Answered step by step

Verified Expert Solution

Question

1 Approved Answer

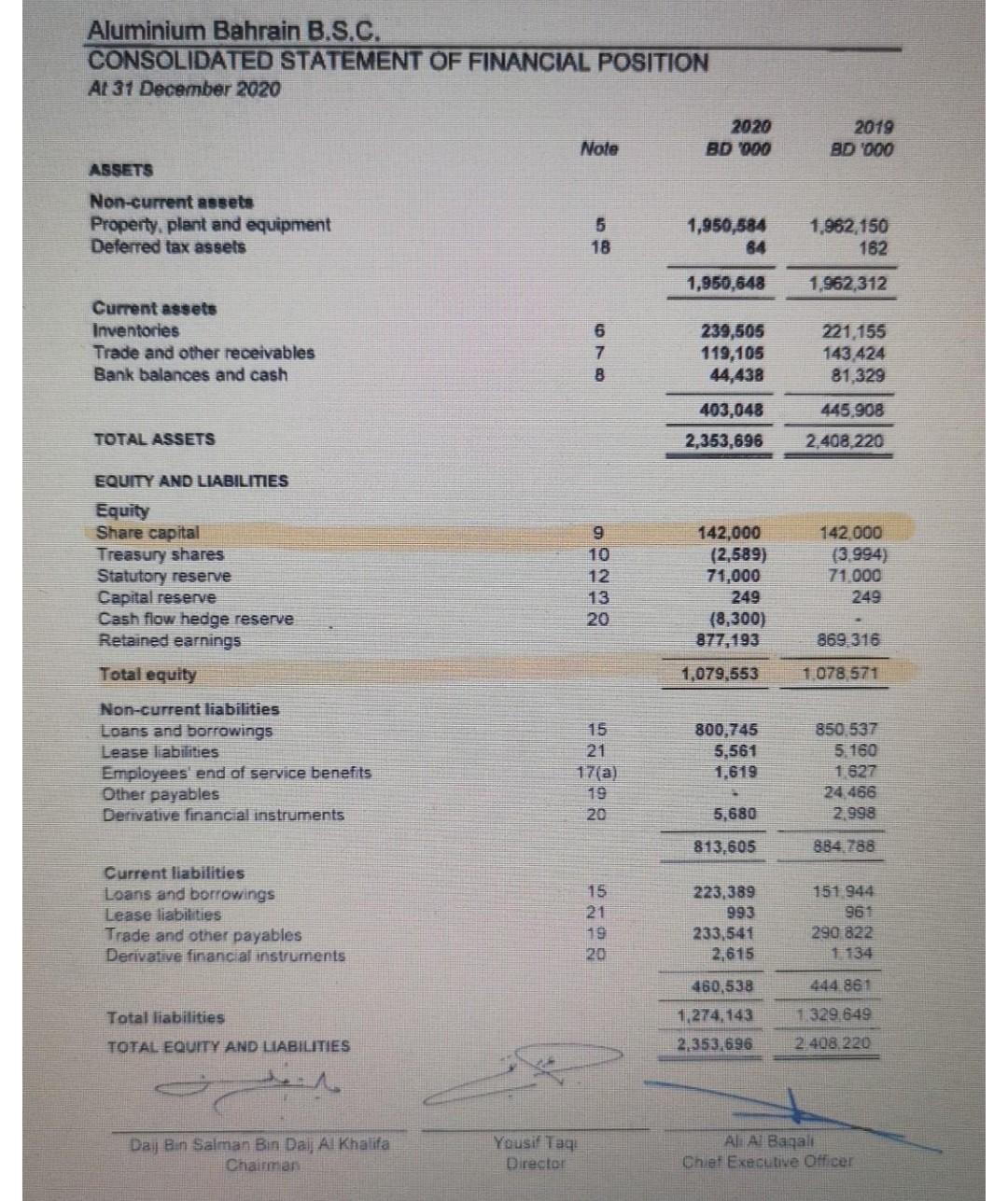

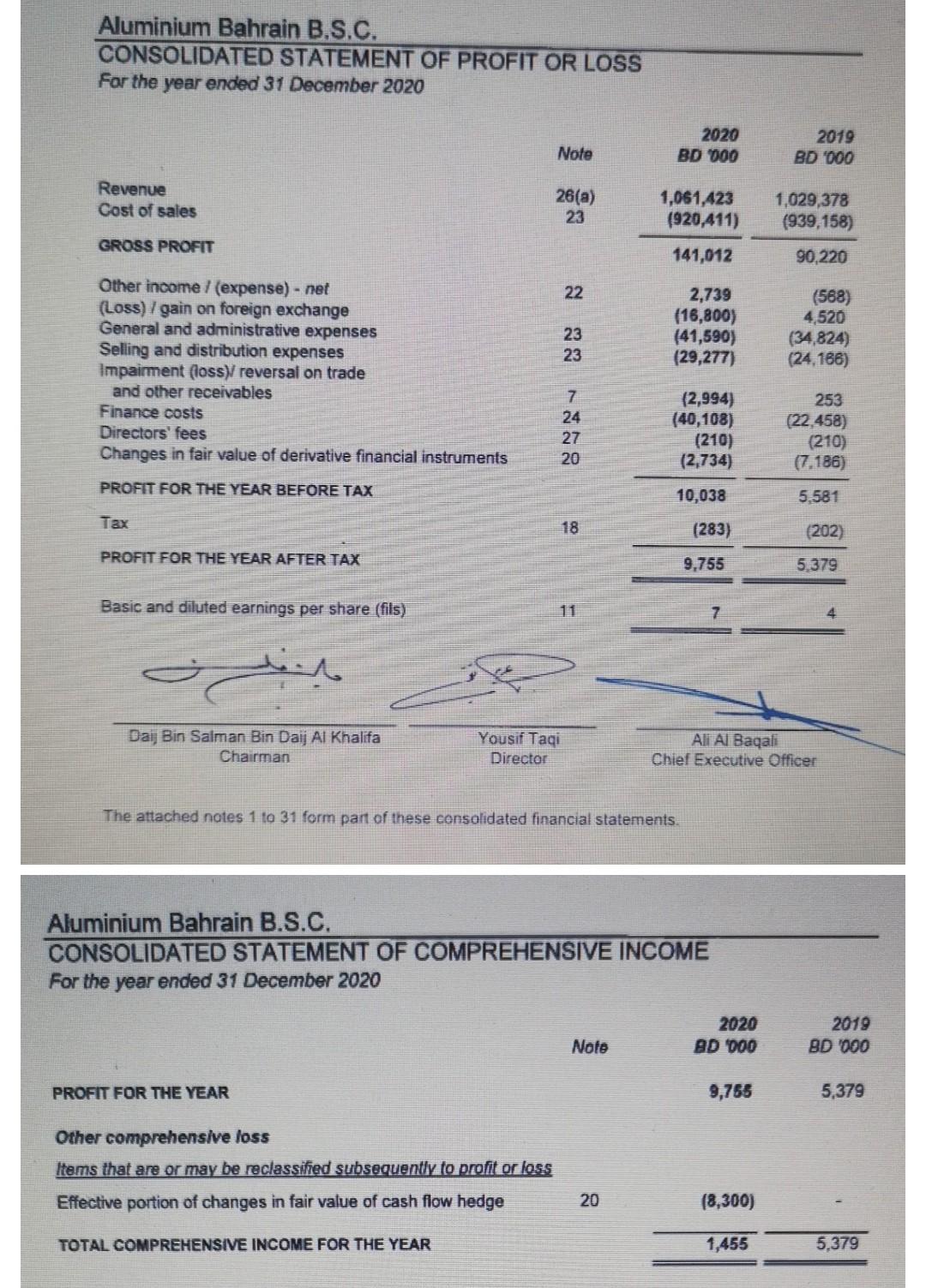

Find the following ratios for both years.. Year 2020 and 2019 Aluminium Bahrain B.S.C. CONSOLIDATED STATEMENT OF FINANCIAL POSITION At 31 December 2020 AESETS EQUIT

Find the following ratios for both years.. Year 2020 and 2019

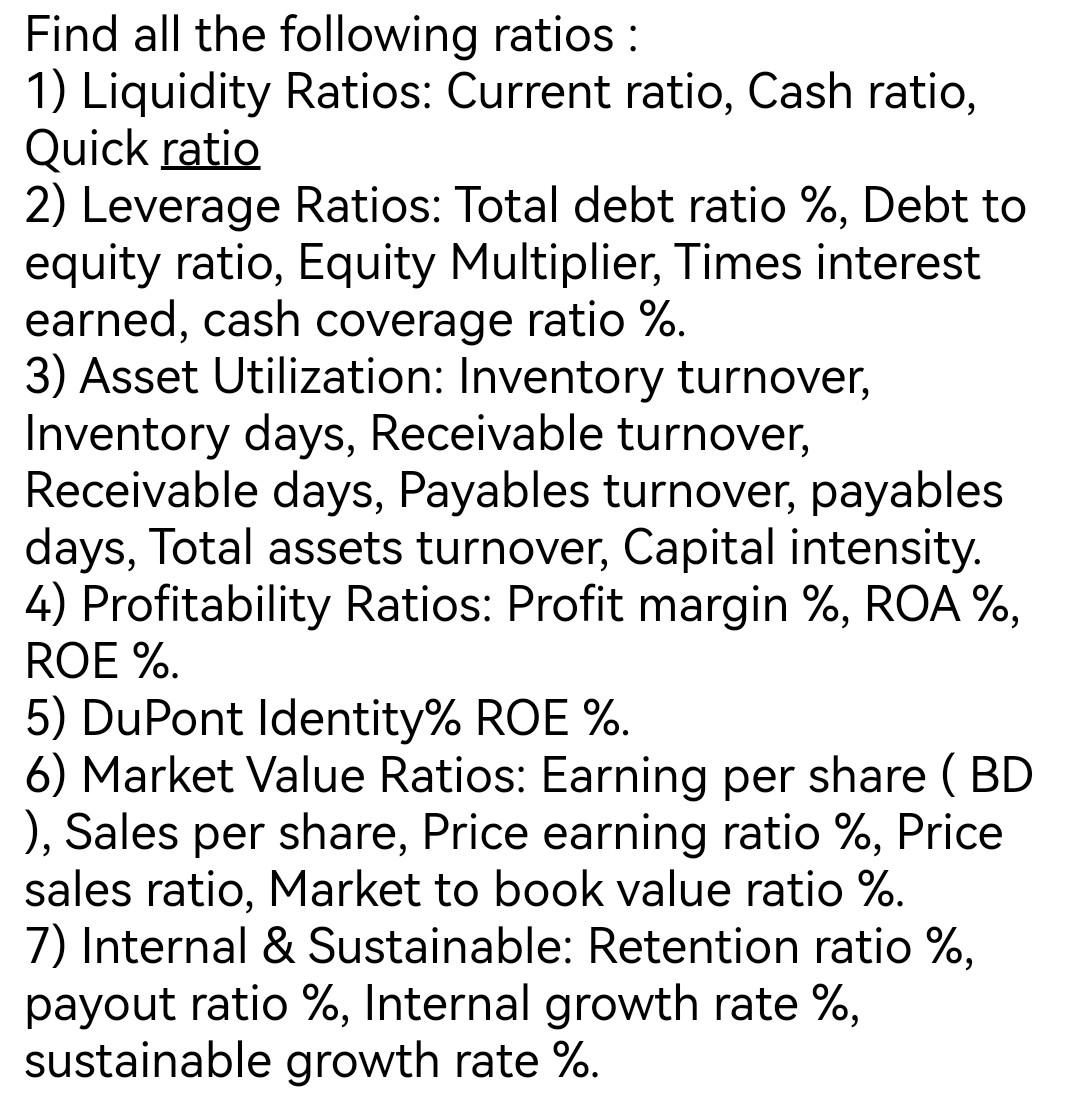

Aluminium Bahrain B.S.C. CONSOLIDATED STATEMENT OF FINANCIAL POSITION At 31 December 2020 AESETS EQUIT AND LIABILITIES Equity Share capital Treasury shares Statutory reserve Capital reserve Cash flow hedge reserve Retained earnings Total equity Non-current liabilities Loans and borrowings Lease liabilities Employees' end of service benef Other payables Derivative financial instruments Aluminium Bahrain B.S.C. CONSOLIDATED STATEMENT OF PROFIT OR LOSS For the year ended 31 December 2020 The attached notes 1 to 31 form part of these consolidated financial statements. Aluminium Bahrain B.S.C. CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME For the year ended 31 December 2020 Find all the following ratios: 1) Liquidity Ratios: Current ratio, Cash ratio, Quick ratio 2) Leverage Ratios: Total debt ratio \%, Debt to equity ratio, Equity Multiplier, Times interest earned, cash coverage ratio \%. 3) Asset Utilization: Inventory turnover, Inventory days, Receivable turnover, Receivable days, Payables turnover, payables days, Total assets turnover, Capital intensity. 4) Profitability Ratios: Profit margin \%, ROA \%, ROE \%. 5) DuPont Identity\% ROE \%. 6) Market Value Ratios: Earning per share ( BD ), Sales per share, Price earning ratio \%, Price sales ratio, Market to book value ratio %. 7) Internal \& Sustainable: Retention ratio \%, payout ratio \%, Internal growth rate \%, sustainable growth rate %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started