Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Find EPS (earnings per share), both basic and diluted better now? At December 31, 2016, The Jason Company has 200,000 shares of cumulative, participating preferred

Find EPS (earnings per share), both basic and diluted

better now?

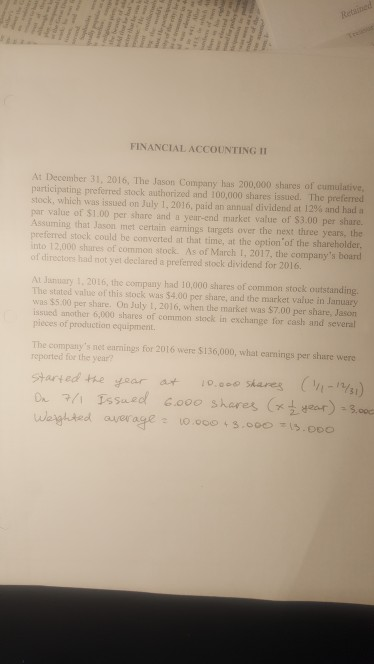

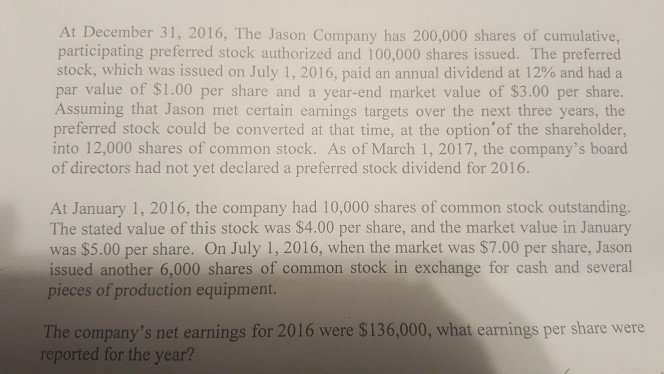

At December 31, 2016, The Jason Company has 200,000 shares of cumulative, participating preferred stock authorized and 100,000 shares issued. The preferred stock, which was issued on July 1, 2016, paid an annual dividend at 12% and had a par value of $1.00 per share and a year-end market value of $3.00 per share. Assuming that Jason met certain earnings targets over the next three years, the preferred stock could be converted at that time, at the option of the shareholder, into 12,000 shares of common stock. As of March 1, 2017, the company's board of directors had not yet declared a preferred stock dividend for 2016. At January 1, 2016, the company had 10,000 shares of common stock outstanding. The stated value of this stock was $4.00 per share, and the market value in January was $5.00 per share. On July 1, 2016, when the market was $7.00 per share, Jason issued another 6,000 shares of common stock in exchange for cash and several pieces of production equipment. The company's net earnings for 2016 were $136,000, what earnings per share were reported for the yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started