Finish the journal entries

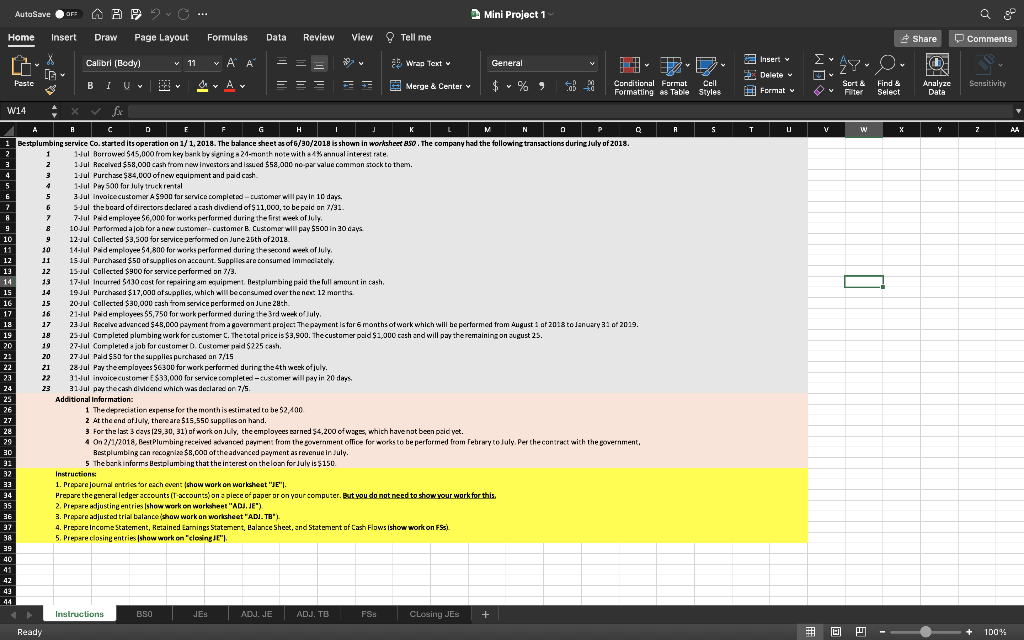

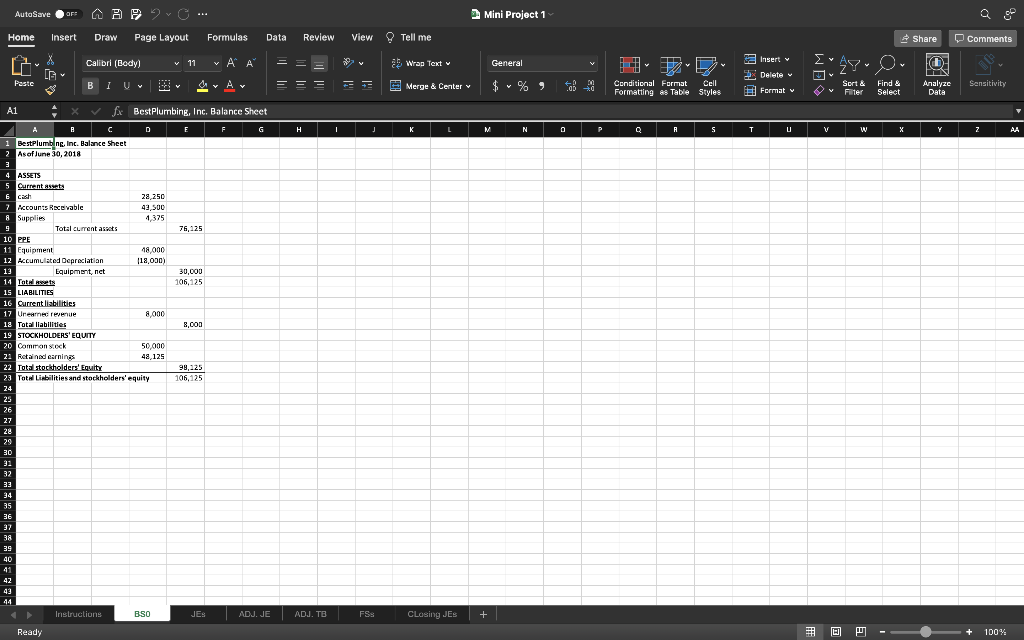

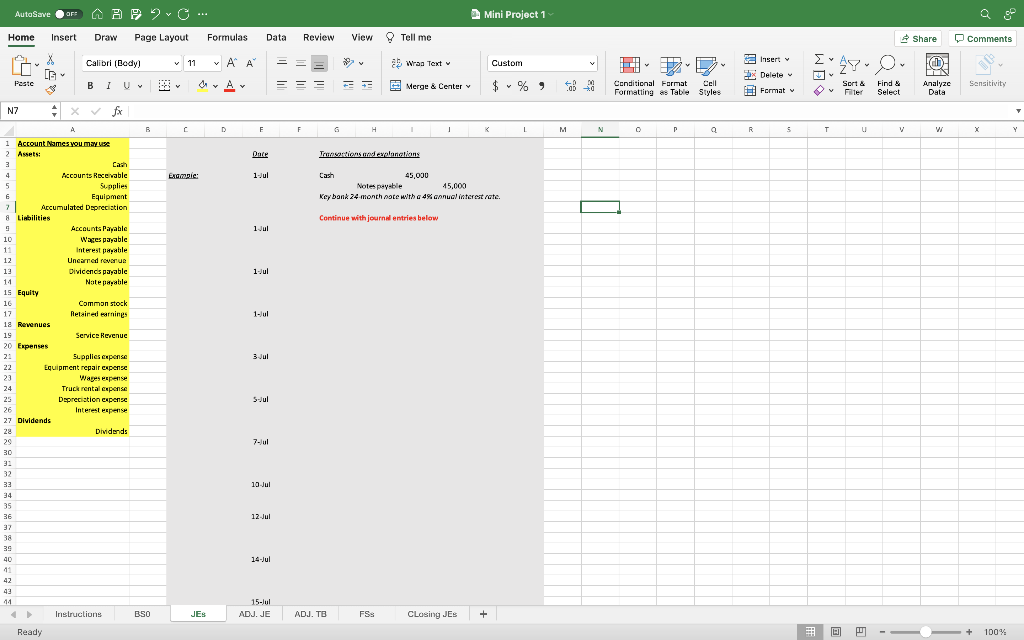

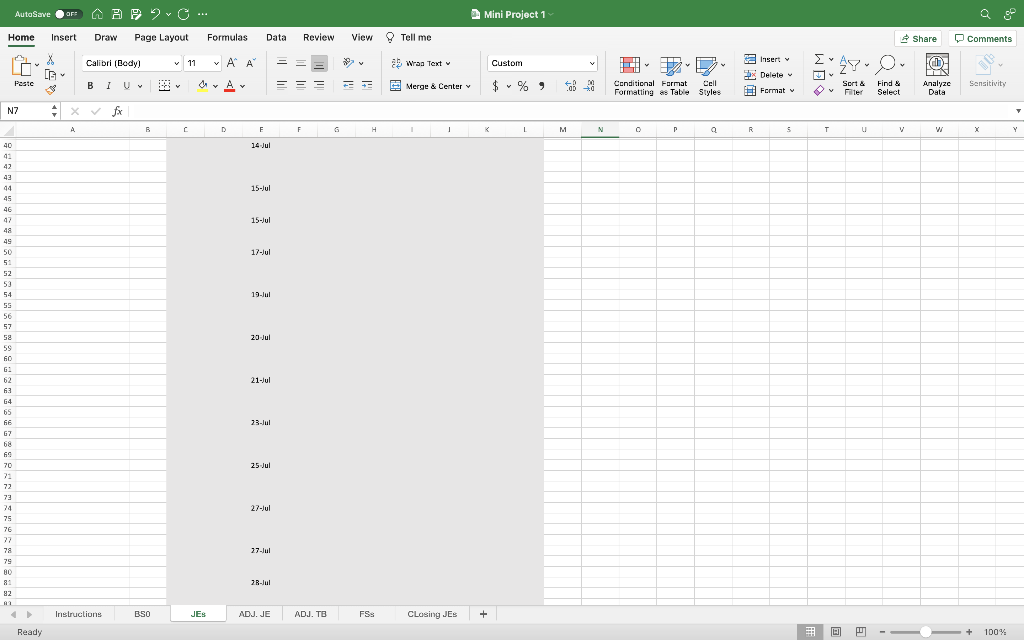

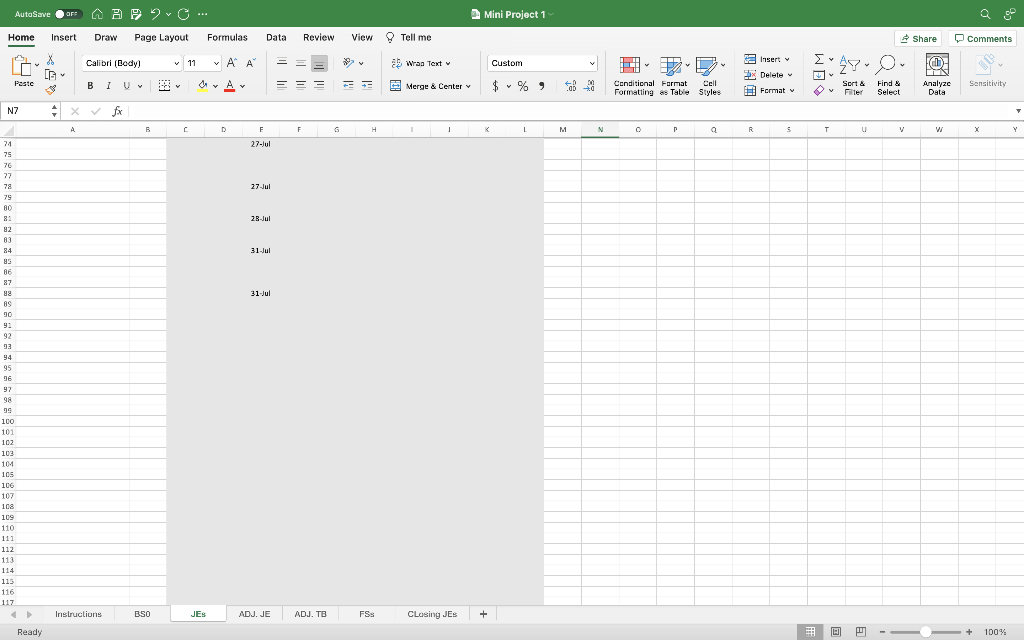

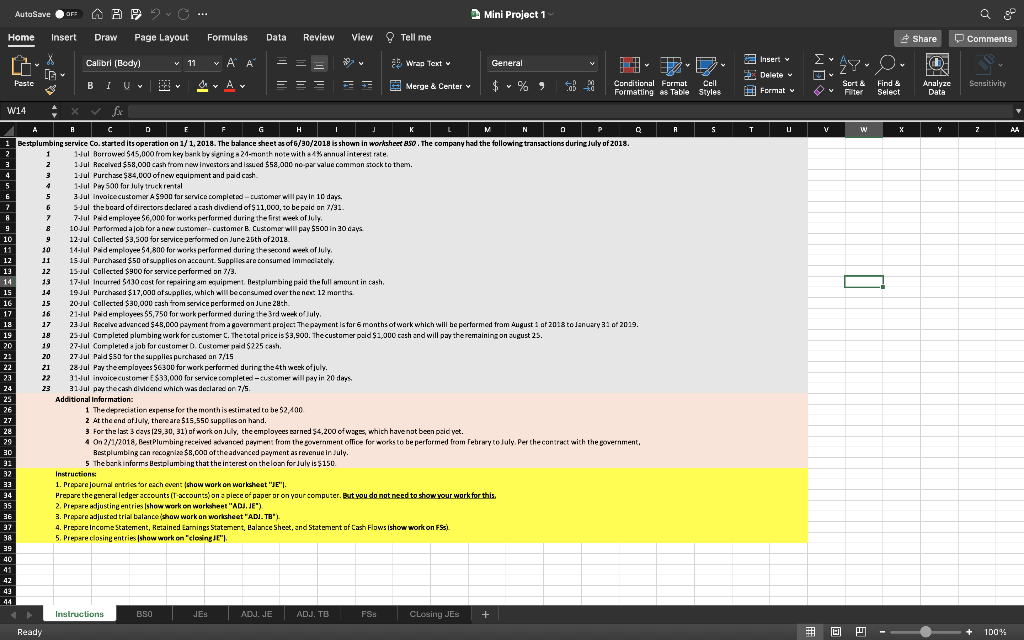

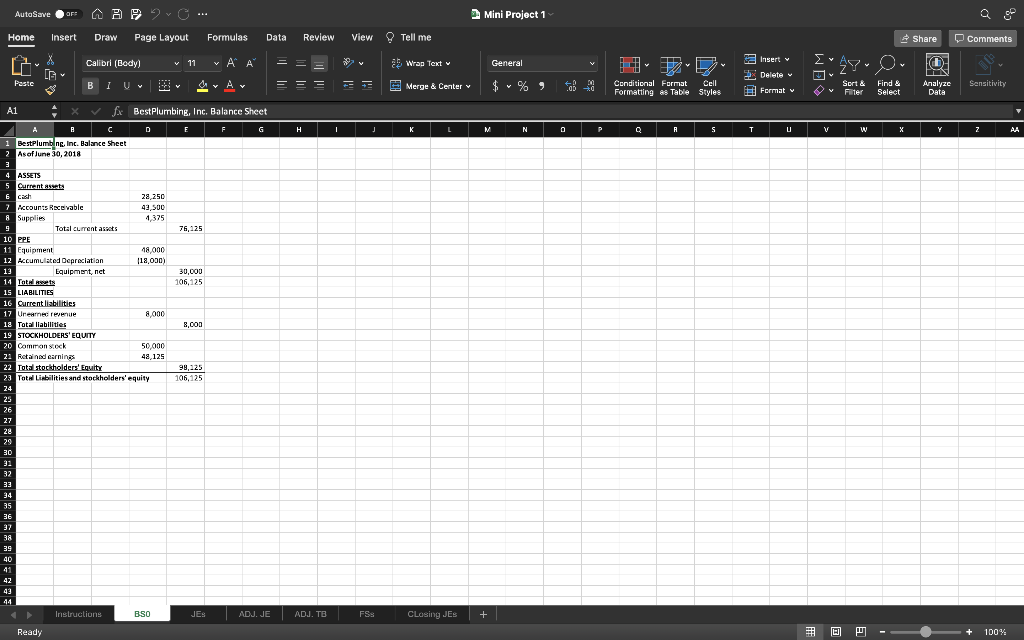

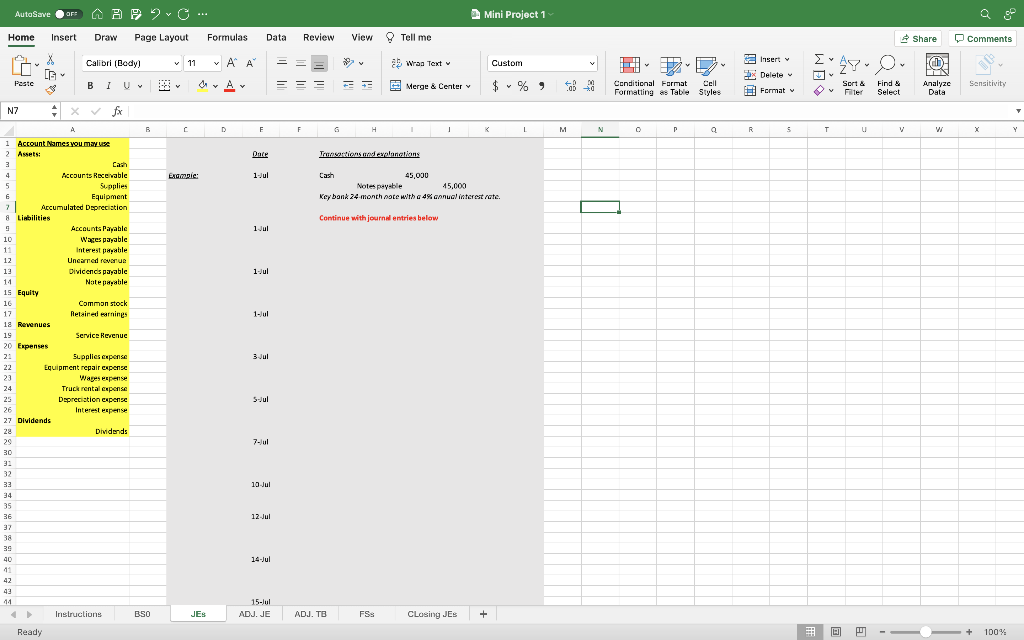

AutoSave OFF ^ B92 vo ... Home Insert Draw Page Layout G W14 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 31 32 33 34 35 36 37 38 39 40 41 42 Paste 43 44 s [A 5 6 7 8 9 10 10 11 12 13 14 Ready 15 16 17 18 19 20 21 22 23 V Calibri (Body) 1 I fx 20 11 Formulas & A A Instructions B C D G H L M A Bestplumbing service Co. started its operation on 1/1, 2018. The balance sheet as of 6/30/2018 is shown in worksheet 850. The company had the following transactions during July of 2018. 1 1-Jul Borrowed $45,000 from key bank by signing a 24-month note with a 4% annual interest rate. 2 1-Jul Received $58,000 cash from new investors and issued $58,000 no-par value common stock to them. 1-Jul Purchase $84,000 of new equipment and paid cash. 3 4 1-Jul Pay 500 for July truck rental Data Review 14-Jul Paid employee 54,800 for works performed during the second week of July. 15-Jul Purchased $50 of supplies on account. Supplies are consumed immediately. BSO 3-Jul invoice customer A $900 for service completed-customer will pay in 10 days. 5-Jul the board of directors declared a cash divdiend of $11,000, to be paid on 7/31. 7-Jul Paid employee $6,000 for works performed during the first week of July. 10-Jul Performed a job for a new customer-customer B. Customer will pay $500 in 30 days. 12-Jul Collected $3,500 for service performed on June 26th of 2018. 31Jul pay the cash dividend which was declared on 7/5. Additional Information = = 15-Jul Collected $900 for service performed on 7/3. 17-Jul Incurred $430 cost for repairing am equipment. Bestplumbing paid the full amount in cash. 19-Jul Purchased $17,000 of supplies, which will be consumed over the next 12 months View Tell me JES == ADJ. JE Wrap Text v ADJ. TB Merge & Center v Instructions: 1. Prepare journal entries for each event (show work on worksheet "JE". Prepare the general ledger accounts (T-accounts) on a piece of paper or on your computer. But you do not need to show your work for this. 2. Prepare adjusting entries Ishow work on worksheet "ADJ. JE") 3. Prepare adjusted trial balance (show work on worksheet "ADJ. TB") 4. Prepare Income Statement, Retained Earnings Statement, Balance Sheet, and Statement of Cash Flows (show work on FSs) 5. Prepare closing entries (show work on "closing JE"). Mini Project 1 20-Jul Collected $30,000 cash from service performed on June 28th. 21-Jul Paid employees 55,750 for work performed during the 3rd week of July. 23-Jul Receive advanced $48,000 payment from a government project The payment is for 6 months of work which will be performed from August 1 of 2018 to January 31 of 2019. 25-Jul Completed plumbing work for customer C. The total price is $3,900. The customer paid $1,000 cash and will pay the remaining on august 25. 27-Jul Completed a job for customer D. Customer paid $225 cash. 27-Jul Paid $50 for the supplies purchased on 7/15 28-Jul Pay the employees $6300 for work performed during the 4th week of july. 31-Jul invoice customer E$33,000 for service completed-customer will pay in 20 days. FSS General 1 The depreciation expense for the month is estimated to be $2,100. 2 At the end of July, there are $15,550 supplies on hand. 3 For the last 3 clays (29,30, 31) of work on July, the employees earned $4,200 of wages, which have not been paid yet. 4 On 2/1/2018, Best Plumbing received advanced payment from the government office for works to be performed from Febrery to July. Per the contract with the government, Best plumbing can recognize $8,000 of the advanced payment as revenue in July. 5 The bank informs Bestplumbing that the interest on the loan for July is $150. $*%9 So m CLosing JES + N F Cell Conditional Format Formatting as Table Styles 0 Q R S T Insert v Delete Format v U [*AP* Sort & Find & Filter Select J V V A W X Share Comments Q Analyze Sensitivity Data Z + 100% AA AutoSave OFF ^ B92 vo ... Home Insert Draw Page Layout G Paste A1 f [A V 4 ASSETS 5 Current assets 6 cash 7 Accounts Receivable 8 Supplies 9 42 43 44 A B C 1 BestPlumbing, Inc. Balance Sheet 2 Asof June 30, 2018 Calibri (Body) Ready BI U V M 10 PPE 11 Equipment 12 Accumulated Depreciation 13 Equipment, net 14 Total asets 15 LIABILITIES 16 Current liabilities 17 Uneamed revenue 18 Total liabilities 19 STOCKHOLDERS' EQUITY 20 Common stock 21 Retained earnings Total current assets Instructions D fx BestPlumbing, Inc. Balance Sheet F 28,250 43,500 4,375 48,000 (18,000) 22 Total stockholders' Equity 23 Total Liabilities and stockholders' equity 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 8,000 50,000 48,125 11 BSO E 76,125 30,000 106,125 8,000 98,125 E 106,125 Formulas A. JES A Data G ADJ. JE = Review == H ADJ. TB | View Tell me FSs Wrap Text Merge & Center K L CLosing JES Mini Project 1 General $ * % 9 M + N 0 P Conditional Format Cell Formatting as Table Styles R S T Insert v Delete Format v U [*AP* Sort & Filter J V V A W Find & Select X Share Q Analyze Data Y Comments Sensitivity Z + 100% AA OFF A B 2 , - C Home Insert Draw Page Layout N7 4 5 6 7 8 10 11 12 13 + X A 1 Account Names you may use 2 Assets: 3 AutoSave arr Poste 14 15 Equity 16 17 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 & [A 18 Revenues 19 20 Expenses 21 22 23 24 25 Liabilities 26 27 Dividends Cash Accounts Receivable Supplies Equipment Accumulated Depreciation V Ready Calibri (Body) BI Accounts Payable Wages payable wakes paraule Interest pavable Unearned revenue Divicencis payable Note payable. Common stock Retained earnings Service Revenue Supplies expense Equipment repair expense Wages expense Truck rental expense Depreciation expense Interest expense Dividends Instructions B BSO o ... M 11 C Example: Formulas Data JES A A D E Dace 1-Jul 1-Jul 1-Jul 1-Jul 3-Jul S-Jul 7-Jul 10-Jul 12-Jul 14-Jul 15-Jul ADJ. JE Review == F Cash G View +3 ADJ. TB H Transactions and explanations Tell me Wraa Text w Merge & Center v FSs 45,000 Continue with journal entries below. J Mini Project 1 Notes payable 45,000 Key bank 24-month note with a 4% annual interest rate CLosing JES K Custom + $ Y L 5 M v N D... Conditional Format Cell Formatting as Table Styles 0 P Q R Insert v Delete Format v S * 47. Sort & Find & Filter Select V 3 T u Share Fdb)- Az Analyze Data W Comments Sensitivity + 100% Y OFF A B 2 , - C Home Insert Draw Page Layout * (A Upa 40 41 42 43 44 45 N7 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 AutoSave arr 79 80 81 82 Poste Ready V + Calibri (Body) A BIU x fx Instructions B BSO M o ... 11 Y C Formulas Data JES A Av D E 14-Jul 15-Jul 15-Jul 17-Jul 19-Jul 20-Jul 21-Jul 23-Jul 25-Jul 27-Jul 27-Jul 28-Jul ADJ. JE Review == F ADJ. TB G View H FSs Tell me Wras Text Merge & Center v I 1 CLosing JES Mini Project 1 K + Custom Y L To M v N D... Conditional Format Cell Formatting as Table Styles 0 P q R Insert v Delete Format v S * 47. V T Sort & Find & Filter Select u Share Fdb)- Az Analyze Data W Comments Sensitivity X + 100% Y OFF A B 2 , - C Home Insert Draw Page Layout * (A Upa LO 74 75 76 77 78 N7 79 80 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 AutoSave arr 97 98 Poste 109 110 111 99 100 101 102 103 104 105 106 107 108 112 113 114 113 116 117 Ready V + Calibri (Body) BIU x fx A Instructions B BSO o ... M 11 Y C Formulas Data JES A A D E 27-Jul 27-Jul 28-Jul 31-Jul 31-Jul ADJ. JE Review == F ADJ. TB G View H FSs Tell me Wras Text Merge & Center v I 1 CLosing JEs Mini Project 1 K + Custom Y L To M v N D... Conditional Format Cell Formatting as Table Styles 0 P Q R Insert v Delete Format v S * 47. V T Sort & Find & Filter Select u Share db)- Az Analyze Data W Comments Sensitivity + 100% Y