Answered step by step

Verified Expert Solution

Question

1 Approved Answer

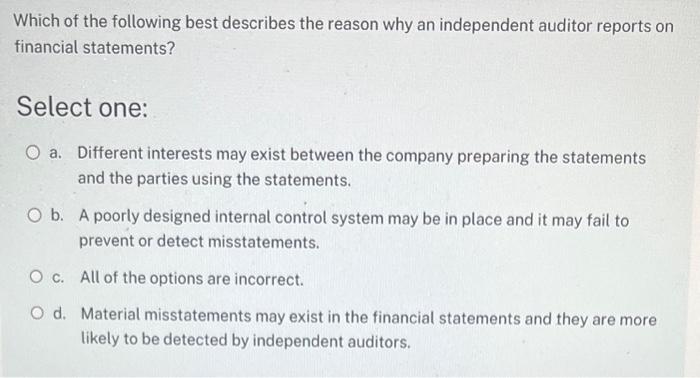

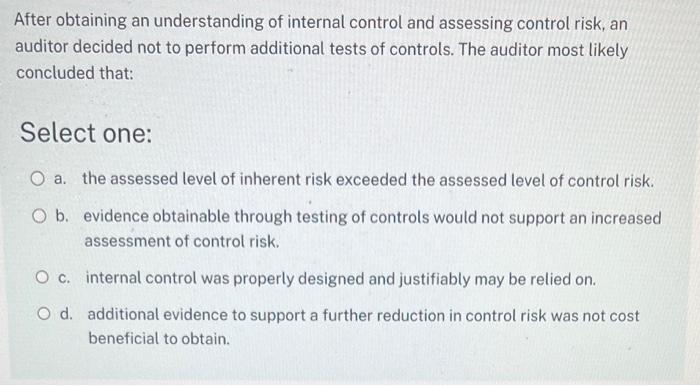

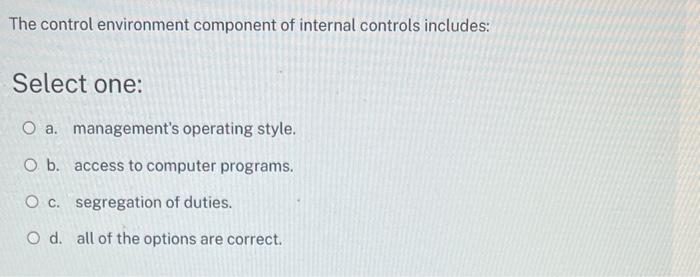

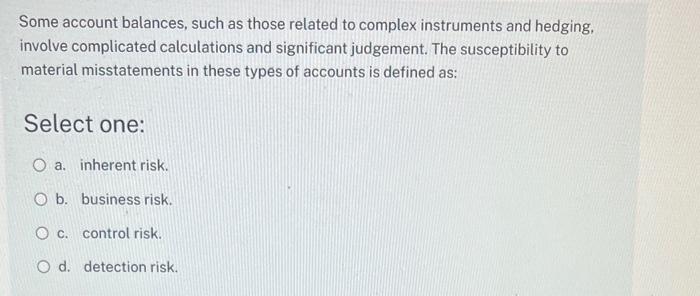

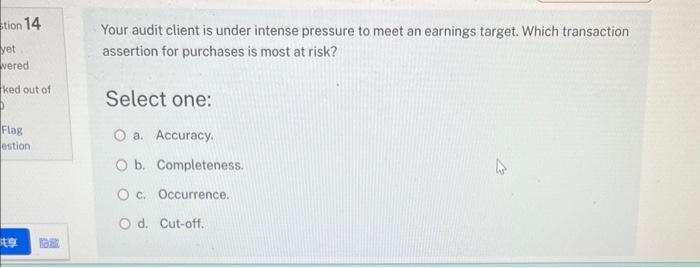

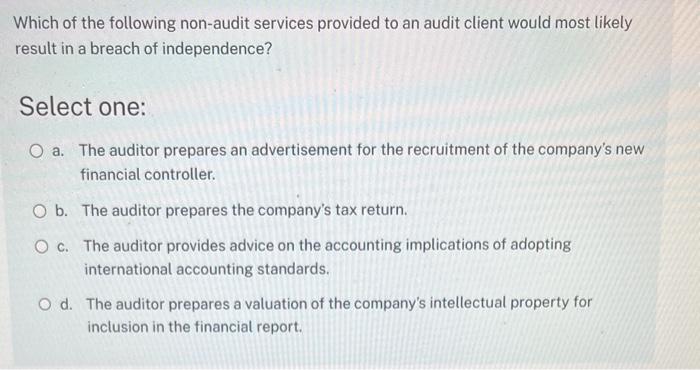

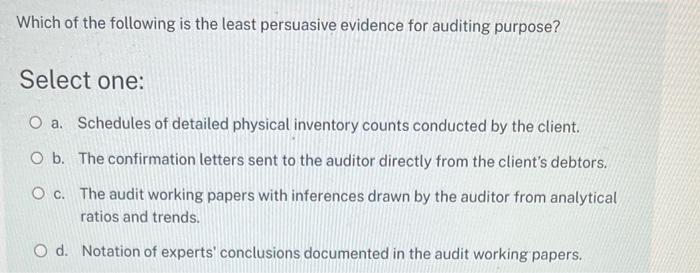

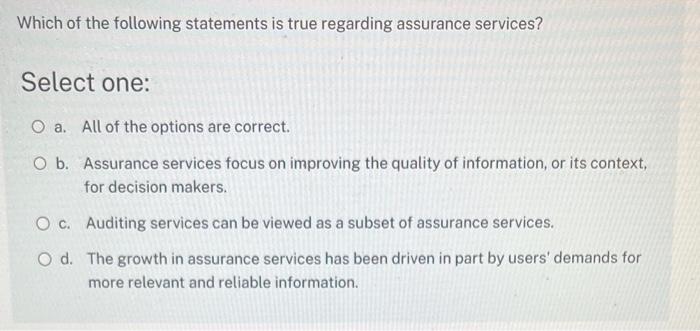

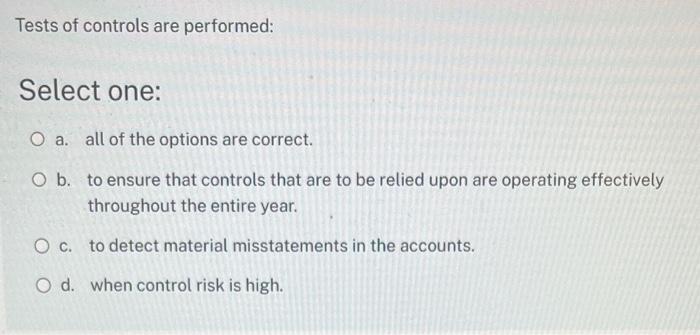

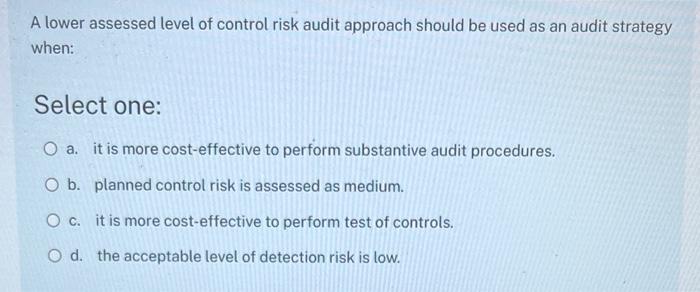

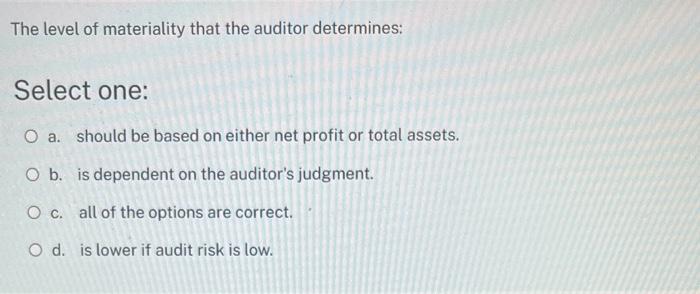

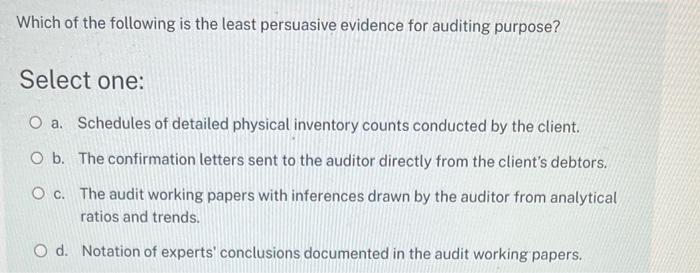

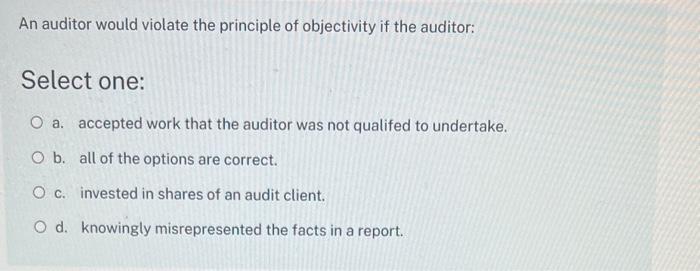

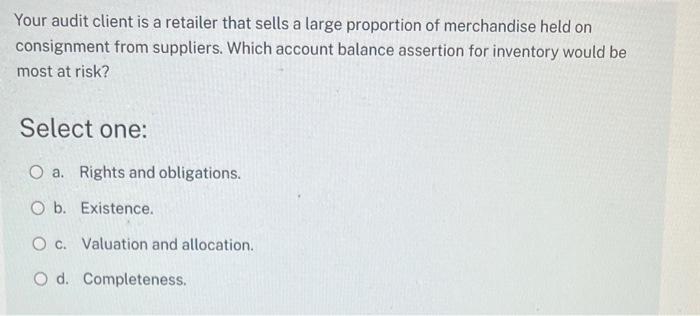

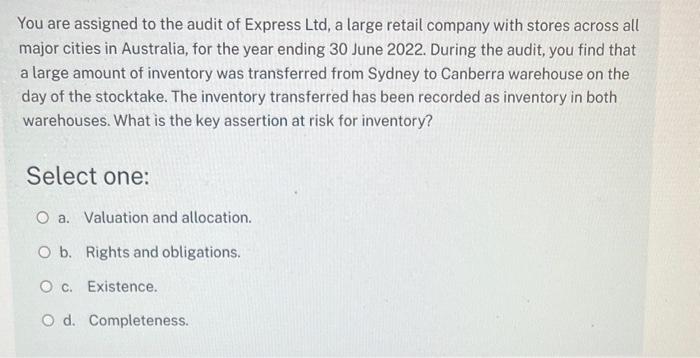

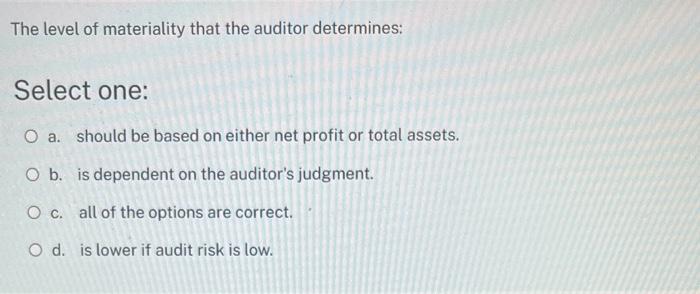

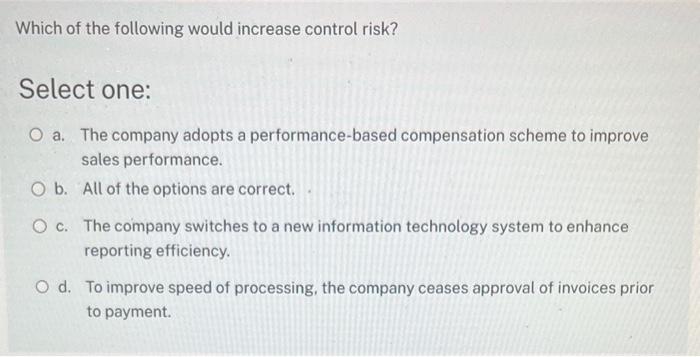

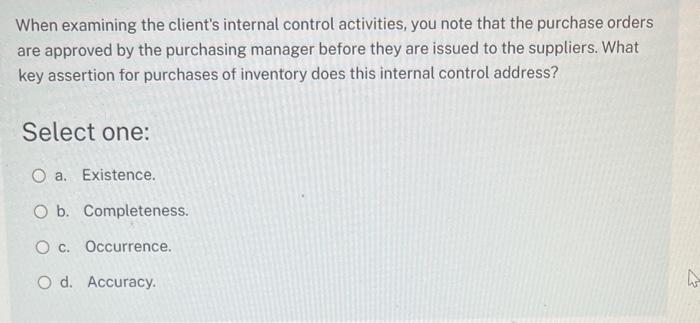

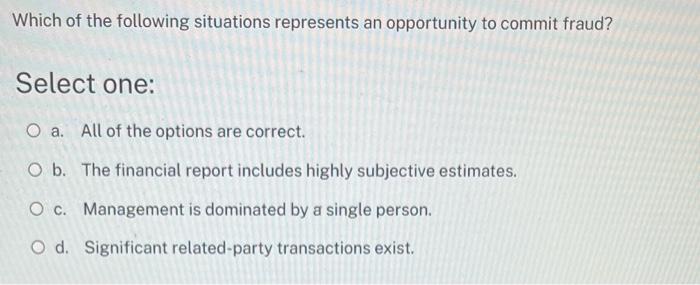

Which of the following best describes the reason why an independent auditor reports on financial statements? Select one: a. Different interests may exist between the

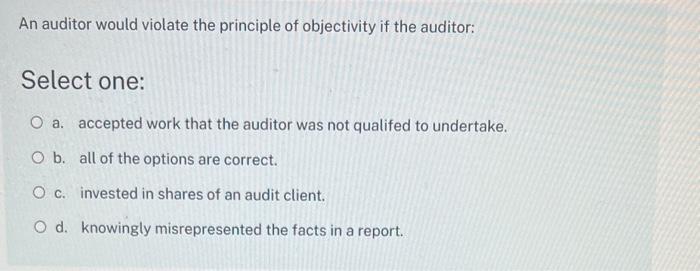

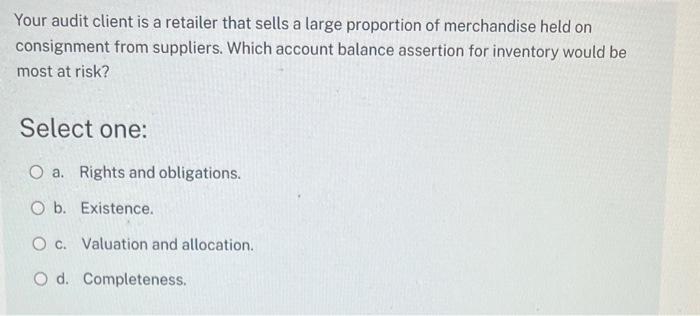

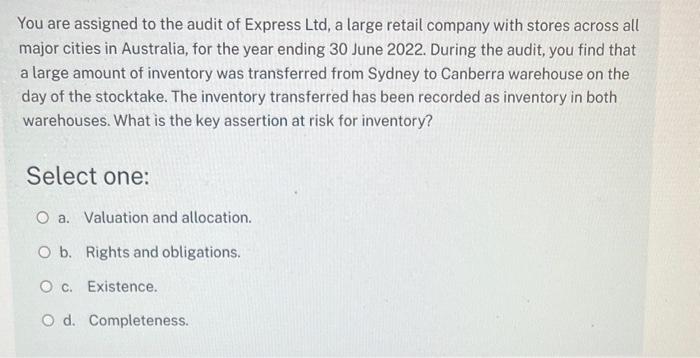

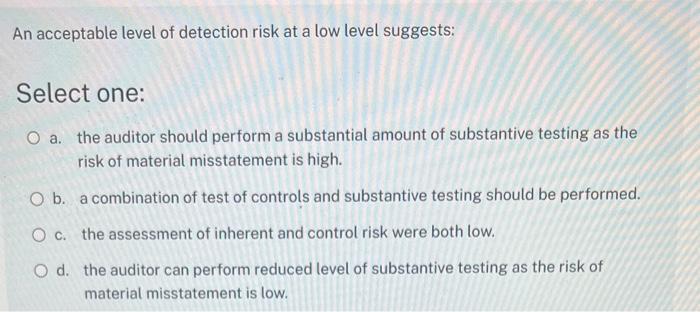

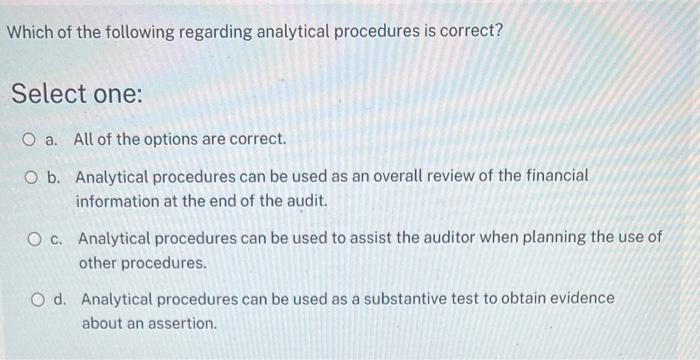

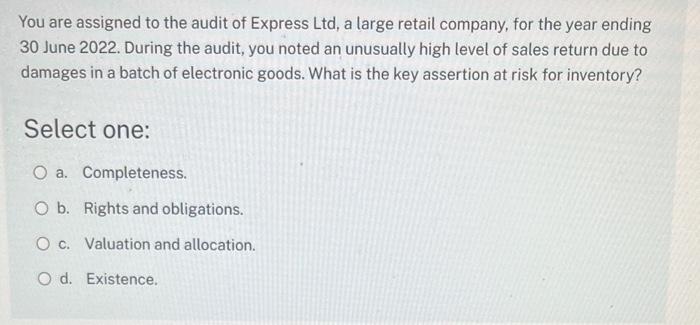

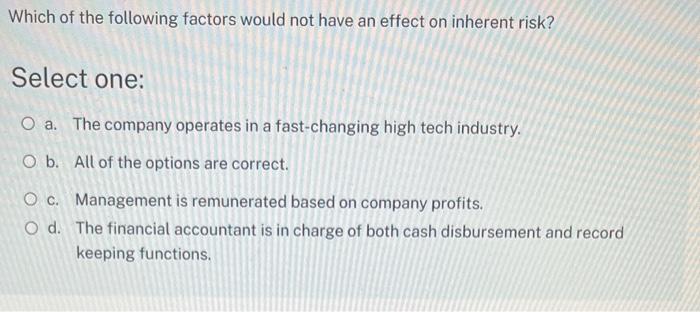

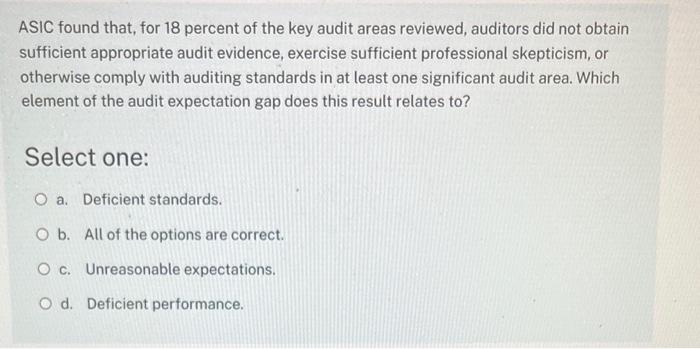

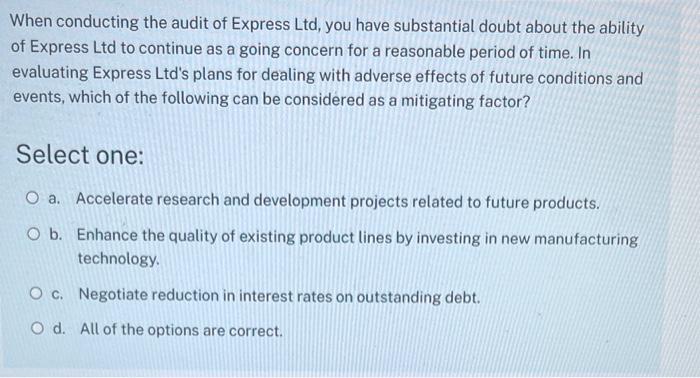

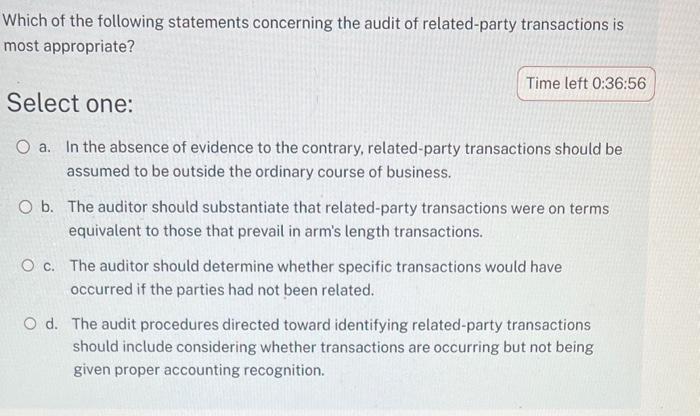

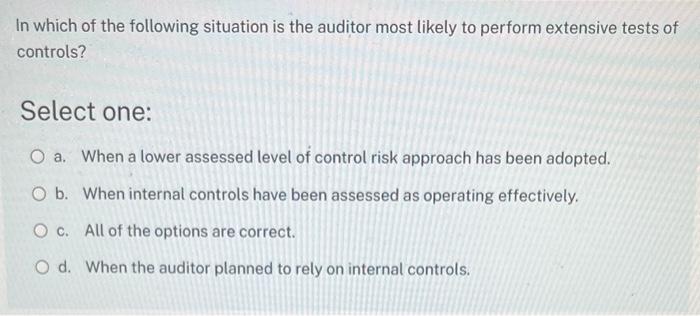

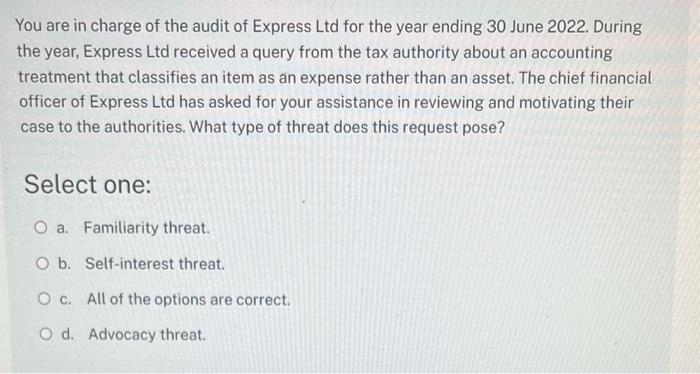

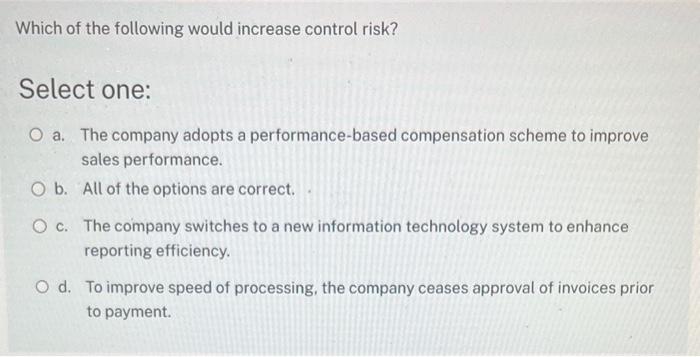

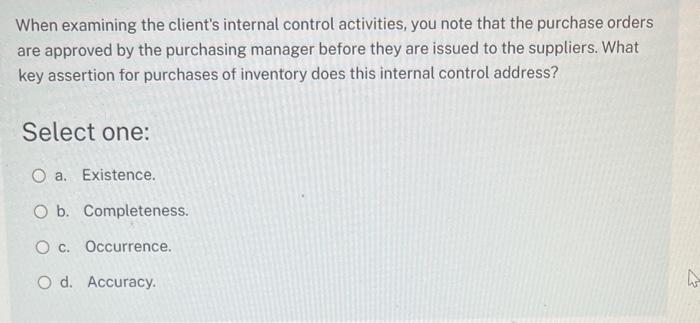

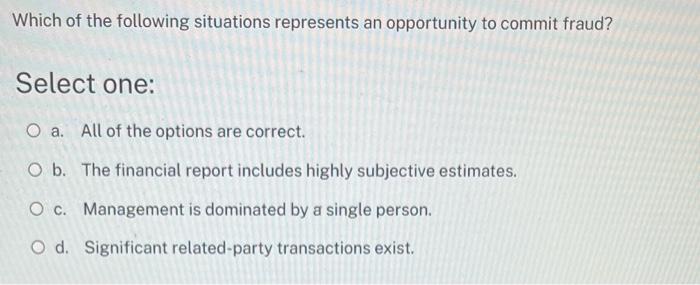

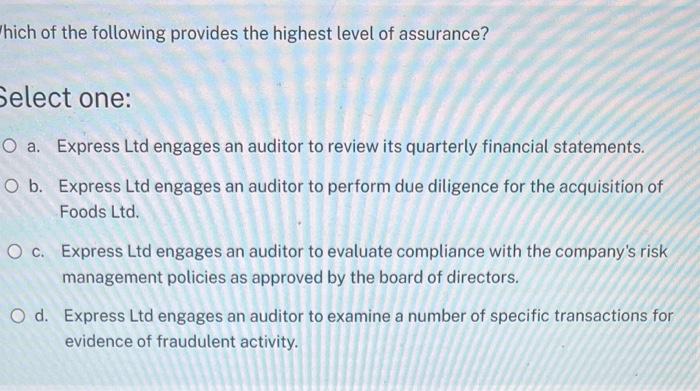

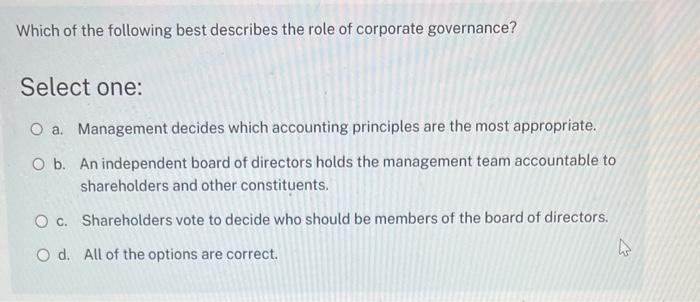

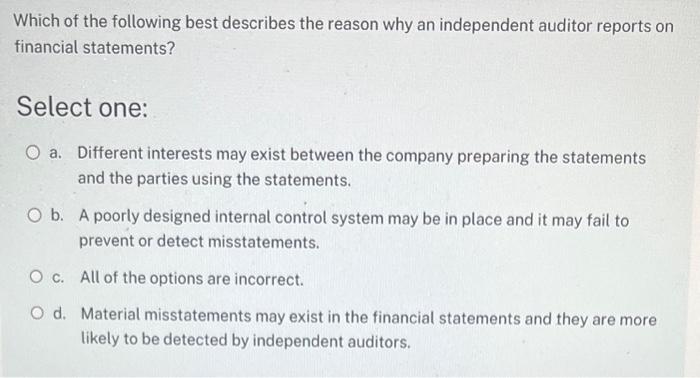

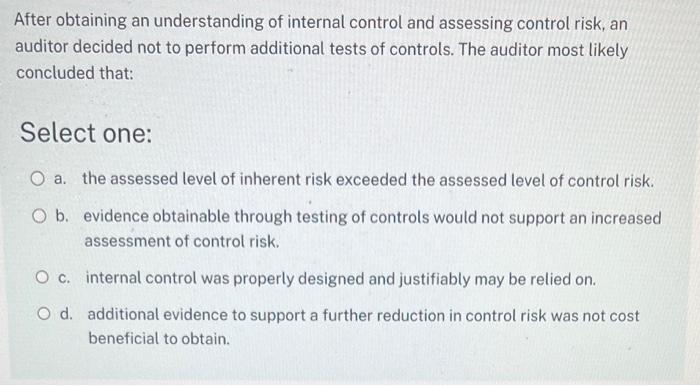

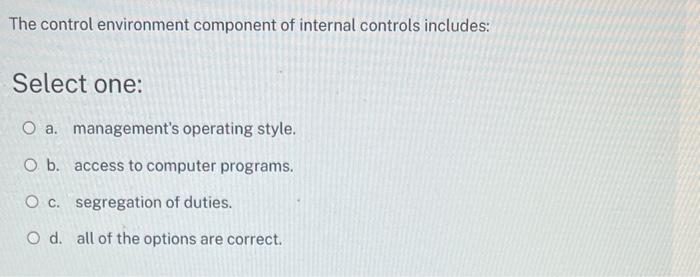

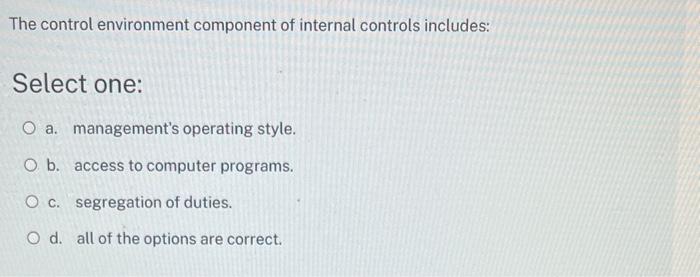

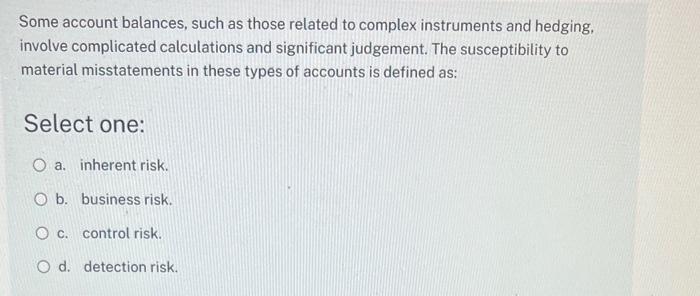

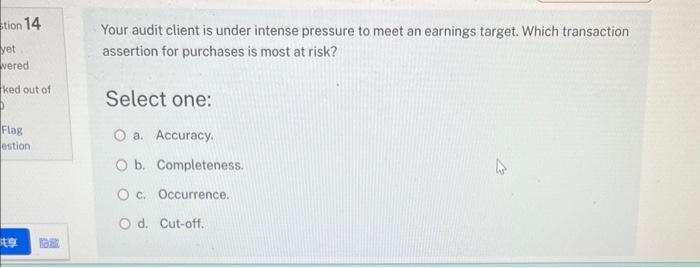

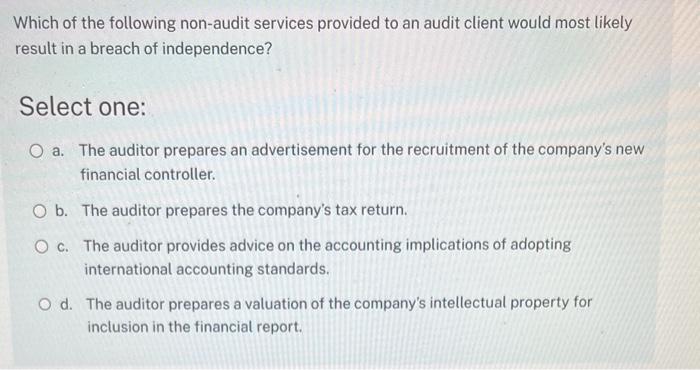

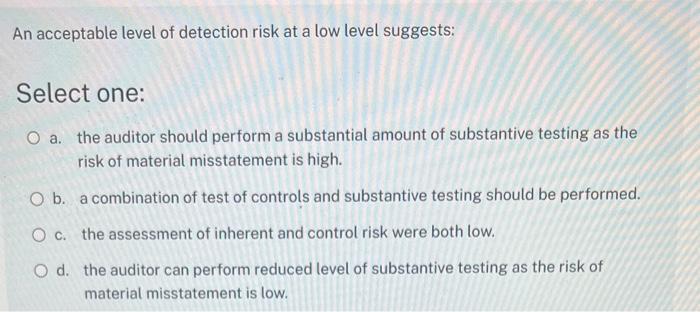

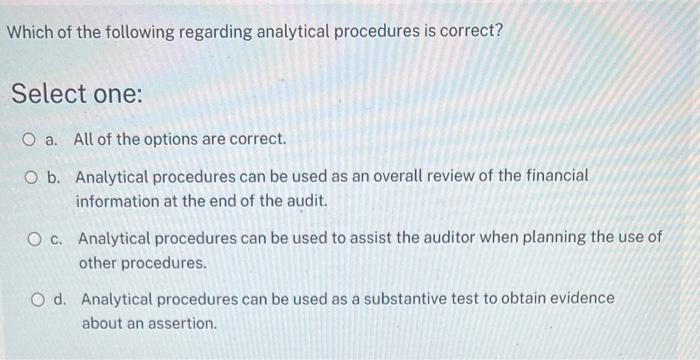

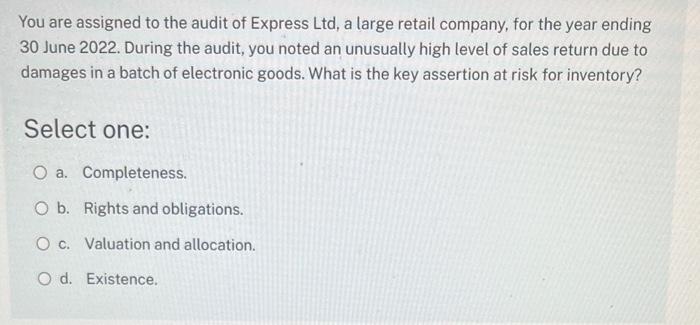

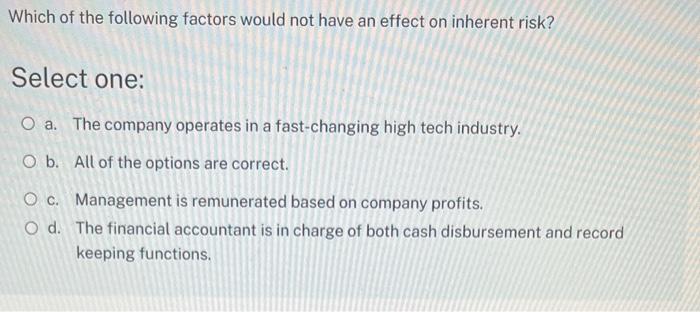

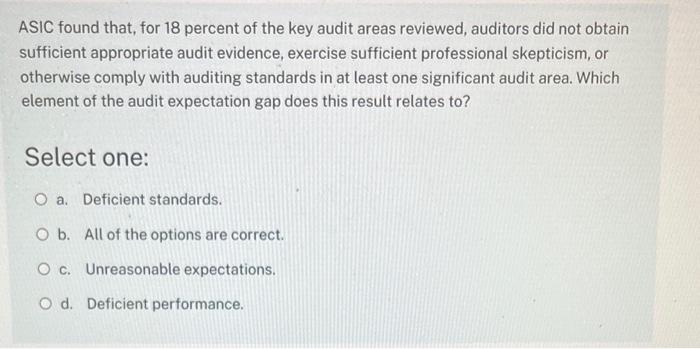

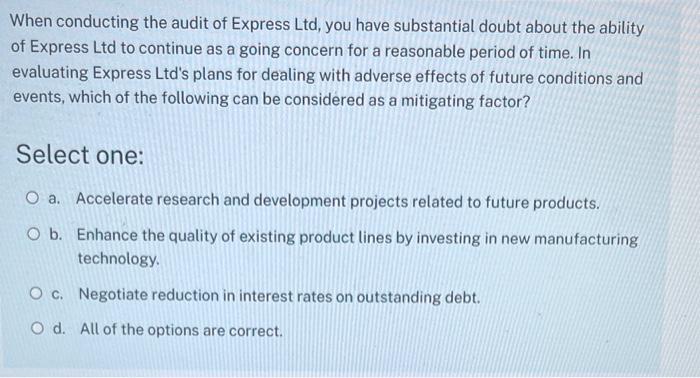

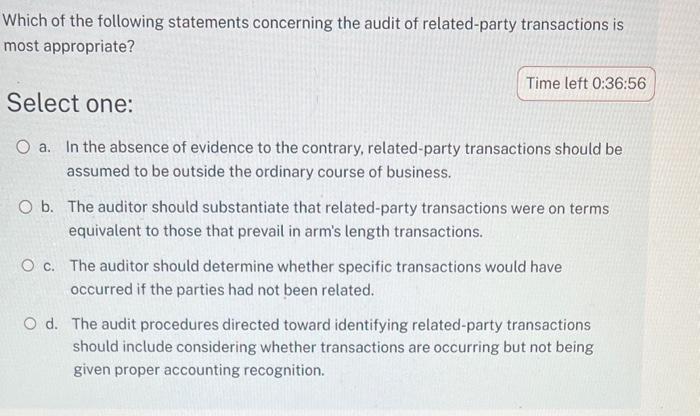

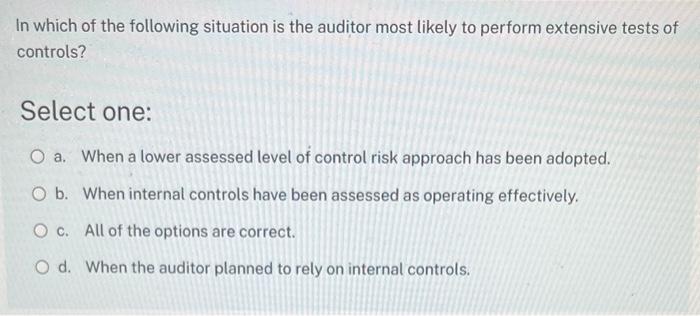

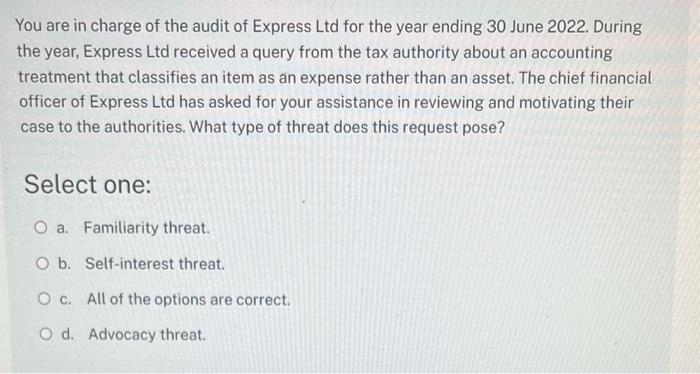

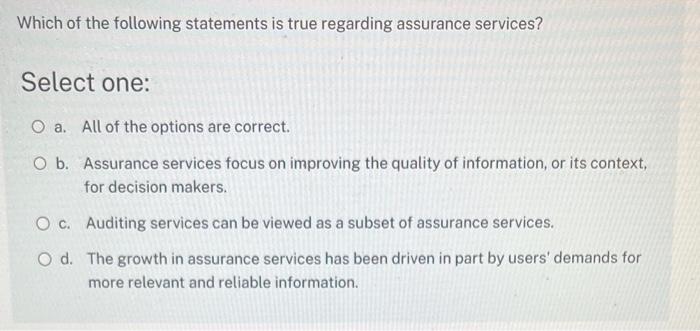

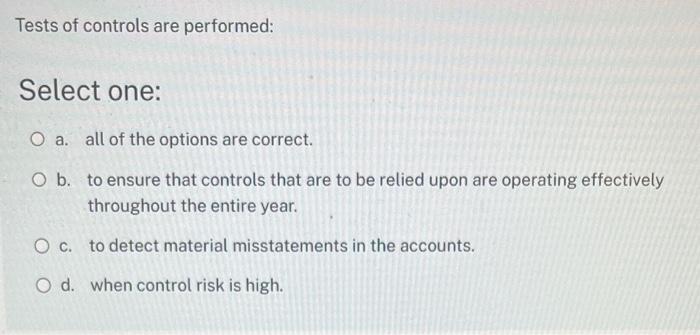

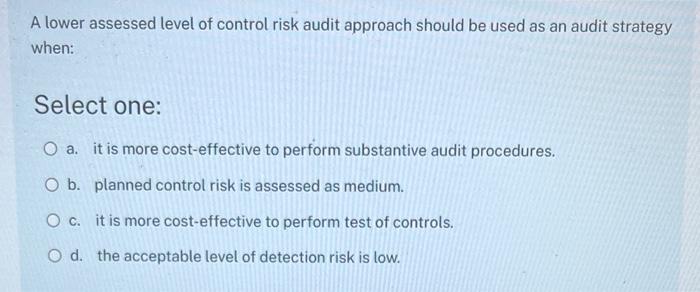

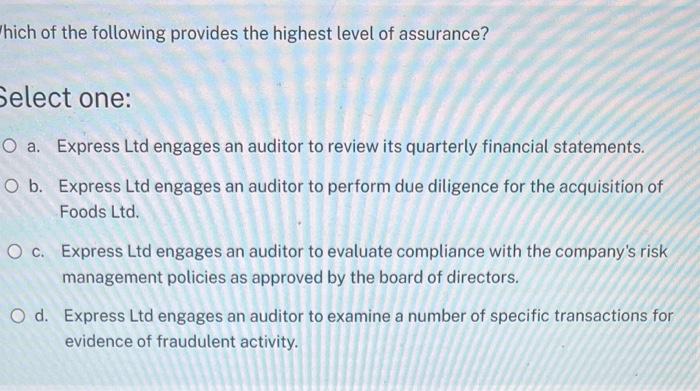

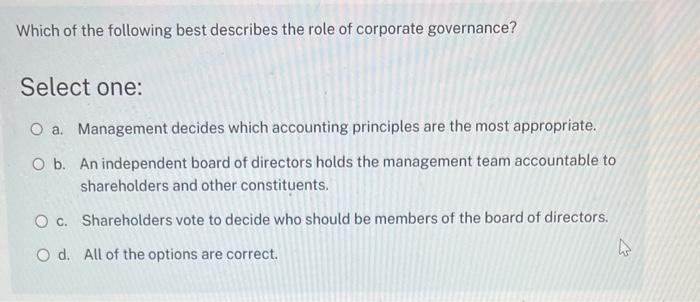

Which of the following best describes the reason why an independent auditor reports on financial statements? Select one: a. Different interests may exist between the company preparing the statements and the parties using the statements. b. A poorly designed internal control system may be in place and it may fail to prevent or detect misstatements. c. All of the options are incorrect. d. Material misstatements may exist in the financial statements and they are more likely to be detected by independent auditors. After obtaining an understanding of internal control and assessing control risk, an auditor decided not to perform additional tests of controls. The auditor most likely concluded that: Select one: a. the assessed level of inherent risk exceeded the assessed level of control risk. b. evidence obtainable through testing of controls would not support an increased assessment of control risk. c. internal control was properly designed and justifiably may be relied on. d. additional evidence to support a further reduction in control risk was not cost beneficial to obtain. The control environment component of internal controls includes: Select one: a. management's operating style. b. access to computer programs. c. segregation of duties. d. all of the options are correct. The control environment component of internal controls includes: Select one: a. management's operating style. b. access to computer programs. c. segregation of duties. d. all of the options are correct. Some account balances, such as those related to complex instruments and hedging, involve complicated calculations and significant judgement. The susceptibility to material misstatements in these types of accounts is defined as: Select one: a. inherent risk. b. business risk. c. control risk. d. detection risk. Your audit client is under intense pressure to meet an earnings target. Which transaction assertion for purchases is most at risk? Select one: a. Accuracy. b. Completeness. c. Occurrence. d. Cut-off. Which of the following non-audit services provided to an audit client would most likely result in a breach of independence? Select one: a. The auditor prepares an advertisement for the recruitment of the company's new financial controller. b. The auditor prepares the company's tax return. c. The auditor provides advice on the accounting implications of adopting international accounting standards. d. The auditor prepares a valuation of the company's intellectual property for inclusion in the financial report. Which of the following is the least persuasive evidence for auditing purpose? Select one: a. Schedules of detailed physical inventory counts conducted by the client. b. The confirmation letters sent to the auditor directly from the client's debtors. c. The audit working papers with inferences drawn by the auditor from analytical ratios and trends. d. Notation of experts' conclusions documented in the audit working papers. An auditor would violate the principle of objectivity if the auditor: Select one: a. accepted work that the auditor was not qualifed to undertake b. all of the options are correct. c. invested in shares of an audit client. d. knowingly misrepresented the facts in a report. Your audit client is a retailer that sells a large proportion of merchandise held on consignment from suppliers. Which account balance assertion for inventory would be most at risk? Select one: a. Rights and obligations. b. Existence. c. Valuation and allocation. d. Completeness. You are assigned to the audit of Express Ltd, a large retail company with stores across all major cities in Australia, for the year ending 30 June 2022. During the audit, you find that a large amount of inventory was transferred from Sydney to Canberra warehouse on the day of the stocktake. The inventory transferred has been recorded as inventory in both warehouses. What is the key assertion at risk for inventory? Select one: a. Valuation and allocation. b. Rights and obligations. c. Existence. d. Completeness. An acceptable level of detection risk at a low level suggests: Select one: a. the auditor should perform a substantial amount of substantive testing as the risk of material misstatement is high. b. a combination of test of controls and substantive testing should be performed. c. the assessment of inherent and control risk were both low. d. the auditor can perform reduced level of substantive testing as the risk of material misstatement is low. Which of the following regarding analytical procedures is correct? Select one: a. All of the options are correct. b. Analytical procedures can be used as an overall review of the financial information at the end of the audit. c. Analytical procedures can be used to assist the auditor when planning the use of other procedures. d. Analytical procedures can be used as a substantive test to obtain evidence about an assertion. You are assigned to the audit of Express Ltd, a large retail company, for the year ending 30 June 2022. During the audit, you noted an unusually high level of sales return due to damages in a batch of electronic goods. What is the key assertion at risk for inventory? Select one: a. Completeness. b. Rights and obligations. c. Valuation and allocation. d. Existence. Which of the following factors would not have an effect on inherent risk? Select one: a. The company operates in a fast-changing high tech industry. b. All of the options are correct. c. Management is remunerated based on company profits. d. The financial accountant is in charge of both cash disbursement and record keeping functions. ASIC found that, for 18 percent of the key audit areas reviewed, auditors did not obtain sufficient appropriate audit evidence, exercise sufficient professional skepticism, or otherwise comply with auditing standards in at least one significant audit area. Which element of the audit expectation gap does this result relates to? Select one: a. Deficient standards. b. All of the options are correct. c. Unreasonable expectations. d. Deficient performance. When conducting the audit of Express Ltd, you have substantial doubt about the ability of Express Ltd to continue as a going concern for a reasonable period of time. In evaluating Express Ltd's plans for dealing with adverse effects of future conditions and events, which of the following can be considered as a mitigating factor? Select one: a. Accelerate research and development projects related to future products. b. Enhance the quality of existing product lines by investing in new manufacturing technology. c. Negotiate reduction in interest rates on outstanding debt. d. All of the options are correct. Which of the following statements concerning the audit of related-party transactions is most appropriate? Select one: a. In the absence of evidence to the contrary, related-party transactions should be assumed to be outside the ordinary course of business. b. The auditor should substantiate that related-party transactions were on terms equivalent to those that prevail in arm's length transactions. c. The auditor should determine whether specific transactions would have occurred if the parties had not been related. d. The audit procedures directed toward identifying related-party transactions should include considering whether transactions are occurring but not being given proper accounting recognition. In which of the following situation is the auditor most likely to perform extensive tests of controls? Select one: a. When a lower assessed level of control risk approach has been adopted. b. When internal controls have been assessed as operating effectively. c. All of the options are correct. d. When the auditor planned to rely on internal controls. You are in charge of the audit of Express Ltd for the year ending 30 June 2022. During the year, Express Ltd received a query from the tax authority about an accounting treatment that classifies an item as an expense rather than an asset. The chief financial officer of Express Ltd has asked for your assistance in reviewing and motivating their case to the authorities. What type of threat does this request pose? Select one: a. Familiarity threat. b. Self-interest threat. c. All of the options are correct. d. Advocacy threat. Which of the following statements is true regarding assurance services? Select one: a. All of the options are correct. b. Assurance services focus on improving the quality of information, or its context, for decision makers. c. Auditing services can be viewed as a subset of assurance services. d. The growth in assurance services has been driven in part by users' demands for more relevant and reliable information. Tests of controls are performed: Select one: a. all of the options are correct. b. to ensure that controls that are to be relied upon are operating effectively throughout the entire year. c. to detect material misstatements in the accounts. d. when control risk is high. A lower assessed level of control risk audit approach should be used as an audit strategy when: Select one: a. it is more cost-effective to perform substantive audit procedures. b. planned control risk is assessed as medium. c. it is more cost-effective to perform test of controls. d. the acceptable level of detection risk is low. The level of materiality that the auditor determines: Select one: a. should be based on either net profit or total assets. b. is dependent on the auditor's judgment. c. all of the options are correct. d. is lower if audit risk is low. Which of the following would increase control risk? Select one: a. The company adopts a performance-based compensation scheme to improve sales performance. b. All of the options are correct. c. The company switches to a new information technology system to enhance reporting efficiency. d. To improve speed of processing, the company ceases approval of invoices prior to payment. When examining the client's internal control activities, you note that the purchase orders are approved by the purchasing manager before they are issued to the suppliers. What key assertion for purchases of inventory does this internal control address? Select one: a. Existence. b. Completeness. c. Occurrence. d. Accuracy. Which of the following situations represents an opportunity to commit fraud? Select one: a. All of the options are correct. b. The financial report includes highly subjective estimates. c. Management is dominated by a single person. d. Significant related-party transactions exist. hich of the following provides the highest level of assurance? Select one: a. Express Ltd engages an auditor to review its quarterly financial statements. b. Express Ltd engages an auditor to perform due diligence for the acquisition of Foods Ltd. c. Express Ltd engages an auditor to evaluate compliance with the company's risk management policies as approved by the board of directors. d. Express Ltd engages an auditor to examine a number of specific transactions for evidence of fraudulent activity. Which of the following best describes the role of corporate governance? Select one: a. Management decides which accounting principles are the most appropriate. b. An independent board of directors holds the management team accountable to shareholders and other constituents. c. Shareholders vote to decide who should be members of the board of directors. d. All of the options are correct

Which of the following best describes the reason why an independent auditor reports on financial statements? Select one: a. Different interests may exist between the company preparing the statements and the parties using the statements. b. A poorly designed internal control system may be in place and it may fail to prevent or detect misstatements. c. All of the options are incorrect. d. Material misstatements may exist in the financial statements and they are more likely to be detected by independent auditors. After obtaining an understanding of internal control and assessing control risk, an auditor decided not to perform additional tests of controls. The auditor most likely concluded that: Select one: a. the assessed level of inherent risk exceeded the assessed level of control risk. b. evidence obtainable through testing of controls would not support an increased assessment of control risk. c. internal control was properly designed and justifiably may be relied on. d. additional evidence to support a further reduction in control risk was not cost beneficial to obtain. The control environment component of internal controls includes: Select one: a. management's operating style. b. access to computer programs. c. segregation of duties. d. all of the options are correct. The control environment component of internal controls includes: Select one: a. management's operating style. b. access to computer programs. c. segregation of duties. d. all of the options are correct. Some account balances, such as those related to complex instruments and hedging, involve complicated calculations and significant judgement. The susceptibility to material misstatements in these types of accounts is defined as: Select one: a. inherent risk. b. business risk. c. control risk. d. detection risk. Your audit client is under intense pressure to meet an earnings target. Which transaction assertion for purchases is most at risk? Select one: a. Accuracy. b. Completeness. c. Occurrence. d. Cut-off. Which of the following non-audit services provided to an audit client would most likely result in a breach of independence? Select one: a. The auditor prepares an advertisement for the recruitment of the company's new financial controller. b. The auditor prepares the company's tax return. c. The auditor provides advice on the accounting implications of adopting international accounting standards. d. The auditor prepares a valuation of the company's intellectual property for inclusion in the financial report. Which of the following is the least persuasive evidence for auditing purpose? Select one: a. Schedules of detailed physical inventory counts conducted by the client. b. The confirmation letters sent to the auditor directly from the client's debtors. c. The audit working papers with inferences drawn by the auditor from analytical ratios and trends. d. Notation of experts' conclusions documented in the audit working papers. An auditor would violate the principle of objectivity if the auditor: Select one: a. accepted work that the auditor was not qualifed to undertake b. all of the options are correct. c. invested in shares of an audit client. d. knowingly misrepresented the facts in a report. Your audit client is a retailer that sells a large proportion of merchandise held on consignment from suppliers. Which account balance assertion for inventory would be most at risk? Select one: a. Rights and obligations. b. Existence. c. Valuation and allocation. d. Completeness. You are assigned to the audit of Express Ltd, a large retail company with stores across all major cities in Australia, for the year ending 30 June 2022. During the audit, you find that a large amount of inventory was transferred from Sydney to Canberra warehouse on the day of the stocktake. The inventory transferred has been recorded as inventory in both warehouses. What is the key assertion at risk for inventory? Select one: a. Valuation and allocation. b. Rights and obligations. c. Existence. d. Completeness. An acceptable level of detection risk at a low level suggests: Select one: a. the auditor should perform a substantial amount of substantive testing as the risk of material misstatement is high. b. a combination of test of controls and substantive testing should be performed. c. the assessment of inherent and control risk were both low. d. the auditor can perform reduced level of substantive testing as the risk of material misstatement is low. Which of the following regarding analytical procedures is correct? Select one: a. All of the options are correct. b. Analytical procedures can be used as an overall review of the financial information at the end of the audit. c. Analytical procedures can be used to assist the auditor when planning the use of other procedures. d. Analytical procedures can be used as a substantive test to obtain evidence about an assertion. You are assigned to the audit of Express Ltd, a large retail company, for the year ending 30 June 2022. During the audit, you noted an unusually high level of sales return due to damages in a batch of electronic goods. What is the key assertion at risk for inventory? Select one: a. Completeness. b. Rights and obligations. c. Valuation and allocation. d. Existence. Which of the following factors would not have an effect on inherent risk? Select one: a. The company operates in a fast-changing high tech industry. b. All of the options are correct. c. Management is remunerated based on company profits. d. The financial accountant is in charge of both cash disbursement and record keeping functions. ASIC found that, for 18 percent of the key audit areas reviewed, auditors did not obtain sufficient appropriate audit evidence, exercise sufficient professional skepticism, or otherwise comply with auditing standards in at least one significant audit area. Which element of the audit expectation gap does this result relates to? Select one: a. Deficient standards. b. All of the options are correct. c. Unreasonable expectations. d. Deficient performance. When conducting the audit of Express Ltd, you have substantial doubt about the ability of Express Ltd to continue as a going concern for a reasonable period of time. In evaluating Express Ltd's plans for dealing with adverse effects of future conditions and events, which of the following can be considered as a mitigating factor? Select one: a. Accelerate research and development projects related to future products. b. Enhance the quality of existing product lines by investing in new manufacturing technology. c. Negotiate reduction in interest rates on outstanding debt. d. All of the options are correct. Which of the following statements concerning the audit of related-party transactions is most appropriate? Select one: a. In the absence of evidence to the contrary, related-party transactions should be assumed to be outside the ordinary course of business. b. The auditor should substantiate that related-party transactions were on terms equivalent to those that prevail in arm's length transactions. c. The auditor should determine whether specific transactions would have occurred if the parties had not been related. d. The audit procedures directed toward identifying related-party transactions should include considering whether transactions are occurring but not being given proper accounting recognition. In which of the following situation is the auditor most likely to perform extensive tests of controls? Select one: a. When a lower assessed level of control risk approach has been adopted. b. When internal controls have been assessed as operating effectively. c. All of the options are correct. d. When the auditor planned to rely on internal controls. You are in charge of the audit of Express Ltd for the year ending 30 June 2022. During the year, Express Ltd received a query from the tax authority about an accounting treatment that classifies an item as an expense rather than an asset. The chief financial officer of Express Ltd has asked for your assistance in reviewing and motivating their case to the authorities. What type of threat does this request pose? Select one: a. Familiarity threat. b. Self-interest threat. c. All of the options are correct. d. Advocacy threat. Which of the following statements is true regarding assurance services? Select one: a. All of the options are correct. b. Assurance services focus on improving the quality of information, or its context, for decision makers. c. Auditing services can be viewed as a subset of assurance services. d. The growth in assurance services has been driven in part by users' demands for more relevant and reliable information. Tests of controls are performed: Select one: a. all of the options are correct. b. to ensure that controls that are to be relied upon are operating effectively throughout the entire year. c. to detect material misstatements in the accounts. d. when control risk is high. A lower assessed level of control risk audit approach should be used as an audit strategy when: Select one: a. it is more cost-effective to perform substantive audit procedures. b. planned control risk is assessed as medium. c. it is more cost-effective to perform test of controls. d. the acceptable level of detection risk is low. The level of materiality that the auditor determines: Select one: a. should be based on either net profit or total assets. b. is dependent on the auditor's judgment. c. all of the options are correct. d. is lower if audit risk is low. Which of the following would increase control risk? Select one: a. The company adopts a performance-based compensation scheme to improve sales performance. b. All of the options are correct. c. The company switches to a new information technology system to enhance reporting efficiency. d. To improve speed of processing, the company ceases approval of invoices prior to payment. When examining the client's internal control activities, you note that the purchase orders are approved by the purchasing manager before they are issued to the suppliers. What key assertion for purchases of inventory does this internal control address? Select one: a. Existence. b. Completeness. c. Occurrence. d. Accuracy. Which of the following situations represents an opportunity to commit fraud? Select one: a. All of the options are correct. b. The financial report includes highly subjective estimates. c. Management is dominated by a single person. d. Significant related-party transactions exist. hich of the following provides the highest level of assurance? Select one: a. Express Ltd engages an auditor to review its quarterly financial statements. b. Express Ltd engages an auditor to perform due diligence for the acquisition of Foods Ltd. c. Express Ltd engages an auditor to evaluate compliance with the company's risk management policies as approved by the board of directors. d. Express Ltd engages an auditor to examine a number of specific transactions for evidence of fraudulent activity. Which of the following best describes the role of corporate governance? Select one: a. Management decides which accounting principles are the most appropriate. b. An independent board of directors holds the management team accountable to shareholders and other constituents. c. Shareholders vote to decide who should be members of the board of directors. d. All of the options are correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started