Answered step by step

Verified Expert Solution

Question

1 Approved Answer

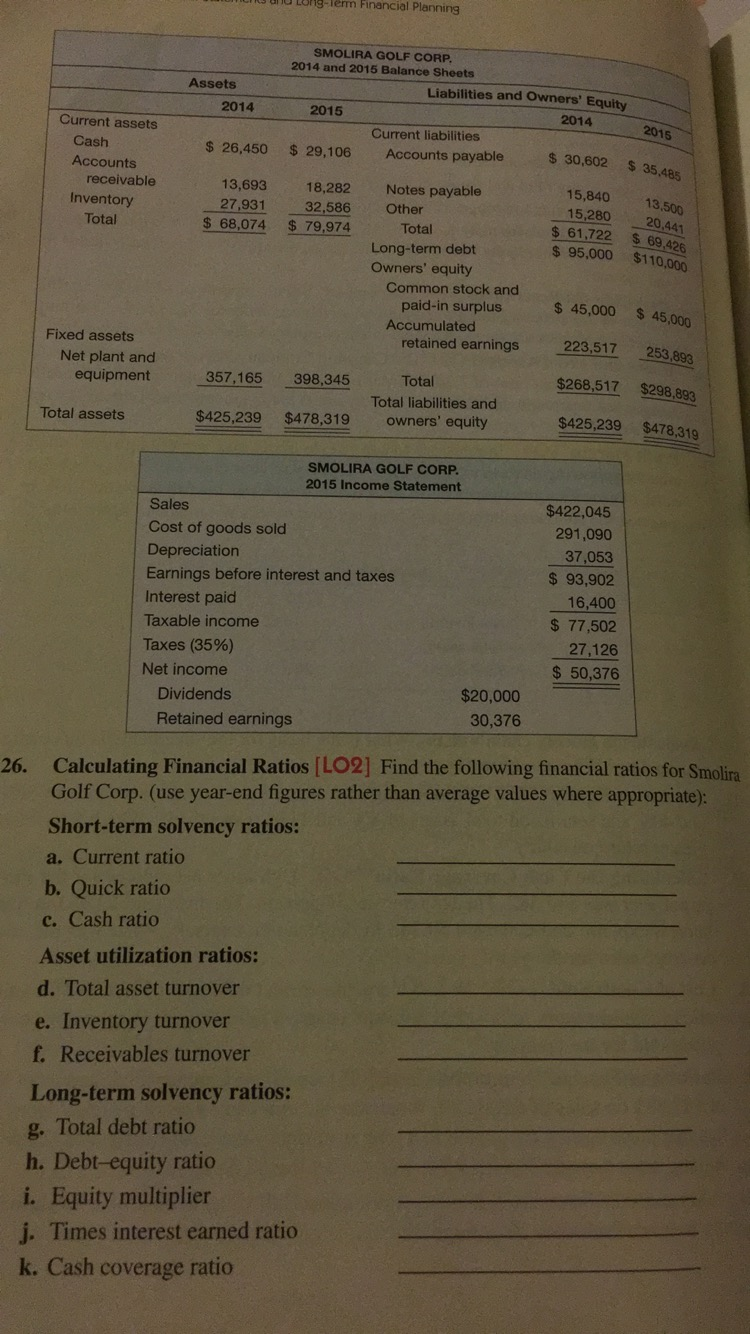

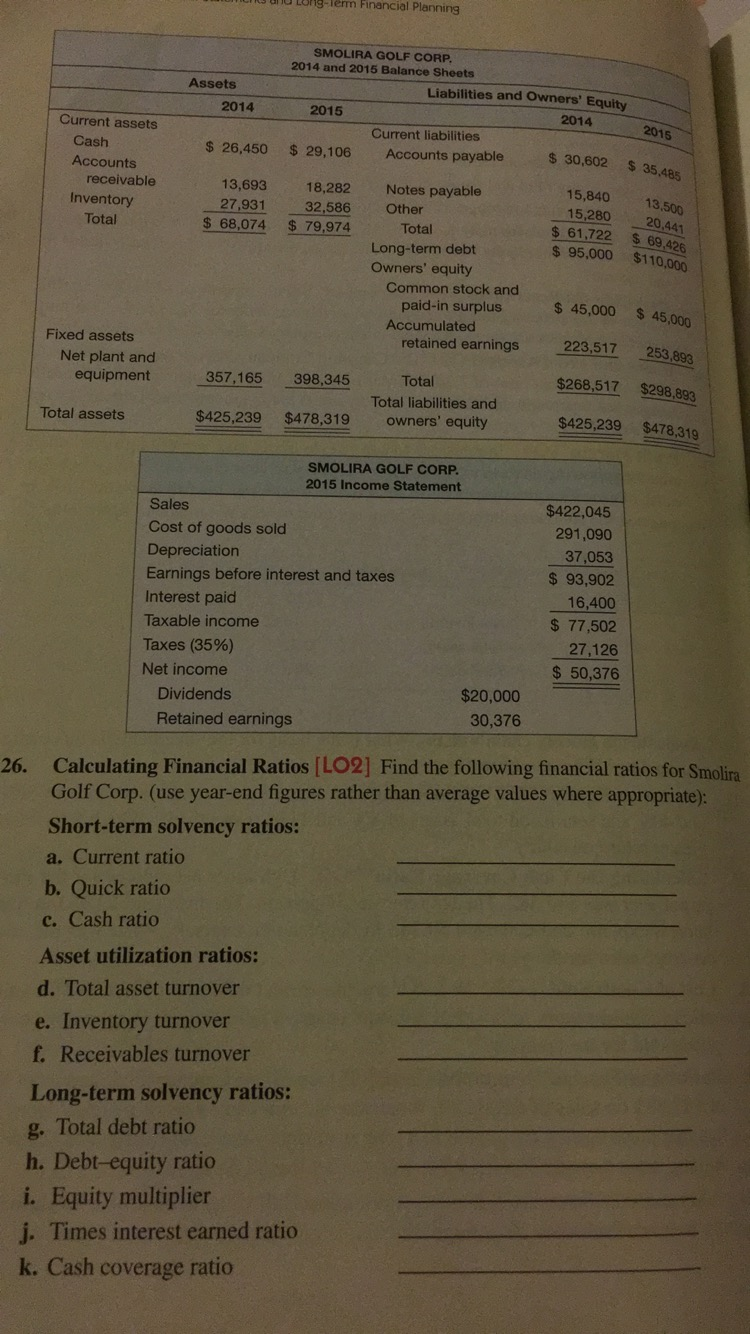

Find the following f inancial ratios for Smolira Golf Copr. (Use year-end figures rather than average values where appropriate) Current ratio, quick ratio, cash ratio,

Find the following f

Find the following f inancial ratios for Smolira Golf Copr. (Use year-end figures rather than average values where appropriate)

inancial ratios for Smolira Golf Copr. (Use year-end figures rather than average values where appropriate)

Current ratio, quick ratio, cash ratio, total asset turnover, inventory turnover, receivables turnover, total debt ratio, debt rquity ratio, equity multipler, times interest earned ratio, cash coverage ratio, profit margin, return on assets, return on equity

1g-Term Financial Planning SMOLIRA GOLF CORP 2014 and 2015 Balance Sheets Assets Liabilities and Owners' Equity 2014 2015 2014 Current assets Current liabilities Cash Accounts 26,450 29,106 Accounts payable 485 15,84013,500 15,280 61,722 $ 69 receivable 13,693 18,282 Notes payable 27,93132.586 Other Inventory Total $ 68,074 $ 79,974Total $95,000 $110,000 Long-term debt Owners' equity Common stock and 45,000 45,000 paid-in surplus retained earnings Total Accumulated 223517 253.893 $268,517 $298,893 $425,239 $478,319 Fixed assets 223,517 253,893 Net plant and equipment 357,165 398,345 Total liabilities and Total assets $425,239 $478,319 owners' equity SMOLIRA GOLF CORP 2015 Income Statement $422,045 Sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes (35%) Net income 291,090 37,053 93,902 16,400 77,502 27,126 $ 50,376 $20,000 30,376 Dividends Retained earnings Calculating Financial Ratios [LO2] Find the following financial ratios for Smolira Golf Corp. (use year-end figures rather than average values where appropriate Short-term solvency ratios: a. Current ratio b. Quick ratio c. Cash ratio Asset utilization ratios: d. Total asset turnover e. Inventory turnover f. Receivables turnover 26. Long-term solvency ratios: g. Total debt ratio h. Debt-equity ratio i. Equity multiplier j. Times interest earned ratio k. Cash coverage ratioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started