Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Find two current options in the real market that fit the descriptions in the first graph, (one American option and one European option), and write

Find two current options in the real market that fit the descriptions in the first graph, (one American option and one European option), and write the answer using the example format in the second graph.

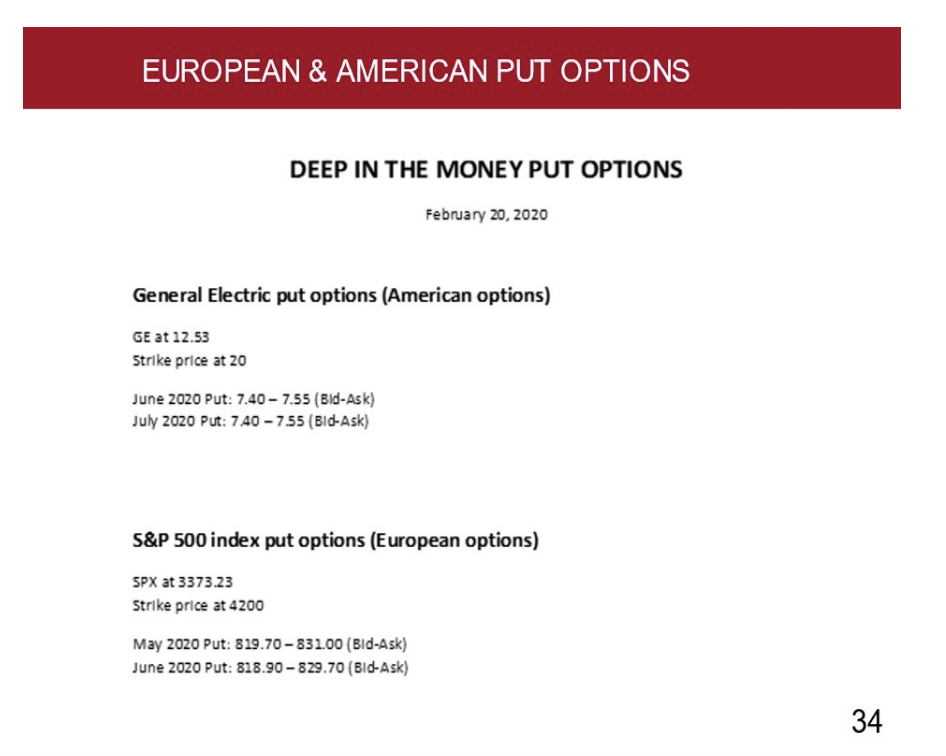

2. Some Deep in the Money (DITM) Puts have distinct characteristics. European style Puts ; Longer Maturity puts may be traded at lower prices than Shorter maturity American style Puts ; Longer Maturity puts may be trade at exactly the same price as shorter maturity ones. Find Current put options (European and American) that fit the above description. Provide Information as shown Below. EUROPEAN \& AMERICAN PUT OPTIONS DEEP IN THE MONEY PUT OPTIONS February 20, 2020 General Electric put options (American options) GE at 12.53 Strike price at 20 June 2020 Put: 7.407.55 (BId-Ask) July 2020 Put: 7.407.55 (Bld-Ask) S\&P 500 index put options (European options) SPX at 3373.23 Strike price at 4200 May 2020 Put: 819.70831.00 (BId-Ask) June 2020 Put: 818.90829.70 (BId-Ask) 34

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started