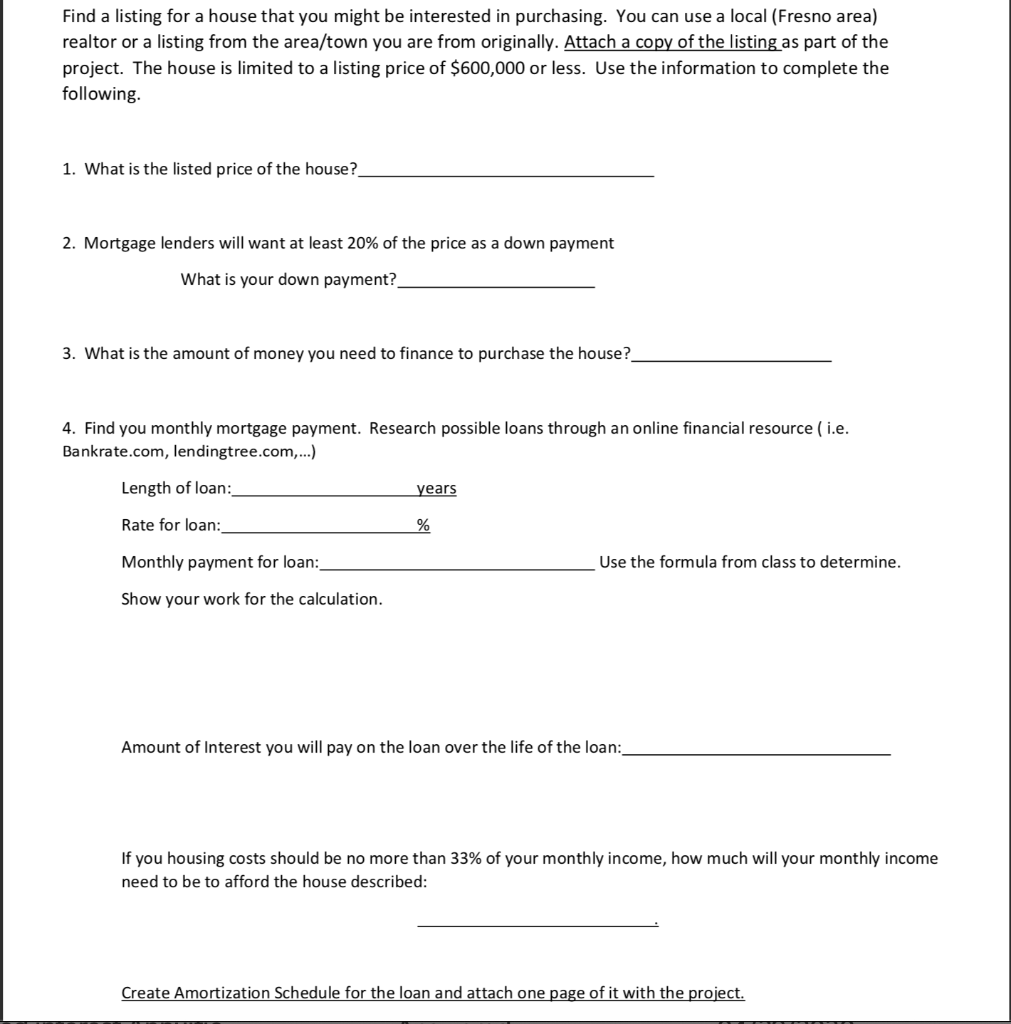

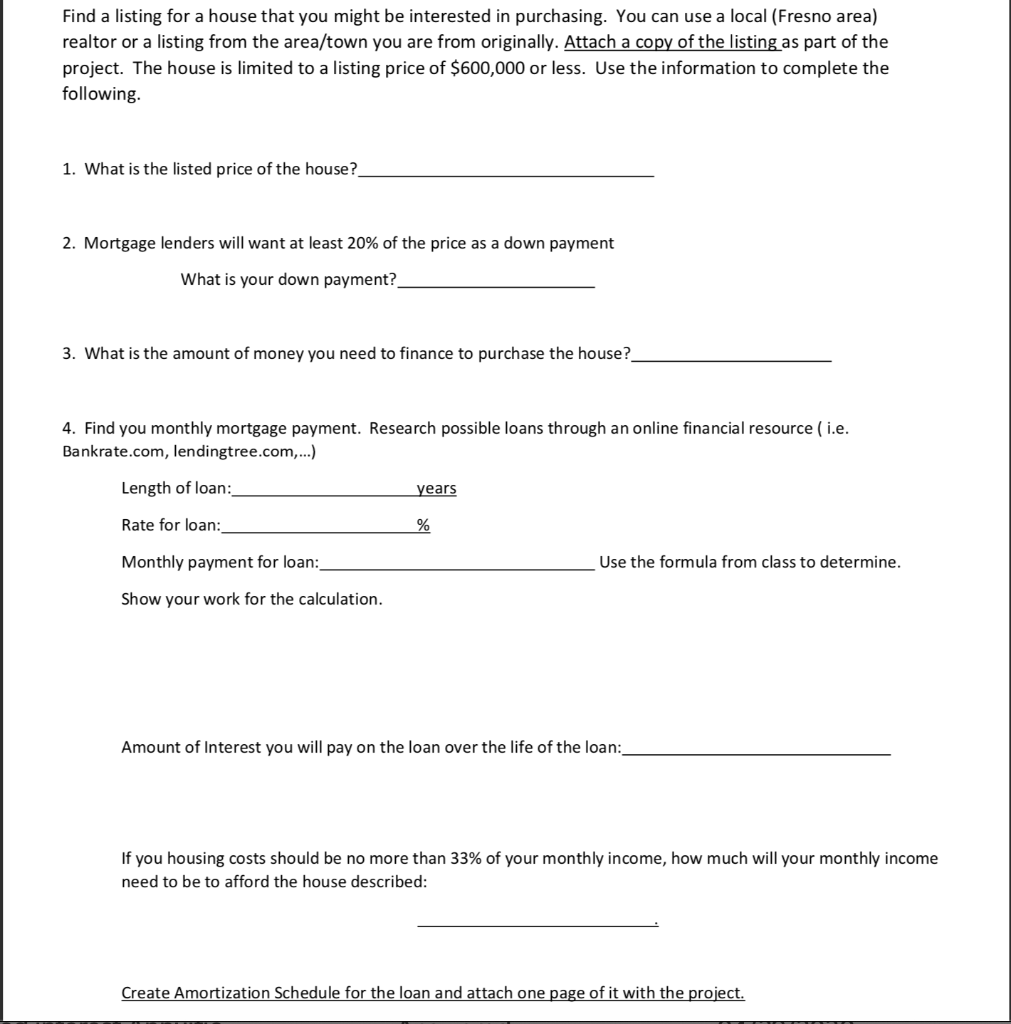

Find a listing for a house that you might be interested in purchasing. You can use a local (Fresno area) realtor or a listing from the area/town you are from originally. Attach a copy of the listing as part of the project. The house is limited to a listing price of $600,000 or less. Use the information to complete the following 1. What is the listed price of the house? 2. Mortgage lenders will want at least 20% of the price as a down payment What is your down payment?_ 3. What is the amount of money you need to finance to purchase the house? 4. Find you monthly mortgage payment. Research possible loans through an online financial resource ( i.e. Bankrate.com, lendingtree.com,...) Length of loan: years Rate for loan: Monthly payment for loan: Use the formula from class to determine. Show your work for the calculation. Amount of Interest you will pay on the loan over the life of the loan: If you housing costs should be no more than 33% of your monthly income, how much will your monthly income need to be to afford the house described: Create Amortization Schedule for the loan and attach one page of it with the project. Find a listing for a house that you might be interested in purchasing. You can use a local (Fresno area) realtor or a listing from the area/town you are from originally. Attach a copy of the listing as part of the project. The house is limited to a listing price of $600,000 or less. Use the information to complete the following 1. What is the listed price of the house? 2. Mortgage lenders will want at least 20% of the price as a down payment What is your down payment?_ 3. What is the amount of money you need to finance to purchase the house? 4. Find you monthly mortgage payment. Research possible loans through an online financial resource ( i.e. Bankrate.com, lendingtree.com,...) Length of loan: years Rate for loan: Monthly payment for loan: Use the formula from class to determine. Show your work for the calculation. Amount of Interest you will pay on the loan over the life of the loan: If you housing costs should be no more than 33% of your monthly income, how much will your monthly income need to be to afford the house described: Create Amortization Schedule for the loan and attach one page of it with the project