please solve all questions. thank you

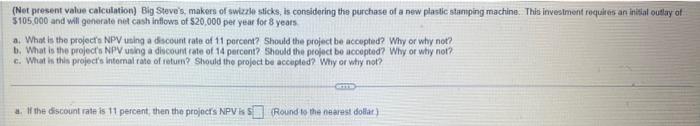

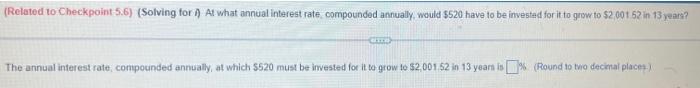

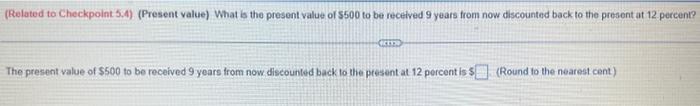

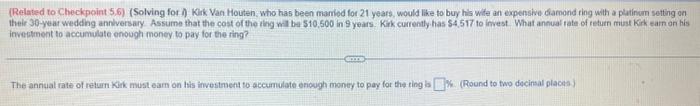

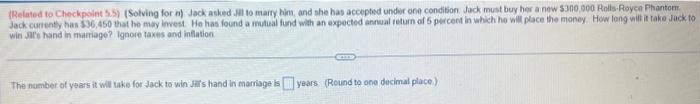

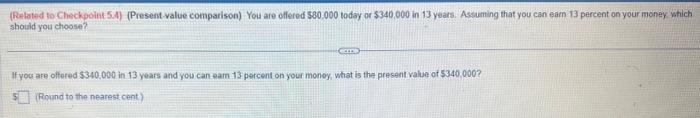

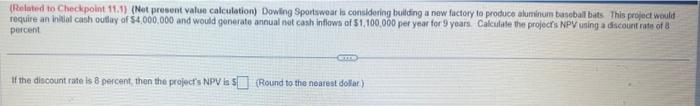

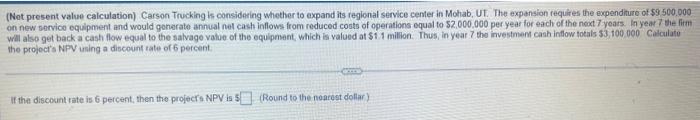

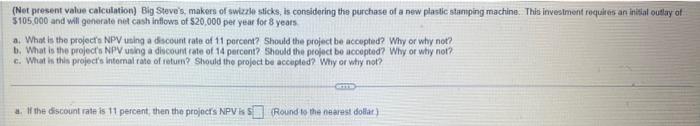

(Related to Checkpoint 5.6 ) (Solving for 0 ) At what annual interest rate, compounded annually, would $520 have to be investad for it to grow to $2. 00t 52 in 13 years? The annual interest rate, compounded annually, at which $520 must be invested for it to grow to $2,001,52 in 13 yean is (Round to tho decimal placez) (Related to Checkpoint 5.4). (Present value) What is the present value of 5500 to be recelved 9 years from now discounted back to the present at 12 percent? The present value of $500 to be received 9 years from now dlscounted back to the ptesent at 12 percent is $ (Round to the nearest cent) (Related to Checkpoint 5.6) (Solving for i) Kark Van Houten. who has been mamled for 21 years. would like to buy his wite an expensive diamond ring with a platinum setting on their 30 -year wedding anniversary. Assume that the cost of the iting will ba 510.500 in 9 years. Krk currently has $4.517 to invest. What annual tate of return must kirk earn an bis inveptenent to accumulate enough money to pay for the ring? (Related ta Checkpolint 5.5) (Solving for n) Jack asked . Mi to marty hin, and she has accepted under one condition. Jack must buy her a new s300.060 Rolls-Royce Phantorm Jack cumenty has $36,450 that he may ines. Ho has found a malual fund with an expected annwal retum of 5 percent in which he will place the money. How long will it take Jack to win Jit's hand in marriage? lgaore taxes and inflation The number of years it will take for Jack to win Jhis hand in marriage is years: (Round to one decimal place) (Related to Checkpoint 5.4) (Present-value comparison) You are offered 580.000 today or $340,000 in 13 years. Assuming that you can eam 13 percent on your money vhich should you choose? If you are olfered $340,000 in 13 yoars and you can eam 13 percent on your money, what is the presant value of 5340.000 ? (Round to the nearest cent) (Related to Checkpoint 11.1) (Net present value calculation) Dowling Sportswoar is considering bullding a naw factory to produce aluminum baseball bats. Ihis propect would require an inhlal cash outlay of 54,000,000 and would gonerate annual nat cash inflows of 51,100,000 per year for 9 years. Calculale the projechs NpV using a discount rate of a percent If the discouint rate is 8 percent, then the project's NPV is 4 (Round to the neatest doflar) (Net present value caiculation) Carson Trucking is considering whether to expand its regional service center in Mohab, UT. The expansion requires the expenditure of $9500.000. on new senvice equipment and would generate annual net cash inflows from reduced costs of operations oqual to $2.000.000 per year for each of the noxt 7 years. in year 7 the firk will also get back a cash flow equal to the salvage value of the equipment which is valued at $1.1 milion. Thus, in year 7 the investmen cash inflow toeals $3, 100 000. Calculate the projects NPV using a discount tate of 6 percent. If tha discount rate is 6 percent, then the projects NPV is 5 (Round to the noarset dollar) (Net present value calculation) Big Steve's, makers of swizze sticks, is considering the purchase of a new plastic staniping machine. This invesiment requites an intitial oullay of $105,000 and will generale net cash intlows of $20,000 per year for 8 years a. What is the projecro NPV using a discount rate of 11 percent? Should the project be accepted? Why or why not? b. What is the projects NPV using a discount rate of 14 percent? Should the prolect be accepted? Why or why nor? c. What is this project's intomal rate of return? Should the project be accepled? Why or viry not? a. If the discount rate is 11 percent, then the projocts NPV ts? (Round ts the nearest dolat)

please solve all questions. thank you

please solve all questions. thank you