finicial statements, cash flow, and taxes help

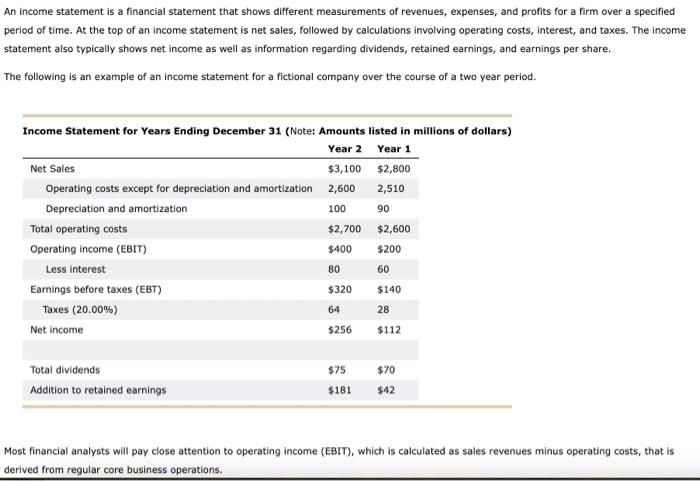

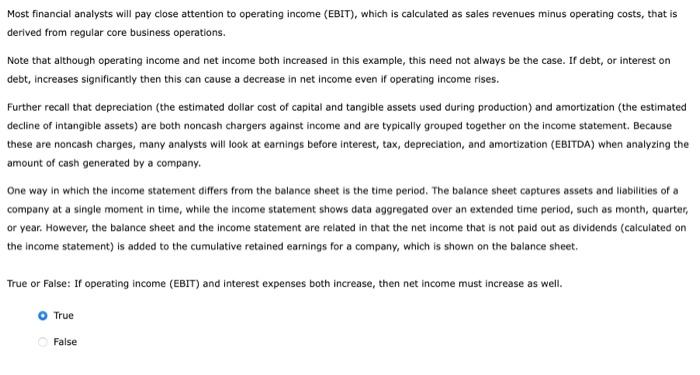

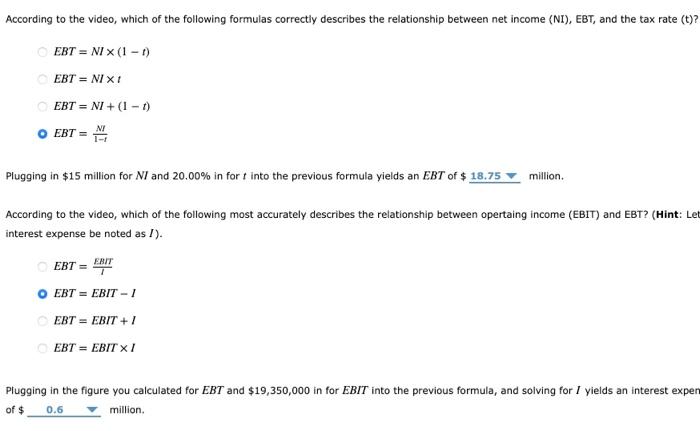

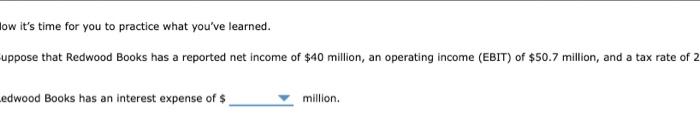

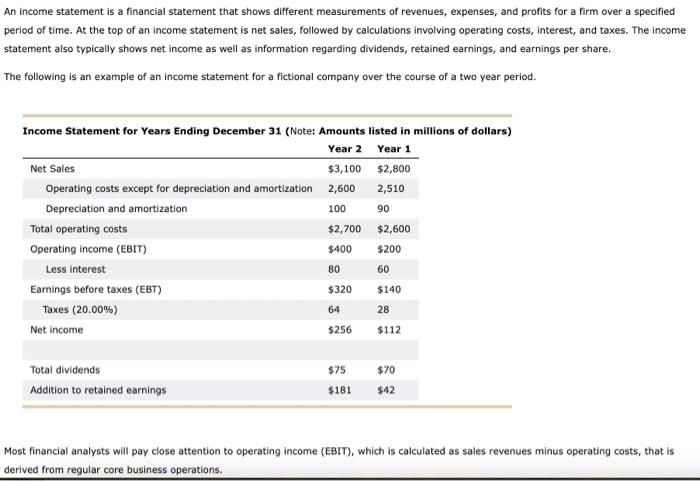

An income statement is a financial statement that shows different measurements of revenues, expenses, and profits for a firm over a specified period of time. At the top of an income statement is net sales, followed by calculations involving operating costs, interest, and taxes. The income statement also typically shows net income as well as information regarding dividends, retained earnings, and earnings per share. The following is an example of an income statement for a fictional company over the course of a two year period. 100 90 Income Statement for Years Ending December 31 (Note: Amounts listed in millions of dollars) Year 2 Year 1 Net Sales $3,100 $2,800 Operating costs except for depreciation and amortization 2,600 2,510 Depreciation and amortization Total operating costs $2,700 $2,600 Operating income (EBIT) Less interest 60 Earnings before taxes (EBT) $320 $140 Taxes (20.00%) Net income $256 $400 $200 80 64 28 $112 $75 $70 Total dividends Addition to retained earnings $181 $42 Most financial analysts will pay close attention to operating income (EBIT), which is calculated as sales revenues minus operating costs, that is derived from regular core business operations. Most financial analysts will pay close attention to operating income (EBIT), which is calculated as sales revenues minus operating costs, that is derived from regular core business operations. Note that although operating income and net income both increased in this example, this need not always be the case. If debt, or interest on debt, increases significantly then this can cause a decrease in net income even if operating income rises. Further recall that depreciation (the estimated dollar cost of capital and tangible assets used during production) and amortization (the estimated decline of intangible assets) are both noncash chargers against income and are typically grouped together on the income statement. Because these are noncash charges, many analysts will look at earnings before interest, tax, depreciation, and amortization (EBITDA) when analyzing the amount of cash generated by a company. One way in which the income statement differs from the balance sheet is the time period. The balance sheet captures assets and liabilities of a company at a single moment in time, while the income statement shows data aggregated over an extended time period, such as month, quarter, or year. However, the balance sheet and the income statement are related in that the net income that is not paid out as dividends (calculated on the income statement) is added to the cumulative retained earnings for a company, which is shown on the balance sheet True or False: If operating income (EBIT) and interest expenses both increase, then net income must increase as well. O True False According to the video, which of the following formulas correctly describes the relationship between net income (NI), EBT, and the tax rate (t)? EBT = NI X (1-1) EBT = NI X1 EBT = NI + (1 - 1) O EBT = M NI Plugging in $15 million for Nl and 20.00% in fort into the previous formula yields an EBT of $ 18.75 million According to the video, which of the following most accurately describes the relationship between opertaing income (EBIT) and EBT? (Hint: Let interest expense be noted as I). ERIT EBT = O EBT = EBIT -1 EBT = EBIT + 1 EBT = EBIT X1 Plugging in the figure you calculated for EBT and $19,350,000 in for EBIT into the previous formula, and solving for 1 yields an interest expen of $ 0.6 million low it's time for you to practice what you've learned. uppose that Redwood Books has a reported net income of $40 million, an operating income (EBIT) of $50.7 million, and a tax rate of 2 edwood Books has an interest expense of $ million