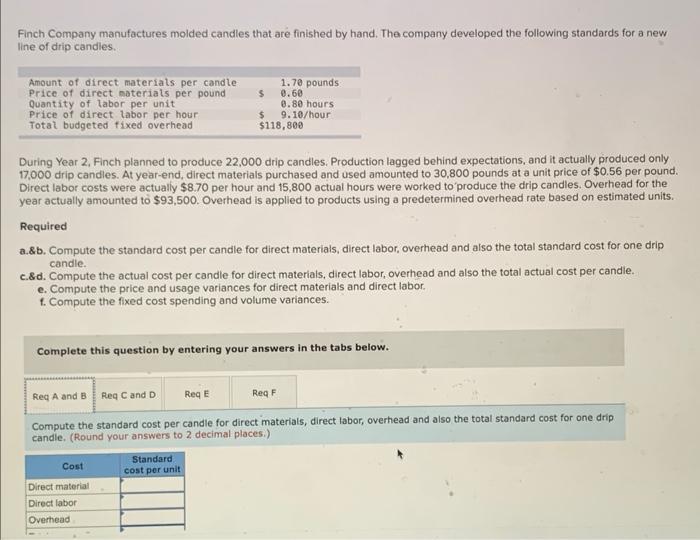

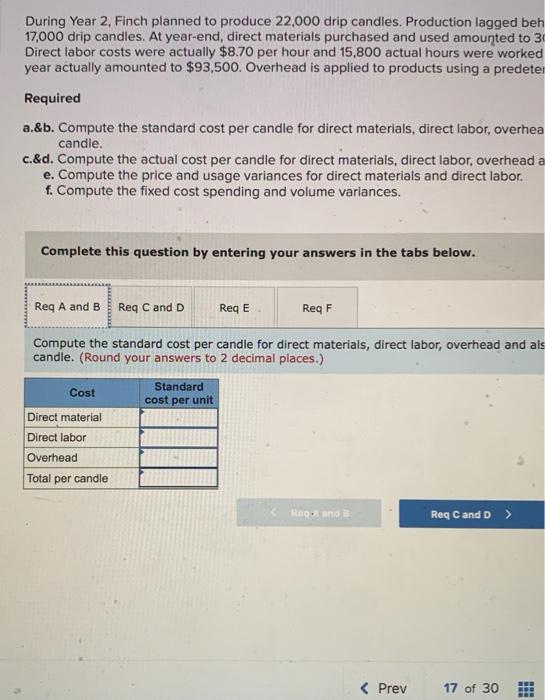

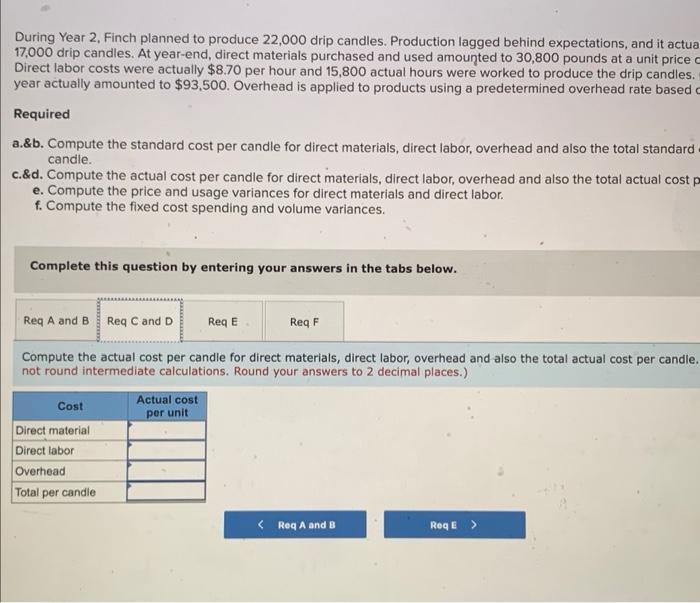

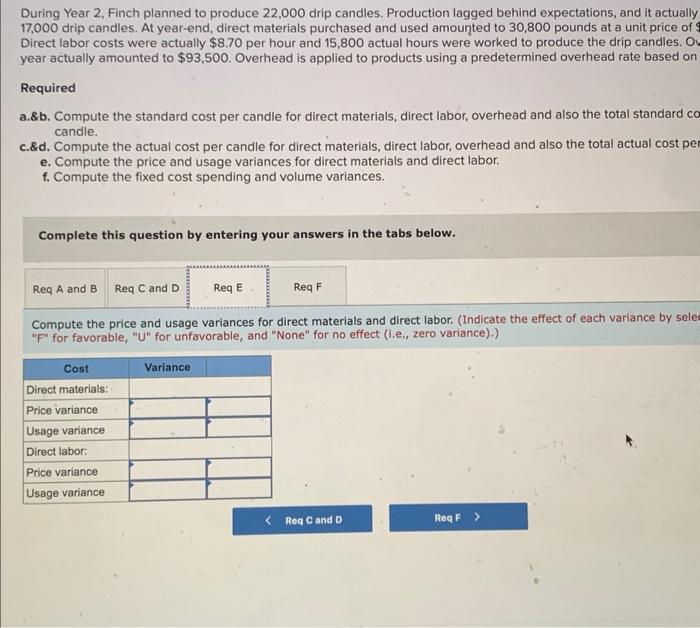

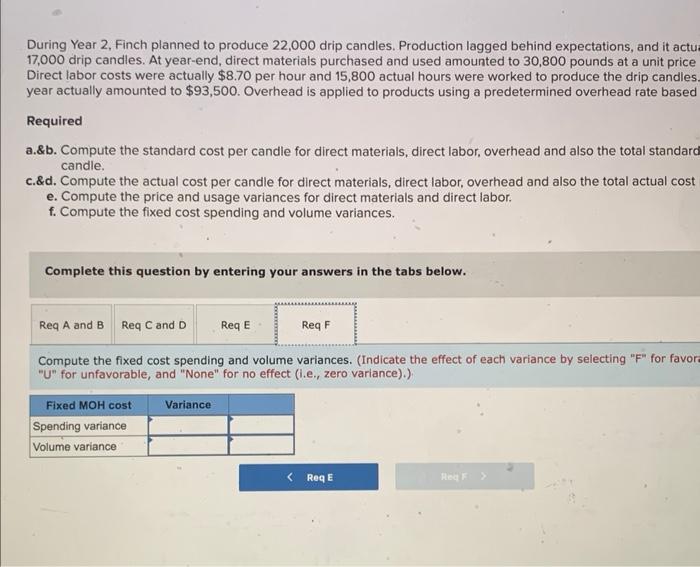

Finch Company manufactures molded candles that are finished by hand. The company developed the following standards for a new line of drip candles. During Year 2. Finch planned to produce 22,000 drip candles. Production lagged behind expectations, and it actually produced only 17,000 drip candles. At year-end, direct materials purchased and used amounted to 30,800 pounds at a unit price of $0.56 per pound. Direct labor costs were actually $8.70 per hour and 15,800 actual hours were worked to produce the drip candles. Overhead for the year actually amounted to $93,500. Overhead is applied to products using a predetermined overhead rate based on estimated units. Required a.\&b. Compute the standard cost per candle for direct materials, direct labor, overhead and also the total standard cost for one drip candie. c.\&d. Compute the actual cost per candle for direct materials, direct labor, overhead and also the total actual cost per candle. e. Compute the price and usage variances for direct materials and direct labor. f. Compute the fixed cost spending and volume variances. Complete this question by entering your answers in the tabs below. Compute the standard cost per candle for direct materials, direct labor, overhead and also the total standard cost for one drip candle. (Round your answers to 2 decimal places.) During Year 2, Finch planned to produce 22,000 drip candles. Production lagged beh 17,000 drip candles. At year-end, direct materials purchased and used amounted to 31 Direct labor costs were actually $8.70 per hour and 15,800 actual hours were worked year actually amounted to $93,500. Overhead is applied to products using a predetel Required a.\&b. Compute the standard cost per candle for direct materials, direct labor, overhea candle. c.\&d. Compute the actual cost per candle for direct materials, direct labor, overhead a e. Compute the price and usage variances for direct materials and direct labor. f. Compute the fixed cost spending and volume variances. Complete this question by entering your answers in the tabs below. Compute the standard cost per candle for direct materials, direct labor, overhead and als candle. (Round your answers to 2 decimal places.) During Year 2, Finch planned to produce 22,000 drip candles. Production lagged behind expectations, and it actua 17,000 drip candles. At year-end, direct materials purchased and used amounted to 30,800 pounds at a unit price Direct labor costs were actually $8.70 per hour and 15,800 actual hours were worked to produce the drip candles. year actually amounted to $93,500. Overhead is applied to products using a predetermined overhead rate based Required a.\&b. Compute the standard cost per candle for direct materials, direct labor, overhead and also the total standard candie. c.\&d. Compute the actual cost per candle for direct materials, direct labor, overhead and also the total actual cost e. Compute the price and usage variances for direct materials and direct labor. f. Compute the fixed cost spending and volume variances. Complete this question by entering your answers in the tabs below. Compute the actual cost per candle for direct materials, direct labor, overhead and also the total actual cost per candle not round intermediate calculations. Round your answers to 2 decimal places.) During Year 2, Finch planned to produce 22,000 drip candles. Production lagged behind expectations, and it actually 17,000 drip candles. At year-end, direct materials purchased and used amounted to 30,800 pounds at a unit price of Direct labor costs were actually $8.70 per hour and 15,800 actual hours were worked to produce the drip candles. O year actually amounted to $93,500. Overhead is applied to products using a predetermined overhead rate based on Required a.\&b. Compute the standard cost per candle for direct materials, direct labor, overhead and also the total standard ce candle. c.\&d. Compute the actual cost per candle for direct materials, direct labor, overhead and also the total actual cost pe e. Compute the price and usage variances for direct materials and direct labor. f. Compute the fixed cost spending and volume variances. Complete this question by entering your answers in the tabs below. Compute the price and usage variances for direct materials and direct labor. (Indicate the effect of each variance by sele "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance).) During Year 2, Finch planned to produce 22,000 drip candles. Production lagged behind expectations, and it actu 17,000 drip candles. At year-end, direct materials purchased and used amounted to 30,800 pounds at a unit price Direct labor costs were actually $8.70 per hour and 15,800 actual hours were worked to produce the drip candles year actually amounted to $93,500. Overhead is applied to products using a predetermined overhead rate based Required a.\&b. Compute the standard cost per candle for direct materials, direct labor, overhead and also the total standarc candle. c.\&d. Compute the actual cost per candle for direct materials, direct labor, overhead and also the total actual cost e. Compute the price and usage variances for direct materials and direct labor. f. Compute the fixed cost spending and volume variances. Complete this question by entering your answers in the tabs below. Compute the fixed cost spending and volume variances. (Indicate the effect of each variance by selecting "F" for favor "U" for unfavorable, and "None" for no effect (i.e., zero variance).)