Find the answer for (c)

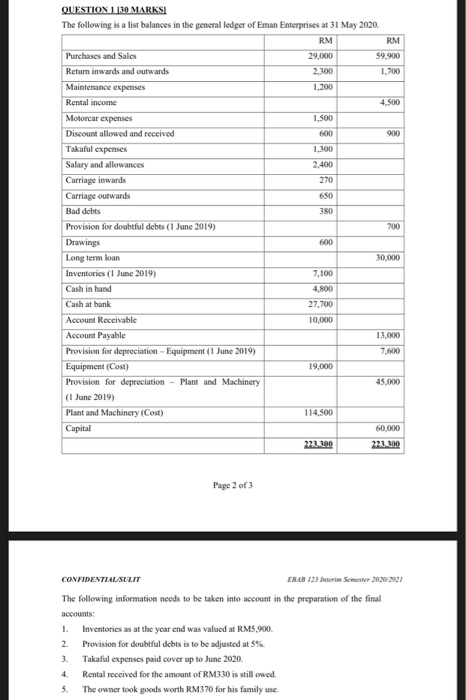

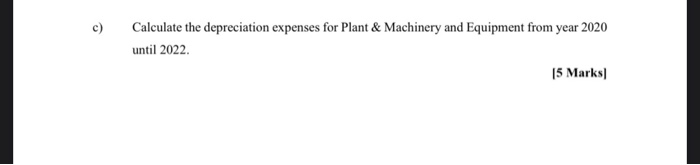

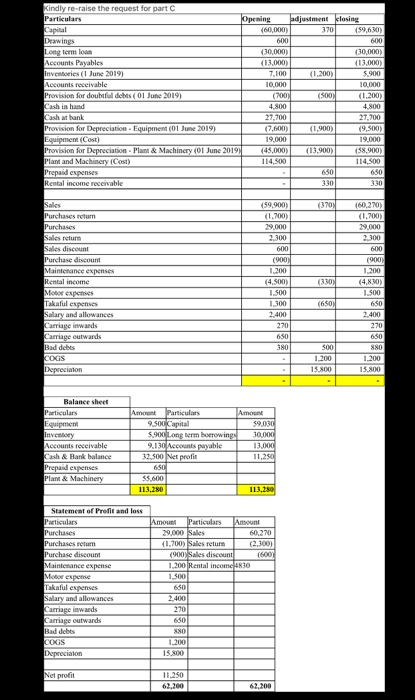

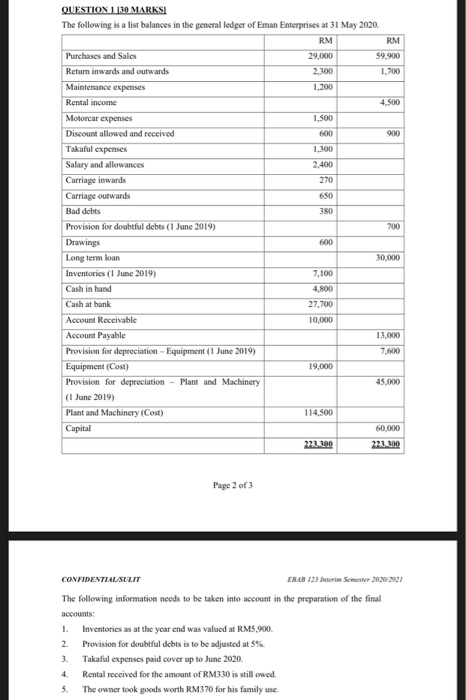

QUESTION 1 [30 MARKSI The following is a list balances in the general ledger of Eman Enterprises at 31 May 2020. RM RM Purchases and Sales 29,000 59.900 Retum inwards and outwards 2.300 1.700 Maintenance expenses 1,200 Rental income 4.500 Motorcar expenses 1.500 Discount allowed and received 600 900 Takaful expenses 1,300 Salary and allowances 2,400 Carriage inwards 270 Carriage outwards 650 Bad debts 380 Provision for doubtful debts (1 June 2019) 700 Drawings 600 Long term loan 30,000 Inventories (1 June 2019) 7,100 Cash in hand 4,800 Cash at bank 27,700 Account Receivable 10,000 Account Payable 13,000 Provision for depreciation - Equipment (1 June 2019) 7,600 Equipment (Cost) 19,000 Provision for depreciation Plant and Machinery 45,000 (1 June 2019) Plant and Machinery (Cost) 114,500 Capital 60,000 223.100 223 300 Page 2 of 3 CONFIDENTIAL SULIT EBAB 123serin Semester 2020 2021 The following information needs to be taken into account in the preparation of the final accounts: 1. Inventories as at the year end was valued at RM5,900. Provision for doubtful debts is to be adjusted at 5% 3. Takaful expenses paid cover up to June 2020. 4 Rental received for the amount of RM330 is still owed. 5. The owner took goods worth RM370 for his family use. 2. c) Calculate the depreciation expenses for Plant & Machinery and Equipment from year 2020 until 2022. 15 Marks Kindly re-raise the request for part C Particulars Opening adjustment closing (60,000) 370 (59.630) Drawings 600 600 Long term loan (30,000) (30,000) Accounts Payables (13,000) (13,000) Inventories (1 June 2019) 7.100 (1.2001 5.900 Accounts receivable 10,000 10,000 Provision for doubtfuldebts (01 June 2019) (700) (S00 (1.200) Cash in hand 4.800 4.800 Cash at bank 27.700 27,700 Provision for Depreciation Equipment (01 June 2019) (7.600) (1.900) (9.500) Equipment (Cost) 19.000 19.000 Provision for Depreciation - Plant & Machinery (01 June 2019) (45,000) (13.900) (58.900) Plant and Machinery (Cost) 114.500 114.500 Prepaid expenses 650 Rental income receivable 330 330 680 (370) Sales Purchases return Purchases Sales return Sales discount Purchase discount Maintenance expenses Rental income More expenses Takaful expenses Salary and allowances Carriage inwards Carriage outwards Bad debes COGS Depreciation (59,900) (1.700) 19.000 2.300 600 (900) 1.300 (4.500) 1.500 1,300 2.400 270 650 380 (330) (60,270) (1.700) 29,000 2.300 600 (900 1.200 (4,830) 1.500 650 2.400 270 650 880 1.200 15.800 (650) 500 1.200 15.800 Balance sheet Particulars Equipment Inventory Accounts receivable Cash & Bank balance Prepaid expenses Plant & Machinery Amount Particulars Amount 9.500 Capital $9.030 5.900 Long term borrowings 30,000 9.130 Accounts payable 13.000 32.500 Net profit 11.250 650 55,600 113,280 113.280 Statement of Profit and loss Particulars Purchases Purchases retur Purchase discount Maintenance expense Takaful expenses Salary and allowances Carriage inwards Carriage outwards Bad debes COGS Depreciation Amount Particulars Amount 29,000 Sales 60,270 (1.700) Sales return (900) Sales discount (600 1.200 Rental income 4830 1.500 650 2.400 270 650 880 1.200 15.800 Net profit 11.250 62,200 QUESTION 1 [30 MARKSI The following is a list balances in the general ledger of Eman Enterprises at 31 May 2020. RM RM Purchases and Sales 29,000 59.900 Retum inwards and outwards 2.300 1.700 Maintenance expenses 1,200 Rental income 4.500 Motorcar expenses 1.500 Discount allowed and received 600 900 Takaful expenses 1,300 Salary and allowances 2,400 Carriage inwards 270 Carriage outwards 650 Bad debts 380 Provision for doubtful debts (1 June 2019) 700 Drawings 600 Long term loan 30,000 Inventories (1 June 2019) 7,100 Cash in hand 4,800 Cash at bank 27,700 Account Receivable 10,000 Account Payable 13,000 Provision for depreciation - Equipment (1 June 2019) 7,600 Equipment (Cost) 19,000 Provision for depreciation Plant and Machinery 45,000 (1 June 2019) Plant and Machinery (Cost) 114,500 Capital 60,000 223.100 223 300 Page 2 of 3 CONFIDENTIAL SULIT EBAB 123serin Semester 2020 2021 The following information needs to be taken into account in the preparation of the final accounts: 1. Inventories as at the year end was valued at RM5,900. Provision for doubtful debts is to be adjusted at 5% 3. Takaful expenses paid cover up to June 2020. 4 Rental received for the amount of RM330 is still owed. 5. The owner took goods worth RM370 for his family use. 2. c) Calculate the depreciation expenses for Plant & Machinery and Equipment from year 2020 until 2022. 15 Marks Kindly re-raise the request for part C Particulars Opening adjustment closing (60,000) 370 (59.630) Drawings 600 600 Long term loan (30,000) (30,000) Accounts Payables (13,000) (13,000) Inventories (1 June 2019) 7.100 (1.2001 5.900 Accounts receivable 10,000 10,000 Provision for doubtfuldebts (01 June 2019) (700) (S00 (1.200) Cash in hand 4.800 4.800 Cash at bank 27.700 27,700 Provision for Depreciation Equipment (01 June 2019) (7.600) (1.900) (9.500) Equipment (Cost) 19.000 19.000 Provision for Depreciation - Plant & Machinery (01 June 2019) (45,000) (13.900) (58.900) Plant and Machinery (Cost) 114.500 114.500 Prepaid expenses 650 Rental income receivable 330 330 680 (370) Sales Purchases return Purchases Sales return Sales discount Purchase discount Maintenance expenses Rental income More expenses Takaful expenses Salary and allowances Carriage inwards Carriage outwards Bad debes COGS Depreciation (59,900) (1.700) 19.000 2.300 600 (900) 1.300 (4.500) 1.500 1,300 2.400 270 650 380 (330) (60,270) (1.700) 29,000 2.300 600 (900 1.200 (4,830) 1.500 650 2.400 270 650 880 1.200 15.800 (650) 500 1.200 15.800 Balance sheet Particulars Equipment Inventory Accounts receivable Cash & Bank balance Prepaid expenses Plant & Machinery Amount Particulars Amount 9.500 Capital $9.030 5.900 Long term borrowings 30,000 9.130 Accounts payable 13.000 32.500 Net profit 11.250 650 55,600 113,280 113.280 Statement of Profit and loss Particulars Purchases Purchases retur Purchase discount Maintenance expense Takaful expenses Salary and allowances Carriage inwards Carriage outwards Bad debes COGS Depreciation Amount Particulars Amount 29,000 Sales 60,270 (1.700) Sales return (900) Sales discount (600 1.200 Rental income 4830 1.500 650 2.400 270 650 880 1.200 15.800 Net profit 11.250 62,200