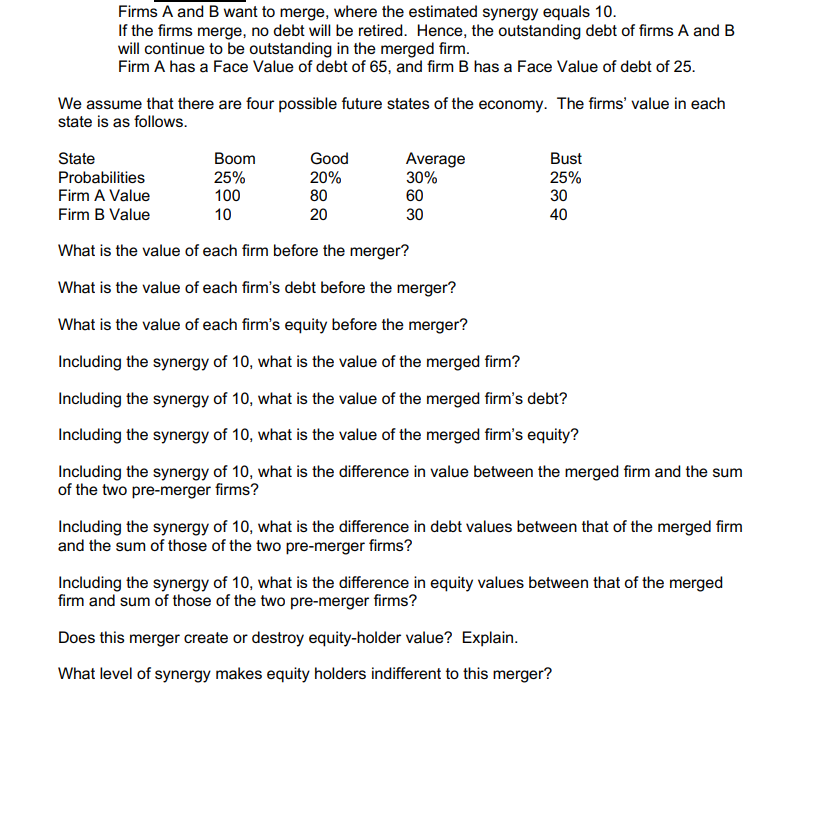

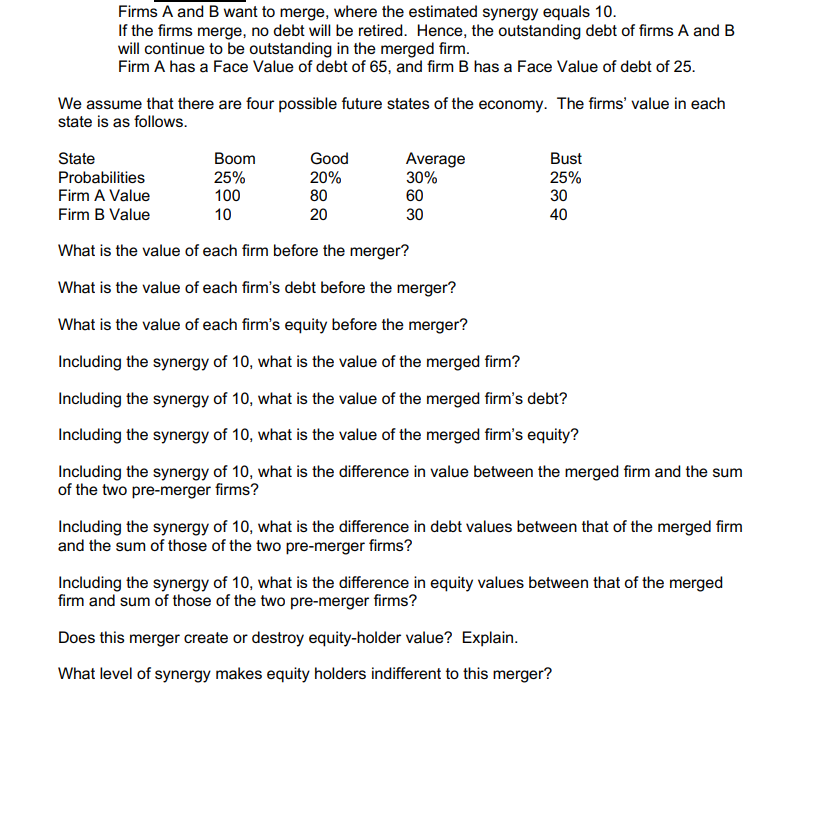

Firms A and B want to merge, where the estimated synergy equals 10. If the firms merge, no debt will be retired. Hence, the outstanding debt of firms A and B will continue to be outstanding in the merged firm. Firm A has a Face Value of debt of 65 , and firm B has a Face Value of debt of 25. We assume that there are four possible future states of the economy. The firms' value in each state is as follows. What is the value of each firm before the merger? What is the value of each firm's debt before the merger? What is the value of each firm's equity before the merger? Including the synergy of 10 , what is the value of the merged firm? Including the synergy of 10, what is the value of the merged firm's debt? Including the synergy of 10, what is the value of the merged firm's equity? Including the synergy of 10 , what is the difference in value between the merged firm and the sum of the two pre-merger firms? Including the synergy of 10 , what is the difference in debt values between that of the merged firm and the sum of those of the two pre-merger firms? Including the synergy of 10 , what is the difference in equity values between that of the merged firm and sum of those of the two pre-merger firms? Does this merger create or destroy equity-holder value? Explain. What level of synergy makes equity holders indifferent to this merger? Firms A and B want to merge, where the estimated synergy equals 10. If the firms merge, no debt will be retired. Hence, the outstanding debt of firms A and B will continue to be outstanding in the merged firm. Firm A has a Face Value of debt of 65 , and firm B has a Face Value of debt of 25. We assume that there are four possible future states of the economy. The firms' value in each state is as follows. What is the value of each firm before the merger? What is the value of each firm's debt before the merger? What is the value of each firm's equity before the merger? Including the synergy of 10 , what is the value of the merged firm? Including the synergy of 10, what is the value of the merged firm's debt? Including the synergy of 10, what is the value of the merged firm's equity? Including the synergy of 10 , what is the difference in value between the merged firm and the sum of the two pre-merger firms? Including the synergy of 10 , what is the difference in debt values between that of the merged firm and the sum of those of the two pre-merger firms? Including the synergy of 10 , what is the difference in equity values between that of the merged firm and sum of those of the two pre-merger firms? Does this merger create or destroy equity-holder value? Explain. What level of synergy makes equity holders indifferent to this merger