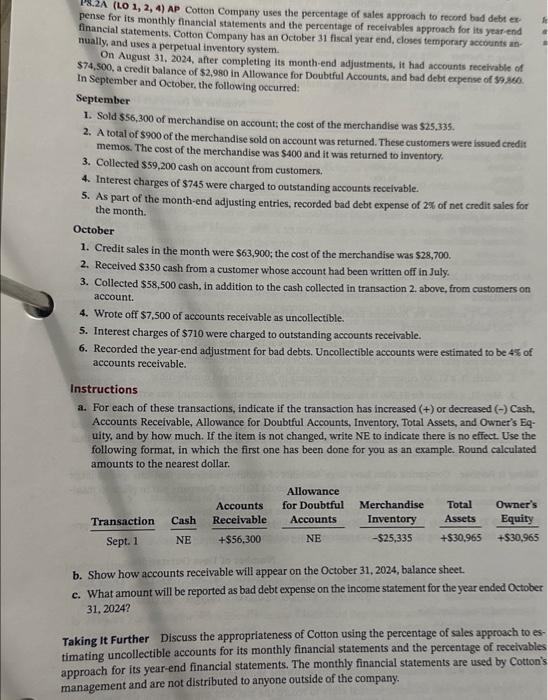

finanelal statementhly financial statements and the percentage of receivables approach for its year-end nually, and uses a perpetual inventory system. On August 31. 2024, after completing its month-end adjustments, it had accounts receivable of \$74,500, a credit balance of $2,980 in Allowance for Doubtful Accounts, and bad debt expense of $9.260. In September and October, the following occurred: September 1. Sold $56,300 of merchandise on account; the cost of the merchandise was $25.335. 2. A total of $900 of the merchandise sold on account was returned. These customers were issued credit memos. The cost of the merchandise was $400 and it was returned to inventory. 3. Collected $59,200 cash on account from customers. 4. Interest charges of $745 were charged to outstanding accounts recelvable. 5. As part of the month-end adjusting entries, recorded bad debt expense of 2% of net credit sales for the month. October 1. Credit sales in the month were $63,900; the cost of the merchandise was $28,700. 2. Received $350 cash from a customer whose account had been written off in July. 3. Collected $58,500 cash, in addition to the cash collected in transaction 2 , above, from customers on account. 4. Wrote off $7,500 of accounts receivable as uncollectible. 5. Interest charges of $710 were charged to outstanding accounts receivable. 6. Recorded the year-end adjustment for bad debts. Uncollectible accounts were estimated to be 45 of accounts receivable. Instructions a. For each of these transactions, indicate if the transaction has increased (t) or decreased () Cash, Accounts Receivable, Allowance for Doubtful Accounts, Inventory, Total Assets, and Owner's Equity, and by how much. If the item is not changed, write NE to indicate there is no effect. Use the following format, in which the first one has been done for you as an example. Round calculated amounts to the nearest dollar. b. Show how accounts receivable will appear on the October 31,2024 , balance sheet. c. What amount will be reported as bad debt expense on the income statement for the year ended October 31,2024? Taking It Further Discuss the appropriateness of Cotton using the percentage of sales approach to estimating uncollectible accounts for its monthly financlal statements and the percentage of receivables approach for its year-end financial statements. The monthly financial statements are used by Cotton's management and are not distributed to anyone outside of the company. finanelal statementhly financial statements and the percentage of receivables approach for its year-end nually, and uses a perpetual inventory system. On August 31. 2024, after completing its month-end adjustments, it had accounts receivable of \$74,500, a credit balance of $2,980 in Allowance for Doubtful Accounts, and bad debt expense of $9.260. In September and October, the following occurred: September 1. Sold $56,300 of merchandise on account; the cost of the merchandise was $25.335. 2. A total of $900 of the merchandise sold on account was returned. These customers were issued credit memos. The cost of the merchandise was $400 and it was returned to inventory. 3. Collected $59,200 cash on account from customers. 4. Interest charges of $745 were charged to outstanding accounts recelvable. 5. As part of the month-end adjusting entries, recorded bad debt expense of 2% of net credit sales for the month. October 1. Credit sales in the month were $63,900; the cost of the merchandise was $28,700. 2. Received $350 cash from a customer whose account had been written off in July. 3. Collected $58,500 cash, in addition to the cash collected in transaction 2 , above, from customers on account. 4. Wrote off $7,500 of accounts receivable as uncollectible. 5. Interest charges of $710 were charged to outstanding accounts receivable. 6. Recorded the year-end adjustment for bad debts. Uncollectible accounts were estimated to be 45 of accounts receivable. Instructions a. For each of these transactions, indicate if the transaction has increased (t) or decreased () Cash, Accounts Receivable, Allowance for Doubtful Accounts, Inventory, Total Assets, and Owner's Equity, and by how much. If the item is not changed, write NE to indicate there is no effect. Use the following format, in which the first one has been done for you as an example. Round calculated amounts to the nearest dollar. b. Show how accounts receivable will appear on the October 31,2024 , balance sheet. c. What amount will be reported as bad debt expense on the income statement for the year ended October 31,2024? Taking It Further Discuss the appropriateness of Cotton using the percentage of sales approach to estimating uncollectible accounts for its monthly financlal statements and the percentage of receivables approach for its year-end financial statements. The monthly financial statements are used by Cotton's management and are not distributed to anyone outside of the company