Answered step by step

Verified Expert Solution

Question

1 Approved Answer

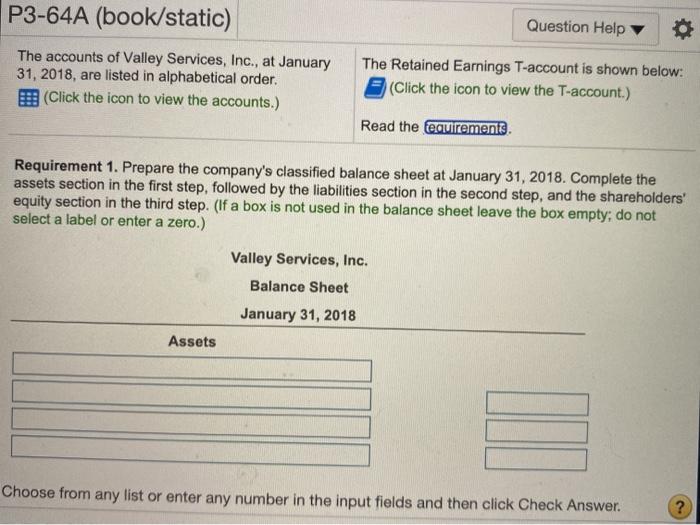

Finish requirement 1 and 2 P3-64A (book/static) Question Help The accounts of Valley Services, Inc., at January 31, 2018, are listed in alphabetical order. (Click

Finish requirement 1 and 2

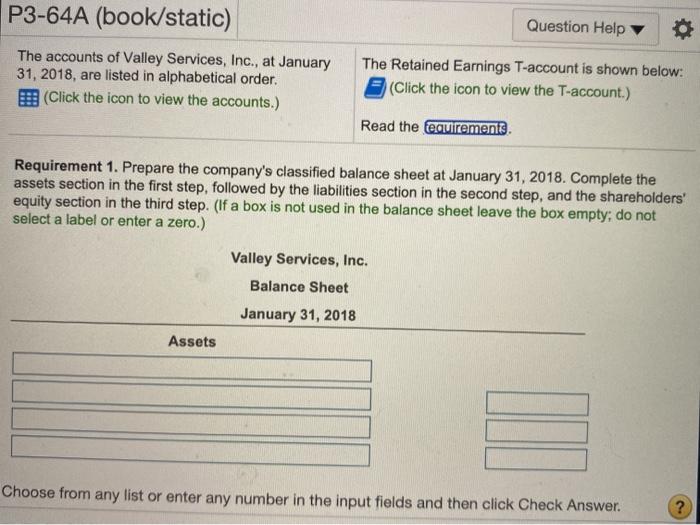

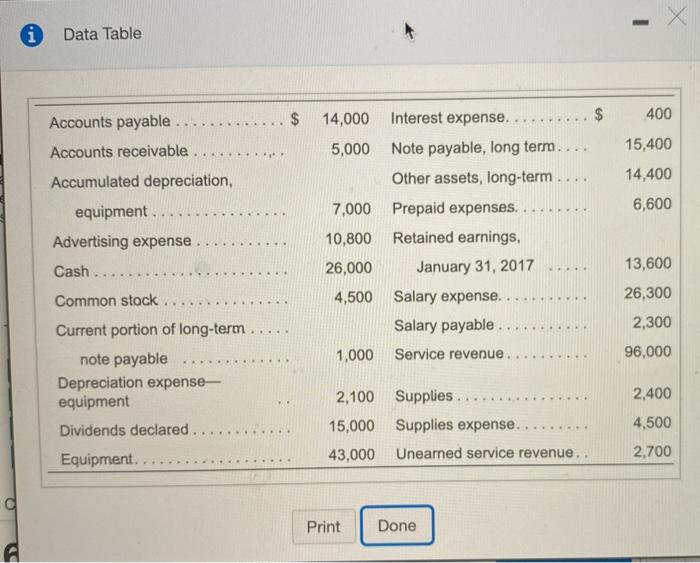

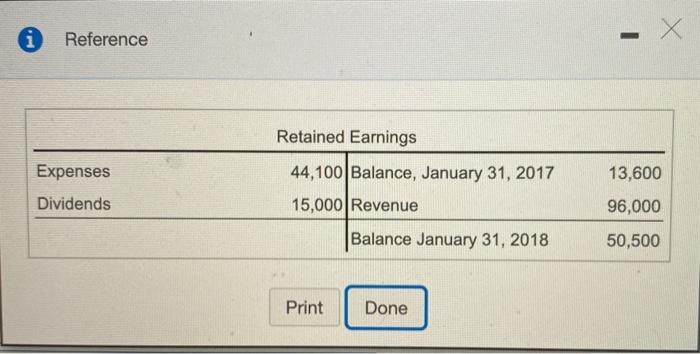

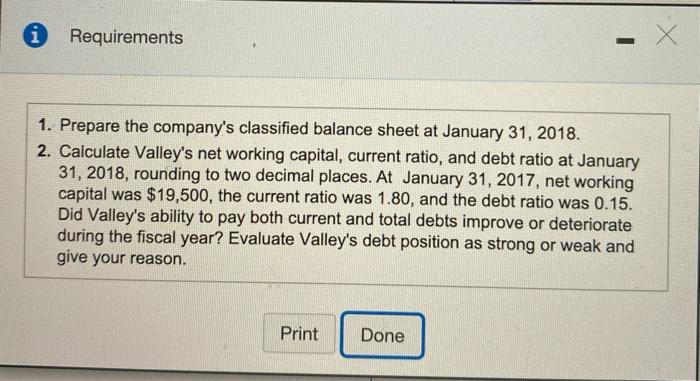

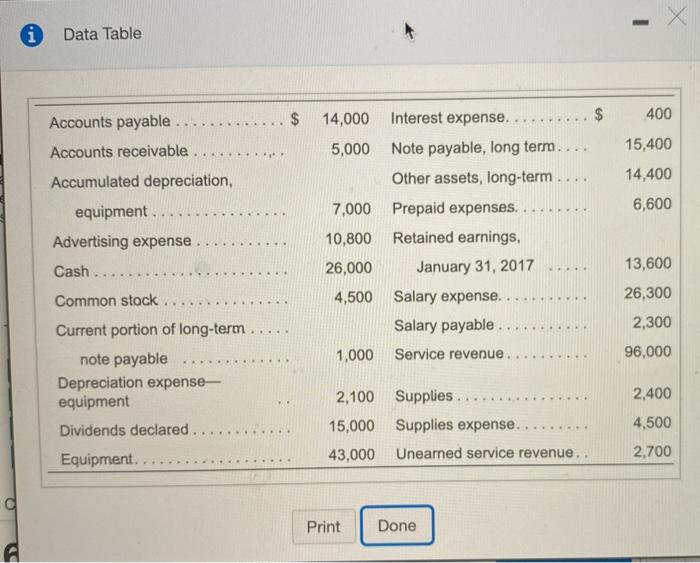

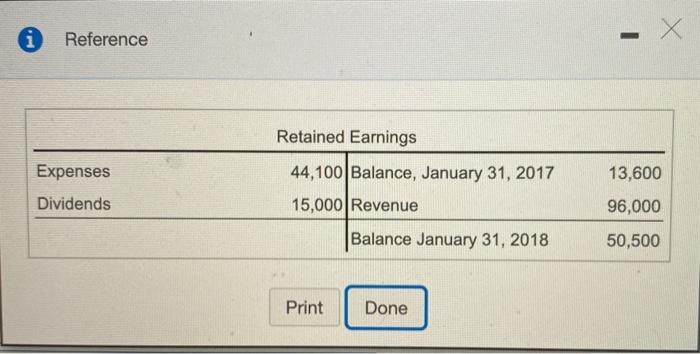

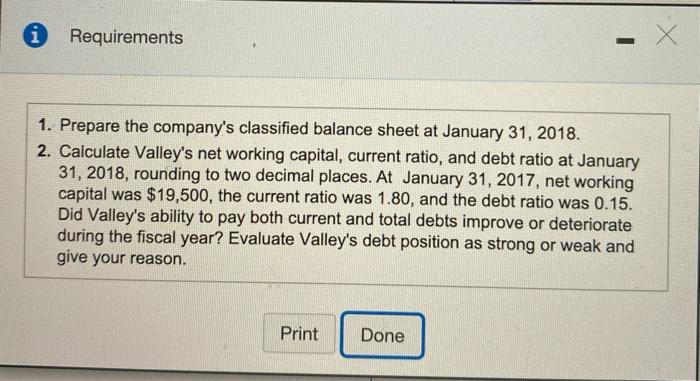

P3-64A (book/static) Question Help The accounts of Valley Services, Inc., at January 31, 2018, are listed in alphabetical order. (Click the icon to view the accounts.) The Retained Earnings T-account is shown below: (Click the icon to view the T-account.) Read the requirements Requirement 1. Prepare the company's classified balance sheet at January 31, 2018. Complete the assets section in the first step, followed by the liabilities section in the second step, and the shareholders' equity section in the third step. (If a box is not used in the balance sheet leave the box empty; do not select a label or enter a zero.) Valley Services, Inc. Balance Sheet January 31, 2018 Assets Choose from any list or enter any number in the input fields and then click Check Answer. . i Data Table $ 400 --- 15,400 ... Accounts payable Accounts receivable. Accumulated depreciation, equipment Advertising expense Cash.. 14,400 6,600 14,000 Interest expense... 5,000 Note payable, long term.... Other assets, long-term .. 7,000 Prepaid expenses. 10,800 Retained earnings, 26,000 January 31, 2017 4,500 Salary expense. . Salary payable 1,000 Service revenue ... Common stock 13,600 26,300 2,300 96,000 . --- --- Current portion of long-term. note payable Depreciation expense- equipment Dividends declared...... Equipment. 2,100 Supplies .... 15,000 Supplies expense. 43,000 Unearned service revenue.. 2,400 4,500 2.700 g Print Done i Reference - X Retained Earnings Expenses Dividends 44,100 Balance, January 31, 2017 15,000 Revenue 13,600 96,000 Balance January 31, 2018 50,500 Print Done i Requirements 1. Prepare the company's classified balance sheet at January 31, 2018. 2. Calculate Valley's net working capital, current ratio, and debt ratio at January 31, 2018, rounding to two decimal places. At January 31, 2017, net working capital was $19,500, the current ratio was 1.80, and the debt ratio was 0.15. Did Valley's ability to pay both current and total debts improve or deteriorate during the fiscal year? Evaluate Valley's debt position as strong or weak and give your reason. Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started