Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Find a solution HSA Scenario 2: Ed and Christine Martinez Interview Notes Ed and Christine are married and will fle a joint return. Ed is

Find a solution

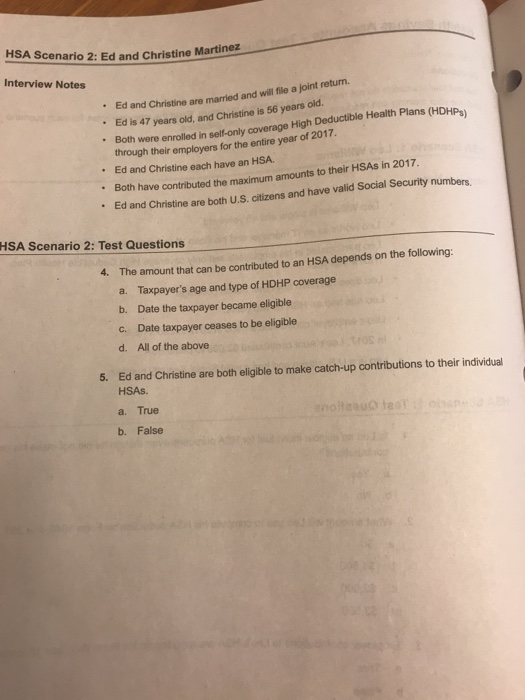

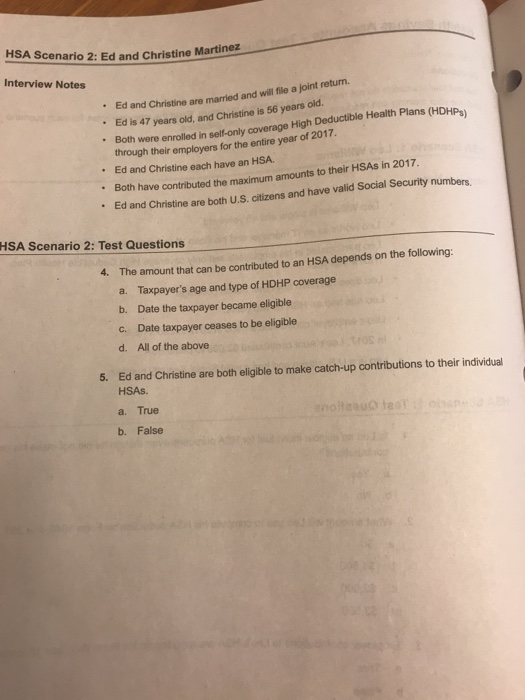

HSA Scenario 2: Ed and Christine Martinez Interview Notes Ed and Christine are married and will fle a joint return. Ed is 47 years old, and Christine is 56 years old. Both were enrolled in self-only coverage High Deductible Health Plans (HDHP through their employers for the entire year of 2017 Ed and Christine each have an HSA. Both have contributed the maximum amounts to their HSAs in 2017. Ed and Christine are both U.S. citizens and have valid Social Security numbers. HSA Scenario 2: Test Questions 4. The amount that can be contributed to an HSA depends on the following: a. Taxpayer's age and type of HDHP coverage b. Date the taxpayer became eligible Date taxpayer ceases to be eligible c. d. All of the above 5. Ed and Christine are both eligible to make catch-up contributions to their individual HSAs. a. True b. False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started