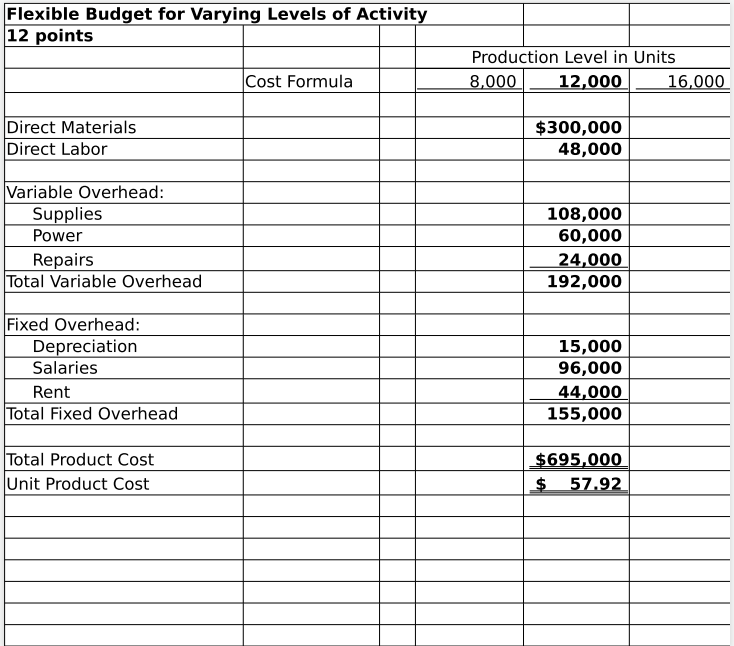

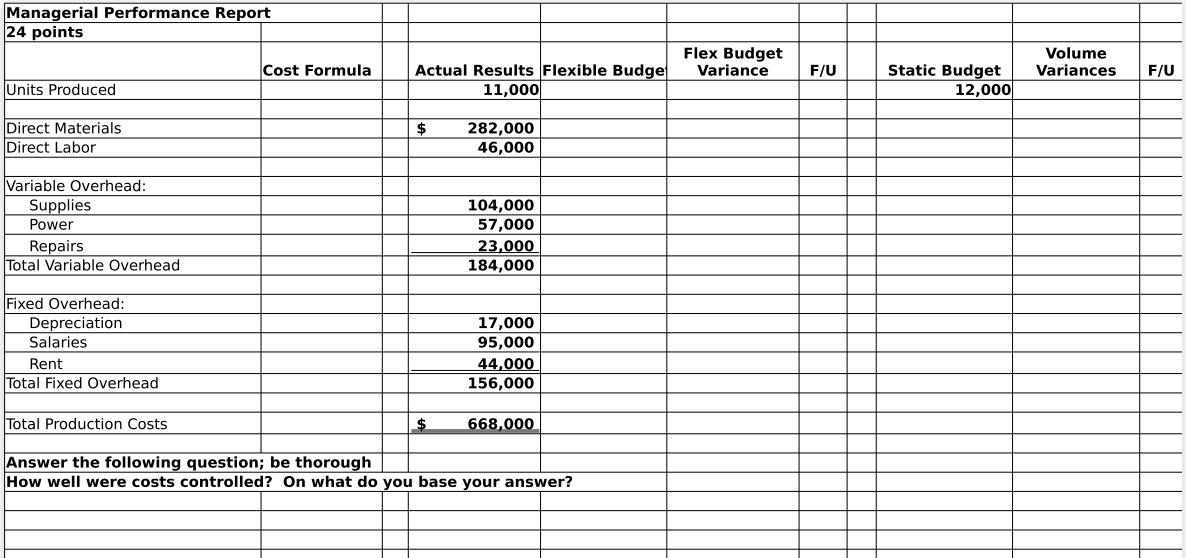

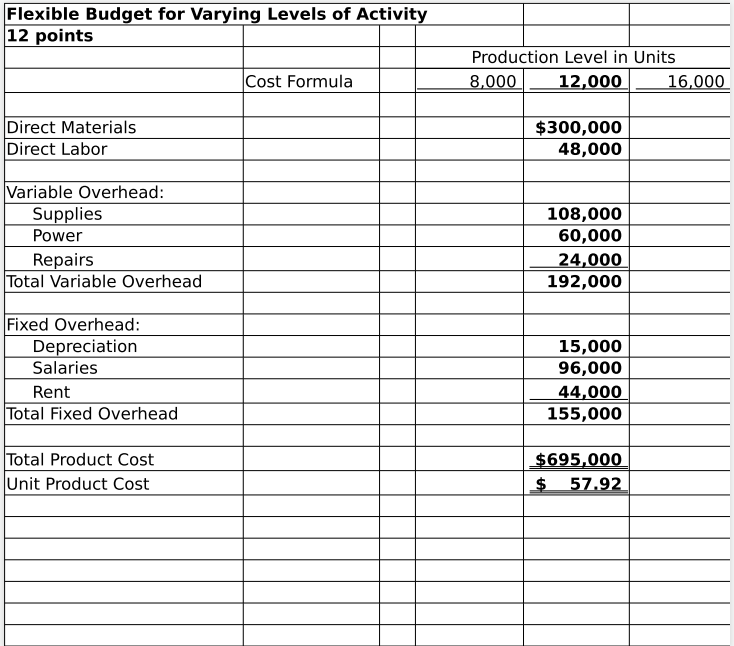

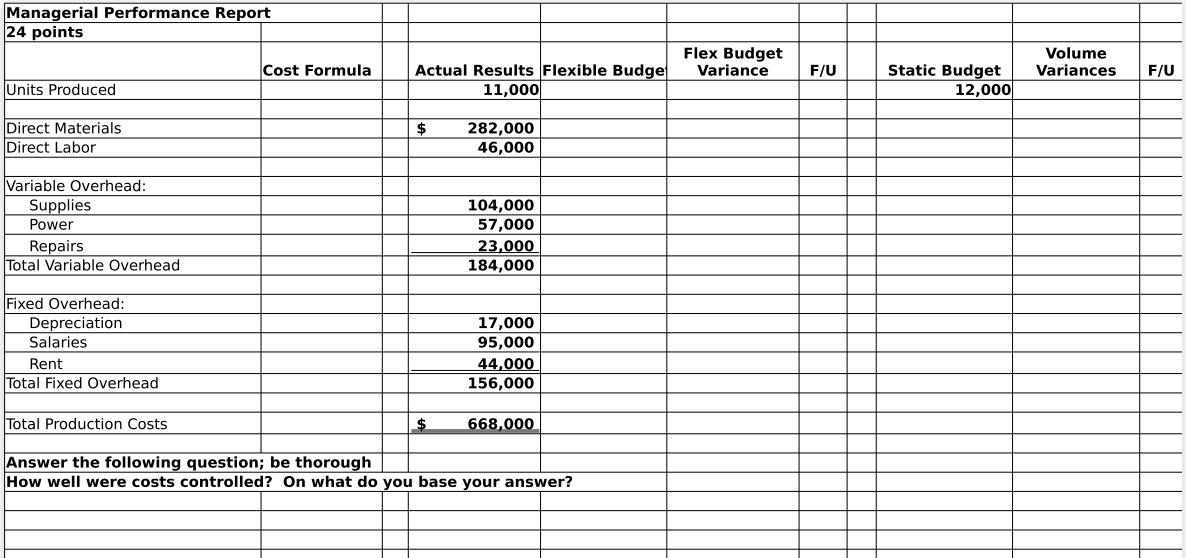

First Tab: Flexible Budget (12 points) The company is doing their planning for the coming year and has developed a production cost budget for 12,000 units, and they also want to figure out a budget for other potential production levels. Required: 1) Compute the cost formula for each of the cost elements. 2) Calculate the flexible budget amounts for 8,000 units and 16,000 units (which are both in the relevant range of output). Use excel formulas based on the cost formulas to determine the budgeted amounts. Second Tab: Performance Report (24 points) Assume that at the beginning of the year, the company settles on the production cost budget for 12,000 units as the most likely scenario and includes that in their master budget. At the end of the year, actual units produced for the year were 11,000. Actual production costs are as shown on the spreadsheet. Required: 1) Prepare a performance report comparing actual results to a flexible budget for the same level of production a. Compute the flexible budget (using the cost formulas) and the flexible budget variances. b. Compute the volume variances. c. Indicate whether each variance is Favorable - For Unfavorable - U. 2) Answer the question at the bottom about cost control. Flexible Budget for varying Levels of Activity 12 points Production Level in Units 8,000 12,000 16,000 Cost Formula Direct Materials Direct Labor $300,000 48,000 Variable Overhead: Supplies Power Repairs Total Variable Overhead 108,000 60,000 24,000 192,000 Fixed Overhead: Depreciation Salaries Rent Total Fixed Overhead 15,000 96,000 44,000 155,000 Total Product Cost Unit Product Cost $695,000 $ 57.92 Managerial Performance Report 24 points Flex Budget Variance Volume Variances Cost Formula F/U F/U Actual Results Flexible Budge 11,000 Static Budget 12,000 Units Produced $ Direct Materials Direct Labor 282,000 46,000 Variable Overhead: Supplies Power Repairs Total Variable Overhead 104,000 57,000 23,000 184,000 Fixed Overhead: Depreciation Salaries Rent Total Fixed Overhead 17,000 95,000 44,000 156,000 Total Production Costs 668,000 Answer the following question; be thorough How well were costs controlled? On what do you base your