Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question : Troy Industries purchased a new machine year(s) ago for 84,000 . It is being depreciated under MACRS with a 5-year recovery period using

question : Troy Industries purchased a new machine year(s) ago for 84,000 . It is being depreciated under MACRS with a 5-year recovery period using the schedule LOADING.... Assume 40% ordinary and capital gains tax rates.

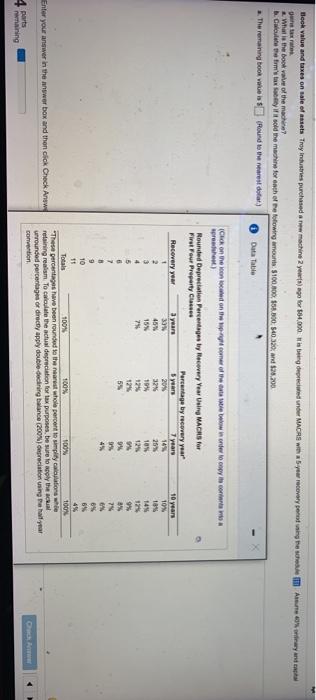

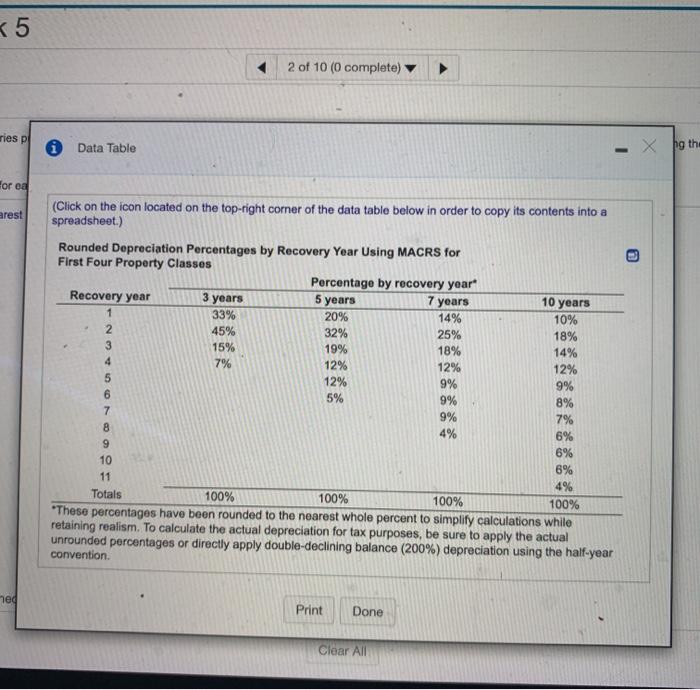

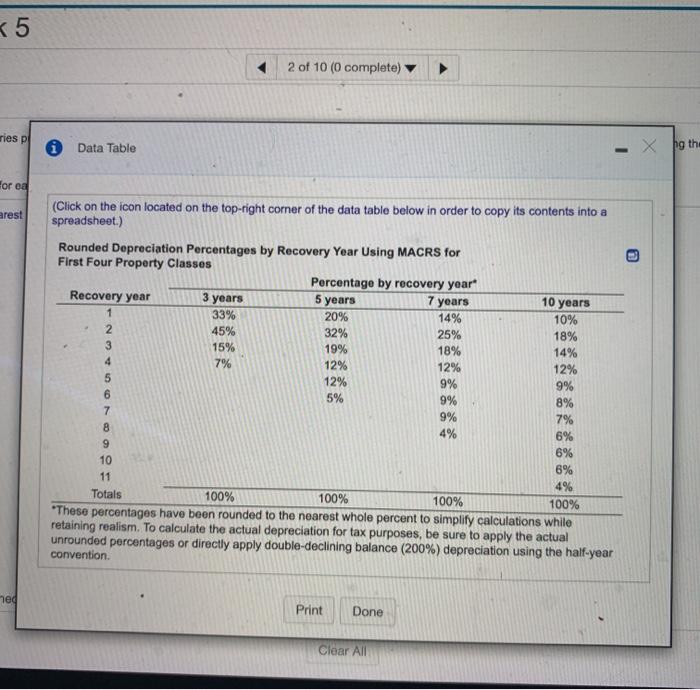

Data tek value and taxes on sale of assets Troy Industries purchased a new machine 2 years ago for $4,000 ang deprecated under MACAS with your recevery persone che crew and What is the book value of the machine C est to cry sold to maine for each of the following amount 100,000,000.000,00 320, and $28.200 The remaining booklis Round to the nearest dolar) Data Table TON Click on the one on the comer of the state blow in one copy its content wprow) Rounded Depreciation Percentages by covery Yearsing MACRS for First Four Property Classe Percentage by recovery year Recovery year years 7 years 10 years 20% 18 45% 32% 28% 18% 15% 19% 10% 14% 7 12% 12 124 9% 55 9% % % 7 B 45 6 9 6% 10 65 11 4% Totals 100 100% 100% 100 These percentages have been founded to the nearest whole percento simplity calculations whe retaining reaam To calculate the actual depreciation for tax purposes, be sure to apply the urrounded percentages or directly apply double-clining balance (2005) Opreciation using a year contion Enter your answer in the answer box and then click Check Answ parts waining a. What is the book value of the machine?

b. Calculate the firm's tax liability if it sold the machine for each of the following amounts: $100,800; $58800; $40,320; and $28,200 .

Data Table

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started