Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Firm W will pay a dividend of $0.1 a quarter from now. The firm's dividends will grow at 0.5% per quarter. Its stock is

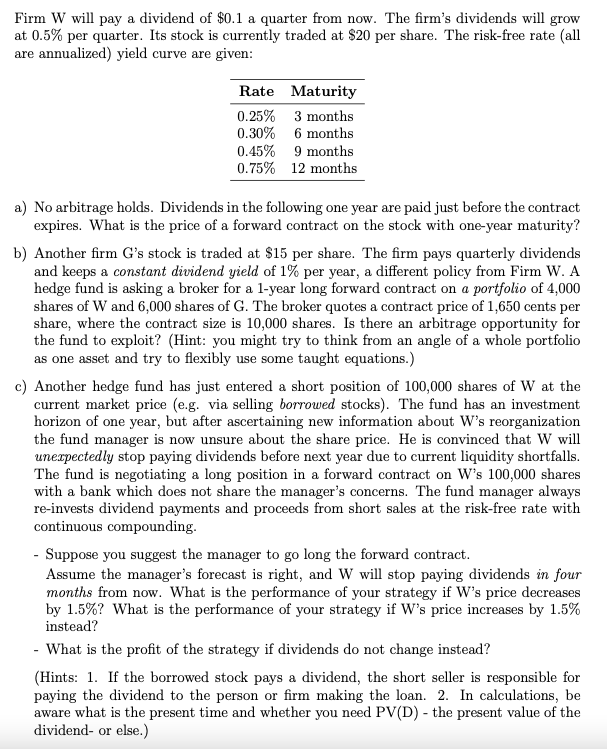

Firm W will pay a dividend of $0.1 a quarter from now. The firm's dividends will grow at 0.5% per quarter. Its stock is currently traded at $20 per share. The risk-free rate (all are annualized) yield curve are given: Rate Maturity 0.25% 3 months 6 months 0.30% 0.45% 9 months 0.75% 12 months a) No arbitrage holds. Dividends in the following one year are paid just before the contract expires. What is the price of a forward contract on the stock with one-year maturity? b) Another firm G's stock is traded at $15 per share. The firm pays quarterly dividends and keeps a constant dividend yield of 1% per year, a different policy from Firm W. A hedge fund is asking a broker for a 1-year long forward contract on a portfolio of 4,000 shares of W and 6,000 shares of G. The broker quotes a contract price of 1,650 cents per share, where the contract size is 10,000 shares. Is there an arbitrage opportunity for the fund to exploit? (Hint: you might try to think from an angle of a whole portfolio as one asset and try to flexibly use some taught equations.) c) Another hedge fund has just entered a short position of 100,000 shares of W at the current market price (e.g. via selling borrowed stocks). The fund has an investment horizon of one year, but after ascertaining new information about W's reorganization the fund manager is now unsure about the share price. He is convinced that W will unexpectedly stop paying dividends before next year due to current liquidity shortfalls. The fund is negotiating a long position in a forward contract on W's 100,000 shares with a bank which does not share the manager's concerns. The fund manager always re-invests dividend payments and proceeds from short sales at the risk-free rate with continuous compounding. - Suppose you suggest the manager to go long the forward contract. Assume the manager's forecast is right, and W will stop paying dividends in four months from now. What is the performance of your strategy if W's price decreases by 1.5%? What is the performance of your strategy if W's price increases by 1.5% instead? - What is the profit of the strategy if dividends do not change instead? (Hints: 1. If the borrowed stock pays a dividend, the short seller is responsible for paying the dividend to the person or firm making the loan. 2. In calculations, be aware what is the present time and whether you need PV(D) - the present value of the dividend- or else.)

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the price of a forward contract on the stock with oneyear maturity we need to consider the present value of all future dividends and th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started