find WACC according to the template

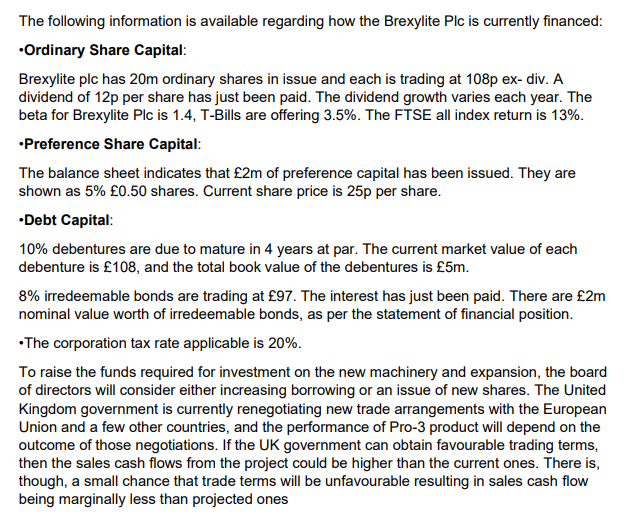

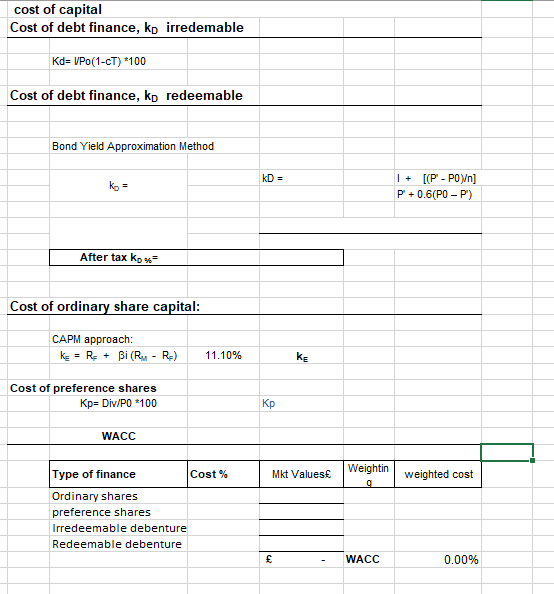

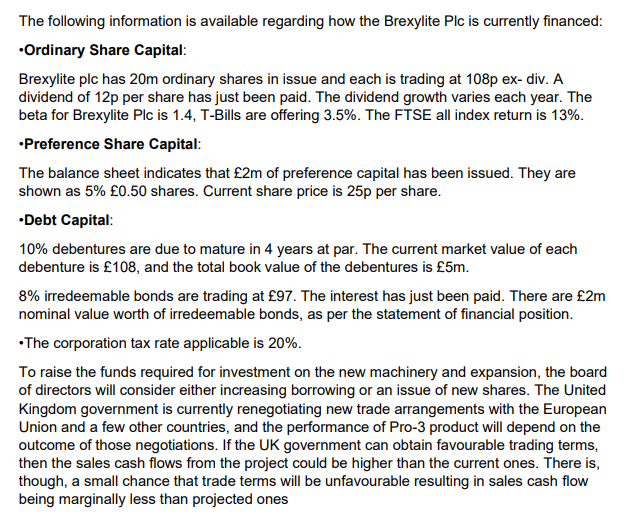

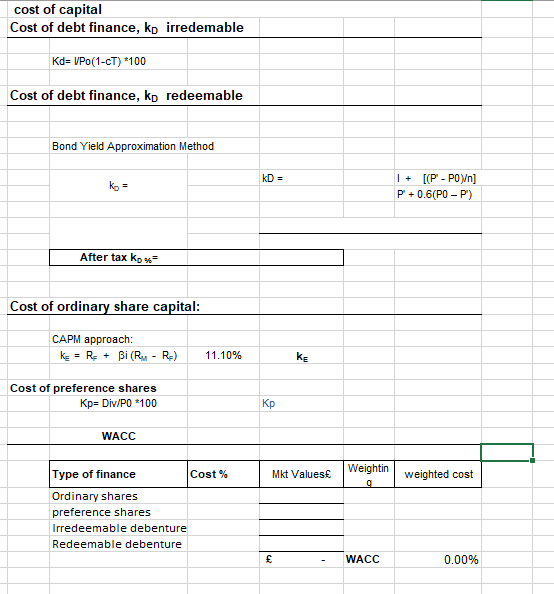

The following information is available regarding how the Brexylite Plc is currently financed: Ordinary Share Capital: Brexylite plc has 20m ordinary shares in issue and each is trading at 108p ex-div. A dividend of 12p per share has just been paid. The dividend growth varies each year. The beta for Brexylite Plc is 1.4, T-Bills are offering 3.5%. The FTSE all index return is 13%. Preference Share Capital: The balance sheet indicates that 2m of preference capital has been issued. They are shown as 5% 0.50 shares. Current share price is 25p per share. Debt Capital: 10% debentures are due to mature in 4 years at par. The current market value of each debenture is 108, and the total book value of the debentures is 5m. 8% irredeemable bonds are trading at 97. The interest has just been paid. There are 2m nominal value worth of irredeemable bonds, as per the statement of financial position. The corporation tax rate applicable is 20%. To raise the funds required for investment on the new machinery and expansion, the board of directors will consider either increasing borrowing or an issue of new shares. The United Kingdom government is currently renegotiating new trade arrangements with the European Union and a few other countries, and the performance of Pro-3 product will depend on the outcome of those negotiations. If the UK government can obtain favourable trading terms, then the sales cash flows from the project could be higher than the current ones. There is, though, a small chance that trade terms will be unfavourable resulting in sales cash flow being marginally less than projected ones cost of capital Cost of debt finance, ko irredemable Kd=VPo(1-CT)*100 Cost of debt finance, ko redeemable Bond Yield Approximation Method KD = ko = 1 + ((P-POYn] P+0.6(PO-P) After tax ko y Cost of ordinary share capital: CAPM approach: k = R + Bi (RM - R=) 11.10% ke Cost of preference shares Kp=Div/PO 100 WACC Mkt Values Weightin weighted cost g Type of finance Cost% Ordinary shares preference shares Irredeemable debenture Redeemable debenture WACC 0.00% The following information is available regarding how the Brexylite Plc is currently financed: Ordinary Share Capital: Brexylite plc has 20m ordinary shares in issue and each is trading at 108p ex-div. A dividend of 12p per share has just been paid. The dividend growth varies each year. The beta for Brexylite Plc is 1.4, T-Bills are offering 3.5%. The FTSE all index return is 13%. Preference Share Capital: The balance sheet indicates that 2m of preference capital has been issued. They are shown as 5% 0.50 shares. Current share price is 25p per share. Debt Capital: 10% debentures are due to mature in 4 years at par. The current market value of each debenture is 108, and the total book value of the debentures is 5m. 8% irredeemable bonds are trading at 97. The interest has just been paid. There are 2m nominal value worth of irredeemable bonds, as per the statement of financial position. The corporation tax rate applicable is 20%. To raise the funds required for investment on the new machinery and expansion, the board of directors will consider either increasing borrowing or an issue of new shares. The United Kingdom government is currently renegotiating new trade arrangements with the European Union and a few other countries, and the performance of Pro-3 product will depend on the outcome of those negotiations. If the UK government can obtain favourable trading terms, then the sales cash flows from the project could be higher than the current ones. There is, though, a small chance that trade terms will be unfavourable resulting in sales cash flow being marginally less than projected ones cost of capital Cost of debt finance, ko irredemable Kd=VPo(1-CT)*100 Cost of debt finance, ko redeemable Bond Yield Approximation Method KD = ko = 1 + ((P-POYn] P+0.6(PO-P) After tax ko y Cost of ordinary share capital: CAPM approach: k = R + Bi (RM - R=) 11.10% ke Cost of preference shares Kp=Div/PO 100 WACC Mkt Values Weightin weighted cost g Type of finance Cost% Ordinary shares preference shares Irredeemable debenture Redeemable debenture WACC 0.00%