763.0) (331.0) 3,238.0 404.0 2,834.0 In Millions of GBP except Per Share 12 Months Ending Statement of Financial Position/ Balance Sheet Non-current Assets: Property, Plant And Equipment Office Furniture Equipment Investments Laptop Current Assets: Cash And Cash Equivalents Inventories Accounts Receivables Prepaid expenses Total Assets Current Liabilities: Short-term borrowings Accounts payable Other Loans Non Current Liabilities: Finance Lease Liabilities Borrowings (Long-Term) Bonds payable Total Liabilities P&G Ltd. - As Reported Stockholder Equity: Non-Controlling Interests Share Capital Retained Earnings Total Equity Source: Bloomberg FY 2020 09/30/2020 1,899.0 18,160.0 54 117.0 940.0 1,626.0 4,065.0 1,062.0 53.0 32,310.0 1,442.0 10,170.0 4,065.0 647.0 103.0 FY 2021 09/30/2021 2,364.0 5,518.0 1,715.0 16,674.0 32.0 88.0 1,046.0 1,287.0 3,834.0 35.0 68.0 29,090.0 235.0 340 10,210.0 8,715.0 4,065.0 3,834.0 26,792.0 23,150.0 1,107.0 9,106.0 3,834.0 588.0 103.0 788.0 5,940.0 Annual Data | Millions of US $ except per share data Revenue Cost Of Goods Sold Gross Profit Research And Development Expenses SG&A Expenses Other Operating Income Or Expenses Operating Expenses Operating Income Total Non-Operating Income/Expense Pre-Tax Income Income Taxes Income After Taxes Other Income Company 2 Income From Continuous Operations Income From Discontinued Operations Net Income EBITDA EBIT Labl Ll Labd Label Labd Lad Label Labl Labl EE EEE Nestle Ltd. Income Statement 2021-12-31 $95,700.93 $49,746.54 $45,954.39 $1,827.147 $27,585.54 $-3,763.704 $33,176.4 $12,777.99 $-955.149 $11,822.84 $2,473.76 $9,349.085 $18,814.14 $18,495.76 $19,401.67 $12.777.99 2020-12-31 $90,320.76 $45,832.87 $44,487.89 $1,680.962 $26,911.38 S-114.126 $28,706.47 $15,781.42 $-932.208 $14,849.21 $3,589.109 $11,260.1 $13,195.97 $13,046.65 $19,477.19 $15,781.42 Annual Data | Millions of US S except per share data Cash On Hand Receivables Inventory. Pre-Paid Expenses Other Current Assets Total Current Assets Property Plant And Equipment Long-Term Investments Goodwill And Intangible Assets Other Long-Term Assets Total Long-Term Assets Total Assets Total Current Liabilities Long Term Debt Other Non-Current Liabilities Total Long Term Liabilities Nestle Ltd. Statement of Financial Position Total Liabilities Common Stock Net Retained Earnings (Accumulated Deficit) Comprehensive Income Other Share Holders Equity Share Holder Equity. Total Liabilities And Share Holders Equity d chl Lahd Labd L.bl bl Ladd Labl chl bl Lbl EEE 2021-12-31 $15,311.93 $12,204.69 $13,109.51 $629.108 $1,621.456 $42,951.08 $31,012.26 $16,006.68 $58,244.41 $109,284.2 $152,235.3 $43,785.88 $39,914.96 $1,466.094 $49,666.67 $93,452.55 $308.536 $89,019.26 $-24,410.46 $58,782.71 $152,235.3 2020-12-31 $9,182.359 $11,461.68 $10,773.73 $508.768 $1,085.799 $36,336.93 $27,560.94 $15,571.29 $50,949.35 $95,951.34 $132,288.3 $42,367.48 $29,788 $2,250.526 $40,308.95 $82,676.43 $307.181 $81,927.68 $-26,411.15 $49,611.83 $132,288.3 Guide lines: Financial Statements Analysis must be carried out for the most required two financial year ends. Financial Statements Analysis report must satisfy a minimum of 1500- word count and presented in a word document file. Look up the company you are trying to analysis on any finance data base so you can get a detailed description and industry classification of the business. Financial Statements Analysis of A COMPANY The purpose of most financial statement analyses is to reduce uncertainty in business decisions through a rigorous and sound evaluation. A financial statement analysis report helps by directly addressing the building blocks of analysis and by identifying weaknesses in inference by requiring explanation: It forces us to organize our reasoning and to verify its flow and logic. A report helps us (re)evaluate evidence and refine conclusions on key building blocks. Required: A. Students are expected to produce a Financial Statements Analysis report about a Company of their choice. B. Are Financial Ratios Reliable Financial Indicator? A good analysis report usually consists of four sections: 1. Executive summary brief focus on important analysis results and conclusions. 2. Analysis overview-background on the company, its industry, and its economic setting. 3. Evidential matter financial statements and information used in the analysis, including ratios, comparisons, statistics, and graph. 4. Inferences forecasts, estimates, interpretations, and conclusions drawing on all sections of the report. In Millions of GBP 12 Months Ending Income Statement Revenue Cost Of Sales Gross Profit Company 1 P&G Ltd. - As Reported Distribution, Advertising And Selling Costs Administrative And Other Expenses Net Income Source: Bloomberg Interest Profit Before Taxation (EBIT) Taxation FY 2020 09/30/2020 FY 2021 09/30/2021 32,562.0 32,791.0 (10,420.0) (10,535.0) 6,180.0 6,027.0 (2,329.0 (2,118.0) (1,120.0) (608.0 2,166.0 671.0 1,495.0 (763.0) (331.0) 3,238.0 404.0 2,834.0 In Millions of GBP except Per Share 12 Months Ending Statement of Financial Position/ Balance Sheet Non-current Assets: Property, Plant And Equipment Office Furniture Equipment Investments Laptop Current Assets: Cash And Cash Equivalents Inventories Accounts Receivables Prepaid expenses Total Assets Current Liabilities: Short-term borrowings Accounts payable Other Loans Non Current Liabilities: Finance Lease Liabilities Borrowings (Long-Term) Bonds payable Total Liabilities P&G Ltd. - As Reported Stockholder Equity: Non-Controlling Interests Share Capital Retained Earnings Total Equity Source: Bloomberg FY 2020 09/30/2020 1,899.0 18,160.0 54 117.0 940.0 1,626.0 4,065.0 1,062.0 53.0 32,310.0 1,442.0 10,170.0 4,065.0 647.0 103.0 FY 2021 09/30/2021 2,364.0 5,518.0 1,715.0 16,674.0 32.0 88.0 1,046.0 1,287.0 3,834.0 35.0 68.0 29,090.0 235.0 340 10,210.0 8,715.0 4,065.0 3,834.0 26,792.0 23,150.0 1,107.0 9,106.0 3,834.0 588.0 103.0 788.0 5,940.0 Annual Data | Millions of US $ except per share data Revenue Cost Of Goods Sold Gross Profit Research And Development Expenses SG&A Expenses Other Operating Income Or Expenses Operating Expenses Operating Income Total Non-Operating Income/Expense Pre-Tax Income Income Taxes Income After Taxes Other Income Company 2 Income From Continuous Operations Income From Discontinued Operations Net Income EBITDA EBIT Labl Ll Labd Label Labd Lad Label Labl Labl EE EEE Nestle Ltd. Income Statement 2021-12-31 $95,700.93 $49,746.54 $45,954.39 $1,827.147 $27,585.54 $-3,763.704 $33,176.4 $12,777.99 $-955.149 $11,822.84 $2,473.76 $9,349.085 $18,814.14 $18,495.76 $19,401.67 $12.777.99 2020-12-31 $90,320.76 $45,832.87 $44,487.89 $1,680.962 $26,911.38 S-114.126 $28,706.47 $15,781.42 $-932.208 $14,849.21 $3,589.109 $11,260.1 $13,195.97 $13,046.65 $19,477.19 $15,781.42 Annual Data | Millions of US S except per share data Cash On Hand Receivables Inventory. Pre-Paid Expenses Other Current Assets Total Current Assets Property Plant And Equipment Long-Term Investments Goodwill And Intangible Assets Other Long-Term Assets Total Long-Term Assets Total Assets Total Current Liabilities Long Term Debt Other Non-Current Liabilities Total Long Term Liabilities Nestle Ltd. Statement of Financial Position Total Liabilities Common Stock Net Retained Earnings (Accumulated Deficit) Comprehensive Income Other Share Holders Equity Share Holder Equity. Total Liabilities And Share Holders Equity d chl Lahd Labd L.bl bl Ladd Labl chl bl Lbl EEE 2021-12-31 $15,311.93 $12,204.69 $13,109.51 $629.108 $1,621.456 $42,951.08 $31,012.26 $16,006.68 $58,244.41 $109,284.2 $152,235.3 $43,785.88 $39,914.96 $1,466.094 $49,666.67 $93,452.55 $308.536 $89,019.26 $-24,410.46 $58,782.71 $152,235.3 2020-12-31 $9,182.359 $11,461.68 $10,773.73 $508.768 $1,085.799 $36,336.93 $27,560.94 $15,571.29 $50,949.35 $95,951.34 $132,288.3 $42,367.48 $29,788 $2,250.526 $40,308.95 $82,676.43 $307.181 $81,927.68 $-26,411.15 $49,611.83 $132,288.3 Guide lines: Financial Statements Analysis must be carried out for the most required two financial year ends. Financial Statements Analysis report must satisfy a minimum of 1500- word count and presented in a word document file. Look up the company you are trying to analysis on any finance data base so you can get a detailed description and industry classification of the business.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Financial Statements Analysis of Nestle Ltd Introduction Nestle Ltd is a Swiss multinational food and drink processing conglomerate corporation headquartered in Vevey Vaud Switzerland It is the worlds ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started