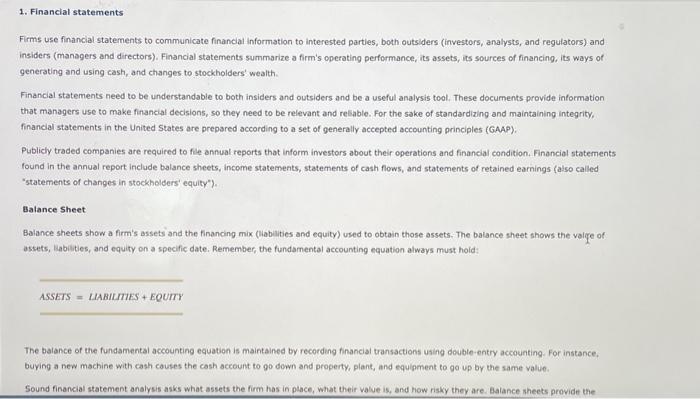

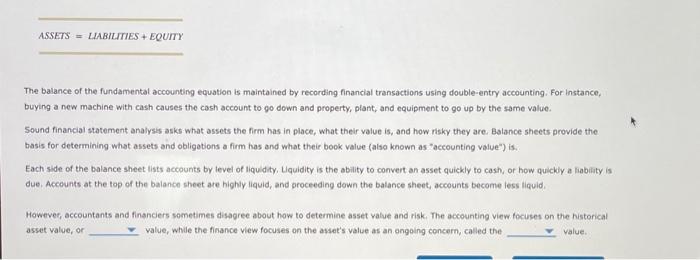

Firms use financial statements to communicate financial information to interested parties, both outsiders (investors, analysts, and regulators) and insiders (managers and directors). Financial statements summarize a firm's operating performance, its assets, its sources of financing, its ways of generating and using cash, and changes to stockholders' wealth. Financial statements need to be understandable to both insiders and outsiders and be a useful analysits tool. These documents provide information that managers use to make financial decisions, so they need to be relevant and resable. For the sake of standardizing and maintaining integrity, financial statements in the United States are prepared according to a set of generally accepted accounting principles (GAAp). Publicly traded companies are required to file annual reports that inform imvestors about their operations and financial condition. Financial statements found in the annual report include balance sheets, income statements, statements of cash flows, and statements of retained earnings (also called "statements of changes in stockholders' equity"). Balance Sheet Balance sheets show a firm's assets and the financing mix (Wlablibies and equity) used to obtain those assets. The balance sheet shows the valige of assets, liabilities, and equity on a specific date. Remember, the fundamental accounting equation always must hold: ASSETS=1ABIIITES+EQUTT The balance of the fundamental accounting equation is maintained by recording financial transactions using double-entry accounting. For instance. buying a new machine with cash causes the cash account to 90 down and property, plant, and equigment to go up by the same value. Sound financial statement analysis asks what assets the firm has in place, what their value is, and how risky they are. Balance sheets provide the ASSETS = LIABILITES + EQUITY The balance of the fundamental accounting equation is maintained by recording financial transactions using double-entry accounting. For instance, buying a new machine with cash causes the cash account to go down and property, plant, and equipment to go up by the same value. Sound financial statement analysis asks what assets the firm has in place, what their value is, and how risky they are. Balance sheets provide the basis for determining what assets and obligations a firm has and what their book value (also known as "accounting value") is. Each side of the balance sheet lists accounts by level of liquidity. Lquidity is the ability to convert an asset quickly to cash, or how quickiy a liabiity is due. Accounts at the top of the balance sheet are highly liquid, and proceeding down the balance sheet, accounts become less liquid. Howevec, accountants and financiers sometimes disagree about how to determine asset value and risk, The accounting view focuses on the historical asset value, or value, while the finance view focuses on the asset's value as an ongoing concern, called the value