Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial statements including: income statement balance sheet statement of changes in stockholders equity all related notes. In the notes to the financial statement include notes

- Financial statements including:

- income statement

- balance sheet

- statement of changes in stockholders equity

- all related notes. In the notes to the financial statement include notes on: significant accounting policies, cash and cash equivalents, revenue recognition, inventory, equipment, and any other notes you deem necessary.

You do not need to prepare a statement of cash flows!

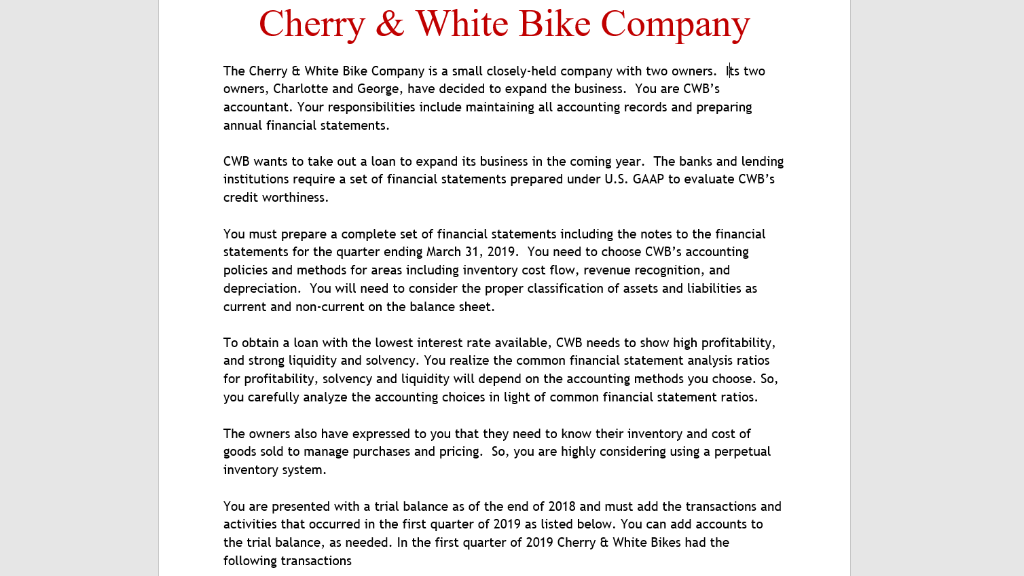

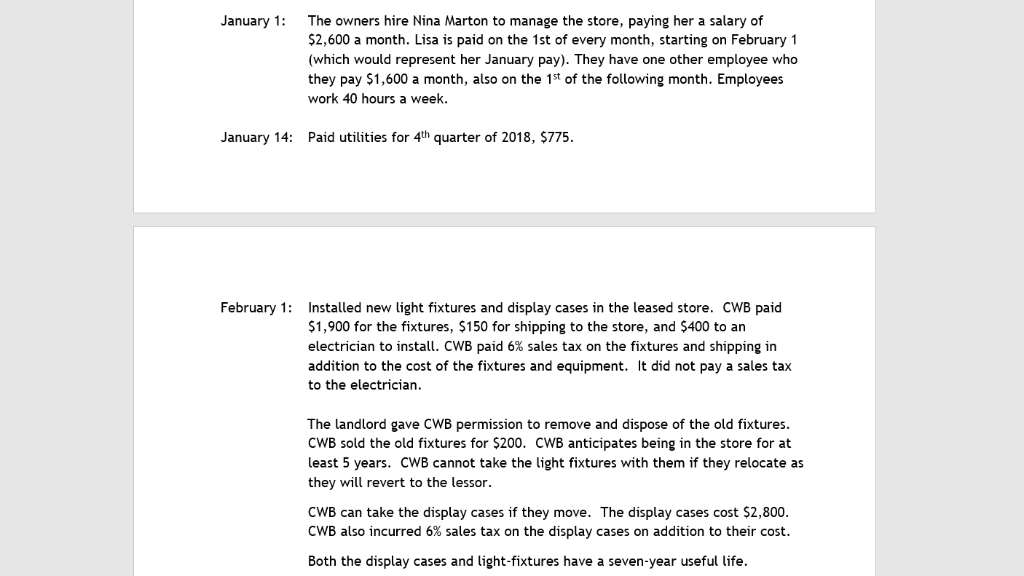

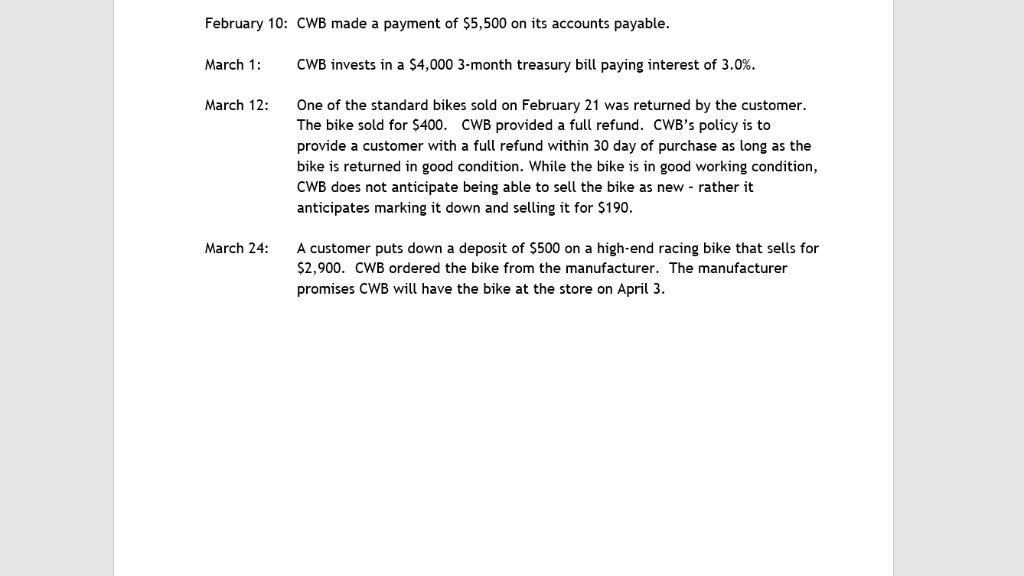

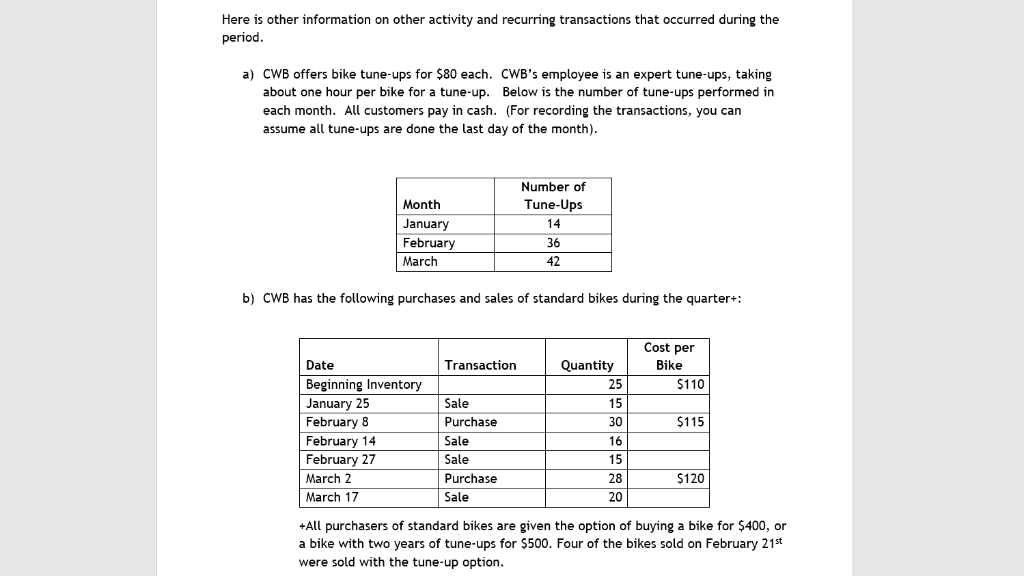

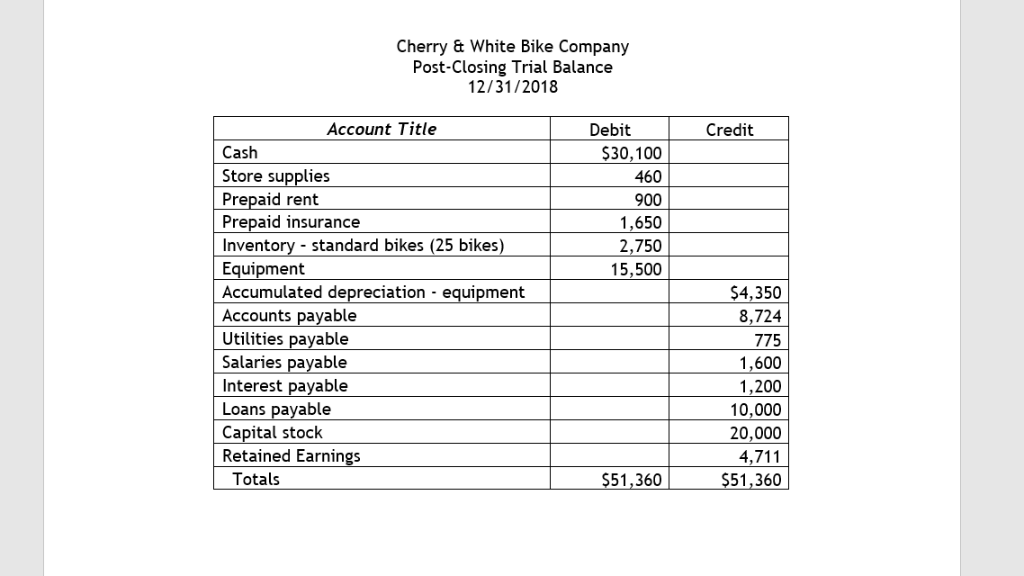

Cherry & White Bike Company The Cherry& White Bike Company is a small closely-held company with two owners. Its two owners, Charlotte and George, have decided to expand the business. You are CWB's accountant. Your responsibilities include maintaining all accounting records and preparing annual financial statements CWB wants to take out a loan to expand its business in the coming year. The banks and lending institutions require a set of financial statements prepared under U.S. GAAP to evaluate CWB's credit worthiness You must prepare a complete set of financial statements including the notes to the financial statements for the quarter ending March 31, 2019. You need to choose CWB's accounting policies and methods for areas including inventory cost flow, revenue recognition, and depreciation. You will need to consider the proper classification of assets adbities as current and non-current on the balance sheet To obtain a loan with the lowest interest rate available, CWB needs to show high profitability and strong liquidity and solvency. You realize the common financial statement analysis ratios for profitability, solvency and iquidity will depend on the accounting methods you choose. So you carefully analyze the accounting choices in light of common financial statement ratios The owners also have expressed to you that they need to know their inventory and cost of goods sold to manage purchases and pricing. So, you are highly considering using a perpetual inventory system You are presented with a trial balance as of the end of 2018 and must add the transactions and activities that occurred in the first quarter of 2019 as listed below. You can add accounts to the trial balance, as needed. In the first quarter of 2019 Cherry & White Bikes had the following transactions January The owners hire Nina Marton to manage the store, paying her a salary of 2,600 a month. Lisa is paid on the 1st of every month, starting on February 1 (which would represent her January pay). They have one other employee who they pay $1,600 a month, also on the 1st of the following month. Employees work 40 hours a week. January 14: Paid utilities for4th quarter of 2018, $775 February 1 nstalled new light fixtures and display cases in the leased store. CWB paid 1,900 for the fixtures, $150 for shipping to the store, and $400 to an electrician to install. CWB paid 6% sales tax on the fixtures and shipping in addition to the cost of the fixtures and equipment. It did not pay a sales tax to the electrician. The landlord gave CWB permission to remove and dispose of the old fixtures. CWB sold the old fixtures for $200. CWB anticipates being in the store for at least 5 years. CWB cannot take the light fixtures with them if they relocate as they will revert to the lessor CWB can take the display cases if they move. The display cases cost $2,800. CWB also incurred 6% sales tax on the display cases on addition to their cost. Both the display cases and light-fixtures have a seven-year useful life. February 10: CWB made a payment of $5,500 on its accounts payable. March 1 : CWB invests in a S4,000 3-month treasury bill paying interest of 3.0%. March 12: One of the standard bikes sold on February 21 was returned by the customer. The bike sold for $400. CWB provided a full refund. CWB's policy is to provide a customer with a full refund within 30 day of purchase as long as the bike is returned in good condition. While the bike is in good working condition, CWB does not anticipate being able to sell the bike as new rather it anticipates marking it down and selling it for $190 March 24: A customer puts down a deposit of $500 on a high-end racing bike that sells for $2,900. CWB ordered the bike from the manufacturer. The manufacturer promises CWB will have the bike at the store on April 3 Here is other information on other activity and recurring transactions that occurred during the period a) CWB offers bike tune-ups for $80 each. CWB's employee is an expert tune-ups, taking about one hour per bike for a tune-up. Below is the number of tune-ups performed in each month. All customers pay in cash. For recording the transactions, you can assume all tune-ups are done the last day of the month) Number of Tune-Ups 14 36 42 Month January February March b) CWB has the following purchases and sales of standard bikes during the quarter: Cost per Bike Date Beginning Inventory January 25 February 8 February 14 February 27 March 2 March 17 Quantity Transaction $110 25 15 30 16 15 28 20 Sale Purchase Sale Sale Purchase Sale $115 $120 +All purchasers of standard bikes are given the option of buying a bike for $400, or a bike with two years of tune-ups for $500. Four of the bikes sold on February 21st were sold with the tune-up option "All purchases were made using cash except the March 2nd purchase for which CWB obtained two-months credit from the bike supplier. c) CWB took out a five-year loan for S1 0,000 with an interest rate of 12% on January 1, 2018. The loan matures on January 1, 2022 d) CWB rents its premises for $900 per month, with rent due on the 15st of the prior month e) CWB has a business insurance policy, which it purchased for $3,300 on July 1, 2018. The policy runs until June 30, 2019 f) CWB owns various tools and equipment which it pools for purpose of calculating depreciation. In the past it has used straight-line depreciation over a ten-year period with no scrap or salvage value for these assets. However, with technology changing rapidly, CWB questions whether it will have to replace the equipment earlier. ) On March 31, CWB had $154 of supplies left in the supply room h) On April 7 received its utilities bill for the first quarter of 2019- $800. i) The tax rate is 20%. Cherry & White Bike Company Post-Closing Trial Balance 12/31/2018 Account Title Debit Credit Cash Store supplies Prepaid rent Prepaid insurance Inventory-standard bikes (25 bikes Equipment Accumulated depreciation equipment Accounts payable Utilities payable Salaries pavable Interest payable Loans payable Capital stock Retained Earnings S30,100 460 900 1,650 2,750 15,500 $4,350 8,724 775 1,600 1,200 10,000 20,000 4,711 $51,360 51,360 Totals Cherry & White Bike Company The Cherry& White Bike Company is a small closely-held company with two owners. Its two owners, Charlotte and George, have decided to expand the business. You are CWB's accountant. Your responsibilities include maintaining all accounting records and preparing annual financial statements CWB wants to take out a loan to expand its business in the coming year. The banks and lending institutions require a set of financial statements prepared under U.S. GAAP to evaluate CWB's credit worthiness You must prepare a complete set of financial statements including the notes to the financial statements for the quarter ending March 31, 2019. You need to choose CWB's accounting policies and methods for areas including inventory cost flow, revenue recognition, and depreciation. You will need to consider the proper classification of assets adbities as current and non-current on the balance sheet To obtain a loan with the lowest interest rate available, CWB needs to show high profitability and strong liquidity and solvency. You realize the common financial statement analysis ratios for profitability, solvency and iquidity will depend on the accounting methods you choose. So you carefully analyze the accounting choices in light of common financial statement ratios The owners also have expressed to you that they need to know their inventory and cost of goods sold to manage purchases and pricing. So, you are highly considering using a perpetual inventory system You are presented with a trial balance as of the end of 2018 and must add the transactions and activities that occurred in the first quarter of 2019 as listed below. You can add accounts to the trial balance, as needed. In the first quarter of 2019 Cherry & White Bikes had the following transactions January The owners hire Nina Marton to manage the store, paying her a salary of 2,600 a month. Lisa is paid on the 1st of every month, starting on February 1 (which would represent her January pay). They have one other employee who they pay $1,600 a month, also on the 1st of the following month. Employees work 40 hours a week. January 14: Paid utilities for4th quarter of 2018, $775 February 1 nstalled new light fixtures and display cases in the leased store. CWB paid 1,900 for the fixtures, $150 for shipping to the store, and $400 to an electrician to install. CWB paid 6% sales tax on the fixtures and shipping in addition to the cost of the fixtures and equipment. It did not pay a sales tax to the electrician. The landlord gave CWB permission to remove and dispose of the old fixtures. CWB sold the old fixtures for $200. CWB anticipates being in the store for at least 5 years. CWB cannot take the light fixtures with them if they relocate as they will revert to the lessor CWB can take the display cases if they move. The display cases cost $2,800. CWB also incurred 6% sales tax on the display cases on addition to their cost. Both the display cases and light-fixtures have a seven-year useful life. February 10: CWB made a payment of $5,500 on its accounts payable. March 1 : CWB invests in a S4,000 3-month treasury bill paying interest of 3.0%. March 12: One of the standard bikes sold on February 21 was returned by the customer. The bike sold for $400. CWB provided a full refund. CWB's policy is to provide a customer with a full refund within 30 day of purchase as long as the bike is returned in good condition. While the bike is in good working condition, CWB does not anticipate being able to sell the bike as new rather it anticipates marking it down and selling it for $190 March 24: A customer puts down a deposit of $500 on a high-end racing bike that sells for $2,900. CWB ordered the bike from the manufacturer. The manufacturer promises CWB will have the bike at the store on April 3 Here is other information on other activity and recurring transactions that occurred during the period a) CWB offers bike tune-ups for $80 each. CWB's employee is an expert tune-ups, taking about one hour per bike for a tune-up. Below is the number of tune-ups performed in each month. All customers pay in cash. For recording the transactions, you can assume all tune-ups are done the last day of the month) Number of Tune-Ups 14 36 42 Month January February March b) CWB has the following purchases and sales of standard bikes during the quarter: Cost per Bike Date Beginning Inventory January 25 February 8 February 14 February 27 March 2 March 17 Quantity Transaction $110 25 15 30 16 15 28 20 Sale Purchase Sale Sale Purchase Sale $115 $120 +All purchasers of standard bikes are given the option of buying a bike for $400, or a bike with two years of tune-ups for $500. Four of the bikes sold on February 21st were sold with the tune-up option "All purchases were made using cash except the March 2nd purchase for which CWB obtained two-months credit from the bike supplier. c) CWB took out a five-year loan for S1 0,000 with an interest rate of 12% on January 1, 2018. The loan matures on January 1, 2022 d) CWB rents its premises for $900 per month, with rent due on the 15st of the prior month e) CWB has a business insurance policy, which it purchased for $3,300 on July 1, 2018. The policy runs until June 30, 2019 f) CWB owns various tools and equipment which it pools for purpose of calculating depreciation. In the past it has used straight-line depreciation over a ten-year period with no scrap or salvage value for these assets. However, with technology changing rapidly, CWB questions whether it will have to replace the equipment earlier. ) On March 31, CWB had $154 of supplies left in the supply room h) On April 7 received its utilities bill for the first quarter of 2019- $800. i) The tax rate is 20%. Cherry & White Bike Company Post-Closing Trial Balance 12/31/2018 Account Title Debit Credit Cash Store supplies Prepaid rent Prepaid insurance Inventory-standard bikes (25 bikes Equipment Accumulated depreciation equipment Accounts payable Utilities payable Salaries pavable Interest payable Loans payable Capital stock Retained Earnings S30,100 460 900 1,650 2,750 15,500 $4,350 8,724 775 1,600 1,200 10,000 20,000 4,711 $51,360 51,360 TotalsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started