Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Find TESLAs latest financial report (either 10-Q or 10-K) and: a) compare earnings (Net Income) vs. FCF for the latest period. From the investors perspective

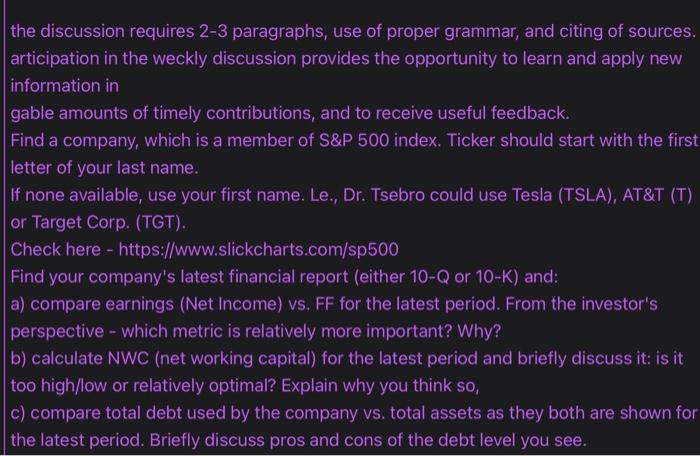

Find TESLAs latest financial report (either 10-Q or 10-K) and: a) compare earnings (Net Income) vs. FCF for the latest period. From the investors perspective which metric is relatively more important? Why?

b) calculate NWC (net working capital) for the latest period and briefly discuss it: is it too high/low or relatively optimal? Explain why you think so.

c) compare total debt used by the company vs. total assets as they both are shown for the latest period. Briefly discuss pros and cons of the debt level you see.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started