Answered step by step

Verified Expert Solution

Question

1 Approved Answer

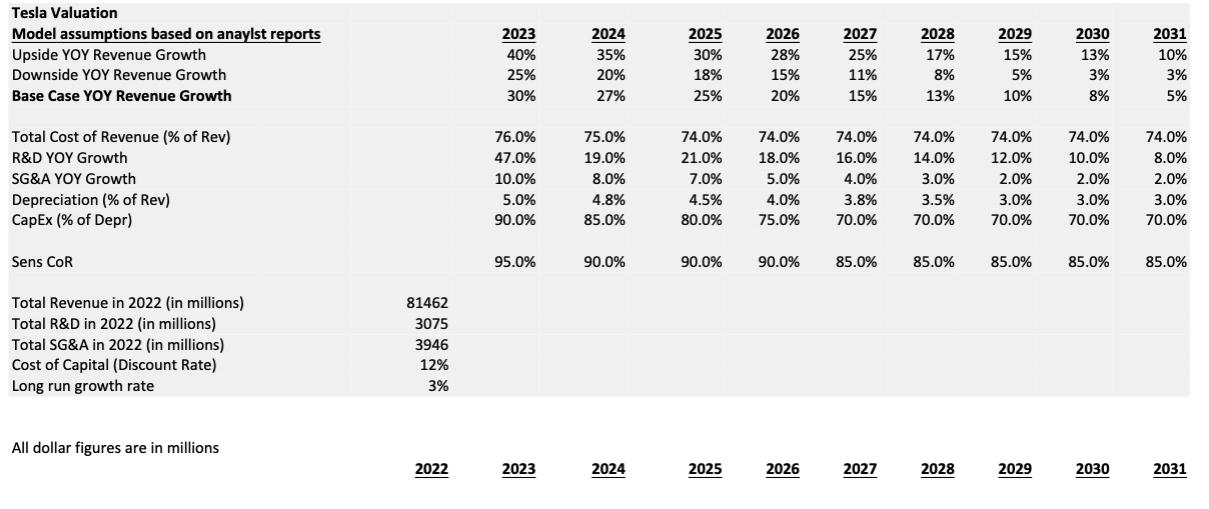

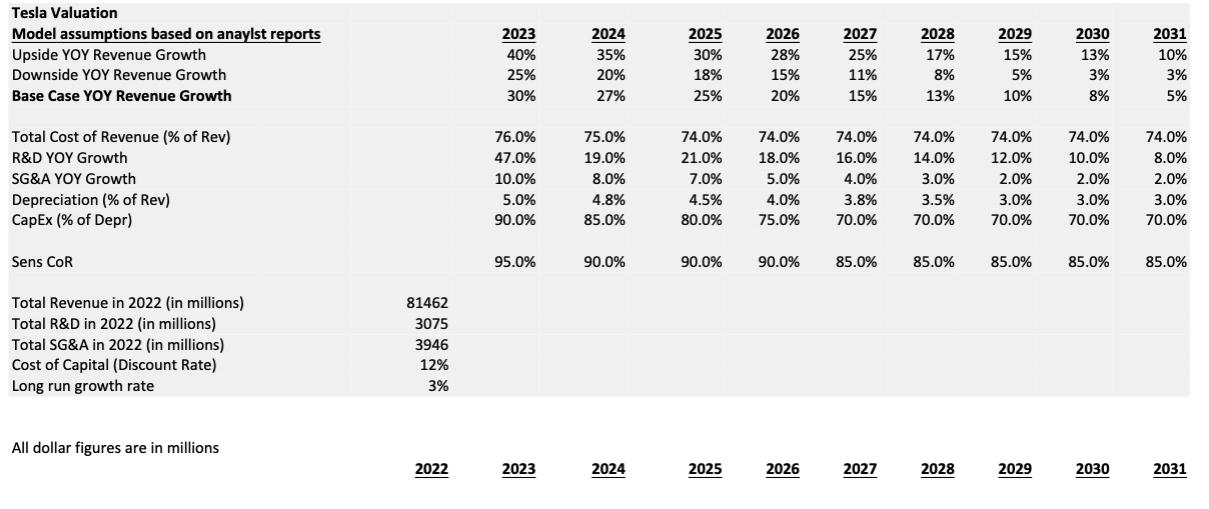

Find the free cash flow Tesla Valuation Model assumptions based on anaylst reports Upside YOY Revenue Growth Downside YOY Revenue Growth Base Case YOY Revenue

Find the free cash flow

Tesla Valuation Model assumptions based on anaylst reports Upside YOY Revenue Growth Downside YOY Revenue Growth Base Case YOY Revenue Growth Total Cost of Revenue (% of Rev) R&D YOY Growth SG&A YOY Growth Depreciation (% of Rev) CapEx (% of Depr) Sens CoR Total Revenue in 2022 (in millions) Total R&D in 2022 (in millions) Total SG&A in 2022 (in millions) Cost of Capital (Discount Rate) Long run growth rate All dollar figures are in millions 81462 3075 3946 12% 3% 2022 2023 40% 25% 30% 76.0% 47.0% 10.0% 5.0% 90.0% 95.0% 2023 2024 35% 20% 27% 75.0% 19.0% 8.0% 4.8% 85.0% 90.0% 2024 2025 30% 18% 25% 74.0% 21.0% 7.0% 4.5% 80.0% 90.0% 2025 2026 28% 15% 20% 74.0% 18.0% 5.0% 4.0% 75.0% 90.0% 2026 2027 25% 11% 15% 74.0% 16.0% 4.0% 3.8% 70.0% 85.0% 2027 2028 17% 8% 13% 74.0% 14.0% 3.0% 3.5% 70.0% 85.0% 2028 2029 15% 5% 10% 74.0% 12.0% 2.0% 3.0% 70.0% 85.0% 2029 2030 13% 3% 8% 74.0% 10.0% 2.0% 3.0% 70.0% 85.0% 2030 2031 10% 3% 5% 74.0% 8.0% 2.0% 3.0% 70.0% 85.0% 2031

Step by Step Solution

★★★★★

3.30 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Okay here are the steps to calculate the free cash flow 1 Calculate revenue based on bas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started