Answered step by step

Verified Expert Solution

Question

1 Approved Answer

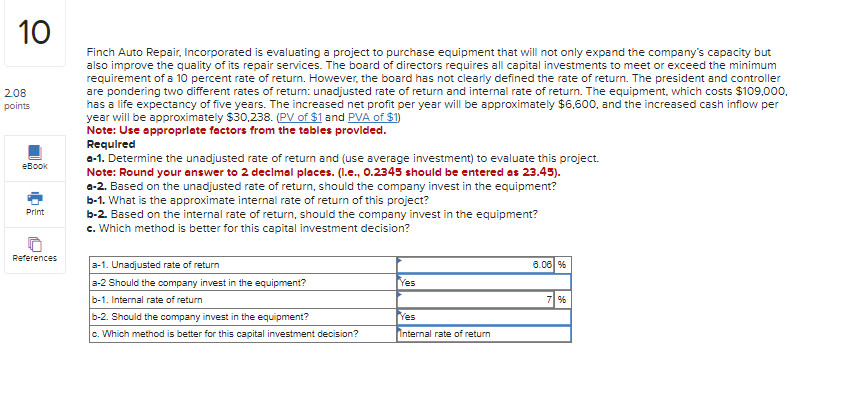

Finch Auto Repair, Incorporated is evaluating a project to purchase equipment that will not only expand the company's capacity but also improve the quality of

Finch Auto Repair, Incorporated is evaluating a project to purchase equipment that will not only expand the company's capacity but

also improve the quality of its repair services. The board of directors requires all capital investments to meet or exceed the minimum

requirement of a percent rate of return. However, the board has not clearly defined the rate of return. The president and controller

are pondering two different rates of return: unadjusted rate of return and internal rate of return. The equipment, which costs $

has a life expectancy of five years. The increased net profit per year will be approximately $ and the increased cash inflow per

year will be approximately $PV of $ and PVA of $

Note: Use approprlate factors from the tables provlded.

Required

Q Determine the unadjusted rate of return and use average investment to evaluate this project.

Note: Round your answer to declmal pleces. le should be entered es

a Based on the unadjusted rate of return, should the company invest in the equipment?

b What is the approximate internal rate of return of this project?

b Based on the internal rate of return, should the company invest in the equipment?

c Which method is better for this capital investment decision?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started