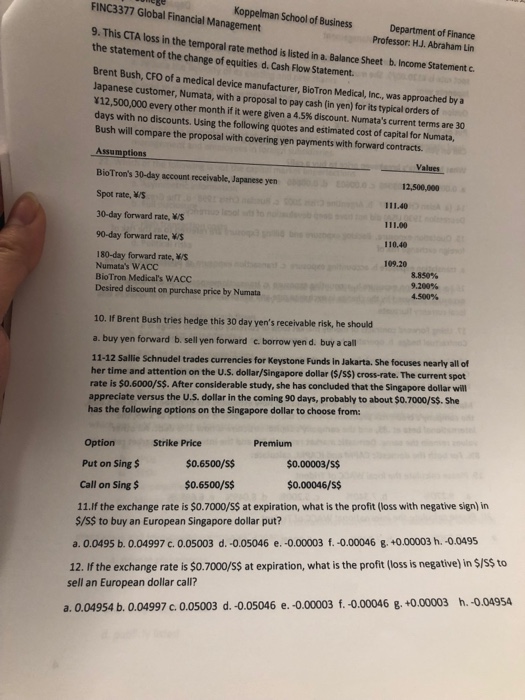

FINC3377 Global Financial Management Koppelman School of Business Department of Finance Professor: H.J. Abraham Lin 9. This CTA loss in the temporal rate method is listed in a. Balance Sheet b. Income Statement c the statement of the change of equities d. Cash Flow Statement. Brent Bush, CFO of a medical device manufacturer, BioTron Medical, Inc., was approached by a Japanese customer, Numata, with a proposal to pay cash (in yen) for its typical orders of \ 12,500,000 every other month if it were given a 4.5% discount. Numata's current terms are 30 days with no discounts. Using the following quotes and estimated cost of capital for Numata, Bush will compare the proposal with covering yen payments with forward contracts Assumptions BioTron's 30-day account receivable, Japanese yen Spot rate, WS 30-day forward rate, WS 90-day forward rate, Ws Values 12,500,000 111.40 111.00 110.40 109.20 180-day forward rate, ws Numata's WACC BioTron Medical's WACC Desired discount on purchase price by Numata 8.850% 9,200% 4.500% 10. If Brent Bush tries hedge this 30 day yen's receivable risk, he should a. buy yen forward b. sell yen forward c. borrow yen d. buy a call 11-12 Sallie Schnudel trades currencies for Keystone Funds in Jakarta. She focuses nearly al of her time and attention on the U.S. dollar/Singapore dollar (5/S5) cross-rate. The current spot rate is $0.6000/S$. After considerable study, she has concluded that the Singapore dollar will appreciate versus the U.S. dollar in the coming 90 days, probably to about $0.7000/s$. She has the following options on the Singapore dollar to choose from: Premium OptionStrike Price Put on Sing$ Call on Sing$ 11.If the exchange rate is $0.7000/SS at expiration, what is the profit (loss with negative sign) in $0.00003/s$ $0.6500/s$ $0.6500/S$ $0.00046/s$ S/S$ to buy an European Singapore dollar put? a. 0.0495 b. 0.04997 c.0.05003 d.-0.05046 e. -0.00003 f.-0.00046 g.+0.00003 h. 0.0495 12. If the exchange rate is $o.7000/S$ at expiration, what is the profit (loss is negative) in S/S$ to sell an European dollar call? a. 0.04954 b. 0.04997 c.0.05003 d.-0.05046 e. -0.00003 f.-0.00046 8. +0.00003 h.-0.04954