Answered step by step

Verified Expert Solution

Question

1 Approved Answer

First Choice Company is seeking buy another firm (MFG) as part of its strategic expansion growth. You have been hired as the consultant to

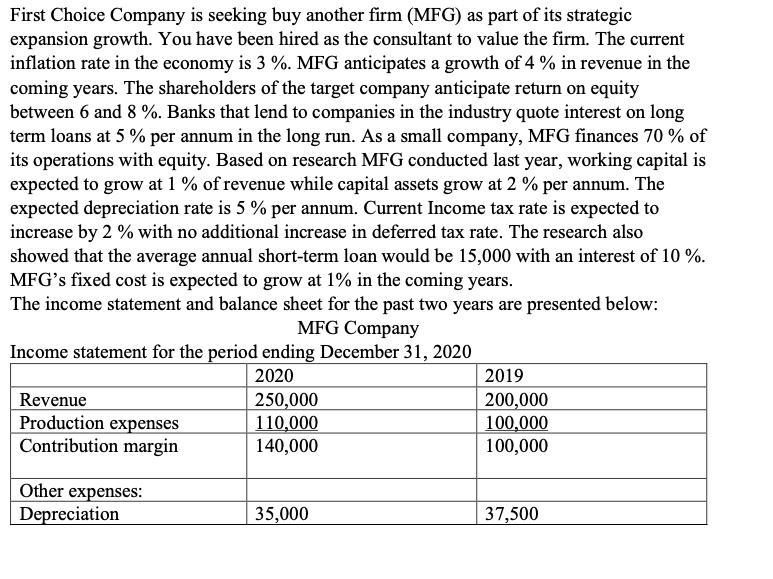

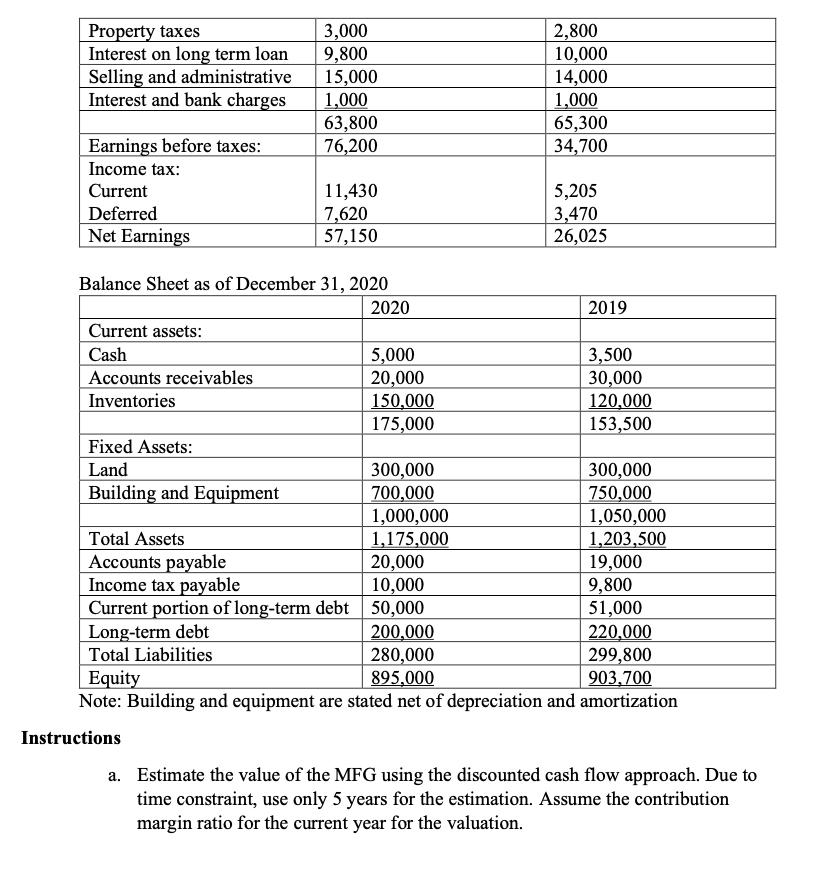

First Choice Company is seeking buy another firm (MFG) as part of its strategic expansion growth. You have been hired as the consultant to value the firm. The current inflation rate in the economy is 3 %. MFG anticipates a growth of 4 % in revenue in the coming years. The shareholders of the target company anticipate return on equity between 6 and 8 %. Banks that lend to companies in the industry quote interest on long term loans at 5% per annum in the long run. As a small company, MFG finances 70% of its operations with equity. Based on research MFG conducted last year, working capital is expected to grow at 1% of revenue while capital assets grow at 2 % per annum. The expected depreciation rate is 5 % per annum. Current Income tax rate is expected to increase by 2 % with no additional increase in deferred tax rate. The research also showed that the average annual short-term loan would be 15,000 with an interest of 10%. MFG's fixed cost is expected to grow at 1% in the coming years. The income statement and balance sheet for the past two years are presented below: MFG Company Income statement for the period ending December 31, 2020 2020 Revenue Production expenses Contribution margin Other expenses: Depreciation 250,000 110,000 140,000 35,000 2019 200,000 100,000 100,000 37,500 Property taxes Interest on long term loan Selling and administrative Interest and bank charges Earnings before taxes: Income tax: Current Deferred Net Earnings Current assets: Cash Accounts receivables Inventories 3,000 9,800 Fixed Assets: Land Building and Equipment 15,000 1,000 63,800 76,200 Balance Sheet as of December 31, 2020 2020 11,430 7,620 57,150 5,000 20,000 150,000 175,000 300,000 700,000 1,000,000 1,175,000 2,800 10,000 14,000 1,000 65,300 34,700 5,205 3,470 26,025 2019 3,500 30,000 120,000 153,500 300,000 750,000 1,050,000 1,203,500 Total Assets Accounts payable 20,000 19,000 Income tax payable 10,000 9,800 Current portion of long-term debt 50,000 51,000 Long-term debt 200,000 220,000 Total Liabilities 280,000 299,800 Equity 895,000 903,700 Note: Building and equipment are stated net of depreciation and amortization Instructions a. Estimate the value of the MFG using the discounted cash flow approach. Due to time constraint, use only 5 years for the estimation. Assume the contribution margin ratio for the current year for the valuation.

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Part1 Table Or Calculator Function Face Value Of Bond Issuance From Future Value 2500 Bonds X 1000 M...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started