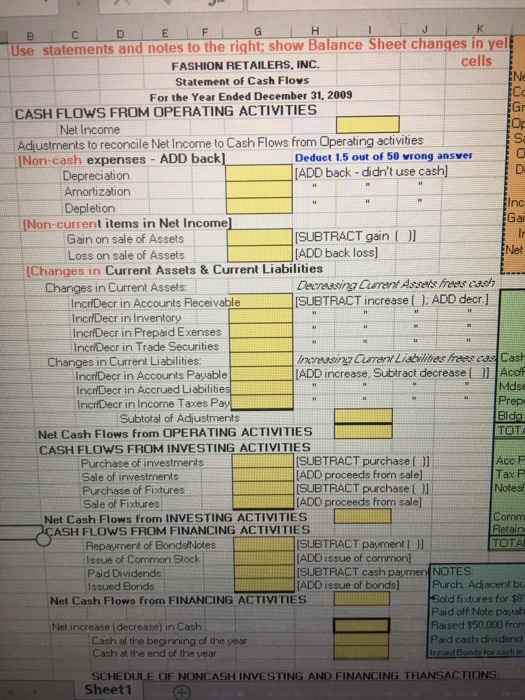

finish a cashflow staemt

finish a cash flow staemt using the indirect method

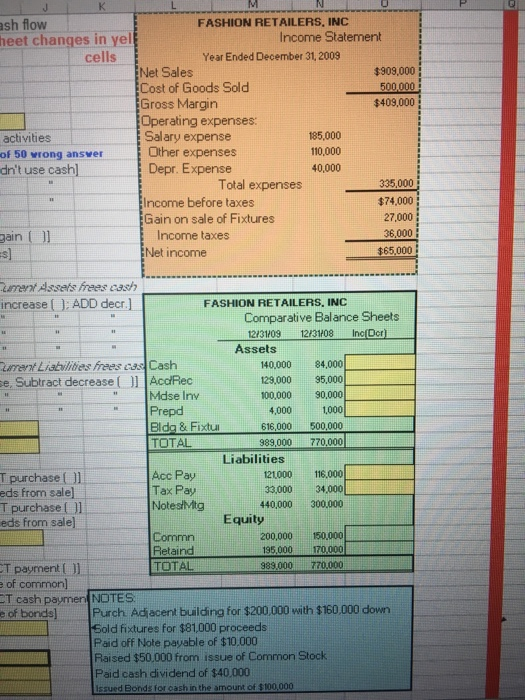

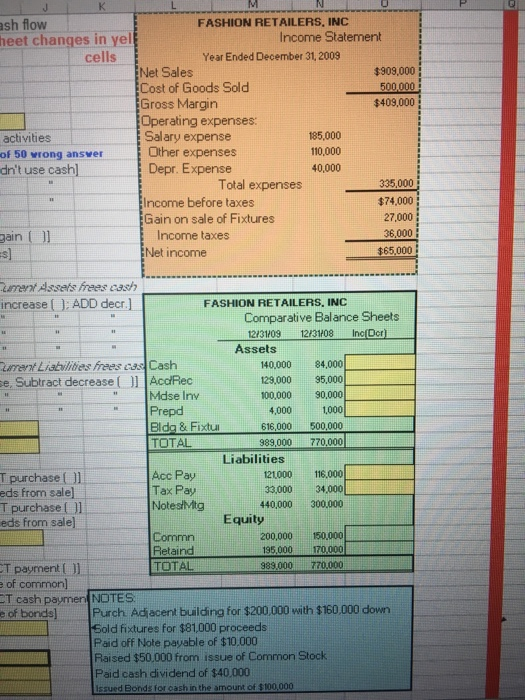

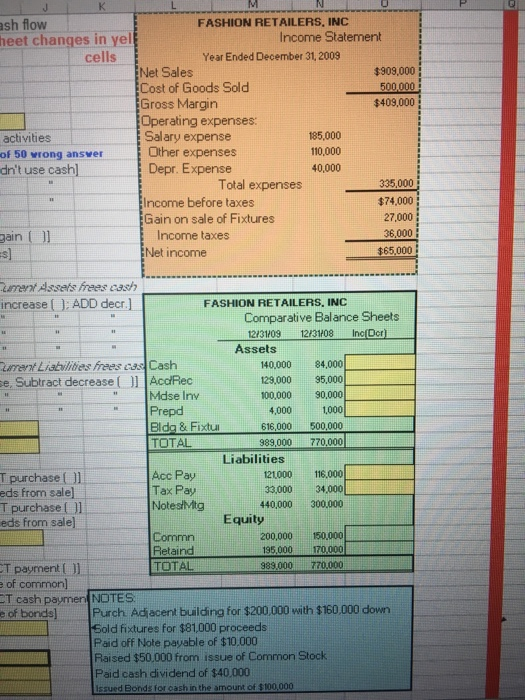

this is the imcome statement and comparative balance sheet for the problem

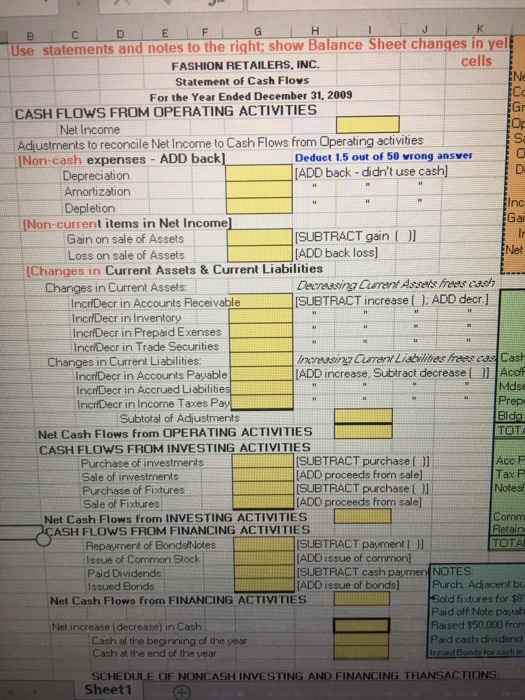

286 od 1 Inc 11 11 11 B C D E F G HT Use statements and notes to the right; show Balance Sheet changes in yel FASHION RETAILERS, INC. cells Statement of Cash Flows For the Year Ended December 31, 2009 CASH FLOWS FROM OPERATING ACTIVITIES Net Income 0 Adjustments to reconcile Net Income to Cash Flows from Operating activities [Non-cash expenses - ADD back] Deduct 1.5 out of 50 wrong ansver Depreciation (ADD back - didn't use cash) D Amortization Depletion [Non-current items in Net Income] Gai Gain on sale of Assets (SUBTRACT gain ()] Loss on sale of Assets [ADD back loss) Net [Changes in Current Assets & Current Liabilities Changes in Current Assets: Deersing time escash IncrDecr in Accounts Receivable [SUBTRACT increase ( ). ADD decr.] IncrDecr in Inventory Incn Decr in Prepaid Exenses IncriDeer in Trade Securities Changes in Current Liabilities: Inayousin Cure Listilities as as Cast Incn Decr in Accounts Payable (ADD increase, Subtract decrease ( Acar Incr/Decr in Accrued Liabilities Mdse IncrtDecr in Income Taxes Pay! Preps Subtotal of Adjustments Net Cash Flows from OPERATING ACTIVITIES TOTE CASH FLOWS FROM INVESTING ACTIVITIES Purchase of investments (SUBTRACT purchase Aco F Sale of investments (ADD proceeds from sale] Tax P Purchase of Fixtures [SUBTRACT purchase Notes Sale of Fixtures (ADD proceeds from sale] Net Cash Flows from INVESTING ACTIVITIES Comm CASH FLOWS FROM FINANCING ACTIVITIES Retain Repayment of Bonds Notes ISUBTRACT payment TOTAL Issue of Common Stock [ADD issue of common] Paid Dividends (SUBTRACT cash paymen NOTES: Issued Bonds [ADD issue of bonds) Purch. Adjacent bu Net Cash Flows from FINANCING ACTIVITIES Sold fixtures for $8 Paid off Note payab Net increase (decrease) in Cash Raised $50.000 from Cash at the beginning of the year Paid cash dividend Cash at the end of the year Issued Bonds for cash in Bida SCHEDULE OF NONCASH INVESTING AND FINANCING TRANSACTIONS Sheet1 K M ash flow FASHION RETAILERS, INC heet changes in yel Income Statement cells Year Ended December 31, 2009 Net Sales $909,000 Cost of Goods Sold 500.000 Gross Margin $409,000 Operating expenses: activities Salary expense 185,000 of 50 wrong answer Other expenses 110,000 dn't use cash) Depr. Expense 40,000 Total expenses 335,000 Income before taxes $74,000 Gain on sale of Fixtures 27,000 gain ( Income taxes 36,000 s] Net income $65,000 11 13 11 11 11 4,000 umeni Assers Frees cash increase ( ). ADD decr.) FASHION RETAILERS, INC Comparative Balance Sheets 12/31/09 1273108 Ino Dor) Assets Luer Liabilities frees cas. Cash 140,000 84,000 se, Subtract decrease ( AccRec 129,000 95,000 Mdse Iny 100,000 90,000 Prepd 1,000 Bldg & Fixtu 616,000 500.000 TOTAL 989,000 770.000 Liabilities T purchase ( Acc Pay 121000 116.000 eds from sale] Tax Pay 33,000 34,000 T purchase Notes/Mtg 440,000 300,000 eds from sale) Equity Commn 200,000 150,000 Retaind 195,000 170.000 ET payment TOTAL 989.000 770.000 e of common ET cash payment NOTES e of bonds) Purch Adjacent building for $200,000 with $160,000 down Sold fixtures for $81,000 proceeds Paid off Note payable of $10.000 Raised $50,000 from issue of Common Stock Paid cash dividend of $40.000 Issued Bonds for cash in the amount of $100,000

finish a cash flow staemt using the indirect method

finish a cash flow staemt using the indirect method