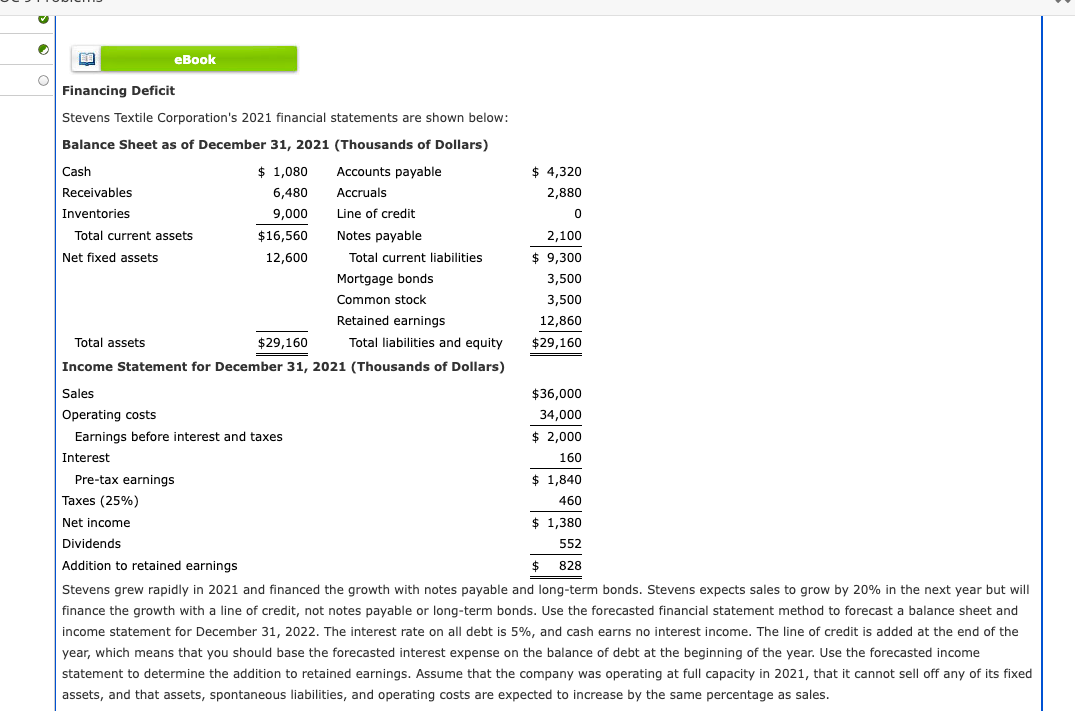

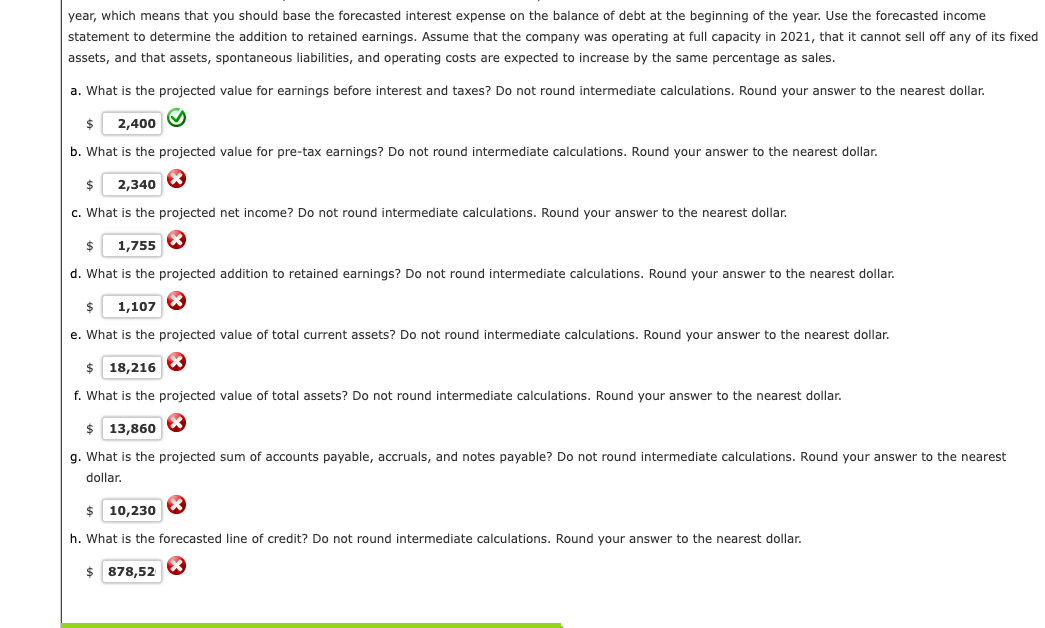

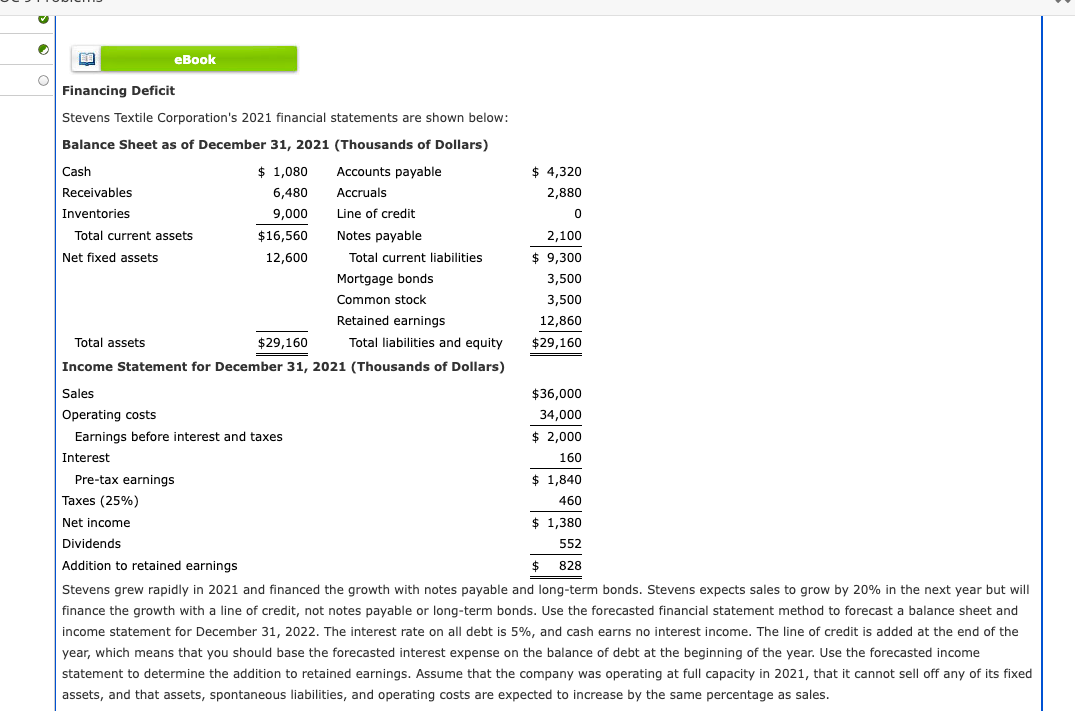

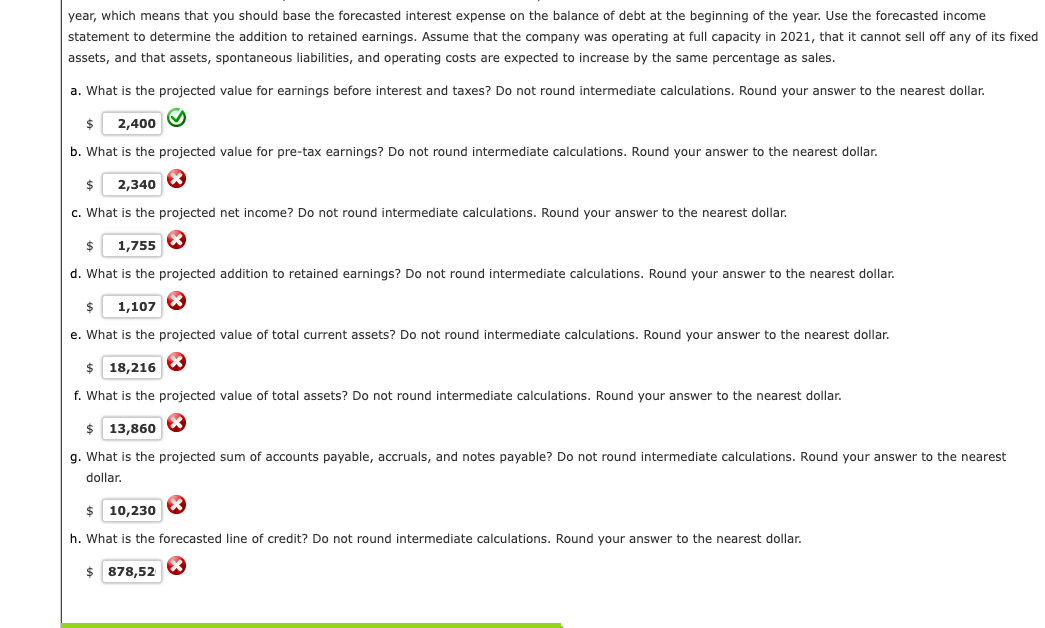

Financing Deficit Stevens Textile Corporation's 2021 financial statements are shown below: Balance Sheet as of December 31,2021 (Thousands of Dollars) finance the growth with a line of credit, not notes payable or long-term bonds. Use the forecasted financial statement method to forecast a balance sheet and income statement for December 31,2022 . The interest rate on all debt is 5%, and cash earns no interest income. The line of credit is added at the end of the statement to determine the addition to retained earnings. Assume that the company was operating at full capacity in 2021 , that it cannot sell off any of its fixed assets, and that assets, spontaneous liabilities, and operating costs are expected to increase by the same percentage as sales. year, which means that you should base the forecasted interest expense on the balance of debt at the beginning of the year. Use the forecasted income assets, and that assets, spontaneous liabilities, and operating costs are expected to increase by the same percentage as sales. a. What is the projected value for earnings before interest and taxes? Do not round intermediate calculations. Round your answer to the nearest dollar. $ b. What is the projected value for pre-tax earnings? Do not round intermediate calculations. Round your answer to the nearest dor $ c. What is the projected net income? Do not round intermediate calculations. Round your answer to the nearest dollar. $ d. What is the projected addition to retained earnings? Do not round intermediate calculations. Round your answer to the nearest dollar. $ e. What is the projected value of total current assets? Do not round intermediate calculations. Round your answer to the nearest dollar. $ f. What is the projected value of total assets? Do not round intermediate calculations. Round your answer to the nearest dollar. $ g. What is the projected sum of accounts payable, accruals, and notes payable? Do not round intermediate calculations. Round your answer to the nearest dollar. $ h. What is the forecasted line of credit? Do not round intermediate calculations. Round your answer to the nearest dollar. Financing Deficit Stevens Textile Corporation's 2021 financial statements are shown below: Balance Sheet as of December 31,2021 (Thousands of Dollars) finance the growth with a line of credit, not notes payable or long-term bonds. Use the forecasted financial statement method to forecast a balance sheet and income statement for December 31,2022 . The interest rate on all debt is 5%, and cash earns no interest income. The line of credit is added at the end of the statement to determine the addition to retained earnings. Assume that the company was operating at full capacity in 2021 , that it cannot sell off any of its fixed assets, and that assets, spontaneous liabilities, and operating costs are expected to increase by the same percentage as sales. year, which means that you should base the forecasted interest expense on the balance of debt at the beginning of the year. Use the forecasted income assets, and that assets, spontaneous liabilities, and operating costs are expected to increase by the same percentage as sales. a. What is the projected value for earnings before interest and taxes? Do not round intermediate calculations. Round your answer to the nearest dollar. $ b. What is the projected value for pre-tax earnings? Do not round intermediate calculations. Round your answer to the nearest dor $ c. What is the projected net income? Do not round intermediate calculations. Round your answer to the nearest dollar. $ d. What is the projected addition to retained earnings? Do not round intermediate calculations. Round your answer to the nearest dollar. $ e. What is the projected value of total current assets? Do not round intermediate calculations. Round your answer to the nearest dollar. $ f. What is the projected value of total assets? Do not round intermediate calculations. Round your answer to the nearest dollar. $ g. What is the projected sum of accounts payable, accruals, and notes payable? Do not round intermediate calculations. Round your answer to the nearest dollar. $ h. What is the forecasted line of credit? Do not round intermediate calculations. Round your answer to the nearest dollar