Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Xerox Company which was established in 1996, is a business that is family-owned and they basically import and export medical supplies to different countries

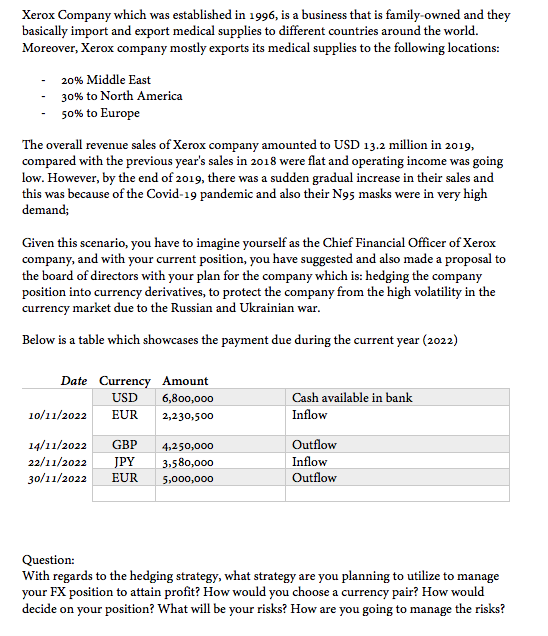

Xerox Company which was established in 1996, is a business that is family-owned and they basically import and export medical supplies to different countries around the world. Moreover, Xerox company mostly exports its medical supplies to the following locations: 20% Middle East 30% to North America 50% to Europe The overall revenue sales of Xerox company amounted to USD 13.2 million in 2019, compared with the previous year's sales in 2018 were flat and operating income was going low. However, by the end of 2019, there was a sudden gradual increase in their sales and this was because of the Covid-19 pandemic and also their N95 masks were in very high demand; Given this scenario, you have to imagine yourself as the Chief Financial Officer of Xerox company, and with your current position, you have suggested and also made a proposal to the board of directors with your plan for the company which is: hedging the company position into currency derivatives, to protect the company from the high volatility in the currency market due to the Russian and Ukrainian war. Below is a table which showcases the payment due during the current year (2022) Date Currency USD 10/11/2022 EUR 14/11/2022 GBP 22/11/2022 JPY 30/11/2022 EUR Amount 6,800,000 2,230,500 4,250,000 3,580,000 5,000,000 Cash available in bank Inflow Outflow Inflow Outflow Question: With regards to the hedging strategy, what strategy are you planning to utilize to manage your FX position to attain profit? How would you choose a currency pair? How would decide on your position? What will be your risks? How are you going to manage the risks?

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER As the Chief Financial Officer of Xerox company I would suggest implementing a currency derivative hedging strategy to protect the company from ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started