Question

FINIANCIAL ACCOUNTING Question 1 An investment is expected to accumulate $165,000 in six years. Assuming that the investor requires a 6% return and will purchase

FINIANCIAL ACCOUNTING

Question 1

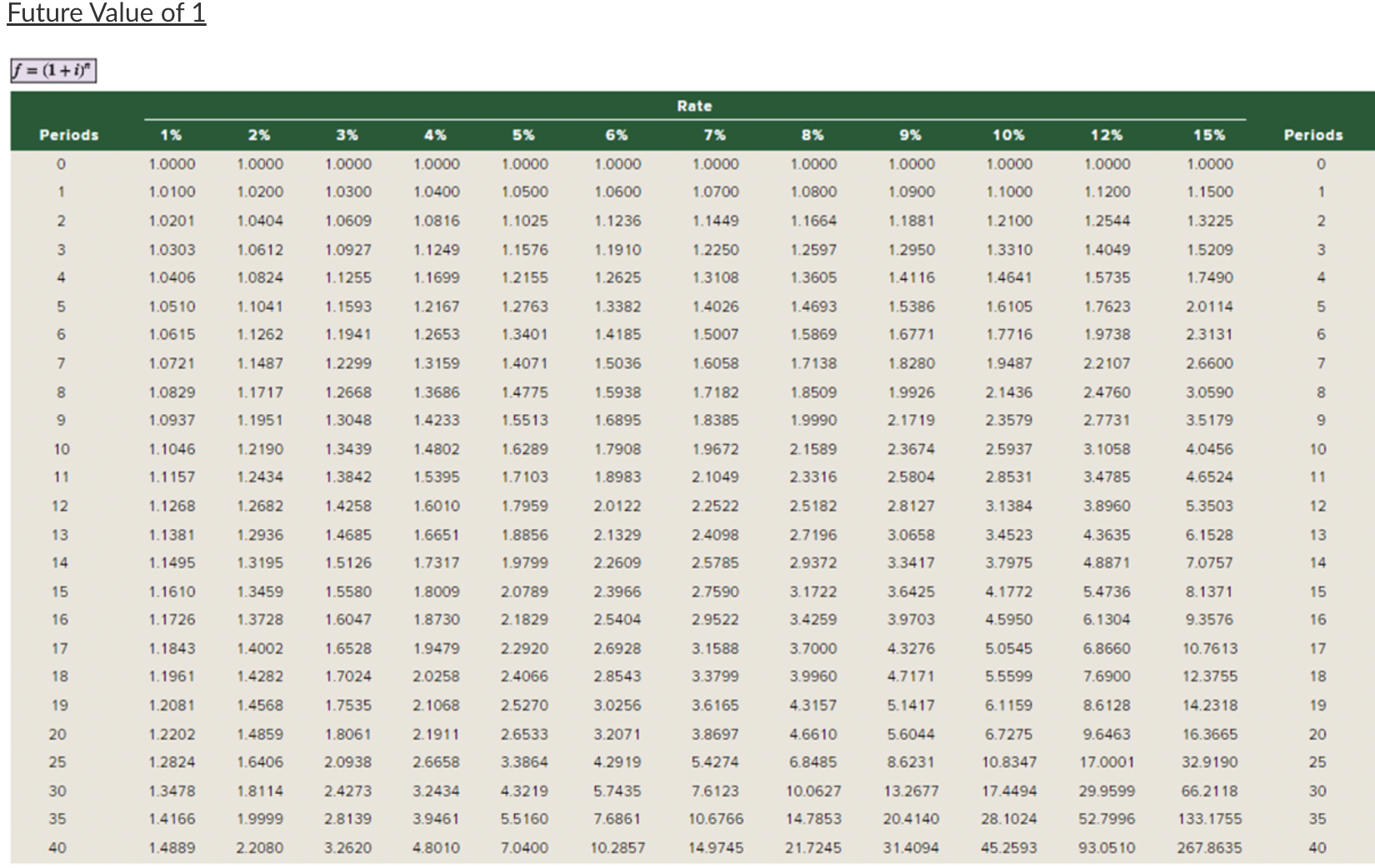

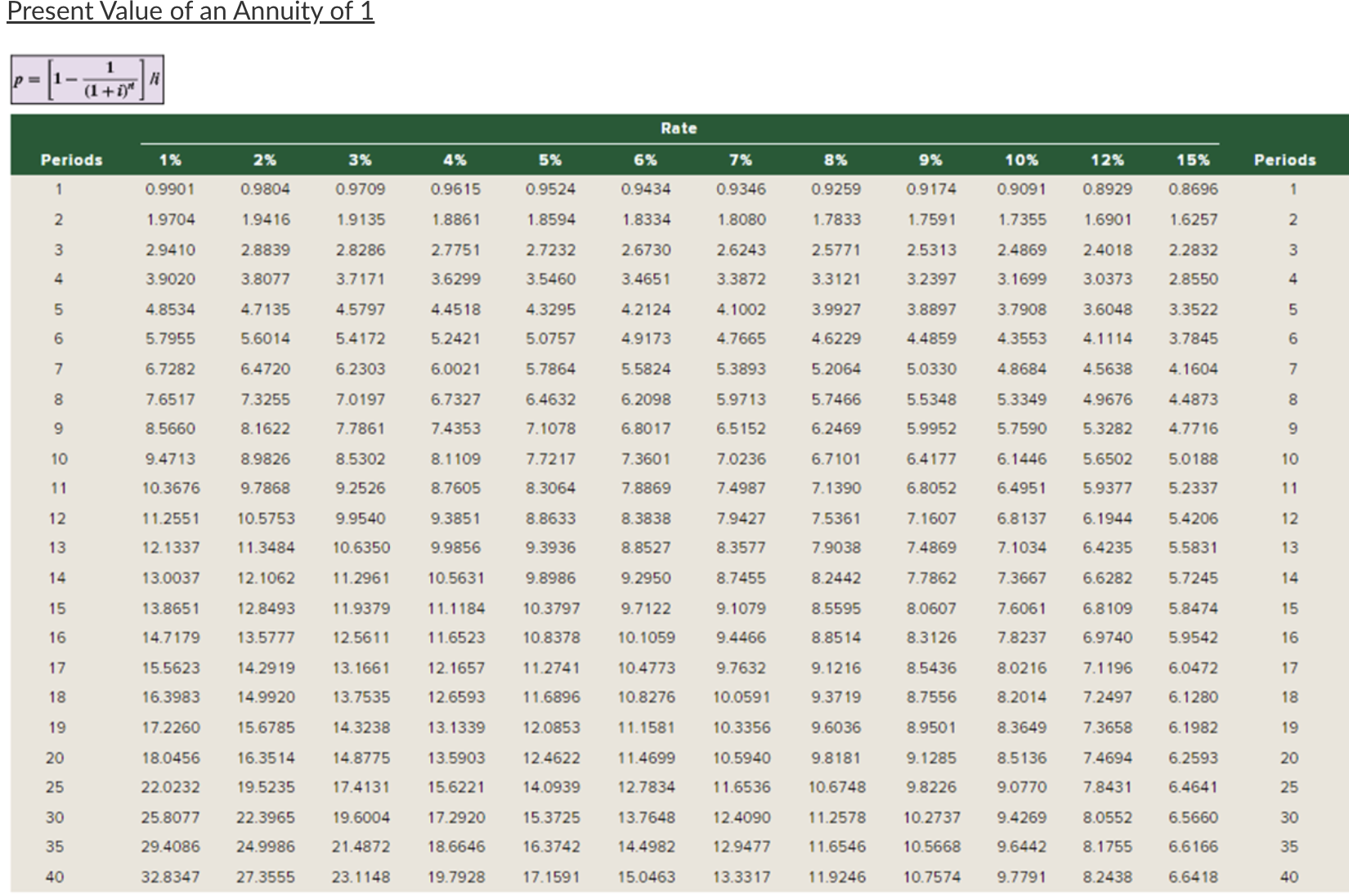

An investment is expected to accumulate $165,000 in six years. Assuming that the investor requires a 6% return and will purchase the investment today, using the Present Value of 1 table, how much will the investor pay for this investment? Round your answer to the nearest dollar.

Question 2

What is the future value of $1,000 in 10 years with a 12% annual interest rate. Round your answer to the nearest dollar.

Question 3

What is the future value of $1,000 in 5 years with a 12% annual interest rate if interest is compounded monthly. Round your answer to the nearest dollar.

Question 4

What is the future value of $1,000 in 10 years with a 12% annual interest rate if interest is compounded monthly. Round your answer to the nearest dollar.

Question 5

What is the present value of $1,000 in 5 years with a 12% annual interest rate. Round your answer to the nearest dollar.

Question 6

What is the present value of $1,000 in 5 years with a 12% annual interest rate if interest is compounded monthly. Round your answer to the nearest dollar.

Question 7

How much cash would you need to invest today if you knew you had to pay $10,000 each year for the next 5 years. Assume the annual interest rate is 12%. Round your answer to the nearest dollar.

Question 8

How much cash would you need to invest today if you knew you had to pay $1,000 each month for the next 5 years. Assume the annual interest rate is 12%. Round your answer to the nearest dollar.

Question 9

If borrowed $100,000 today, what would your annual payment be for the next 20 years if the annual interest rate was 12%? Round your answer to the nearest dollar.

Question 10

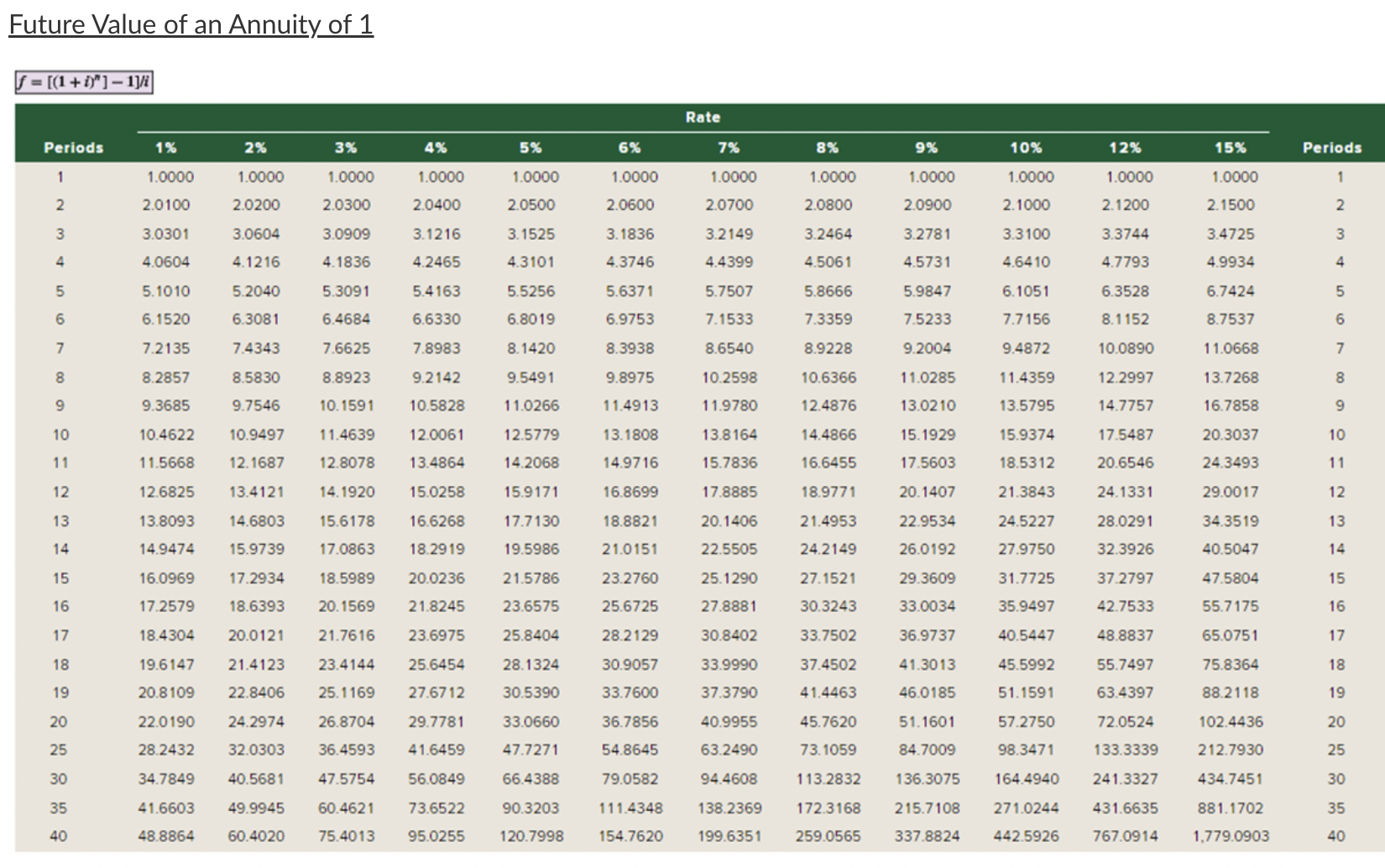

A person has an individual retirement account that they contribute $2,150 to annually at the end of each year. The person wants to retire after making 35 annual contributions to the account. Assuming that the account earns 12% interest annually, using the Future Value of an Annuity of 1 table, compute the value of the account on the date of the final contribution (35 years from the present).

Present Value of 1 Future Value of 1 f=(1+i)n Present Value of an Annuity of 1 p=[1(1+i)n1]h Future Value of an Annuity of 1 f=[(1+in]1]/f

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started