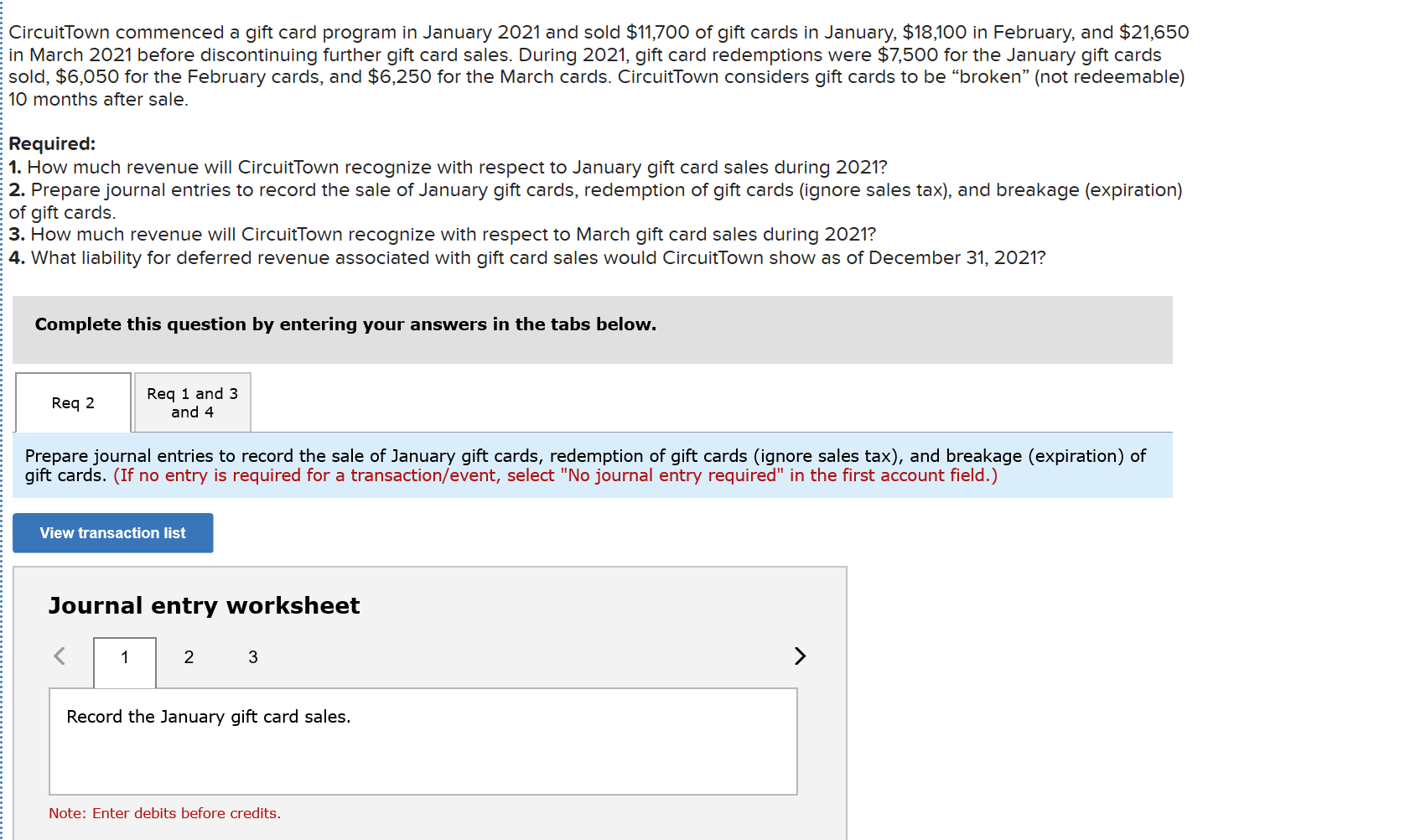

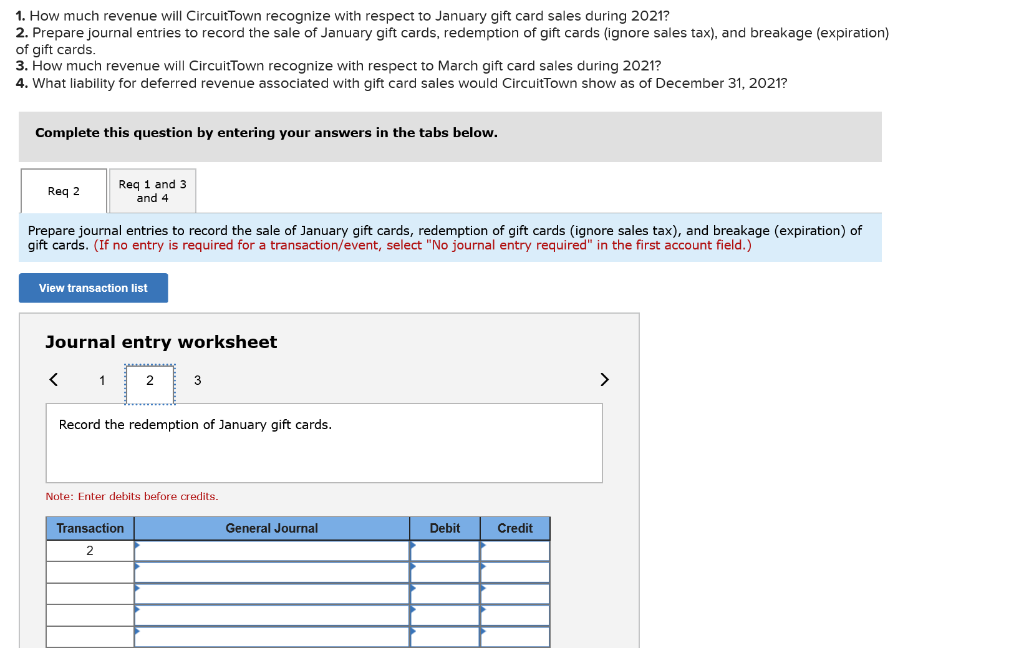

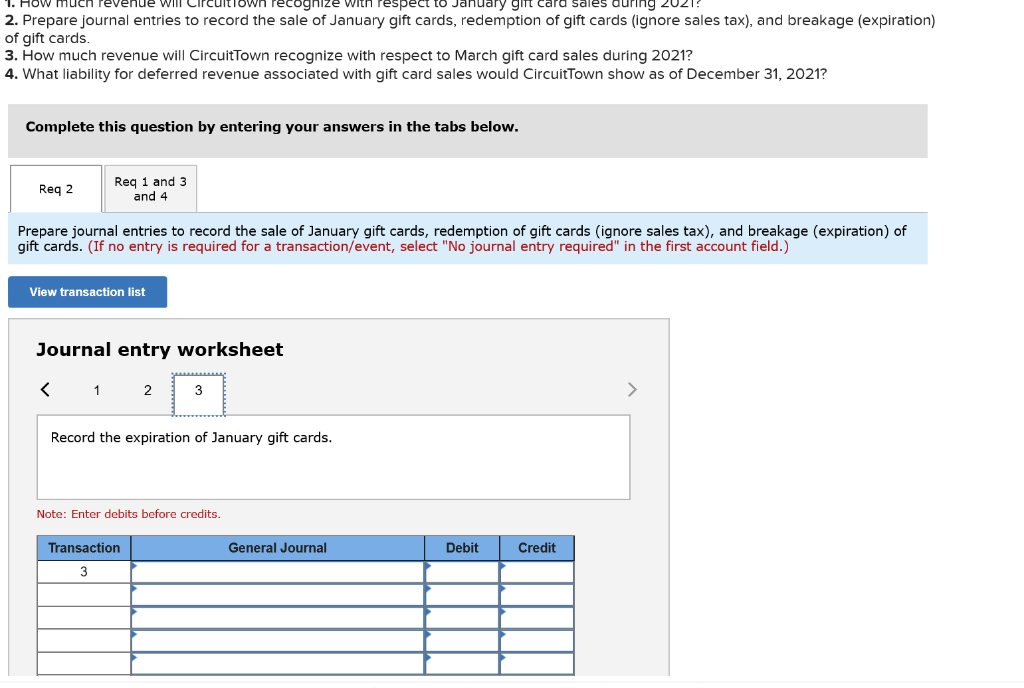

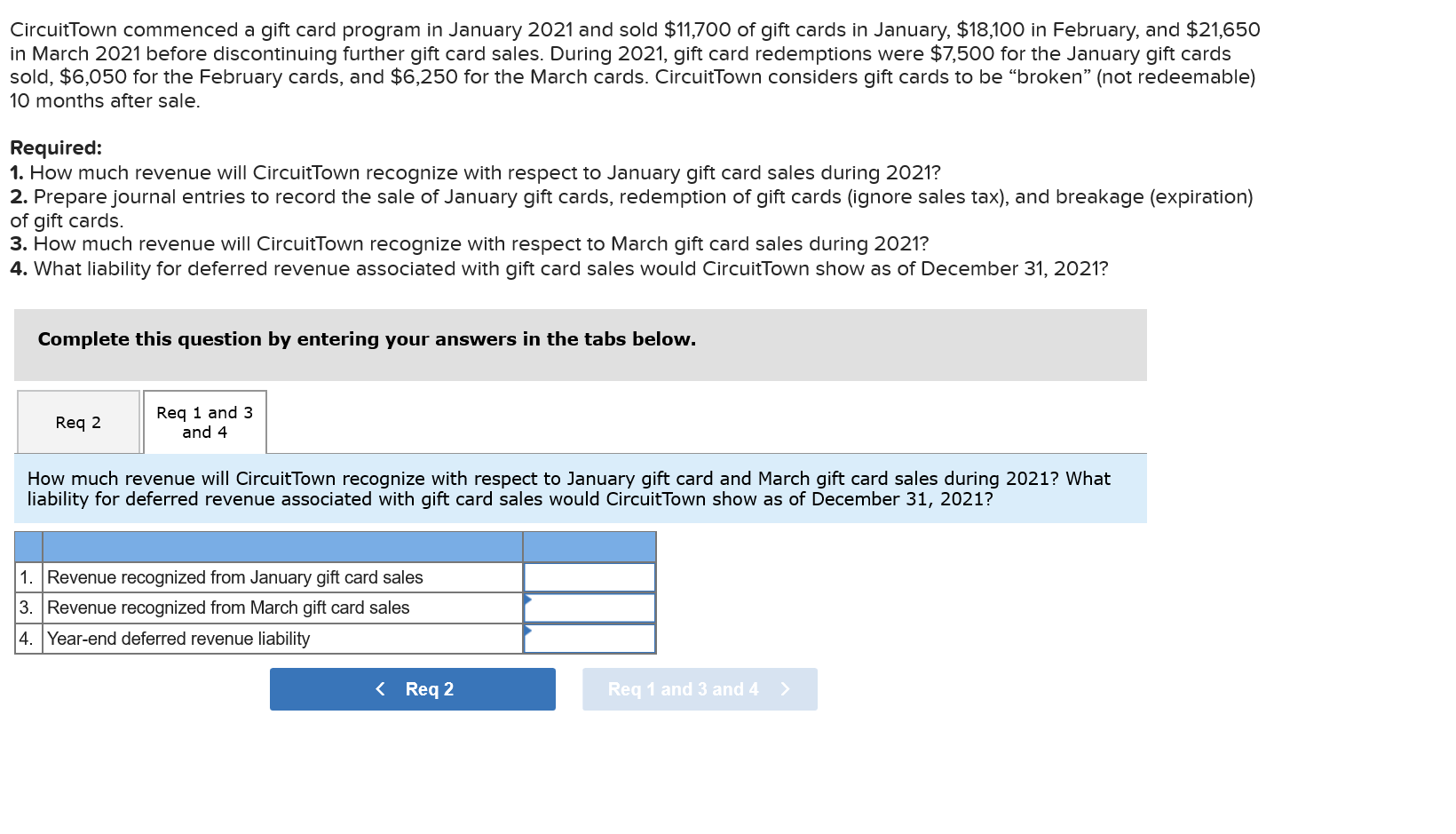

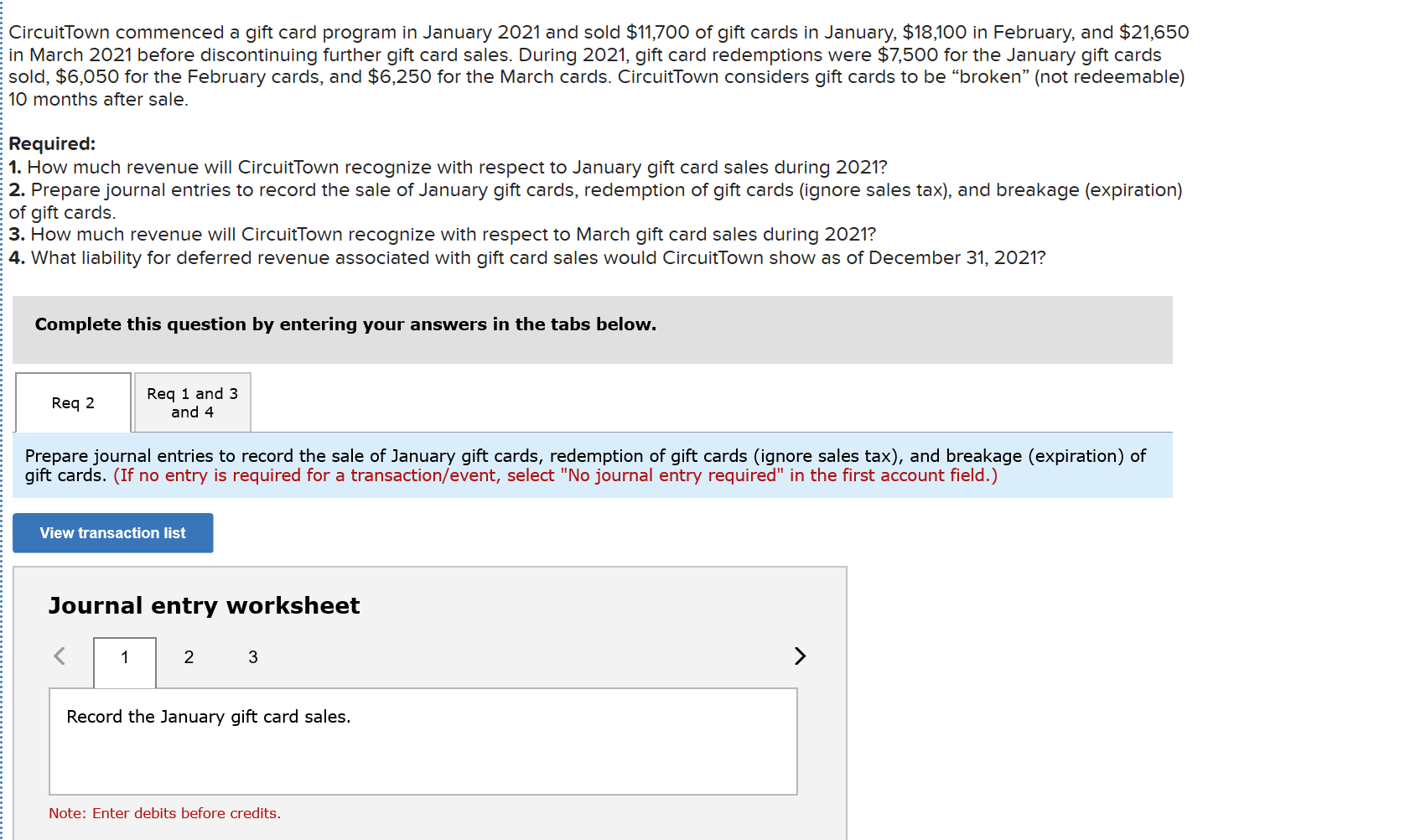

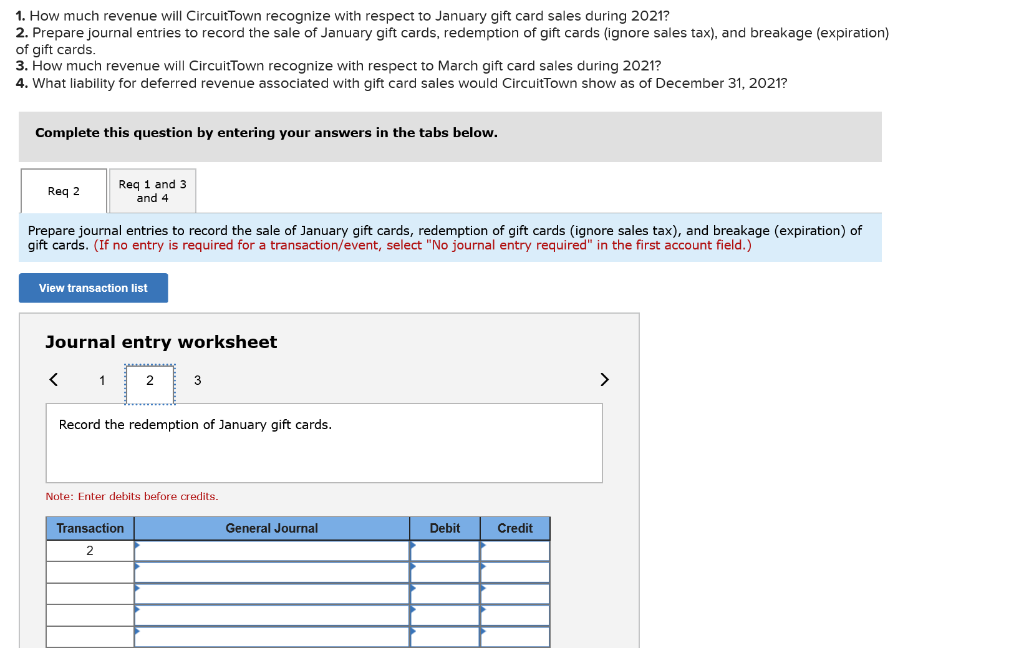

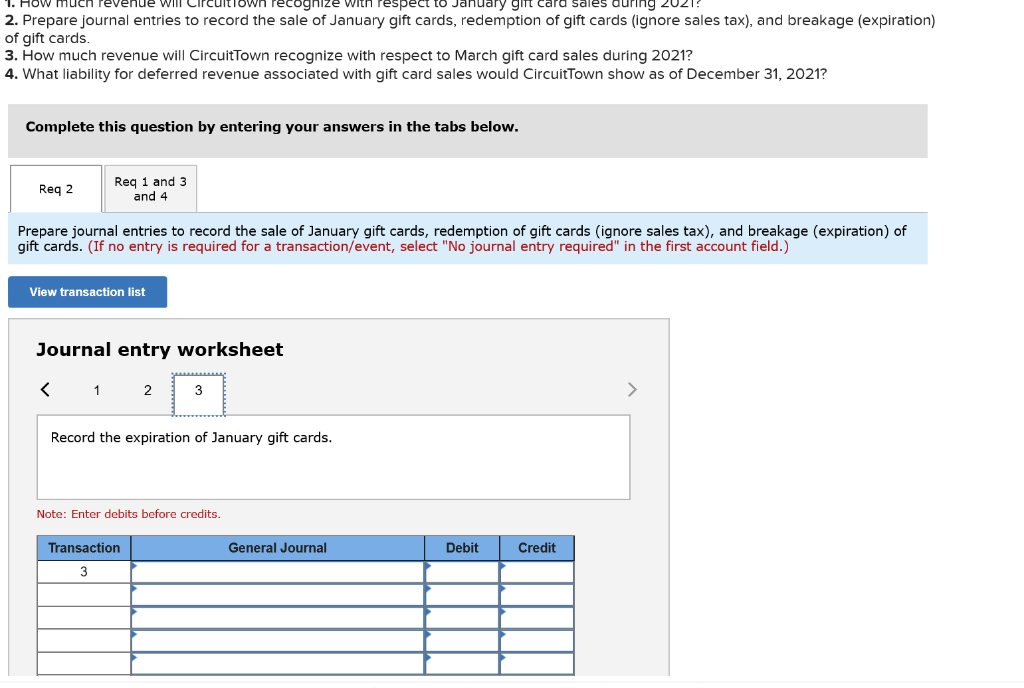

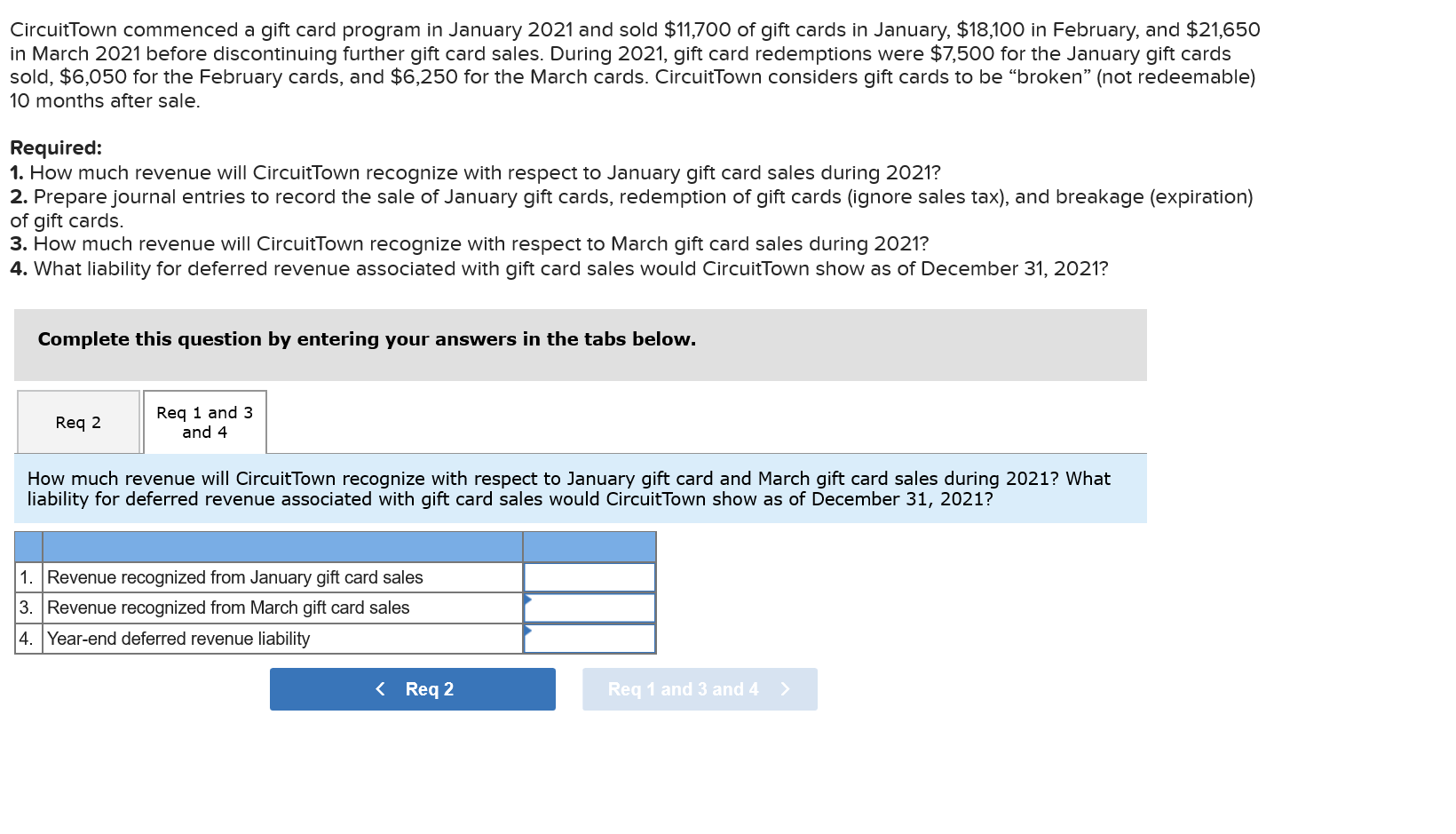

CircuitTown commenced a gift card program in January 2021 and sold $11,700 of gift cards in January, $18,100 in February, and $21,650 E in March 2021 before discontinuing further gift card sales. During 2021, gift card redemptions were $7,500 for the January gift cards sold, $6,050 for the February cards, and $6,250 for the March cards. Circuit Town considers gift cards to be broken (not redeemable) E 10 months after sale. Required: 1. How much revenue will CircuitTown recognize with respect to January gift card sales during 2021? 2. Prepare journal entries to record the sale of January gift cards, redemption of gift cards (ignore sales tax), and breakage (expiration) E of gift cards. 3. How much revenue will Circuit Town recognize with respect to March gift card sales during 2021? 4. What liability for deferred revenue associated with gift card sales would CircuitTown show as of December 31, 2021? Complete this question by entering your answers in the tabs below. Req 2 Req 1 and 3 and 4 Prepare journal entries to record the sale of January gift cards, redemption of gift cards (ignore sales tax), and breakage (expiration of gift cards. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 Record the January gift card sales. Note: Enter debits before credits. 1. How much revenue will Circuit Town recognize with respect to January gift card sales during 2021? 2. Prepare journal entries to record the sale of January gift cards, redemption of gift cards (ignore sales tax), and breakage (expiration) of gift cards. 3. How much revenue will Circuit Town recognize with respect to March gift card sales during 2021? 4. What liability for deferred revenue associated with gift card sales would CircuitTown show as of December 31, 2021? Complete this question by entering your answers in the tabs below. Req 2 Req 1 and 3 and 4 Prepare journal entries to record the sale of January gift cards, redemption of gift cards (ignore sales tax), and breakage (expiration of gift cards. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the redemption of January gift cards. Note: Enter debits before credits. Transaction General Journal Debit Credit 1. How much revenue WIII Circuit Town Pecognize with respect to January gift cara sales auring 2021? 2. Prepare journal entries to record the sale of January gift cards, redemption of gift cards (ignore sales tax), and breakage (expiration) of gift cards. 3. How much revenue will Circuit Town recognize with respect to March gift card sales during 2021? 4. What liability for deferred revenue associated with gift card sales would CircuitTown show as of December 31, 2021? Complete this question by entering your answers in the tabs below. Req 2 Req 1 and 3 and 4 Prepare journal entries to record the sale of January gift cards, redemption of gift cards (ignore sales tax), and breakage (expiration) of gift cards. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet