Answered step by step

Verified Expert Solution

Question

1 Approved Answer

First Drop down - Buy or Sell Second Drop Down - 0,1,10,11 A bonds Third Drop Down - Buy or Sell Fourth Drop Down -

First Drop down - Buy or Sell

Second Drop Down - 0,1,10,11 A bonds

Third Drop Down - Buy or Sell

Fourth Drop Down - 0,1,10,11 B bonds

Fifth Drop Down - Buy or Sell

Sixth Drop Down - 0,1,10,11 C bonds

Seventh Drop Down - Buy or Sell

Eighth Drop Down - 0,1,10,11 D bonds

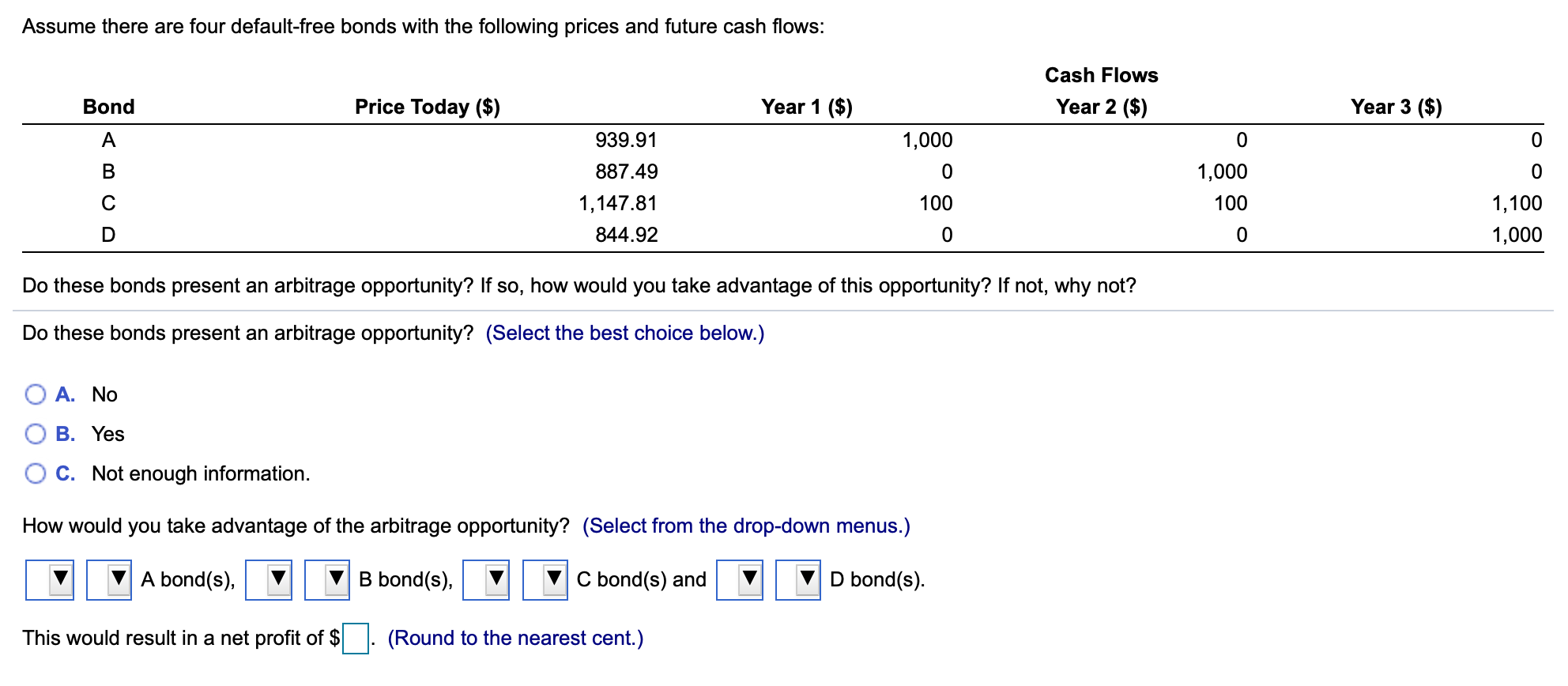

Assume there are four default-free bonds with the following prices and future cash flows: Cash Flows Year 2 ($) Bond Price Today ($) Year 1 ($) Year 3 ($) A 1,000 0 0 B 0 939.91 887.49 1,147.81 844.92 1,000 100 100 1,100 1,000 D 0 0 Do these bonds present an arbitrage opportunity? If so, how would you take advantage of this opportunity? If not, why not? Do these bonds present an arbitrage opportunity? (Select the best choice below.) O A. No B. Yes O C. Not enough information. How would you take advantage of the arbitrage opportunity? (Select from the drop-down menus.) A bond(s), B bond(s), C bond(s) and D bond(s). This would result in a net profit of $. (Round to the nearest cent.) Assume there are four default-free bonds with the following prices and future cash flows: Cash Flows Year 2 ($) Bond Price Today ($) Year 1 ($) Year 3 ($) A 1,000 0 0 B 0 939.91 887.49 1,147.81 844.92 1,000 100 100 1,100 1,000 D 0 0 Do these bonds present an arbitrage opportunity? If so, how would you take advantage of this opportunity? If not, why not? Do these bonds present an arbitrage opportunity? (Select the best choice below.) O A. No B. Yes O C. Not enough information. How would you take advantage of the arbitrage opportunity? (Select from the drop-down menus.) A bond(s), B bond(s), C bond(s) and D bond(s). This would result in a net profit of $. (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started