Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Just the second part 2-b Low value lease TR18-2 Low-Value Leases: (LO 18-1) Argyle Ltd, signed a 48-month lease to rent a new computer for

Just the second part 2-b Low value lease

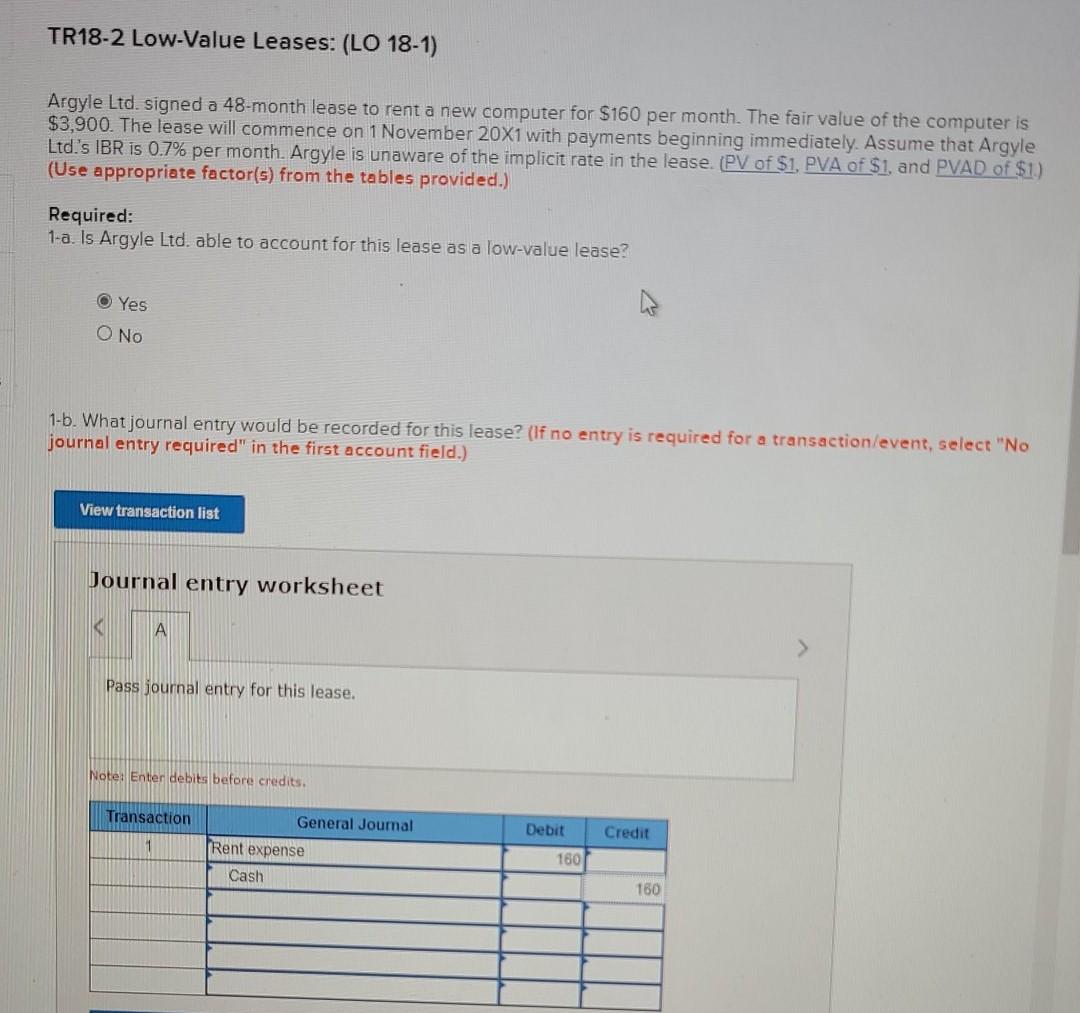

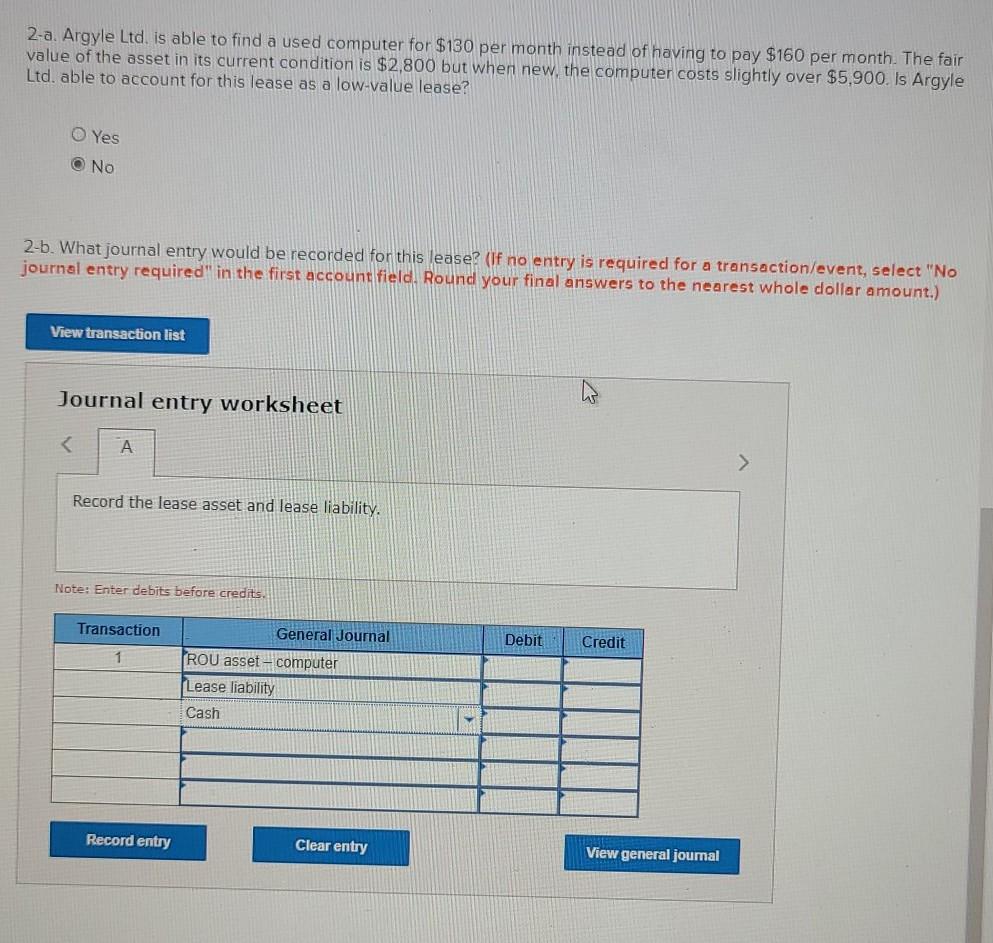

TR18-2 Low-Value Leases: (LO 18-1) Argyle Ltd, signed a 48-month lease to rent a new computer for $160 per month. The fair value of the computer is $3,900. The lease will commence on 1 November 20X1 with payments beginning immediately. Assume that Argyle Ltd's IBR is 0.7% per month. Argyle is unaware of the implicit rate in the lease. (PV of $1. PVA of $1, and PVAD of $1.) (Use appropriate factor(s) from the tables provided.) Required: 1-a. Is Argyle Ltd. able to account for this lease as a low-value lease? Yes O NO 1-b. What journal entry would be recorded for this lease? (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Pass journal entry for this lease. Note: Enter debits before credits Transaction General Journal Debit Credit 1 Rent expense 160 Cash 160 2-a. Argyle Ltd. is able to find a used computer for $130 per month instead of having to pay $160 per month. The fair value of the asset in its current condition is $2,800 but when new, the computer costs slightly over $5,900. Is Argyle Ltd. able to account for this lease as a low-value lease? O Yes No 2-b. What journal entry would be recorded for this lease? (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Round your final answers to the nearest whole dollar amount.) View transaction list Journal entry worksheet Record the lease asset and lease liability. Note: Enter debits before credits. Transaction Debit Credit General Journal ROU asset - computer Lease liability Cash Record entry Clear entry View general journal TR18-2 Low-Value Leases: (LO 18-1) Argyle Ltd, signed a 48-month lease to rent a new computer for $160 per month. The fair value of the computer is $3,900. The lease will commence on 1 November 20X1 with payments beginning immediately. Assume that Argyle Ltd's IBR is 0.7% per month. Argyle is unaware of the implicit rate in the lease. (PV of $1. PVA of $1, and PVAD of $1.) (Use appropriate factor(s) from the tables provided.) Required: 1-a. Is Argyle Ltd. able to account for this lease as a low-value lease? Yes O NO 1-b. What journal entry would be recorded for this lease? (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Pass journal entry for this lease. Note: Enter debits before credits Transaction General Journal Debit Credit 1 Rent expense 160 Cash 160 2-a. Argyle Ltd. is able to find a used computer for $130 per month instead of having to pay $160 per month. The fair value of the asset in its current condition is $2,800 but when new, the computer costs slightly over $5,900. Is Argyle Ltd. able to account for this lease as a low-value lease? O Yes No 2-b. What journal entry would be recorded for this lease? (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Round your final answers to the nearest whole dollar amount.) View transaction list Journal entry worksheet Record the lease asset and lease liability. Note: Enter debits before credits. Transaction Debit Credit General Journal ROU asset - computer Lease liability Cash Record entry Clear entry View general journalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started