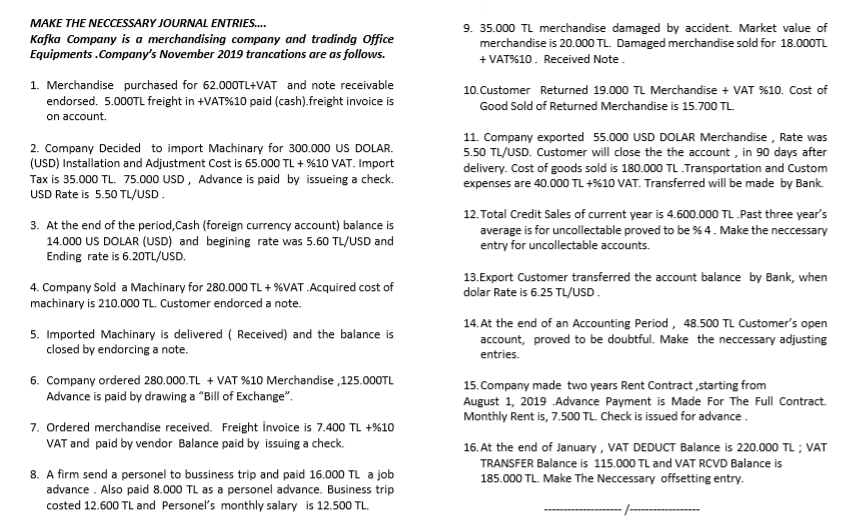

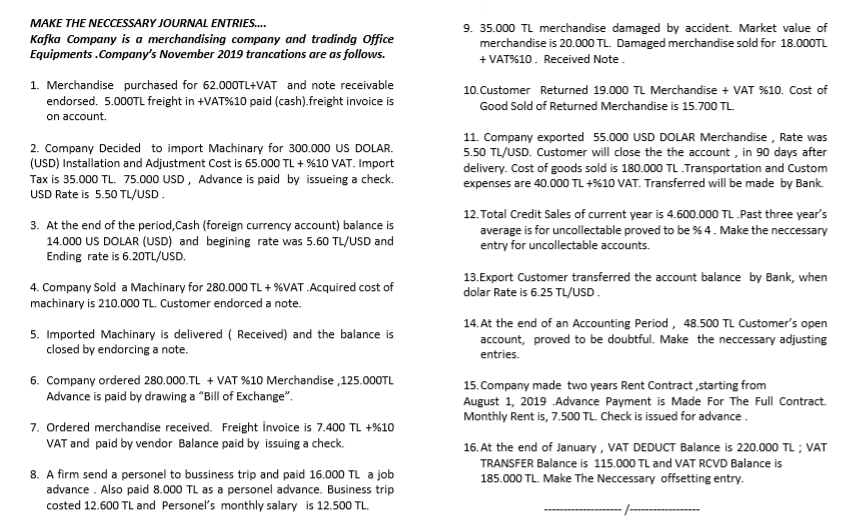

MAKE THE NECCESSARY JOURNAL ENTRIES.... Kafka Company is a merchandising company and tradindg Office Equipments.Company's November 2019 trancations are as follows. 9. 35.000 TL merchandise damaged by accident. Market value of merchandise is 20.000 TL Damaged merchandise sold for 18.000TL + VAT%10. Received Note. 1. Merchandise purchased for 62.000TL+VAT and note receivable endorsed. 5.000TL freight in +VAT%10 paid (cash).freight invoice is on account 10. Customer Returned 19.000 TL Merchandise + VAT %10. Cost of Good Sold of Returned Merchandise is 15.700 TL 2. Company Decided to import Machinary for 300.000 US DOLAR. (USD) Installation and Adjustment Cost is 65.000 TL + %10 VAT. Import Tax is 35.000 TL. 75.000 USD, Advance is paid by issueing a check. USD Rate is 5.50 TL/USD. 11. Company exported 55.000 USD DOLAR Merchandise, Rate was 5.50 TL/USD. Customer will close the the account, in 90 days after delivery. Cost of goods sold is 180.000 TL Transportation and Custom expenses are 40.000 TL +%10 VAT. Transferred will be made by Bank 3. At the end of the period, Cash (foreign currency account) balance is 14.000 US DOLAR (USD) and begining rate was 5.60 TL/USD and Ending rate is 6.20TL/USD. 12. Total Credit Sales of current year is 4.600.000 TL.Past three year's average is for uncollectable proved to be % 4. Make the neccessary entry for uncollectable accounts. 4. Company Sold a Machinary for 280.000 TL + %VAT Acquired cost of machinary is 210.000 TL. Customer endorced a note. 13.Export Customer transferred the account balance by Bank, when dolar Rate is 6.25 TL/USD. 5. Imported Machinary is delivered ( Received) and the balance is closed by endorcing a note. 14. At the end of an Accounting Period, 48.500 TL Customer's open account, proved to be doubtful. Make the neccessary adjusting entries. 6. Company ordered 280.000.TL + VAT %10 Merchandise , 125.000TL Advance is paid by drawing a "Bill of Exchange". 15. Company made two years Rent Contract, starting from August 1, 2019 Advance Payment is Made For The Full Contract. Monthly Rent is, 7.500 TL. Check is issued for advance. 7. Ordered merchandise received. Freight Invoice is 7.400 TL +%10 VAT and paid by vendor Balance paid by issuing a check. 16. At the end of January, VAT DEDUCT Balance is 220.000 TL; VAT TRANSFER Balance is 115.000 TL and VAT RCVD Balance is 185.000 TL. Make The Neccessary offsetting entry. 8. A firm send a personel to bussiness trip and paid 16.000 TL a job advance. Also paid 8.000 TL as a personel advance. Business trip costed 12.600 TL and Personel's monthly salary is 12.500 TL MAKE THE NECCESSARY JOURNAL ENTRIES.... Kafka Company is a merchandising company and tradindg Office Equipments.Company's November 2019 trancations are as follows. 9. 35.000 TL merchandise damaged by accident. Market value of merchandise is 20.000 TL Damaged merchandise sold for 18.000TL + VAT%10. Received Note. 1. Merchandise purchased for 62.000TL+VAT and note receivable endorsed. 5.000TL freight in +VAT%10 paid (cash).freight invoice is on account 10. Customer Returned 19.000 TL Merchandise + VAT %10. Cost of Good Sold of Returned Merchandise is 15.700 TL 2. Company Decided to import Machinary for 300.000 US DOLAR. (USD) Installation and Adjustment Cost is 65.000 TL + %10 VAT. Import Tax is 35.000 TL. 75.000 USD, Advance is paid by issueing a check. USD Rate is 5.50 TL/USD. 11. Company exported 55.000 USD DOLAR Merchandise, Rate was 5.50 TL/USD. Customer will close the the account, in 90 days after delivery. Cost of goods sold is 180.000 TL Transportation and Custom expenses are 40.000 TL +%10 VAT. Transferred will be made by Bank 3. At the end of the period, Cash (foreign currency account) balance is 14.000 US DOLAR (USD) and begining rate was 5.60 TL/USD and Ending rate is 6.20TL/USD. 12. Total Credit Sales of current year is 4.600.000 TL.Past three year's average is for uncollectable proved to be % 4. Make the neccessary entry for uncollectable accounts. 4. Company Sold a Machinary for 280.000 TL + %VAT Acquired cost of machinary is 210.000 TL. Customer endorced a note. 13.Export Customer transferred the account balance by Bank, when dolar Rate is 6.25 TL/USD. 5. Imported Machinary is delivered ( Received) and the balance is closed by endorcing a note. 14. At the end of an Accounting Period, 48.500 TL Customer's open account, proved to be doubtful. Make the neccessary adjusting entries. 6. Company ordered 280.000.TL + VAT %10 Merchandise , 125.000TL Advance is paid by drawing a "Bill of Exchange". 15. Company made two years Rent Contract, starting from August 1, 2019 Advance Payment is Made For The Full Contract. Monthly Rent is, 7.500 TL. Check is issued for advance. 7. Ordered merchandise received. Freight Invoice is 7.400 TL +%10 VAT and paid by vendor Balance paid by issuing a check. 16. At the end of January, VAT DEDUCT Balance is 220.000 TL; VAT TRANSFER Balance is 115.000 TL and VAT RCVD Balance is 185.000 TL. Make The Neccessary offsetting entry. 8. A firm send a personel to bussiness trip and paid 16.000 TL a job advance. Also paid 8.000 TL as a personel advance. Business trip costed 12.600 TL and Personel's monthly salary is 12.500 TL